New Jersey Advisory Agreement between Real Estate Investment Trust and corporation

Description

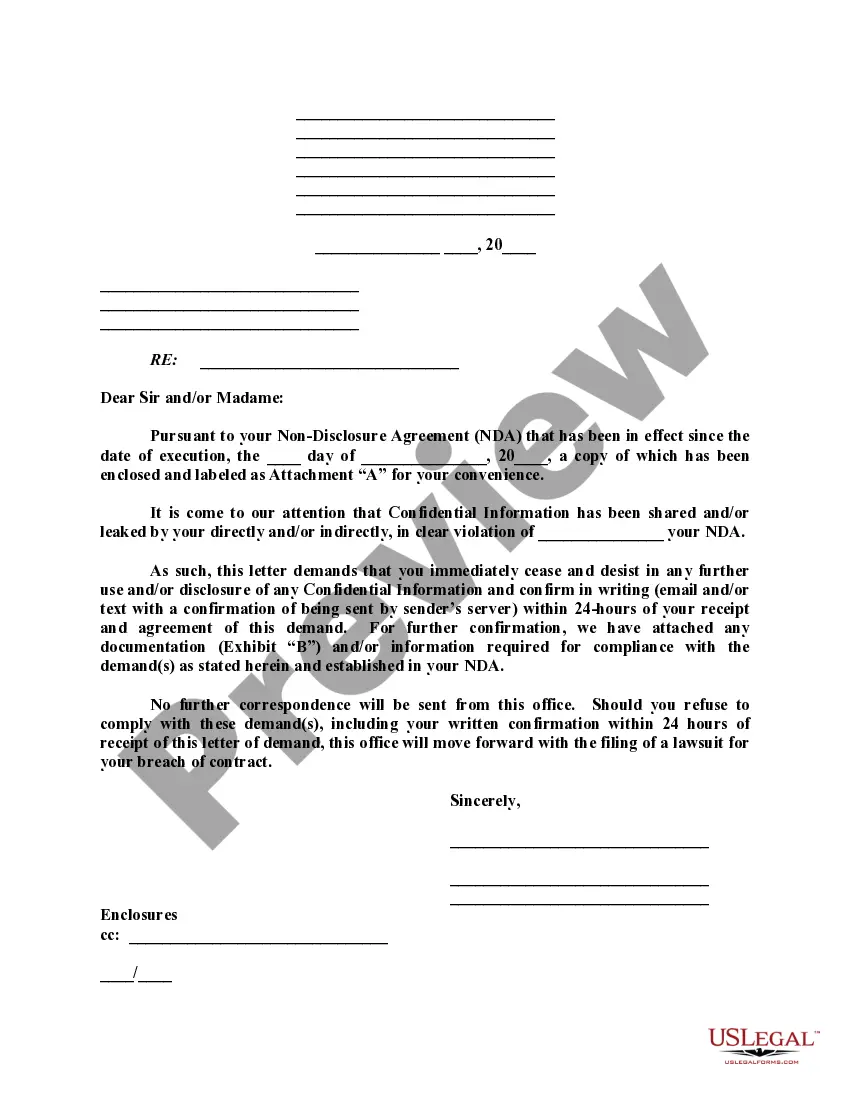

How to fill out Advisory Agreement Between Real Estate Investment Trust And Corporation?

If you want to full, acquire, or printing authorized document layouts, use US Legal Forms, the largest collection of authorized kinds, which can be found on the Internet. Utilize the site`s simple and practical research to get the papers you will need. Various layouts for organization and personal uses are categorized by categories and claims, or keywords and phrases. Use US Legal Forms to get the New Jersey Advisory Agreement between Real Estate Investment Trust and corporation with a few clicks.

In case you are previously a US Legal Forms consumer, log in in your bank account and click on the Download option to have the New Jersey Advisory Agreement between Real Estate Investment Trust and corporation. You can also entry kinds you previously downloaded inside the My Forms tab of your own bank account.

If you are using US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have selected the form for the appropriate metropolis/land.

- Step 2. Use the Review choice to look through the form`s content. Do not forget about to read through the outline.

- Step 3. In case you are not happy using the type, take advantage of the Search discipline near the top of the display to get other models of your authorized type design.

- Step 4. After you have identified the form you will need, click the Acquire now option. Pick the costs program you choose and put your qualifications to sign up for the bank account.

- Step 5. Process the purchase. You should use your credit card or PayPal bank account to finish the purchase.

- Step 6. Choose the format of your authorized type and acquire it on your own gadget.

- Step 7. Comprehensive, modify and printing or indication the New Jersey Advisory Agreement between Real Estate Investment Trust and corporation.

Every authorized document design you acquire is the one you have forever. You have acces to every single type you downloaded inside your acccount. Click on the My Forms segment and decide on a type to printing or acquire yet again.

Remain competitive and acquire, and printing the New Jersey Advisory Agreement between Real Estate Investment Trust and corporation with US Legal Forms. There are millions of professional and state-certain kinds you can use for the organization or personal requires.

Form popularity

FAQ

Tax Implications REITs offer the advantage of exemption from federal corporate income tax on distributed income. However, shareholders are typically subject to taxation on dividends received. In contrast, LLCs' pass-through taxation allows owners to potentially offset real estate losses against other income.

REITs, or real estate investment trusts, are companies that own or finance income-producing real estate across a range of property sectors. These real estate companies have to meet a number of requirements to qualify as REITs. Most REITs trade on major stock exchanges, and they offer a number of benefits to investors.

To qualify as a REIT, an organization must be a corporation, trust or association. A REIT cannot be a financial institution or an insurance company and it must be managed by one or more trustees or directors.

Some REITs may choose to distribute 100% of the revenues, but the law requires them to distribute at least 90% of the net incomes as dividends. For REOCs, the management is at liberty to set policies on how the net income is reinvested in new projects or distributed to shareholders.

To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends.

Many REITs are registered with the SEC and are publicly traded on a stock exchange. These are known as publicly traded REITs. Others may be registered with the SEC but are not publicly traded. These are known as non- traded REITs (also known as non-exchange traded REITs).

REITs trade on major exchanges the same way stocks that do, and their prices fluctuate throughout the trading session. Most REITs are very liquid and trade under substantial volume. Real estate funds don't trade like stocks, and share prices are updated only once a day.

The chief difference between Hotel-REIT and traditional C-corporation legal structures is that stockholders of Hotel-REITs are exempt from corporate taxation on distributed dividends, whereas C-corporation hotels must pay corporate taxes on dividend payments.