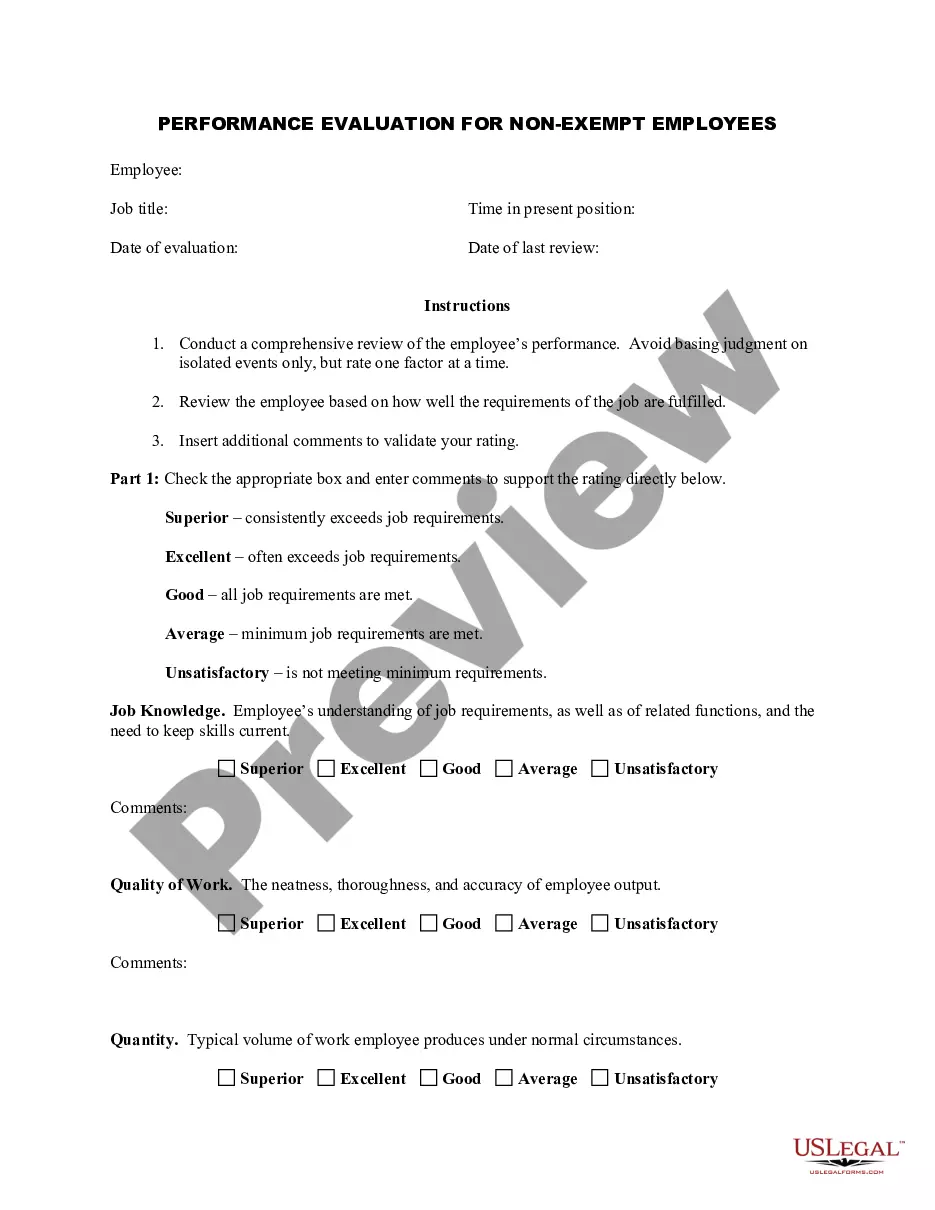

New Jersey Employee Evaluation Form for Sole Trader

Description

How to fill out Employee Evaluation Form For Sole Trader?

Are you in a location where you require documents for potentially business or personal reasons nearly every day? There are numerous legal document templates available online, but finding ones you can trust is challenging.

