New Jersey Private Placement Financing

Description

How to fill out Private Placement Financing?

Have you been in the position in which you need paperwork for either company or personal uses nearly every day time? There are a lot of legitimate document templates available on the Internet, but getting ones you can rely on is not easy. US Legal Forms provides 1000s of type templates, such as the New Jersey Private Placement Financing, that happen to be composed in order to meet federal and state demands.

Should you be presently informed about US Legal Forms internet site and get your account, just log in. After that, you can acquire the New Jersey Private Placement Financing template.

If you do not come with an accounts and want to begin using US Legal Forms, adopt these measures:

- Find the type you need and ensure it is for that proper city/region.

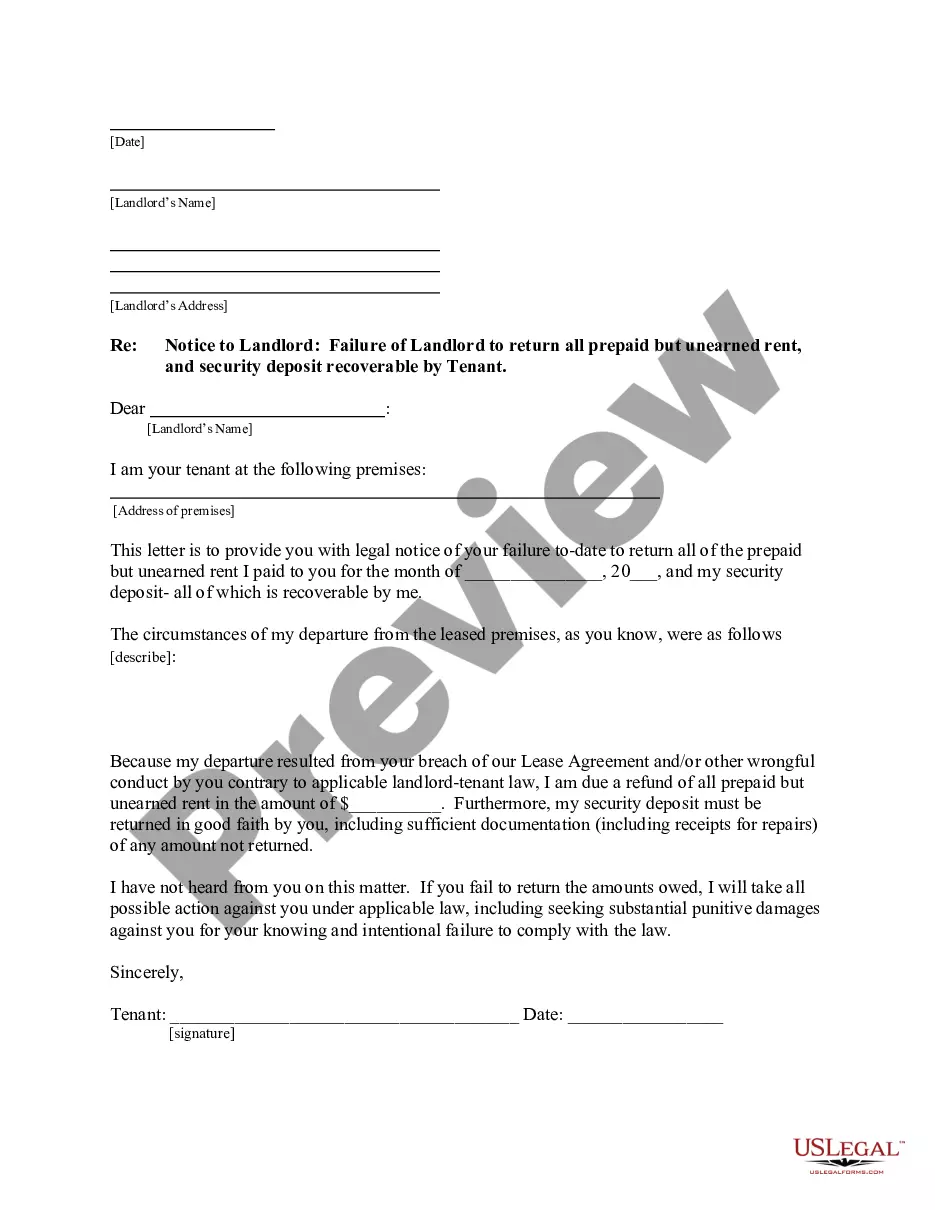

- Make use of the Review switch to check the shape.

- See the description to ensure that you have chosen the correct type.

- In the event the type is not what you are searching for, utilize the Search industry to get the type that meets your needs and demands.

- If you obtain the proper type, click Buy now.

- Choose the costs plan you want, fill in the required info to produce your account, and purchase the order making use of your PayPal or credit card.

- Select a convenient paper file format and acquire your backup.

Discover each of the document templates you may have purchased in the My Forms food selection. You may get a additional backup of New Jersey Private Placement Financing whenever, if needed. Just click on the essential type to acquire or print the document template.

Use US Legal Forms, the most substantial assortment of legitimate types, in order to save time and prevent errors. The service provides expertly manufactured legitimate document templates that can be used for a selection of uses. Create your account on US Legal Forms and commence making your life easier.

Form popularity

FAQ

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than publicly on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.

Rule 701 is important because if a company expects that the total aggregate sales price of stock options issued during any consecutive 12-month period will exceed $10 million, then Rule 701 requires the company to provide certain information to prospective purchasers (i.e., stock option holders who are exercising their ...

Rule 701 is a federal exemption under the Securities Act of 1933 that allows private companies to issue securities to employees and other service providers. This is especially useful when not all of your employees or service providers are accredited investors eligible for other securities exemptions like Regulation D.

A rule under the Securities Act that provides a safe harbor from registration under the Securities Act for grants of equity securities by a non-reporting company to its employees and certain other persons under the terms of a written compensatory benefit plan or written compensation contract.

Disadvantages of using private placements a reduced market for the bonds or shares in your business, which may have a long-term effect on the value of the business as a whole. a limited number of potential investors, who may not want to invest substantial amounts individually.

Created by the Securities and Exchange Commission (SEC), Rule 701 is a safe harbor exemption allowing companies to issue stocks or stock options to employees without needing to register the stock under the Securities Act. For most startups, this is one of the legal requirements for equity compensation.

Under the Securities Act of 1933, any offer to sell securities must either be registered with the SEC or meet an exemption. Issuers and broker-dealers most commonly conduct private placements under Regulation D of the Securities Act of 1933, which provides three exemptions from registration.

Rule 701 exempts certain sales of securities made to compensate employees, consultants and advisors. This exemption is not available to Exchange Act reporting companies. A company can sell at least $1 million of securities under this exemption, regardless of its size.