New Jersey Self-Employed Drywall Services Contract

Description

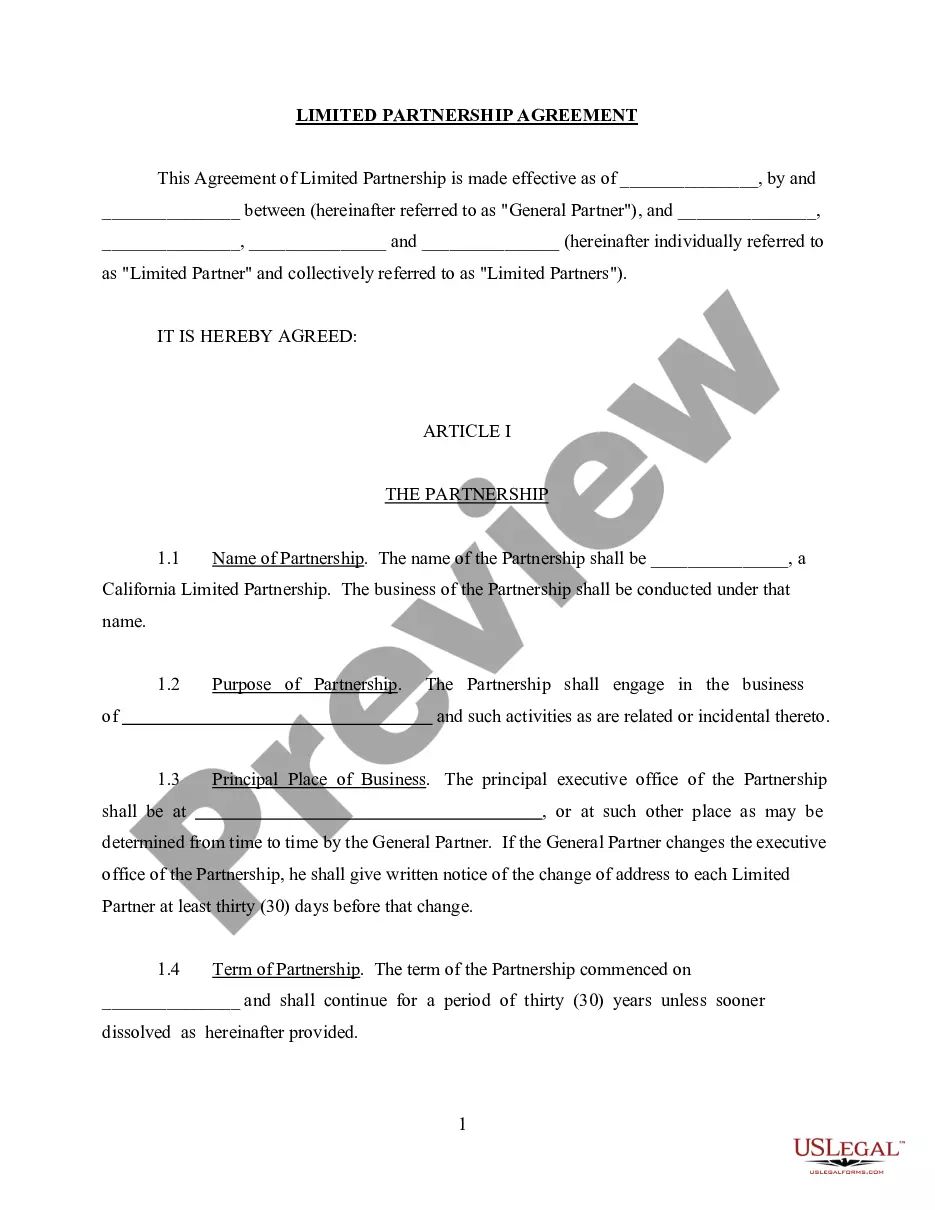

How to fill out Self-Employed Drywall Services Contract?

US Legal Forms - one of the largest collections of legal documents in the country - provides a broad selection of legal document templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most current forms like the New Jersey Self-Employed Drywall Services Contract within moments.

