New Jersey Farm Hand Services Contract - Self-Employed

Description

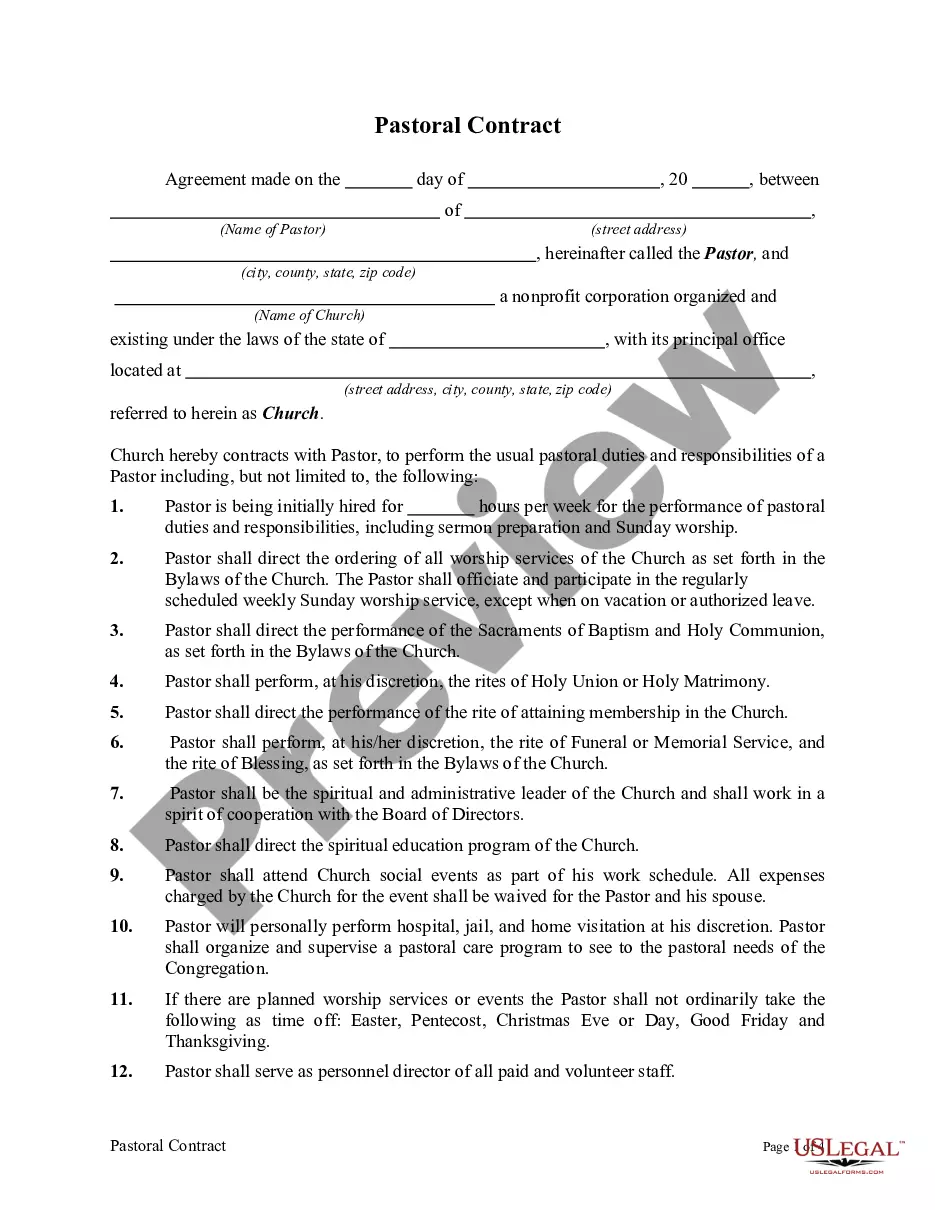

How to fill out Farm Hand Services Contract - Self-Employed?

If you wish to finalize, acquire, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online. Take advantage of the site's straightforward and user-friendly search to find the documents you require. A variety of templates for business and personal purposes are categorized by types and jurisdictions, or keywords. Use US Legal Forms to obtain the New Jersey Farm Hand Services Contract - Self-Employed in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the New Jersey Farm Hand Services Contract - Self-Employed. You can also access forms you previously downloaded in the My documents section of your account.

If you are using US Legal Forms for the first time, follow these steps: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Preview option to review the form's content. Remember to read the description. Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other types of the legal form template. Step 4. Once you have located the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for the account. Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the New Jersey Farm Hand Services Contract - Self-Employed.

- Each legal document template you purchase is yours permanently.

- You have access to every form you downloaded in your account.

- Visit the My documents section and select a form to print or download again.

- Be proactive and download, and print the New Jersey Farm Hand Services Contract - Self-Employed with US Legal Forms.

- There are millions of professional and state-specific forms you can utilize for your business or personal needs.

Form popularity

FAQ

Legal requirements for independent contractors in New Jersey include having a valid tax identification number and adhering to state tax regulations. Additionally, you may need to comply with specific labor laws and contract stipulations. When you enter a New Jersey Farm Hand Services Contract - Self-Employed, it is crucial to confirm that you meet all legal requirements to ensure compliance and protect your rights as a contractor. Utilizing platforms like uslegalforms can help simplify this process.

To get on a New Jersey state contract, you first need to register your business with the state. Next, familiarize yourself with the procurement process, which includes submitting relevant documents and possibly a bid proposal. If you are looking to engage in contracts like the New Jersey Farm Hand Services Contract - Self-Employed, you should consult the state’s procurement website for specific guidelines and opportunities.

In New Jersey, you generally do not need a special license to operate as a contractor. However, certain trades might require specific certifications or registrations. If you are entering into a New Jersey Farm Hand Services Contract - Self-Employed, ensure you meet any local regulations that may apply. Always verify what is necessary for your particular service area.

Contract work and self-employment are closely related but not identical. A self-employed individual often engages in various contracts, while contract workers operate under specific agreements for particular tasks. The New Jersey Farm Hand Services Contract - Self-Employed effectively outlines this relationship and helps protect your rights as a contract worker.

The new federal rule aims to clarify the classification of independent contractors, emphasizing factors such as control and economic dependence. This change affects how many workers are classified as employees versus independent contractors. Familiarizing yourself with the New Jersey Farm Hand Services Contract - Self-Employed ensures you understand your rights and responsibilities under this rule.

1099 rules govern how independent contractors report their income to tax authorities. Essentially, any self-employed individual who earns over a certain threshold must file a 1099 tax form. Utilizing the New Jersey Farm Hand Services Contract - Self-Employed can help you stay compliant with these tax obligations.

Most 1099 employees are classified as self-employed. They receive income directly from clients without the benefits that traditional employees enjoy, such as health insurance or retirement plans. By using the New Jersey Farm Hand Services Contract - Self-Employed, you can establish clear terms for your self-employment.

In New Jersey, workers' compensation is not typically required for independent contractors. However, it's wise to consider obtaining coverage for personal protection. When utilizing the New Jersey Farm Hand Services Contract - Self-Employed, you can better navigate these responsibilities and protect yourself.

Contract work can be considered a form of employment, but it differs from traditional employment. While individuals may engage in contract work, they maintain independence and control over their projects. Understanding the New Jersey Farm Hand Services Contract - Self-Employed helps clarify these distinctions.

Yes, contract employees are typically viewed as self-employed individuals. They take on tasks or projects under a contract but do not have the same relationship with an employer as traditional employees do. The New Jersey Farm Hand Services Contract - Self-Employed clearly outlines the nature of their work, emphasizing their independent status.