New Jersey Employee Evaluation Form (Upon Separation)

Description

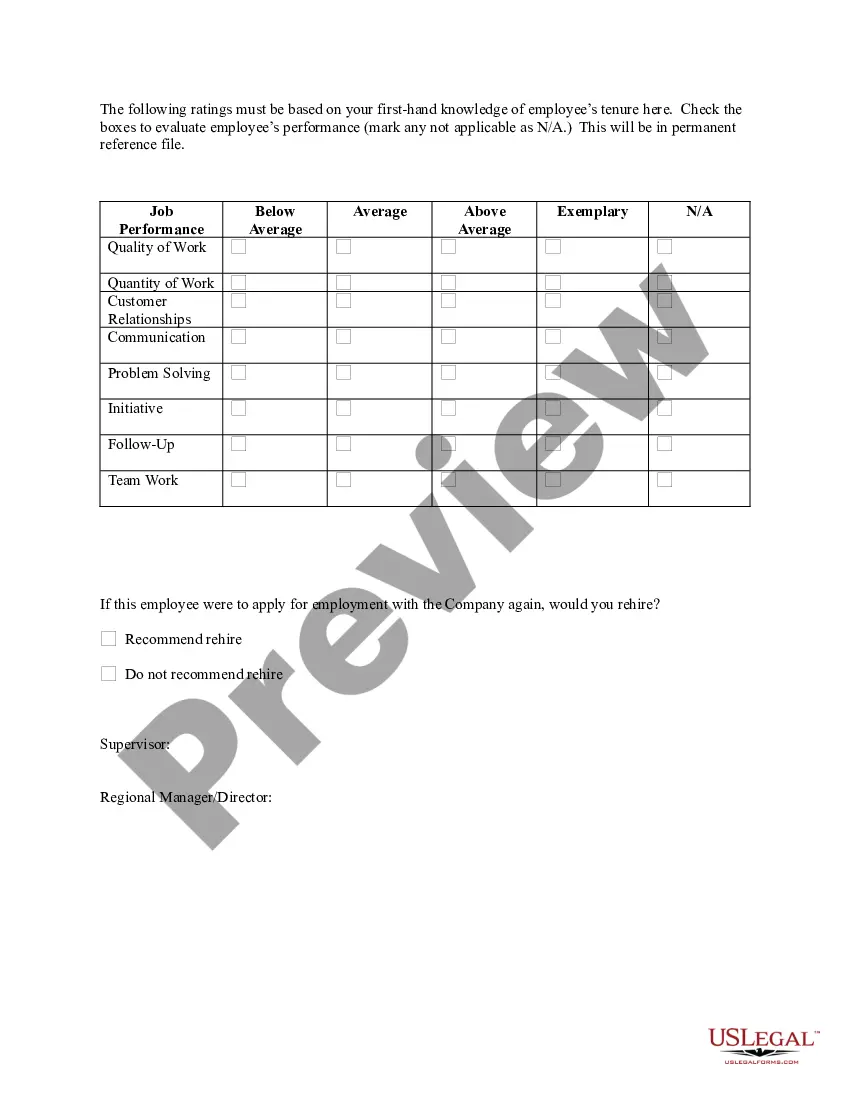

How to fill out Employee Evaluation Form (Upon Separation)?

You can dedicate time online attempting to locate the legal document template that complies with the federal and state regulations you will require.

US Legal Forms offers a vast array of legal documents that are evaluated by experts.

You can conveniently acquire or print the New Jersey Employee Evaluation Form (Upon Separation) from your assistance.

If applicable, utilize the Review option to view the document template simultaneously.

- If you presently possess a US Legal Forms account, you can Log In and select the Obtain option.

- After that, you can complete, modify, print, or sign the New Jersey Employee Evaluation Form (Upon Separation).

- Every legal document template you procure is yours permanently.

- To retrieve another copy of any purchased form, navigate to the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have chosen the correct document template for the region/city that you select.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

A general separation notice is a written communication from an employer or an employee saying that the employment relationship is ending.

To close your Unemployment Account:Call the state at (609) 633-6400.

The New Jersey Department of Labor and Workforce Development announced that fiscal year 2022 (July 1, 2021 to June 30, 2022) state unemployment insurance (SUI) tax rates range from 0.5% to 5.8% on Rate Schedule C, up from a range of 0.4% to 5.4% on Rate Schedule B for fiscal year 2021 (July 1, 2020 to June 30, 2021).

All businesses must first register with the Division of Revenue & Enterprise Services (form NJ-REG). Once your established business employs one or more individuals and pays wages of $1,000 or more in a calendar year, you are considered an employer.

Every year at the beginning of July every employer subject to NJ unemployment taxes receives a Combined Assessment Bill. The form is salmon colored and is mailed from the New Jersey Department of Labor and Workforce Development (NJ LWD) Division of Employer Accounts.

New Jersey Regardless of the reason for separation, all employees who will be separated from employment for at least 7 days must be provided with Form BC-10.

This notice will indicate your weekly UI benefit amount, your maximum benefit amount, the date your benefit year ends, the base period of your claim, and the wages used to calculate your claim. If you are not eligible for UI benefits, the notice will indicate the monetary requirement that you did not meet.

Federal and State law dictate how long employers must retain certain employee related records. For instance, Form I-9 should be retained for either three (3) years after the date of hire or for one (1) year after employment is terminated, whichever is later.

New Jersey law does not require a notice of separation from either the employee or employer. However, if an employer has a policy on notices of separation and that policy is recognized as an enforceable contract, a notice of separation may be required from the employer and/or employee in accordance with the policy.

The Catastrophic Illness Fund Assessment (CIF) was created in 1987 by the NJ State Legislature to provide funds to families who have incurred extraordinary medical expenses due to a child's illness. It is funded, by law, through assessments to all New Jersey employers. There are no exemptions to this assessment.