If you already have a subscription, Log In and retrieve the New Jersey Self-Employed Drywall Services Contract from your US Legal Forms library. The Get button will appear on every form you view. You can access all previously downloaded forms in the My documents tab of your account.

If you are using US Legal Forms for the first time, here are straightforward steps to get you started: Ensure you have selected the correct form for your city/region. Click the Preview button to review the form’s contents. Read the form description to make sure you have selected the right form. If the form does not meet your needs, use the Search field at the top of the page to find one that does. If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the payment plan you prefer and provide your information to create an account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded New Jersey Self-Employed Drywall Services Contract. Every template you upload to your account has no expiration date and is yours permanently. Thus, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire.

- Access the New Jersey Self-Employed Drywall Services Contract through US Legal Forms, the most extensive collection of legal document templates.

- Utilize a vast number of professional and state-specific templates that cater to your business or personal needs and requirements.

Form popularity

FAQ

Independent contractors in New Jersey must comply with various legal requirements, including proper licensing and tax obligations. If you are operating under a New Jersey Self-Employed Drywall Services Contract, it's important to understand your classification and the responsibilities that come with it. This includes filing appropriate taxes and adhering to any local regulations. Utilizing resources from uslegalforms can help you stay informed and compliant as an independent contractor.

In New Jersey, repair services are typically taxable, with some exceptions depending on the type of service rendered. If you provide services under a New Jersey Self-Employed Drywall Services Contract, understanding the tax implications of your specific repairs is vital. Accurate classification of your services can help ensure compliance with tax laws. For further assistance, uslegalforms offers tools and information to help you navigate these complexities.

Construction services in New Jersey are generally subject to sales tax, but certain exceptions exist. For example, if you enter into a New Jersey Self-Employed Drywall Services Contract, the nature of the work may determine tax implications. It is critical to understand the specifics of what you are offering to ensure compliance. Platforms like uslegalforms provide valuable information and resources to help clarify your tax responsibilities.

New Jersey does not legally require an operating agreement for LLCs, but having one is highly recommended. An operating agreement outlines the management structure and operating procedures for your business. If you are entering into a New Jersey Self-Employed Drywall Services Contract, a well-defined operating agreement can help prevent disputes among members. Using resources from uslegalforms can assist you in creating a comprehensive operating agreement tailored to your needs.

In New Jersey, the taxability of repairs depends on the nature of the service provided. Generally, repair services for tangible goods are taxable, but if your work involves a New Jersey Self-Employed Drywall Services Contract, the specifics of your contract may influence tax obligations. Understanding whether your services are classified as repairs or improvements is crucial. Seeking guidance from uslegalforms can clarify your responsibilities in this area.

In New Jersey, certain services are exempt from sales tax, including some specific services related to construction and repair. For instance, services that directly relate to the repair and maintenance of tangible personal property may qualify. However, when dealing with New Jersey Self-Employed Drywall Services Contracts, it's essential to assess whether the specific services you provide are subject to tax. For clarity, consulting with an expert or utilizing platforms like uslegalforms can help navigate these regulations.

Yes, New Jersey mandates that contractors be licensed to operate legally within the state. This includes various fields, including drywall services. If you wish to offer a New Jersey Self-Employed Drywall Services Contract, obtaining your license is crucial to ensure you meet state regulations. Being licensed not only ensures compliance but also builds trust with your clients.

The process of obtaining a contractor's license in New Jersey can vary, but it typically takes several weeks to a few months. Factors such as application completeness and background checks can influence the timeline. To expedite your journey toward offering New Jersey Self-Employed Drywall Services Contract, gather all necessary documents and submit your application promptly. Staying organized can streamline the process.

Yes, New Jersey requires contractors to obtain a license to legally operate. This requirement applies to various trades, including drywall services. If you aim to offer New Jersey Self-Employed Drywall Services Contract, securing your contractor's license is essential for compliance and credibility. Being licensed can also enhance your reputation and attract more clients.

Yes, it is illegal to perform contractor work without a proper license in New Jersey. Engaging in unlicensed contracting can lead to fines and legal issues. If you plan to take on projects under a New Jersey Self-Employed Drywall Services Contract, ensure you have the necessary licenses to operate legally. Always verify your licensing requirements to protect yourself and your clients.