New Jersey Auctioneer Services Contract - Self-Employed Independent Contractor

Description

How to fill out Auctioneer Services Contract - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide range of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by category, state, or keywords. You can find the newest versions of forms like the New Jersey Auctioneer Services Contract - Self-Employed Independent Contractor in just seconds.

If you already have a monthly subscription, Log In to download the New Jersey Auctioneer Services Contract - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will be available on every form you view. You can also access all previously downloaded forms in the My documents tab in your account.

Process the transaction. Use your credit card or PayPal account to complete the payment.

Select the file format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded New Jersey Auctioneer Services Contract - Self-Employed Independent Contractor. Every template you add to your account has no expiration date and belongs to you permanently. So, if you wish to download or print another copy, just go to the My documents section and click on the form you need. Access the New Jersey Auctioneer Services Contract - Self-Employed Independent Contractor with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have selected the right form for your area/state.

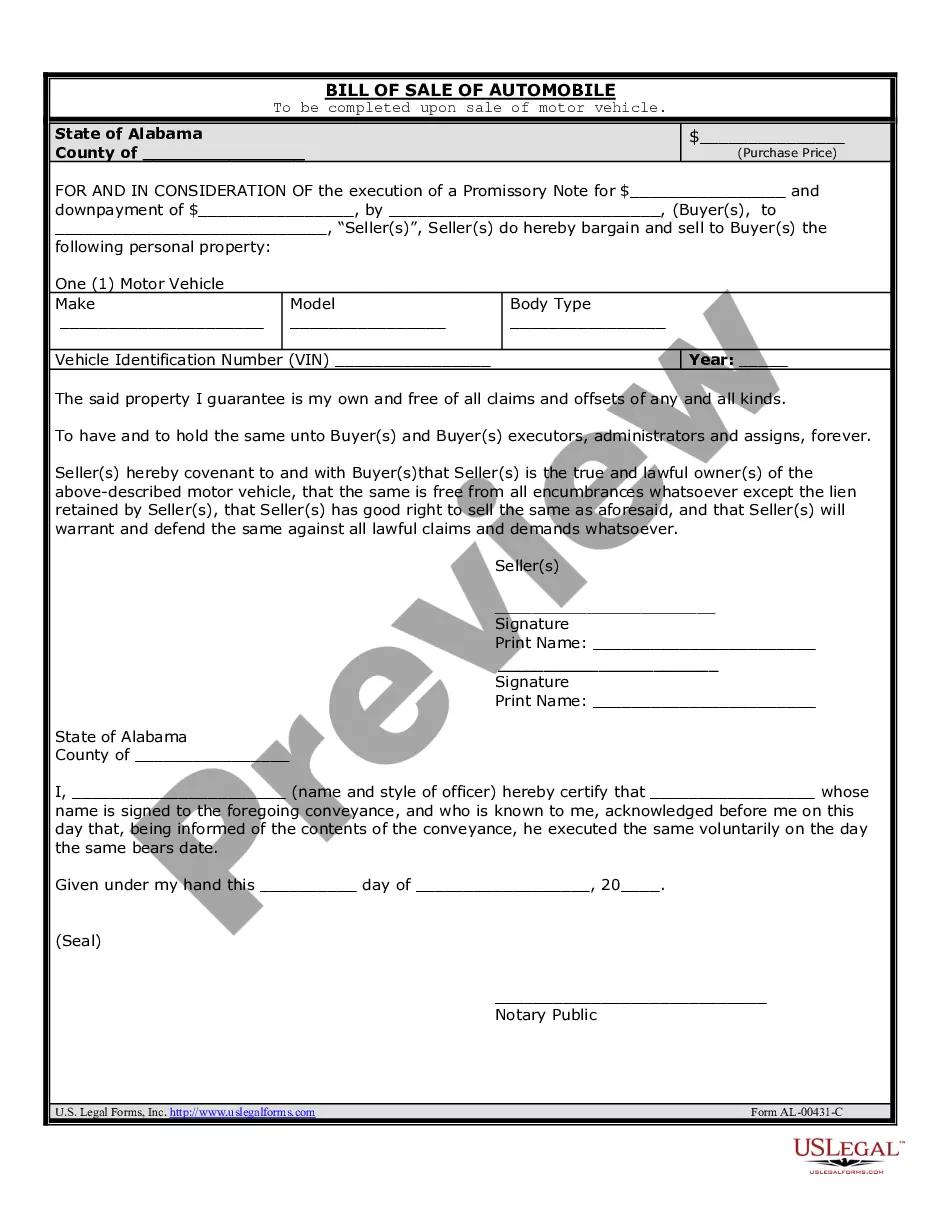

- Click the Preview button to review the form's details.

- Check the form information to ensure that you have selected the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are happy with the form, confirm your choice by clicking the Get now button.

- Then, choose the subscription plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

Reporting income as an independent contractor involves tracking all earnings and expenses. You typically file a Schedule C along with your personal tax return to report your net profit or loss. Keeping detailed records is crucial, especially when managing your New Jersey Auctioneer Services Contract - Self-Employed Independent Contractor, which helps in accurately reporting your income.

Both terms have specific meanings but generally convey the same idea. 'Self-employed' refers broadly to anyone working for themselves, while 'independent contractor' specifies a type of self-employment focused on service-based work. When discussing your situation related to a New Jersey Auctioneer Services Contract - Self-Employed Independent Contractor, using the term that best describes your work arrangement is key.

Yes, independent contractors file taxes as self-employed individuals. This requires you to report all income and expenses related to your business activities. Utilizing a New Jersey Auctioneer Services Contract - Self-Employed Independent Contractor can help clarify your income structure and simplify the filing process.

