New Jersey List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005

Description

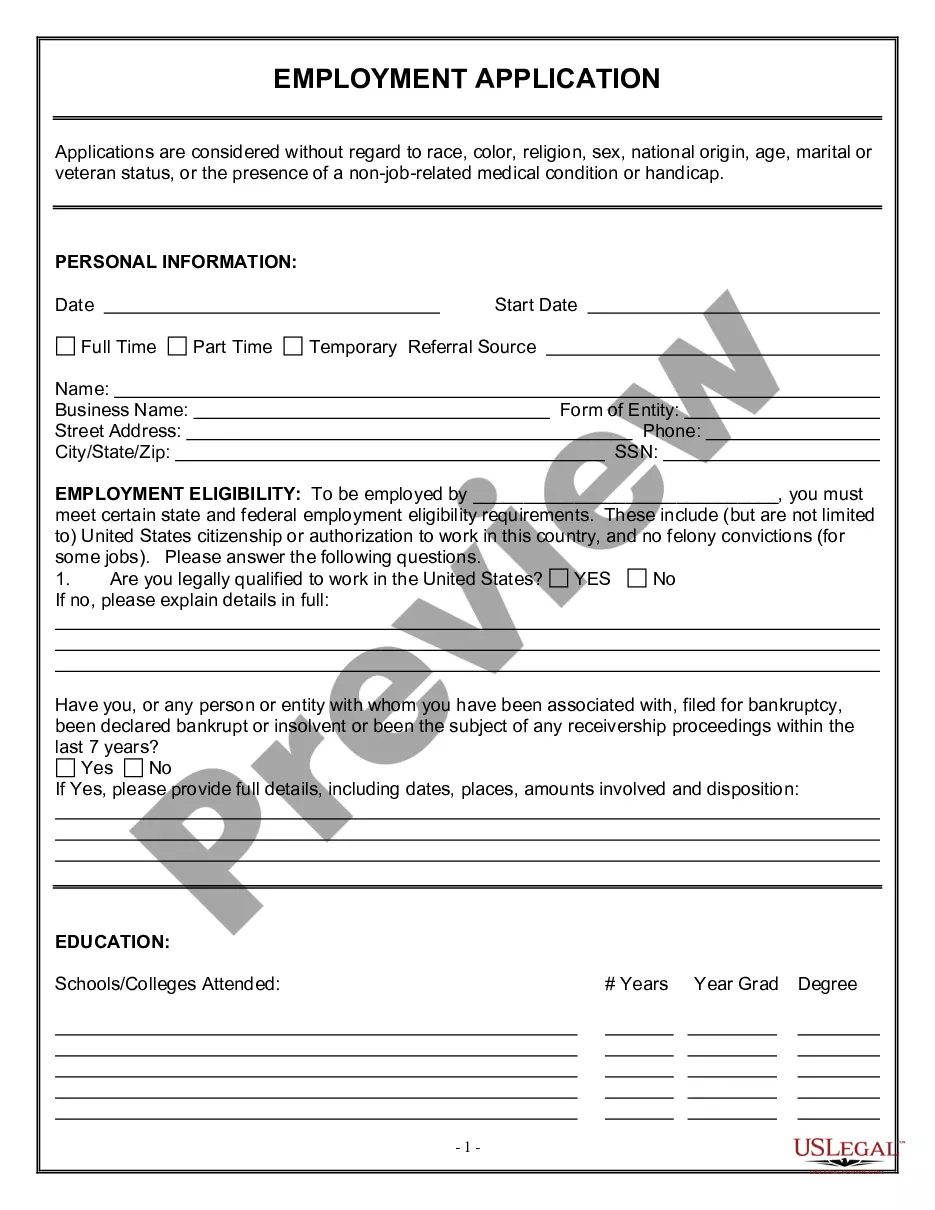

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

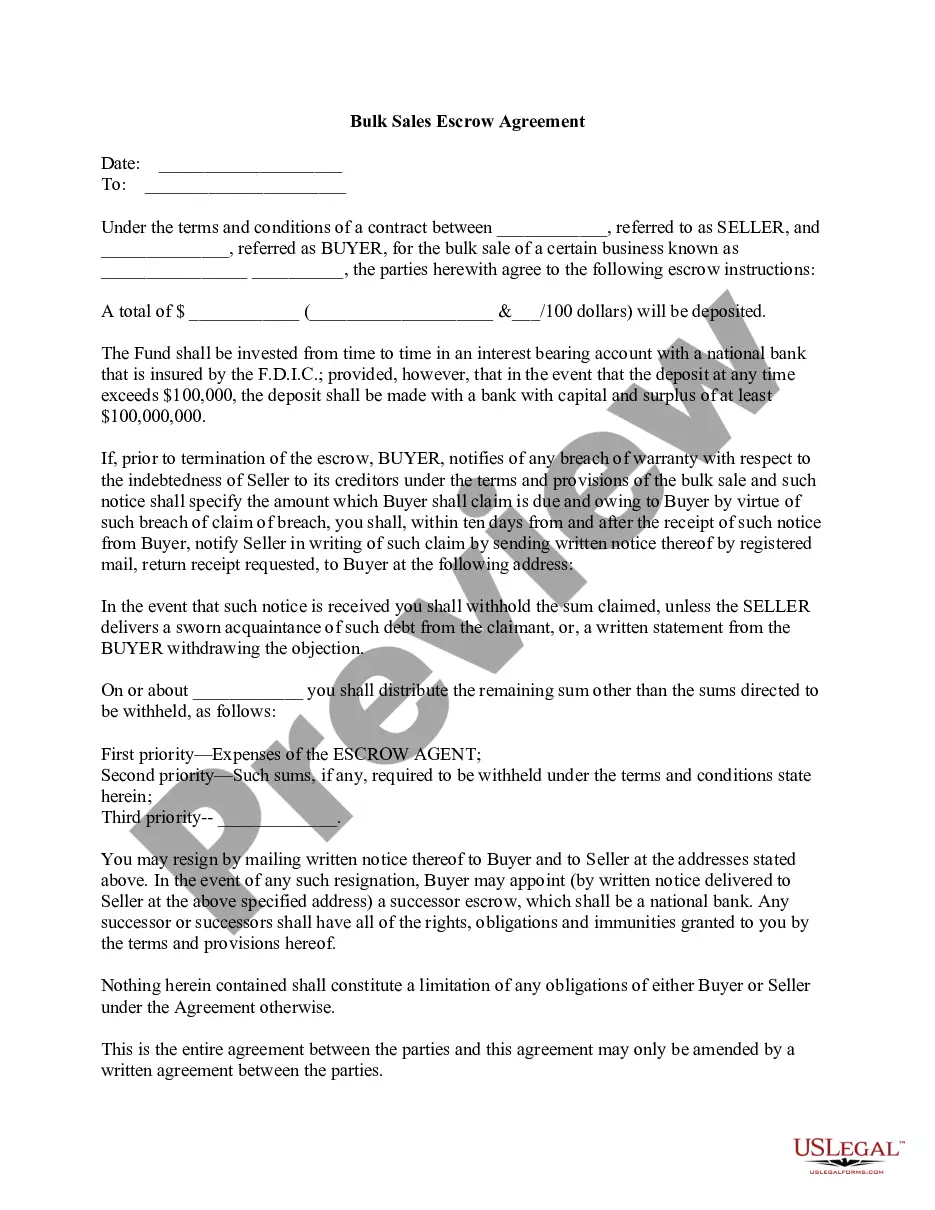

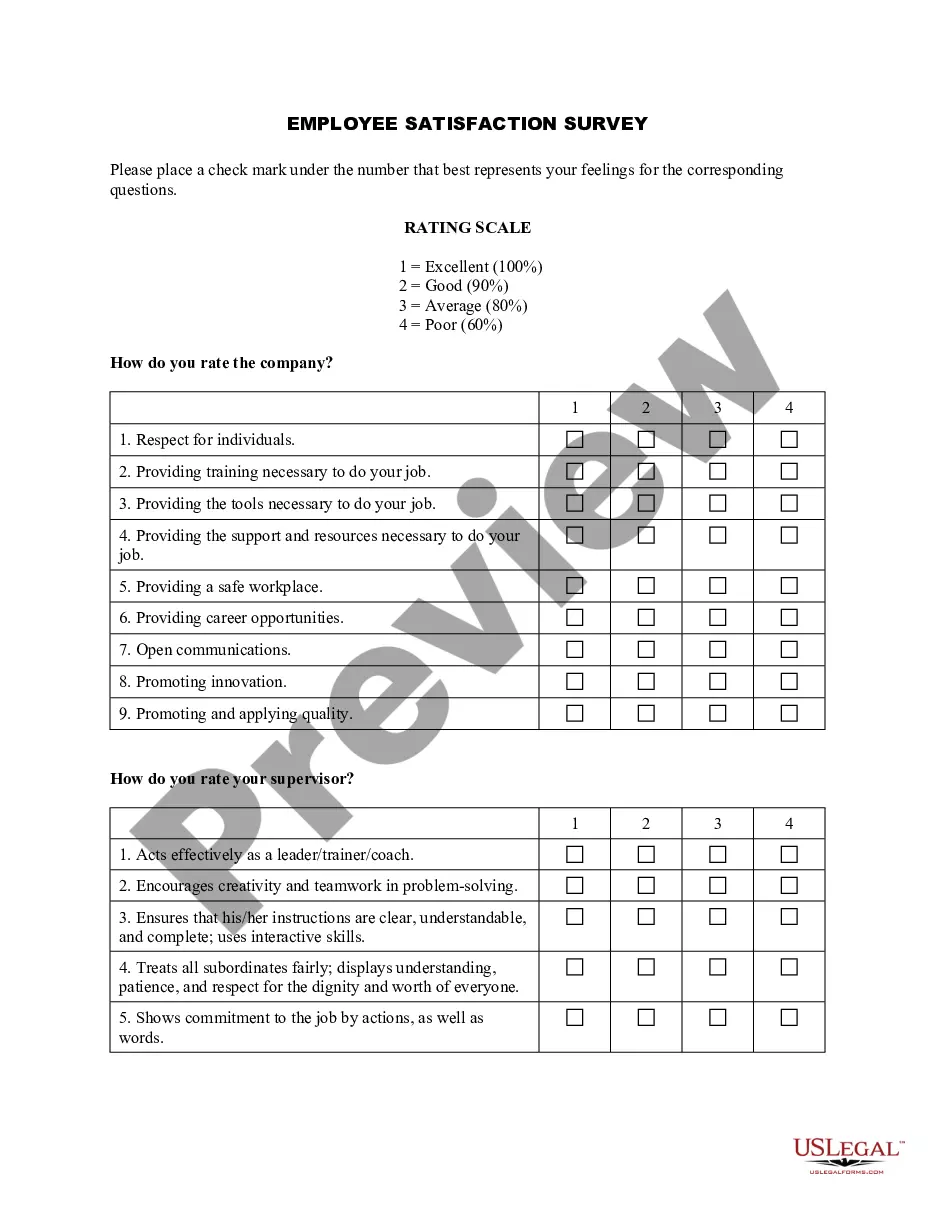

You may commit hrs online looking for the lawful record design that fits the federal and state needs you require. US Legal Forms provides 1000s of lawful varieties that happen to be evaluated by specialists. You can easily download or printing the New Jersey List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 from your support.

If you already possess a US Legal Forms accounts, you are able to log in and click on the Obtain switch. After that, you are able to total, revise, printing, or sign the New Jersey List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005. Each and every lawful record design you buy is yours eternally. To have another copy for any acquired develop, visit the My Forms tab and click on the corresponding switch.

Should you use the US Legal Forms internet site for the first time, follow the straightforward recommendations below:

- First, make certain you have chosen the correct record design for the region/city of your liking. Browse the develop explanation to ensure you have selected the correct develop. If accessible, utilize the Review switch to check throughout the record design also.

- If you want to locate another edition from the develop, utilize the Search industry to obtain the design that meets your needs and needs.

- When you have discovered the design you would like, just click Buy now to proceed.

- Choose the pricing program you would like, type in your references, and sign up for a merchant account on US Legal Forms.

- Total the deal. You can utilize your charge card or PayPal accounts to purchase the lawful develop.

- Choose the format from the record and download it to your gadget.

- Make modifications to your record if needed. You may total, revise and sign and printing New Jersey List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005.

Obtain and printing 1000s of record themes while using US Legal Forms Internet site, that provides the most important variety of lawful varieties. Use skilled and condition-particular themes to deal with your organization or personal demands.

