New Jersey Journalist - Reporter Agreement - Self-Employed Independent Contractor

Description

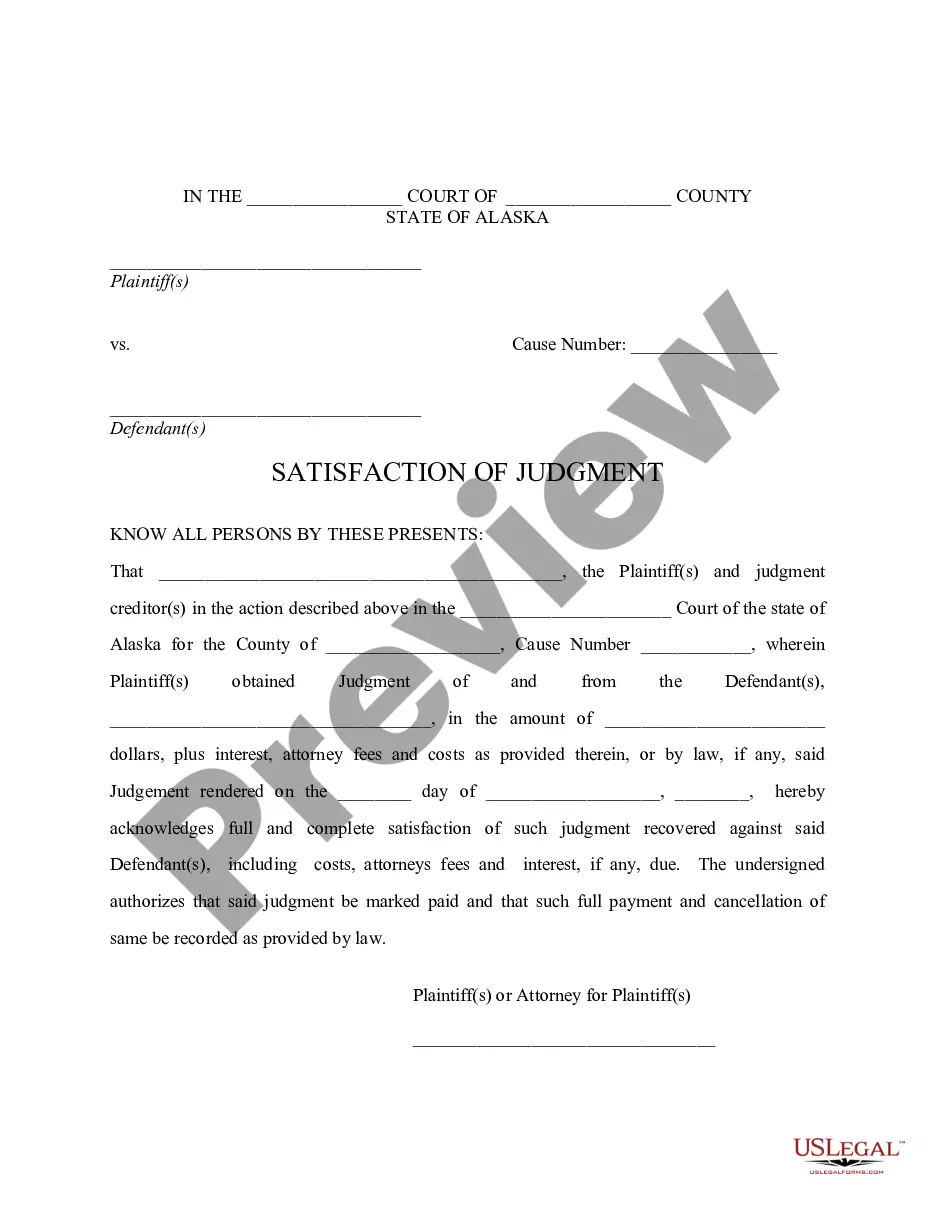

How to fill out Journalist - Reporter Agreement - Self-Employed Independent Contractor?

You might spend hours online trying to locate the legal document format that meets the federal and state requirements you desire.

US Legal Forms offers thousands of legal documents that have been reviewed by professionals.