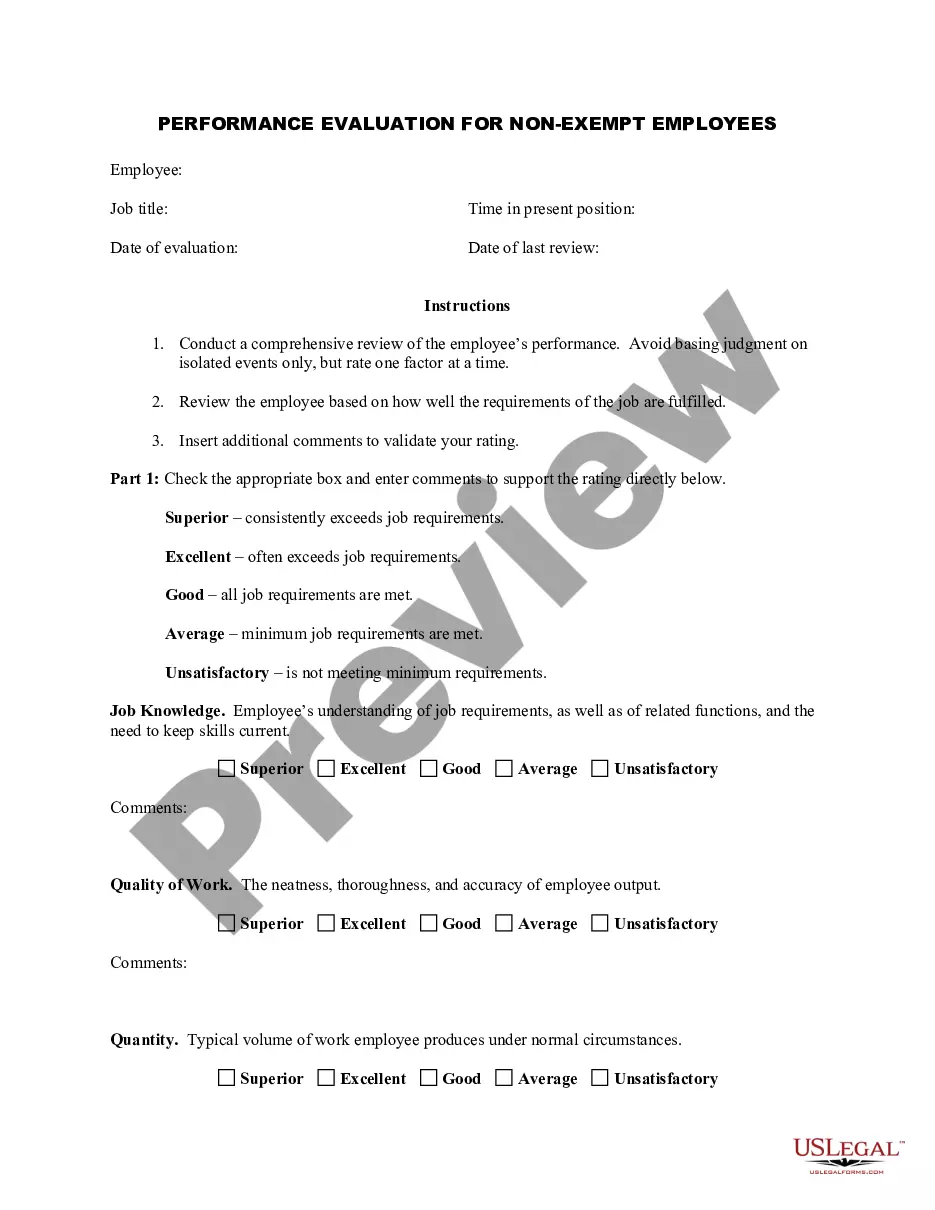

US Legal Forms offers thousands of form templates, such as the New Jersey Employee Evaluation Form for Sole Proprietor, that are crafted to meet federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the New Jersey Employee Evaluation Form for Sole Proprietor template.

- Locate the form you require and ensure it is for your correct area/county.