An independent contractor in New Jersey is an individual who provides services to clients without being classified as an employee. This status allows you more independence in how you perform your work, as outlined in your New Jersey Auctioneer Services Contract - Self-Employed Independent Contractor. It's important to understand the regulations and requirements that come with this designation.

Yes, an independent contractor is considered self-employed. This means you operate your own business and are not under the direct control of another employer. With a New Jersey Auctioneer Services Contract - Self-Employed Independent Contractor, you maintain the freedom to manage your work and set your own schedule.

Independent contractors in New Jersey are taxed on their net income, which may fall into varying tax brackets based on overall earnings. It's essential to keep track of all income and expenses as they directly affect your tax rate. Consulting a tax professional can help ensure compliance and maximize deductions related to your New Jersey Auctioneer Services Contract - Self-Employed Independent Contractor.

To prove you are an independent contractor, typically you need to provide documentation, such as contracts, invoices, or tax forms, that show you operate as a self-employed individual. A New Jersey Auctioneer Services Contract - Self-Employed Independent Contractor can serve as a strong proof of your independent status. It's vital to maintain clear records of your work and payments.

Being self-employed means you work for yourself rather than for a company or organization. This often includes running your own business, as is common among those entering a New Jersey Auctioneer Services Contract - Self-Employed Independent Contractor. You manage your own business operations and earn income directly from clients or customers.

Several factors can disqualify you from receiving unemployment benefits in New Jersey, such as voluntarily quitting your job without good cause or being fired for misconduct. Additionally, failing to meet the base earnings requirement can also be a reason for disqualification. If you operate as an independent contractor under a New Jersey Auctioneer Services Contract - Self-Employed Independent Contractor, ensure you document your income and employment history to support any future claims.

Yes, independent contractors can collect unemployment in New Jersey, but eligibility may vary based on specific conditions, such as income and job loss. You should apply for benefits through the New Jersey Department of Labor and thoroughly review the documentation required. Understanding the nuances of your work, particularly under a New Jersey Auctioneer Services Contract - Self-Employed Independent Contractor, can help clarify your benefit options.