New Jersey Sample Stock Purchase and Investor Rights Agreement of Esoft, Inc.

Description

How to fill out Sample Stock Purchase And Investor Rights Agreement Of Esoft, Inc.?

US Legal Forms - among the biggest libraries of authorized types in the States - delivers a wide range of authorized papers layouts it is possible to down load or produce. Using the website, you may get thousands of types for enterprise and individual reasons, sorted by groups, says, or keywords and phrases.You will discover the most up-to-date versions of types much like the New Jersey Sample Stock Purchase and Investor Rights Agreement of Esoft, Inc. in seconds.

If you already possess a monthly subscription, log in and down load New Jersey Sample Stock Purchase and Investor Rights Agreement of Esoft, Inc. in the US Legal Forms catalogue. The Acquire switch will appear on every form you look at. You gain access to all earlier acquired types from the My Forms tab of your accounts.

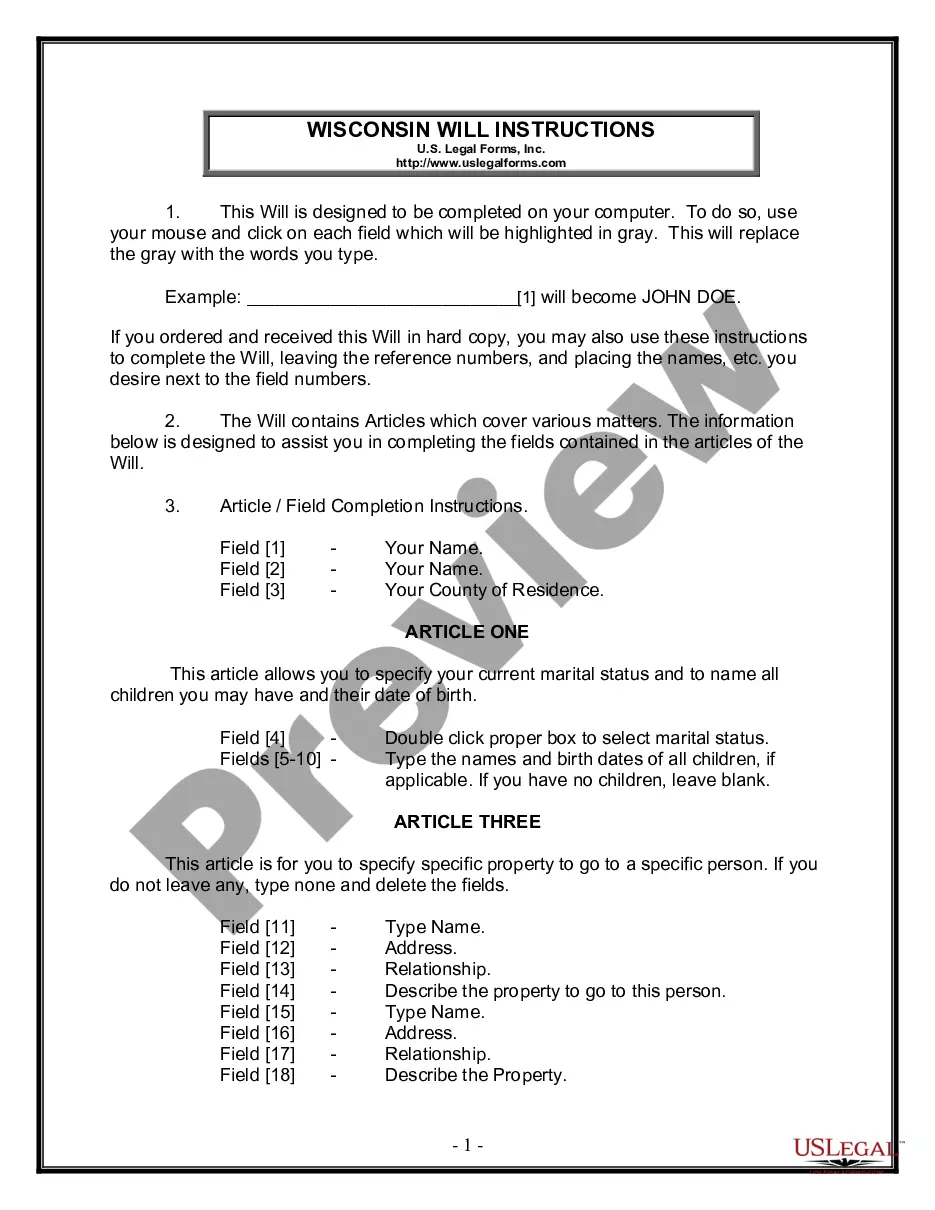

If you want to use US Legal Forms the very first time, allow me to share simple instructions to help you started off:

- Make sure you have selected the proper form for your personal city/area. Go through the Review switch to analyze the form`s content material. Look at the form description to actually have selected the right form.

- If the form does not satisfy your demands, take advantage of the Research discipline on top of the display to obtain the the one that does.

- Should you be content with the shape, verify your option by clicking the Get now switch. Then, pick the pricing plan you prefer and offer your qualifications to sign up to have an accounts.

- Process the financial transaction. Use your charge card or PayPal accounts to perform the financial transaction.

- Find the formatting and down load the shape on your device.

