This is an agreement between the firm and a new partner, for compensation based on generating new business. It lists the base draw and the percentage of fees earned by generating new business. It also covers such areas as secretarial help, office space, medical insurance, and malpractice insurance.

New Jersey Agreement with New Partner for Compensation Based on Generating New Business

Description

How to fill out Agreement With New Partner For Compensation Based On Generating New Business?

Are you currently within a placement in which you will need paperwork for either company or personal uses virtually every working day? There are tons of lawful file templates available on the net, but finding types you can trust is not straightforward. US Legal Forms delivers a large number of type templates, such as the New Jersey Agreement with New Partner for Compensation Based on Generating New Business, which are published to satisfy federal and state requirements.

Should you be previously knowledgeable about US Legal Forms web site and get a merchant account, just log in. Afterward, you may down load the New Jersey Agreement with New Partner for Compensation Based on Generating New Business template.

Unless you come with an bank account and would like to start using US Legal Forms, abide by these steps:

- Discover the type you require and make sure it is to the correct city/region.

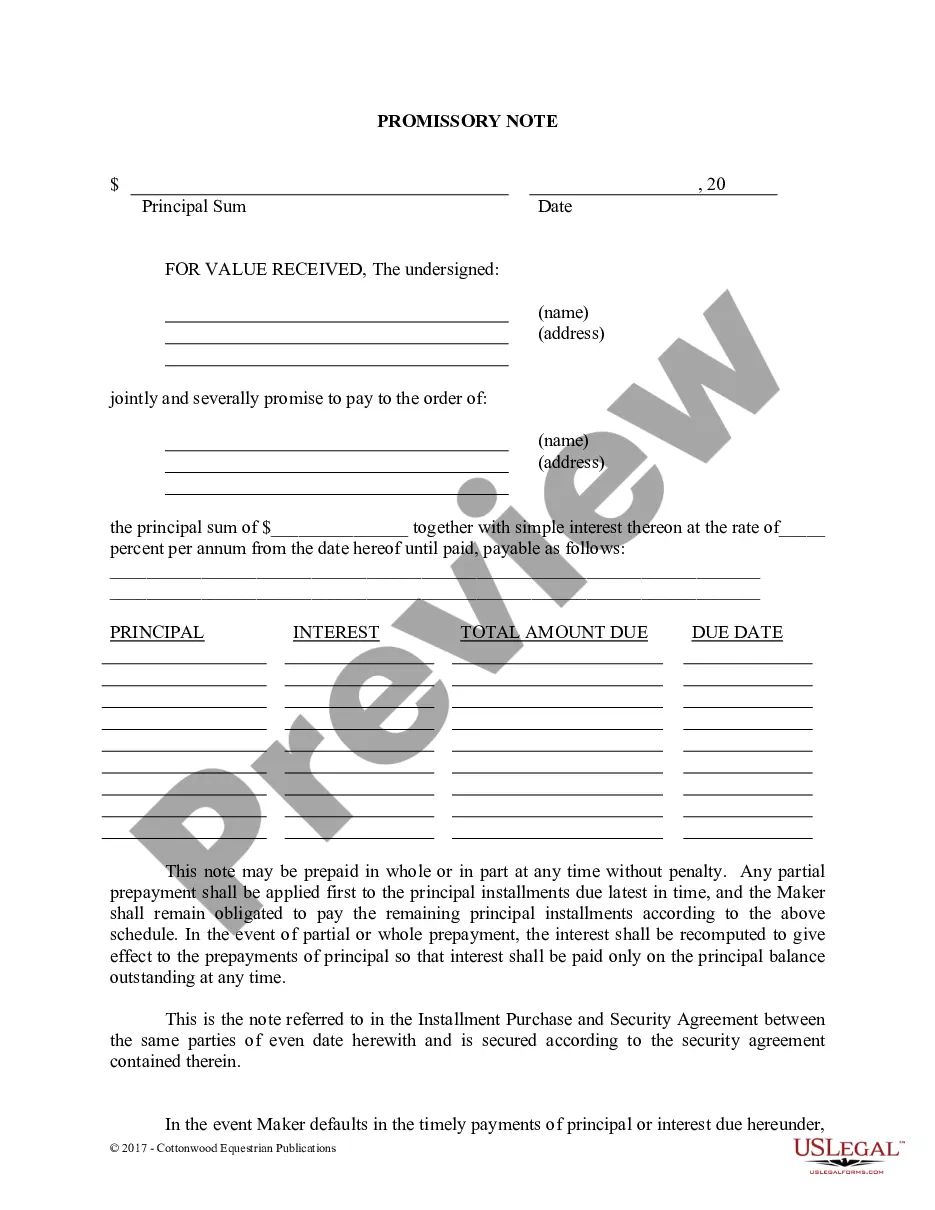

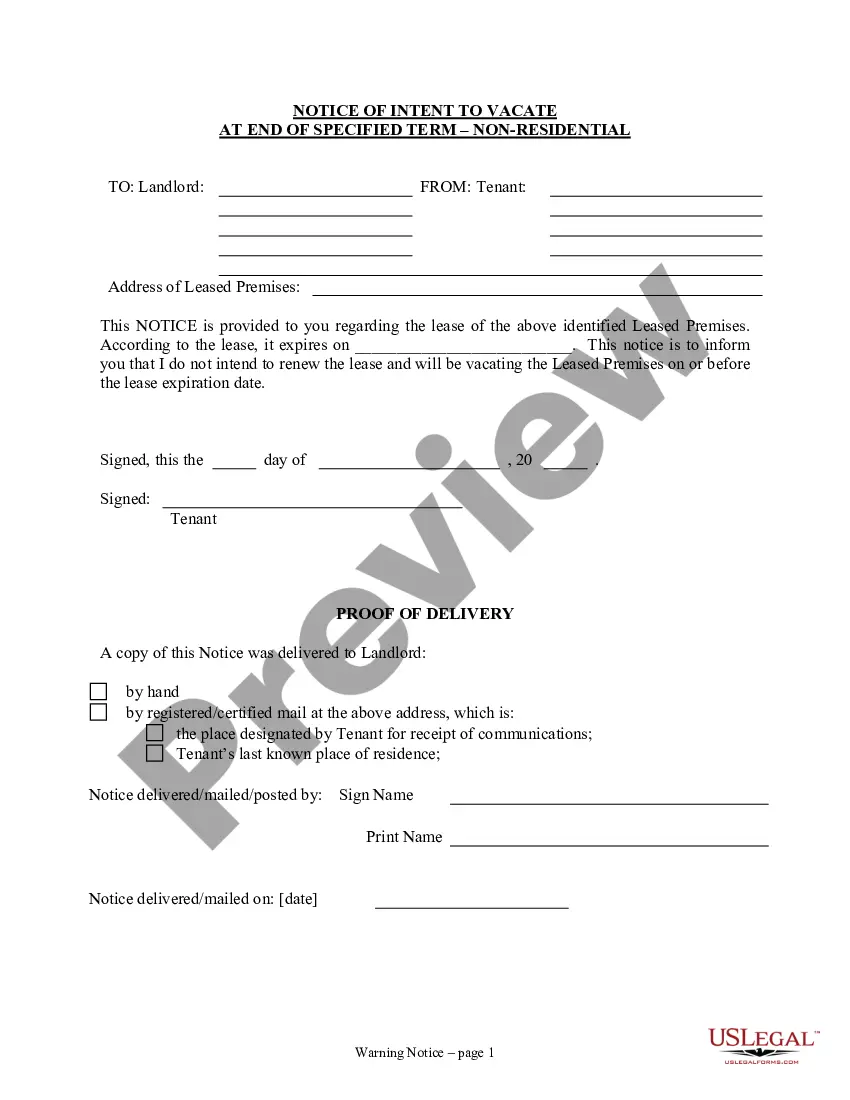

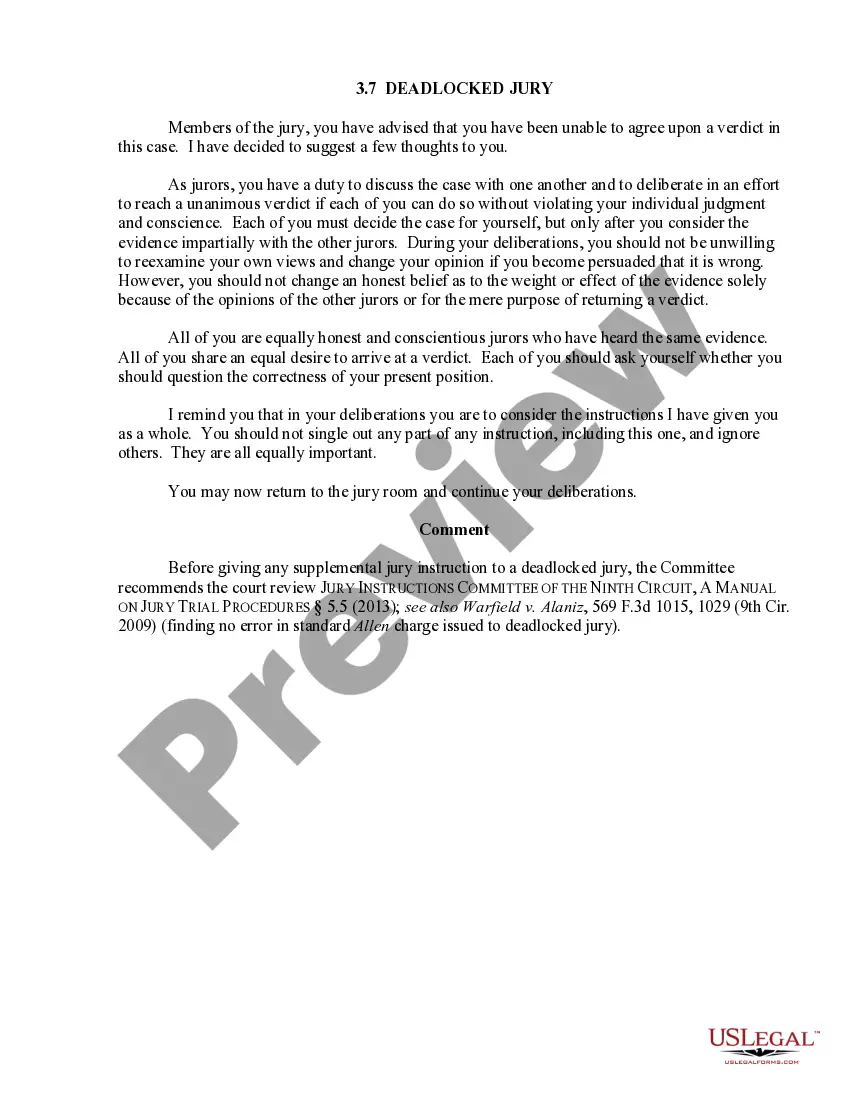

- Use the Review key to analyze the form.

- See the explanation to actually have selected the correct type.

- In case the type is not what you`re seeking, use the Lookup discipline to obtain the type that meets your requirements and requirements.

