New Jersey Affidavit of Heirship for the Owner of the Property

Description

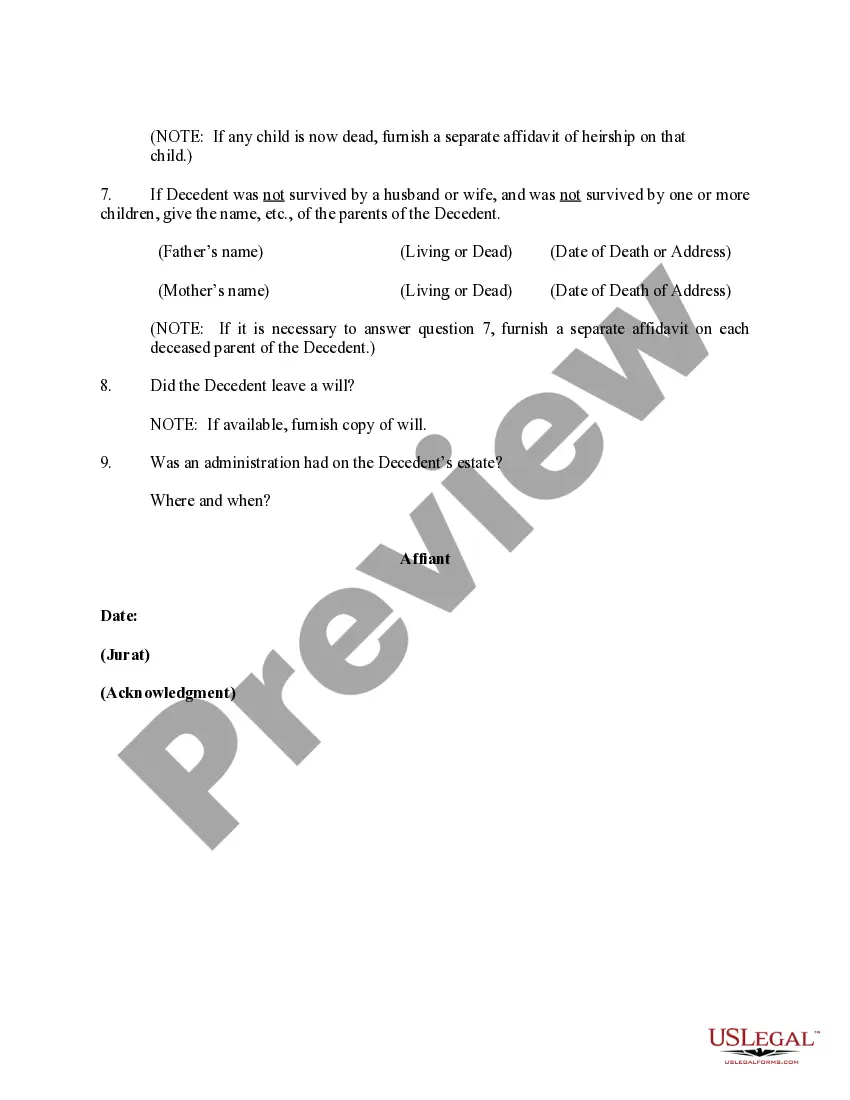

How to fill out Affidavit Of Heirship For The Owner Of The Property?

Discovering the right lawful document format can be quite a have difficulties. Of course, there are a lot of web templates available on the net, but how would you discover the lawful develop you will need? Use the US Legal Forms web site. The service gives thousands of web templates, including the New Jersey Affidavit of Heirship for the Owner of the Property, which can be used for organization and personal requires. All the varieties are checked by pros and meet up with federal and state requirements.

Should you be already authorized, log in in your account and click the Acquire key to find the New Jersey Affidavit of Heirship for the Owner of the Property. Use your account to look from the lawful varieties you might have purchased previously. Proceed to the My Forms tab of your own account and get an additional copy from the document you will need.

Should you be a fresh consumer of US Legal Forms, listed here are straightforward directions that you should stick to:

- Initial, be sure you have selected the appropriate develop for the metropolis/region. It is possible to check out the shape making use of the Preview key and look at the shape explanation to make certain this is basically the right one for you.

- In case the develop is not going to meet up with your preferences, utilize the Seach field to find the appropriate develop.

- Once you are sure that the shape is suitable, select the Acquire now key to find the develop.

- Choose the rates prepare you desire and enter in the required information. Create your account and buy the transaction with your PayPal account or bank card.

- Choose the document file format and acquire the lawful document format in your system.

- Full, change and produce and indication the acquired New Jersey Affidavit of Heirship for the Owner of the Property.

US Legal Forms is the most significant local library of lawful varieties for which you can find various document web templates. Use the company to acquire appropriately-made papers that stick to condition requirements.

Form popularity

FAQ

How to Fill Out Affidavit of Heirship | PDFRUN - YouTube YouTube Start of suggested clip End of suggested clip Read the clause above the signature. Lines. Once you have understood this clause. And have confirmedMoreRead the clause above the signature. Lines. Once you have understood this clause. And have confirmed the information contained in this affidavit. You may sign it a fix your signature.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

In this situation, an heir can simply file what is called an affidavit of heirship with the court. You may find this form on your state court website or through the court clerk's office, or you may need to have an attorney or legal services firm create one for you.

Once the affidavit has been recorded, the heirs are identified in the property records as the new owners of the property. Thereafter, the heir or heirs may transfer or sell the property if they choose to do so.

The Declaration of Heirs aims to legally establish the quality of heirs who succeed in an inheritance, establishing their legitimacy to proceed to the division of that inheritance. As a rule, the declaration is made to designate the heirs; and not some legatees who also succeed in that inheritance.

A ballpark fee for preparation of the affidavit is between $750 for a very simple estate with few heirs to several thousand dollars for a more complicated estate with many heirs. The filing fees to record the affidavit in each county where the real property is located usually run about $50 to $75 in Texas.

The mailing address is: Harris County Clerk, P.O. Box 1525, Houston, TX 77251-1525.

The disinterested witnesses must be someone who knew the decedent and was familiar with the decedent's family history. The disinterested witness can be a friend of the decedent, a friend of the family, or a neighbor, but it cannot be an individual who will directly benefit from the estate financially.