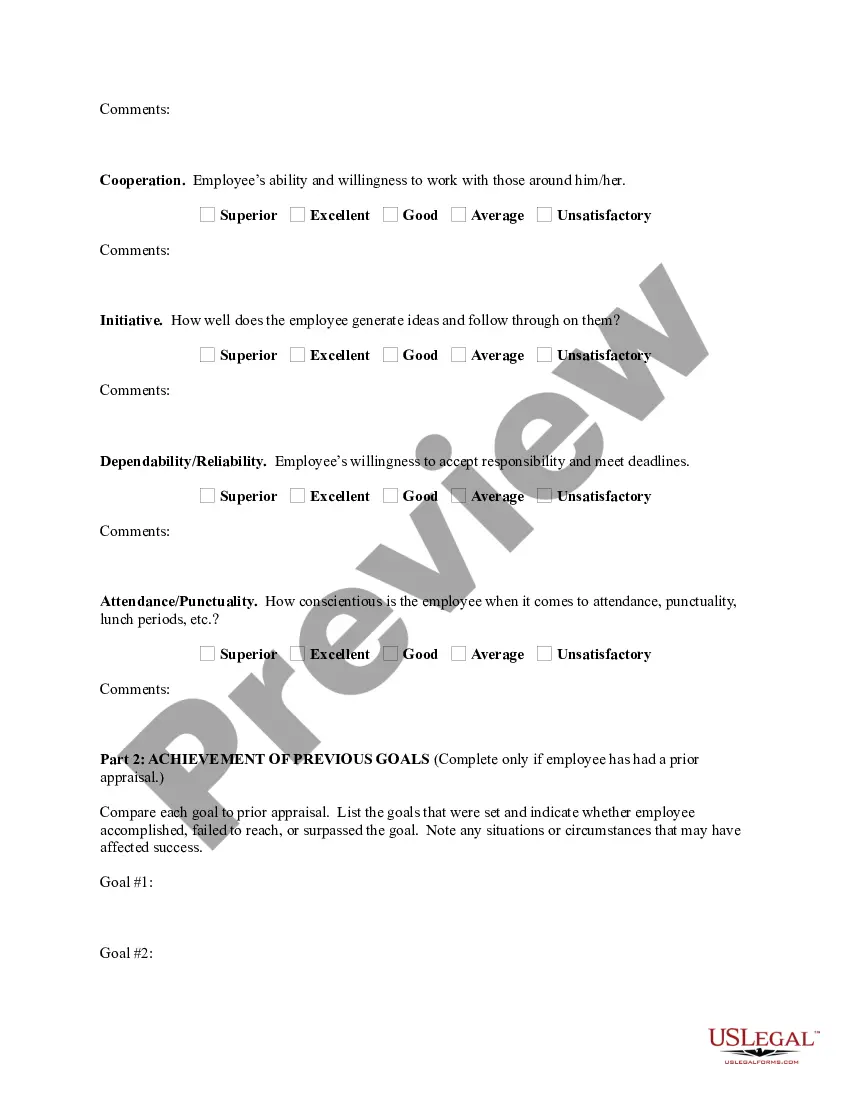

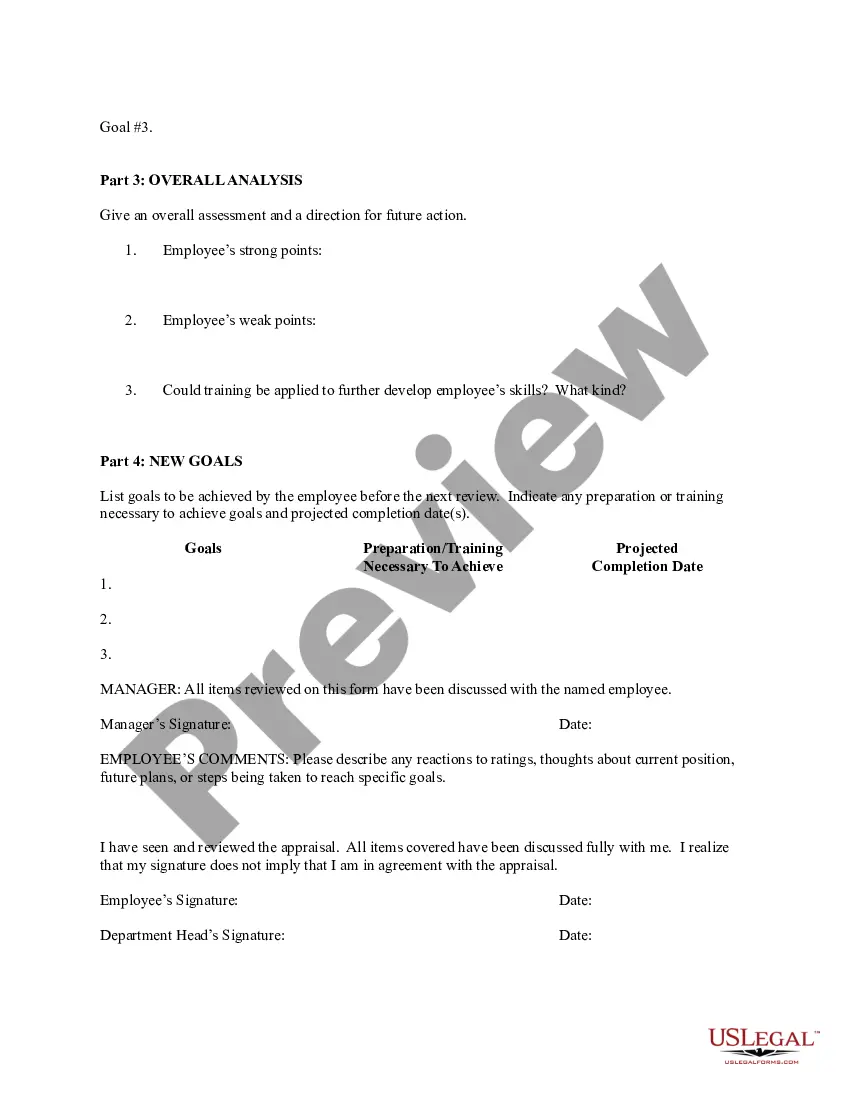

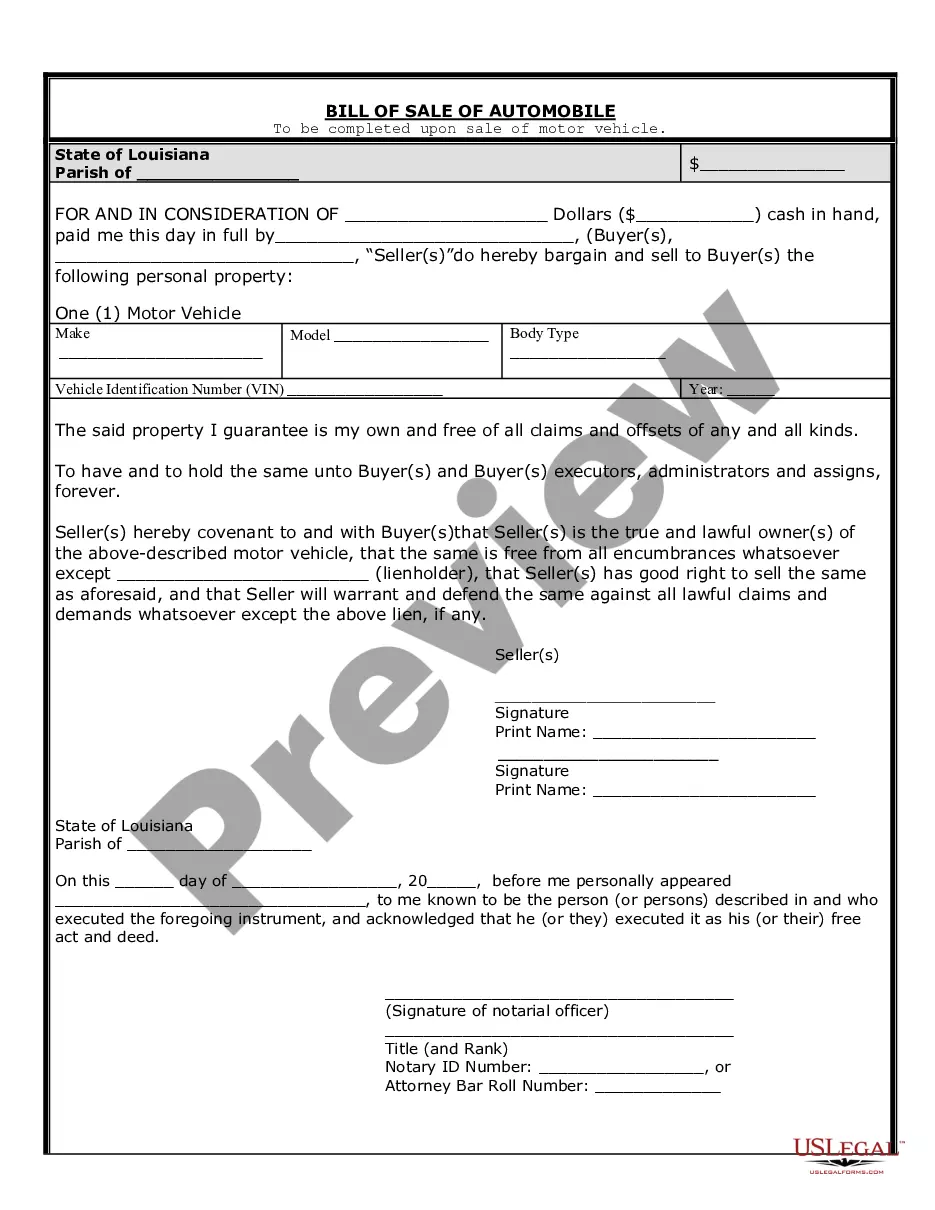

- Utilize the Review feature to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you need, make use of the Search section to find the form that meets your needs and requirements.

- Once you find the correct form, click on Get now.

- Select the pricing plan you prefer, complete the necessary information to create your account, and finalize your order using your PayPal or Visa or Mastercard.

- Choose a suitable paper format and download your copy.

Form popularity

FAQ

Every business in NJ must file an annual report. This includes simply ensuring that your registered agent and address are up to date, and submitting a $75 filing fee. The report is due on the last day of the month in the month in which you completed your business formation (LLC, Corporation etc).

