New Jersey Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan

Description

How to fill out Adoption Of Nonemployee Directors Deferred Compensation Plan With Copy Of Plan?

Choosing the right authorized file web template could be a struggle. Obviously, there are tons of templates available on the net, but how can you obtain the authorized kind you want? Use the US Legal Forms site. The services offers 1000s of templates, such as the New Jersey Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan, which you can use for business and private needs. All of the kinds are inspected by experts and meet up with federal and state needs.

Should you be currently authorized, log in for your profile and then click the Obtain switch to obtain the New Jersey Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan. Utilize your profile to check throughout the authorized kinds you may have ordered earlier. Check out the My Forms tab of your own profile and get yet another duplicate of your file you want.

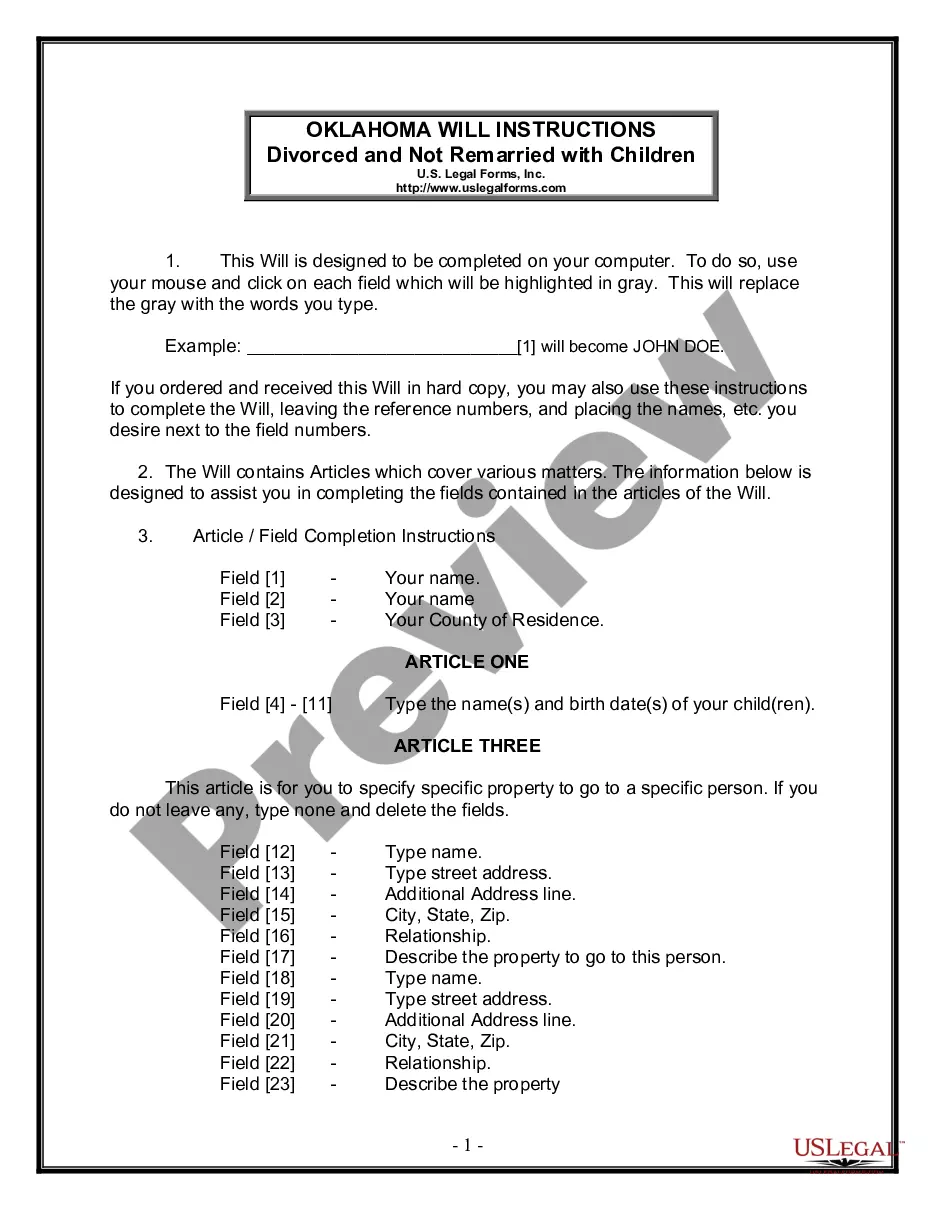

Should you be a whole new consumer of US Legal Forms, here are easy directions for you to adhere to:

- First, make sure you have chosen the correct kind to your metropolis/area. You are able to check out the shape using the Preview switch and look at the shape description to ensure this is basically the best for you.

- In case the kind is not going to meet up with your preferences, take advantage of the Seach industry to obtain the right kind.

- When you are sure that the shape is suitable, click the Acquire now switch to obtain the kind.

- Pick the costs plan you want and type in the required information and facts. Build your profile and pay money for an order with your PayPal profile or bank card.

- Choose the document format and down load the authorized file web template for your system.

- Full, modify and produce and sign the acquired New Jersey Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan.

US Legal Forms may be the most significant local library of authorized kinds in which you can see various file templates. Use the company to down load expertly-created documents that adhere to status needs.

Form popularity

FAQ

To enroll, your employer must participate in the Plan (employers can visit our Employer Resource Center or call us at (800) 696-3907 to learn more). For more information, visit CalPERS 457 Plan website, call the Plan Information Line at (800) 260-0659, or view the additional resources below.

A nonqualified deferred compensation plan is a type of retirement plan that lets select, highly compensated employees enjoy tax advantages by deferring a greater percentage of their compensation (and current income taxes) than is allowed by the IRS in a qualified retirement plan.

Nonqualified deferred compensation plans are used by businesses to supplement existing qualified plans and provide an extra benefit to key personnel and highly compensated employees. In small businesses, this usually includes the owner and founder.

A deferred compensation plan can be qualifying or non-qualifying. Qualifying plans are protected under the ERISA and must be drafted based on ERISA rules. While such rules do not apply to NQDC plans, tax laws require NQDC plans to meet the following conditions: The plan must be in writing.

However, S corporations and unincorporated businesses can adopt NQDC plans for regular employees who have no ownership in the business. NQDC plans are most suitable for employers that are financially sound and have a reasonable expectation of continuing profitable business operations in the future.

Deferred compensation plans are an incentive that employers use to hold onto key employees. Deferred compensation can be structured as either qualified or non-qualified under federal regulations. Some deferred compensation is made available only to top executives.

Section 409A generally applies to plans benefiting service providers, which include individuals, such as employees, directors, partners and proprietors, as well as corporations, S corporations, partnerships, personal service corporations or similar noncorporate entities.

Non-qualified plans are plans that you can use to provide additional benefits to yourself and your key employees and executives. A non-qualified plan is often used along with a qualified plan as an additional benefit to attract and retain key employees.