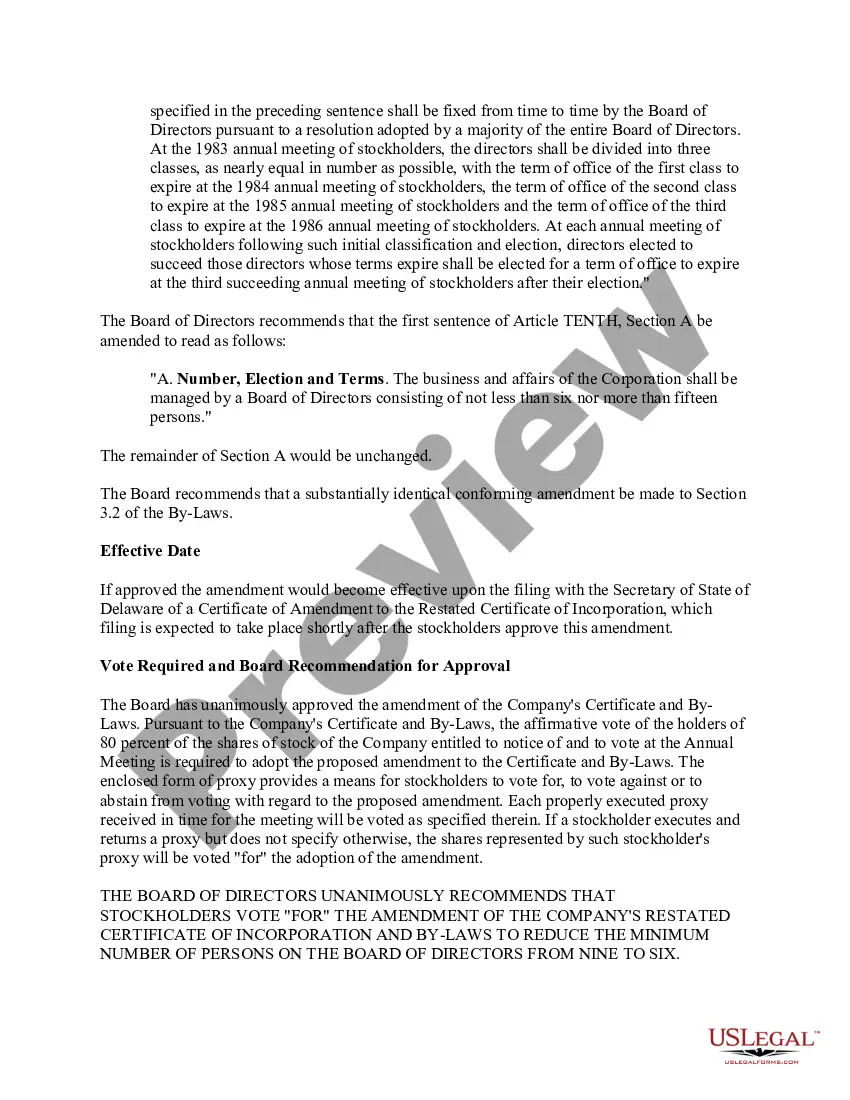

New Jersey Proposed amendments to restated certificate of incorporation

Description

How to fill out Proposed Amendments To Restated Certificate Of Incorporation?

US Legal Forms - one of the most significant libraries of legitimate kinds in the States - offers a variety of legitimate file templates you are able to download or print out. Making use of the site, you may get 1000s of kinds for organization and individual uses, categorized by categories, states, or key phrases.You will find the newest types of kinds such as the New Jersey Proposed amendments to restated certificate of incorporation within minutes.

If you already have a membership, log in and download New Jersey Proposed amendments to restated certificate of incorporation through the US Legal Forms collection. The Obtain switch will appear on every single form you view. You get access to all in the past acquired kinds from the My Forms tab of the profile.

If you would like use US Legal Forms initially, here are easy recommendations to get you started off:

- Ensure you have chosen the right form for your personal town/county. Select the Preview switch to check the form`s articles. Read the form information to actually have chosen the right form.

- In the event the form doesn`t satisfy your requirements, take advantage of the Lookup area on top of the display screen to discover the one which does.

- Should you be satisfied with the shape, confirm your choice by visiting the Acquire now switch. Then, choose the pricing strategy you favor and offer your credentials to sign up to have an profile.

- Procedure the financial transaction. Use your bank card or PayPal profile to accomplish the financial transaction.

- Choose the structure and download the shape in your gadget.

- Make modifications. Complete, change and print out and indication the acquired New Jersey Proposed amendments to restated certificate of incorporation.

Each template you included with your bank account does not have an expiration particular date and is the one you have forever. So, if you wish to download or print out yet another duplicate, just go to the My Forms area and click around the form you want.

Gain access to the New Jersey Proposed amendments to restated certificate of incorporation with US Legal Forms, by far the most comprehensive collection of legitimate file templates. Use 1000s of skilled and express-specific templates that meet your company or individual demands and requirements.

Form popularity

FAQ

Thus, an amended and restated document includes all past amendments executed up to the date of the amended and restated agreement. The purpose of the amended and restated agreement is to simplify reading of the document, as one does not need to read the original document side-by-side with all subsequent amendments.

Within the report, the Division of Revenue requires an assessment of Insurance Policy Information and Workman's Compensation. If your business has insurance, you need to provide policy numbers, the date the policy went into effect and the name of the insurer.

Because New Jersey's annual report is mandatory, LLCs must complete and submit it by the specified deadline to remain in compliance with state regulations. Failing to file the annual report or filing it late may result in penalties or even the administrative dissolution of the LLC.

What is Amended and Restated? ?Amended? means that the document has ?changed?? that someone has revised the document. ?Restated? means ?presented in its entirety?, ? as a single, complete document. ingly, ?amended and restated? means a complete document into which one or more changes have been incorporated.

An Amended and Restated Certificate of Incorporation is a legal document filed with the Secretary of State that restates, integrates, and adjusts the startup's initial Articles of Incorporation (i.e. the company's Charter).

You would file Restated Certificate form to restate or restate and amend the certificate of incorporation. For profit corporations would file form C-100A Restated Certificate of Incorporation. There are two pages required to restate the certificate. Make sure you submit both pages to the Division of Revenue.

This form may be used to restate and integrate, AND FURTHER AMEND, the Certificate of Formation of a Limited Liability Company on file with the Department of the Treasury, as supplemented and amended by any instrument that was executed and filed pursuant NJSA 42. 6.

You can either file an amendment or include the changes in the annual report. Any changes in the operating address or registered office of your corporation have to be reported to the state. You can do this using an amendment or reflect the changes in the annual report.

There may be a number of these over time and, in more complex and long-running transactions, it is common at some point for the original facility agreement with its changes to be ?amended and restated? ? in other words, consolidated and contained in a single document. That is as much for ease of reading as anything.

Amendment deeds and amendment and restatement deeds are different ways of making changes to existing contracts. An amendment and restatement deed adds information and detail to an entire agreement. Yet, an amendment deed simply amends the existing content.