In the state of New Jersey, all New Jersey corporations, LLCs, nonprofits, LPs, and LLPs are required to file an annual report each year. These reports must be submitted to the state of New Jersey Department of the Treasury, Division of Revenue and Enterprise Services.

Certificate of Voluntary Withholding of Gross Income Tax from Pension and Annuity Payments. NJ-927-H.

If you are a non-exempt employee, you have the right to receive minimum hourly wages, overtime at a rate of one-and-one-half times your hourly rate and the right to be paid for all of the hours you work under federal and state law.

If you provide a service, own a business, or own and run a farm, you are self-employed. Self-employment income is reported as Net Profits From Business on your New Jersey Income Tax return.

Even if a company has all necessary business licenses, it still needs to file its annual reports. Annual report filing requirements continue even after forming your company. Just like tax returns and business licenses, formation and incorporation filings are different from annual report filings.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).

Under federal and New Jersey law, an employee who is classified as exempt is not entitled to be paid overtime, at a rate of one and one-half times his or her normal rate of pay, for hours worked in excess of forty in a workweek.

Every business in NJ must file an annual report. This includes simply ensuring that your registered agent and address are up to date, and submitting a $75 filing fee. The report is due on the last day of the month in the month in which you completed your business formation (LLC, Corporation etc).

All corporations, whether domestic or foreign, must also submit an annual report and the associated filing fee electronically with the Division of Revenue and Enterprise Services (DORES). The formation or registration date is the annual report filing due date. For more information, visit DORES' website.