New Jersey Software License Subscription Agreement

Description

How to fill out Software License Subscription Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By using the website, you can find thousands of forms for business and personal use, organized by categories, states, or keywords. You can access the most recent versions of forms like the New Jersey Software License Subscription Agreement in just seconds.

If you already hold a subscription, Log In and download the New Jersey Software License Subscription Agreement from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Choose the format and download the form to your device.

Make changes. Fill out, modify, print, and sign the downloaded New Jersey Software License Subscription Agreement. Every template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your area/region. Click the Preview button to review the form's content.

- Read the form description to confirm you have selected the appropriate form.

- If the form does not meet your requirements, use the Search area at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose the pricing plan you prefer and provide your details to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

Subscriptions may be tax exempt in New Jersey, but this largely depends on the type of service or product offered. The New Jersey Software License Subscription Agreement provides guidelines on which subscriptions qualify for tax exemptions. To ensure your subscription meets the criteria, it's wise to consult with a tax expert or utilize platforms like US Legal Forms that provide essential legal documents and resources tailored to your needs.

Software as a Service (SaaS) is generally considered taxable in New Jersey, especially when it involves the use of software that is hosted remotely. The New Jersey Software License Subscription Agreement clarifies these rules, stating that if the software is accessed online, it usually incurs sales tax. Understanding these regulations will help you make informed decisions about your software subscriptions. You can find valuable insights on this topic through US Legal Forms.

New Jersey exempts certain services from sales tax, including those related to education, health care, and specific professional services. However, when it comes to the New Jersey Software License Subscription Agreement, software-related services may not qualify for exemptions. It's important to review the specific criteria for exemptions to avoid any compliance issues. For detailed information, US Legal Forms offers comprehensive resources to help you navigate the complexities.

Subscriptions in New Jersey can be taxable, particularly when they involve tangible personal property or certain services. The New Jersey Software License Subscription Agreement outlines specific tax regulations that apply to various subscriptions. It’s essential to understand the details surrounding your subscription to determine tax obligations. For assistance, consider exploring US Legal Forms to find relevant documents and guidance.

In New Jersey, whether software subscriptions are taxable depends on the nature of the product. Generally, if the software is delivered electronically and is used for business purposes, it may be taxable under the New Jersey Software License Subscription Agreement. However, personal use may not incur tax. To ensure compliance, consulting a tax professional or utilizing resources on platforms like US Legal Forms can provide clarity.

Yes, New Jersey generally imposes sales tax on software as a service (SaaS) subscriptions. This includes services delivered over the internet, such as cloud-based applications defined under a New Jersey Software License Subscription Agreement. It's essential to account for these taxes in your budgeting to avoid unexpected costs, and consulting with a tax professional can provide clarity.

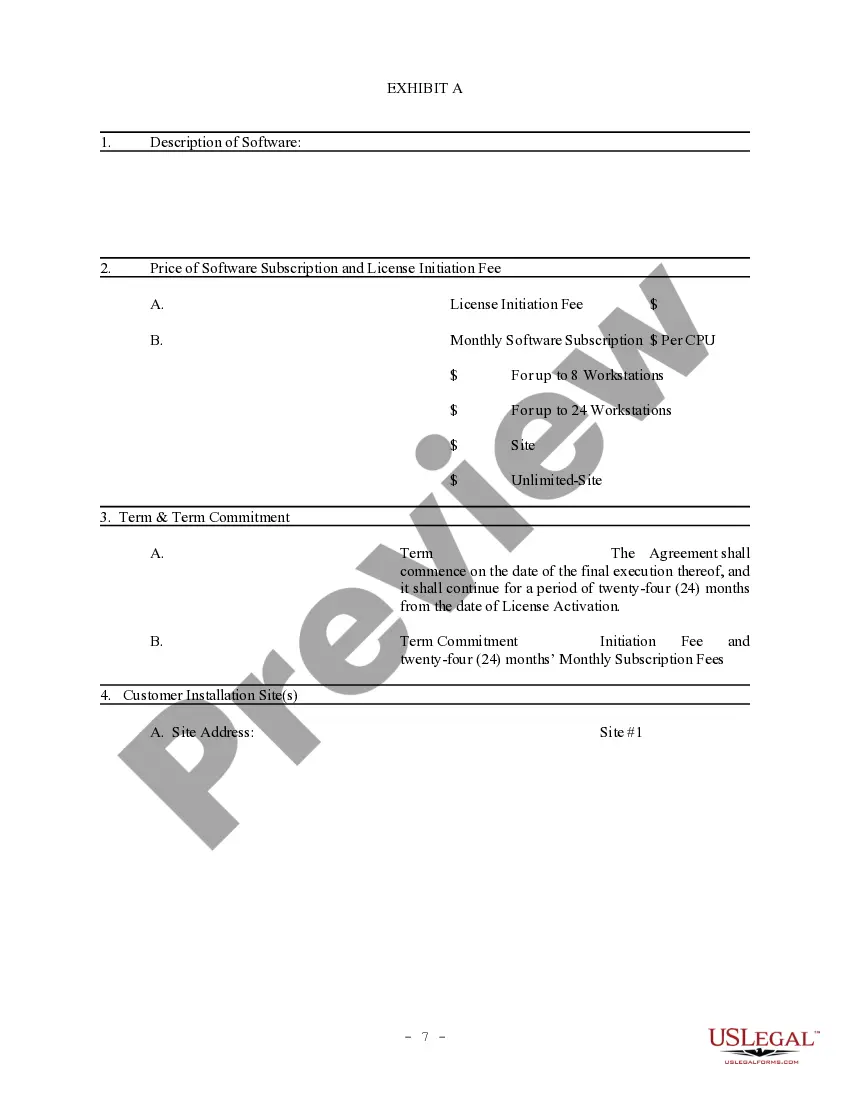

A term license grants users access to software for a specified period, often with a one-time payment, while a subscription license requires ongoing payments to maintain access. In a New Jersey Software License Subscription Agreement, the subscription model often includes updates and support, which may not be the case with a term license. Understanding these differences can help you choose the best option for your needs.

The primary purpose of a subscription agreement is to define the relationship between the software provider and the user. This agreement lays out the expectations regarding payment, usage rights, and services offered. In a New Jersey Software License Subscription Agreement, having clear terms helps prevent disputes and ensures that both parties are on the same page regarding their responsibilities.

A subscription license agreement is a legal document that outlines the terms and conditions of using software based on a subscription model. This agreement specifies the duration of access, payment terms, and any restrictions on usage. When entering into a New Jersey Software License Subscription Agreement, understanding these terms helps ensure compliance and protects your rights as a user.

While New Jersey law does not require an LLC to have an operating agreement, it is highly recommended. An operating agreement helps clarify the management structure and the financial arrangements among members. Without it, a New Jersey Software License Subscription Agreement may lack context, leading to potential misunderstandings. Using USLegalForms can help you draft an effective operating agreement tailored to your needs.