New Jersey Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005

Description

How to fill out Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005?

Choosing the right legal papers template could be a struggle. Needless to say, there are a lot of layouts available on the Internet, but how can you get the legal form you will need? Take advantage of the US Legal Forms internet site. The support delivers thousands of layouts, such as the New Jersey Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005, which you can use for company and personal requirements. All of the kinds are checked out by specialists and fulfill state and federal specifications.

In case you are currently authorized, log in to the account and click the Obtain switch to have the New Jersey Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005. Utilize your account to check through the legal kinds you possess bought in the past. Proceed to the My Forms tab of your account and get yet another version from the papers you will need.

In case you are a fresh customer of US Legal Forms, listed below are basic recommendations that you can adhere to:

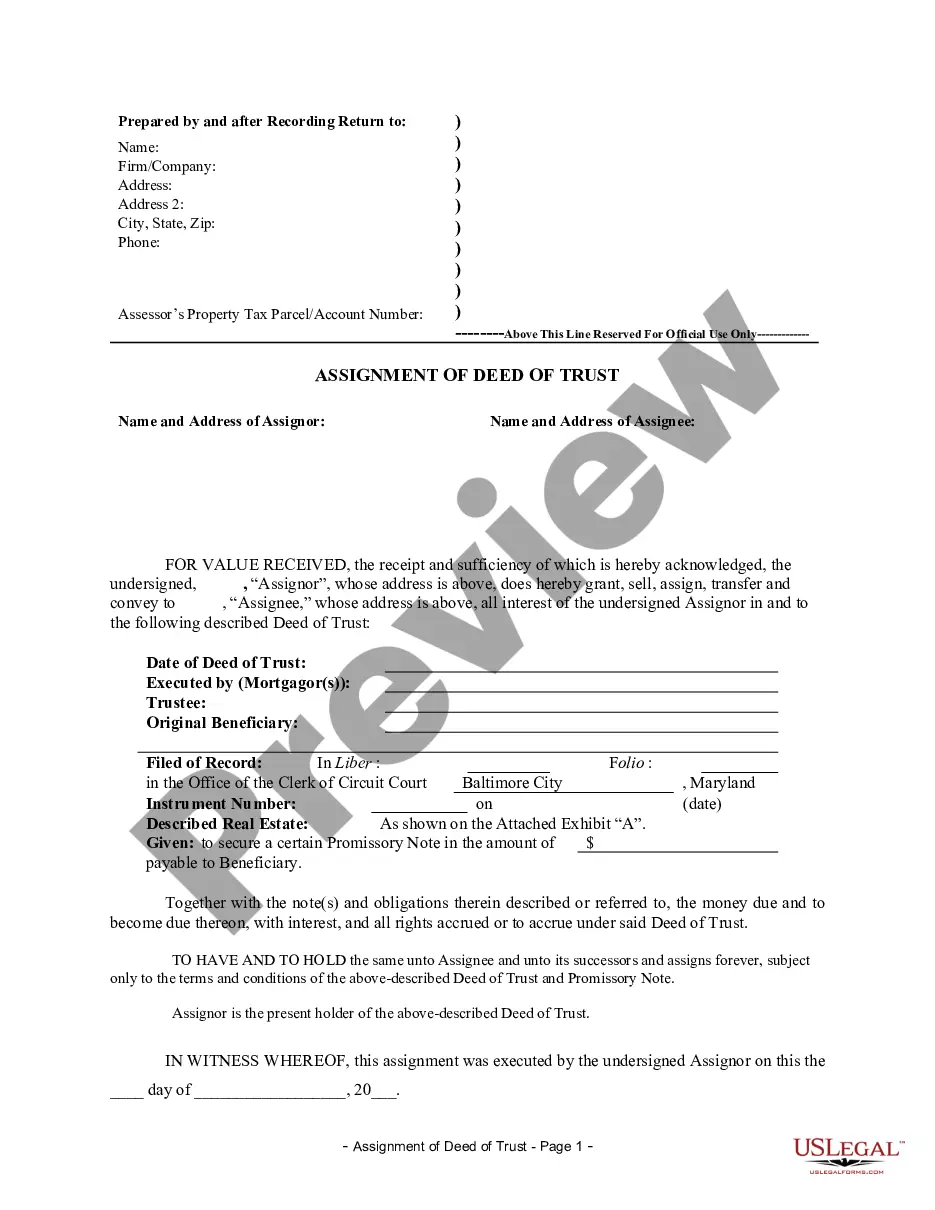

- Very first, ensure you have chosen the appropriate form for the town/state. You can check out the shape using the Review switch and look at the shape explanation to make sure it will be the right one for you.

- When the form will not fulfill your preferences, make use of the Seach field to find the proper form.

- Once you are certain that the shape would work, click on the Buy now switch to have the form.

- Select the prices program you want and enter in the needed details. Build your account and pay for your order with your PayPal account or Visa or Mastercard.

- Opt for the submit format and down load the legal papers template to the system.

- Full, modify and print out and indicator the received New Jersey Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005.

US Legal Forms may be the most significant collection of legal kinds in which you will find different papers layouts. Take advantage of the company to down load professionally-manufactured files that adhere to state specifications.

Form popularity

FAQ

The Code's Order of Priority In general, the Code provides that secured creditors are entitled to receive the entire value of the collateral securing their claims up to the full amount they are owed. Unsecured creditors, then, get to look to any remaining assets of the estate.

An unsecured creditor with a nonpriority claim must be paid at least as much as the creditor would have received had the debtor filed under Chapter 7, and the payments need not be in cash. Nonpriority claims may be paid in cash, property, or securities of the debtor or the successor to the debtor under the plan.

Under Chapter 11 procedures, Secured Creditors will receive payment before the next class of Creditors?those with unsecured claims. Secured claims can be oversecured, meaning the collateral is worth more than the debt, or undersecured, meaning the debt is worth more than the value of the collateral.

Secured creditors like banks are going to get paid first. This is because their credit is secured by assets?typically ones that your business controls. Your plan and the courts may consider how integral the assets are that secure your loans to determine which secured creditors get paid first though.

Under the priority system, certain unsecured creditors are entitled to full payment before other unsecured creditors receive anything at all. Whether a creditor filed a proof of claim form within the deadline also influences the order of payment.

Examples of priority claims include: employee compensation owed, unpaid contributions to employee benefits plans, tax obligations owed to the government, pending personal injury or workplace injury or death claims, certain deposits given to the Creditor to secure future goods or services, alimony, child support, and ...

A Chapter13 bankruptcy may be filed by individuals with regular income. Debtors must present a plan to repay all or part of their debts. The plan must provide for fixed monthly payments to be made to the Chapter 13 trustee for a period of three to five years, depending on income and other factors.

Chapter 11 and Chapter 7 Creditor Recoveries Claims To begin, proceeds first get distributed to the most senior class of creditors until each class is paid in full before moving onto the next class and so forth, until there are no remaining proceeds left.