Form popularity

FAQ

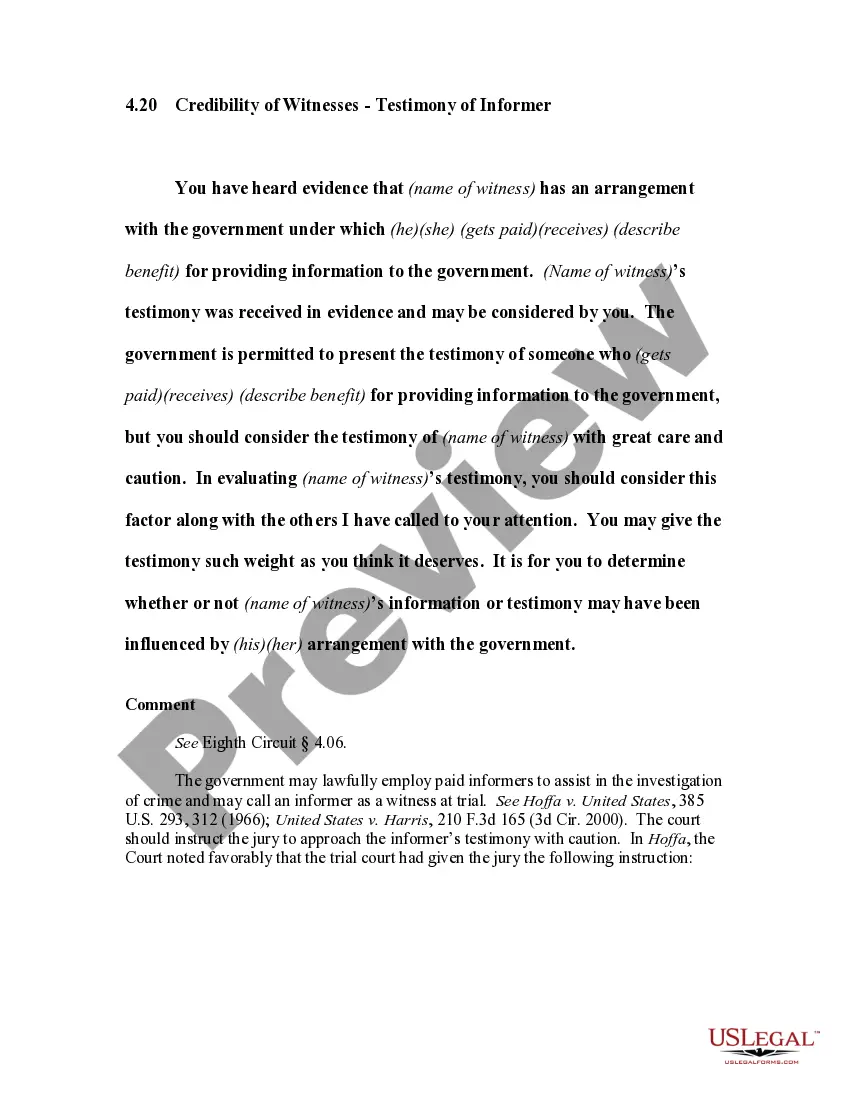

Some assets may have multiple liens placed upon them; in these cases, the first lien has priority over the second lien. Unsecured creditors are divided between preferred and non-preferred, as certain unclaimed creditors like employees and tax agencies are given priority.

The good news is that if you ? or the attorney you hire ? gets the paperwork right and the case moves through the court to the point where debt discharge is determined, the U.S. Bankruptcy Courts says that 99% of Chapter 7 cases succeed. Unfortunately, many don't make it that far and their petition is denied.

A total of 226,777 chapter 13 consumer cases were closed by dismissal or plan completion in 2020. Table 6 illustrates that 116,145 of these cases were dismissed. In 49 percent of the cases closed (110,632 cases), the debtors received a discharge after completing repayment plans, up from 43 percent in 2019.

While a priority claim is not secured by collateral, it is however treated with higher priority over other claims by Federal law. A priority claim is debt that is entitled to special treatment in the bankruptcy process and will get paid ahead of non-priority claims.

Among the top 30 unsecured creditors that Yellow owes are some of the industry's most recognized names. This includes railroads such as BNSF and Union Pacific, retail giants like Amazon and Home Depot, and leading equipment suppliers like Goodyear, Michelin, and DTNA (Daimler Trucks North America).

Unsecured Creditors, like credit card issuers, suppliers, and some cash advance companies (although this is changing), do not hold a lien on its debtor's property to assure payment of the debt if there is a default. The secured creditor holds priority on debt collection from the property on which it holds a lien.

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged).

What is a List of Creditors? When you file a voluntary petition under any bankruptcy chapter, you the debtor (or your attorney, if you use one) must prepare a List of Creditors and submit it to the Court. The List of Creditors is essentially a mailing list of creditors to whom you owe money.