- Make changes. Load, revise and produce and sign the acquired New Jersey Sample Stock Purchase and Investor Rights Agreement of Esoft, Inc..

Each and every design you added to your money does not have an expiry particular date and is the one you have permanently. So, if you want to down load or produce an additional backup, just proceed to the My Forms area and click on around the form you will need.

Obtain access to the New Jersey Sample Stock Purchase and Investor Rights Agreement of Esoft, Inc. with US Legal Forms, probably the most considerable catalogue of authorized papers layouts. Use thousands of skilled and status-specific layouts that fulfill your business or individual needs and demands.

Form popularity

FAQ

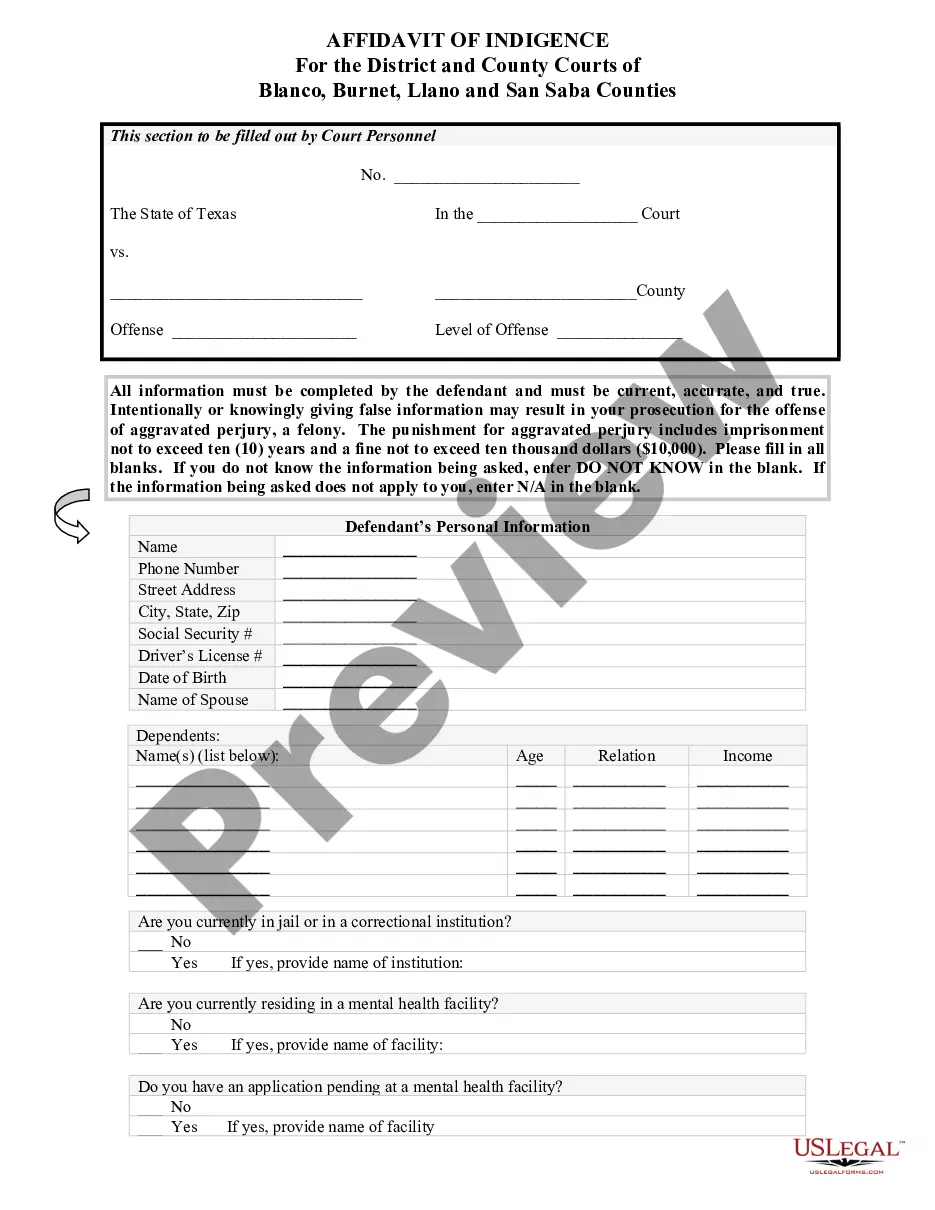

Some of the key items that are listed in a stock purchase agreement are: Name of the company whose shares are being bought and sold; Name of the buyer and seller of shares; The number of shares being sold and the par value of those shares; The date and place of the transaction;

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

Common due diligence issues unique to stock purchases include the seller's title to the target company's stock, terms of key contracts, identifying the target company's liabilities, and the nature and condition of the target company's assets.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

This might include provisions for price and payment, conditions precedent to sale, completion arrangements, warranties, restraints and miscellaneous provisions (such as indemnity clauses, tax provisions or confidentiality agreements).

A stock purchase agreement is a contract signed by two parties when they buy or sell stock in a corporation in the US. Small firms that sell stock frequently use these agreements. Stock can be sold to buyers by either the corporation or its shareholders.

This means that the Seller is entitled to the cash on the balance sheet on the closing date of the transaction, and that the Seller is responsible for debts owed by the company (defined as Indebtedness).