- If you discover the correct type, click Acquire now.

- Select the costs strategy you need, fill out the specified details to make your bank account, and purchase your order using your PayPal or Visa or Mastercard.

- Decide on a handy document file format and down load your copy.

Find each of the file templates you possess purchased in the My Forms food selection. You can aquire a extra copy of New Jersey Agreement with New Partner for Compensation Based on Generating New Business any time, if needed. Just click the required type to down load or print out the file template.

Use US Legal Forms, one of the most extensive selection of lawful kinds, to save lots of time and avoid errors. The support delivers appropriately made lawful file templates which can be used for a variety of uses. Produce a merchant account on US Legal Forms and begin producing your way of life easier.

Form popularity

FAQ

A partnership agreement is an agreement between two or more individuals who sign a contract to start a profitable business together. In the Partnership agreement, the partners are equally responsible for the debt of an organisation.

In many cases, a partner will be able to bind the partnership without the other owners' consent. However, steps can be taken to prevent any one partner from entering into an agreement without the consent of the others.

A Partnership Agreement is a contract between one or more businesses or individuals who are choosing to run a business together. Partnership Agreements define the initial contribution and future contributions that are expected of the partners.

A partnership deed is an agreement between two or more individuals who sign a contract to start a profitable business together. They agree to be the co-owners, distribute responsibilities, income or losses for running a business.

Use the following steps to draft a partnership agreement: Outline Partnership Purpose. ... Document Partner's Name and Business Address. ... Document Ownership Interest and Partner Shares. ... Outline Partner Responsibilities and Liabilities. ... Consult With a Lawyer.

The partnership agreement spells out who owns what portion of the firm, how profits and losses will be split, and the assignment of roles and duties. The partnership agreement will also typically spell how out disputes are to be adjudicated and what happens if one of the partners dies prematurely.

A partnership agreement should include details such as the purpose of the partnership, ownership interest, decision-making process, responsibilities and liabilities of each partner, dispute resolution procedures, and continuity and succession planning.

Each general partner has the power to bind the partnership in matters pertaining to the partnership's business. For instance, partners may purchase ?ordinary matters connected with the partnership for the purposes of the business and within the scope of the business.? UPA §18(b).

General partners should remember that one partner may be able to commit the business to a contract without the other partners' agreement or even knowledge. Because of this, your partnership agreement should address this issue and document how decisions will be made BEFORE going into business with a partner.

California law allows an individual to sell his or her interest in a partnership without your consent. However, it may be possible to override state law by creating a custom partnership agreement.