You can easily obtain or print the New Jersey Journalist - Reporter Agreement - Self-Employed Independent Contractor from their services.

Check the form description to confirm you have selected the right form. If available, use the Preview button to view the document format as well. To find another version of your form, use the Lookup field to find the format that fits your needs and requirements. Once you have found the format you want, click Get now to proceed. Select the pricing plan you prefer, enter your credentials, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the format of your document and download it to your system. Make changes to your document if necessary. You can complete, modify, sign, and print the New Jersey Journalist - Reporter Agreement - Self-Employed Independent Contractor. Download and print thousands of document templates using the US Legal Forms Website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the New Jersey Journalist - Reporter Agreement - Self-Employed Independent Contractor.

- Every legal document format you purchase is yours permanently.

- To get an additional copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document format for the state/region of your choice.

Form popularity

FAQ

Independent contractors can generally work as many hours as they choose, as long as they meet their obligations under the agreement. However, it's important to manage your time effectively to maintain a balance between work and personal life. If you are operating under a New Jersey Journalist - Reporter Agreement - Self-Employed Independent Contractor, be sure to clarify any availability expectations with your clients.

Writing an independent contractor agreement involves clear communication of the terms of work, payment, and responsibilities. It should outline the scope of the work, deadlines, and payment structures. Utilizing a template specifically for a New Jersey Journalist - Reporter Agreement - Self-Employed Independent Contractor can simplify this process and ensure all necessary legal protections are in place.

Yes, the IRS has increased its scrutiny of 1099 employees and independent contractors to ensure proper classification and tax compliance. This means that if you work under a New Jersey Journalist - Reporter Agreement - Self-Employed Independent Contractor, you need to stay compliant with all tax regulations. Proper documentation and reporting can help you avoid potential issues with the IRS.

The new federal rule for independent contractors focuses on the criteria used to determine whether a worker is an independent contractor or an employee. This rule emphasizes the degree of control a business has over the worker. For those working under a New Jersey Journalist - Reporter Agreement - Self-Employed Independent Contractor, it's essential to understand how these regulations apply to your situation.

Independent contractors must report all income, but they do not owe taxes until they earn over a certain threshold, typically $600. However, the IRS expects all income to be declared, which includes payments received under a New Jersey Journalist - Reporter Agreement - Self-Employed Independent Contractor. Staying informed about your tax obligations helps you avoid any penalties in the future.

The new federal rule clarifies the classification of workers as independent contractors or employees. This rule impacts many sectors, including journalism, where a New Jersey Journalist - Reporter Agreement - Self-Employed Independent Contractor can define your working conditions. Understanding this rule is crucial for protecting your rights and ensuring compliance with labor laws.

Filling out an independent contractor agreement involves several key steps. First, clearly define the scope of work, payment terms, and deadlines. It’s also important to include sections on confidentiality and ownership of work products. If you are looking for a structured template, US Legal provides a customizable New Jersey Journalist - Reporter Agreement - Self-Employed Independent Contractor that simplifies this process and ensures you cover all necessary aspects.

To write an independent contractor agreement, start by outlining the scope of work and the specific services you will provide as a New Jersey Journalist - Reporter Agreement - Self-Employed Independent Contractor. Include details about payment terms, deadlines, and any other relevant conditions. Be sure to specify the responsibilities of both parties and include a termination clause. If you find this process challenging, USLegalForms offers templates to simplify creating a comprehensive agreement.

An independent contractor typically fills out several key documents, including a W-9 form, an independent contractor agreement, and sometimes a declaration of independent contractor status form. For those working under a New Jersey Journalist - Reporter Agreement - Self-Employed Independent Contractor, these forms clarify your working relationship with clients. It’s important to keep accurate records of all paperwork for tax purposes. USLegalForms can help streamline this process and ensure you have the correct documents.

Filling out an independent contractor form involves providing your basic information, such as your name, address, and Social Security number. For a New Jersey Journalist - Reporter Agreement - Self-Employed Independent Contractor, it is essential to describe the services you offer and any payment terms you've agreed upon. Use clear language to specify your status as an independent contractor, and ensure you include all necessary signatures. If you need assistance, consider using USLegalForms for a guided approach.