New Jersey Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA

Description

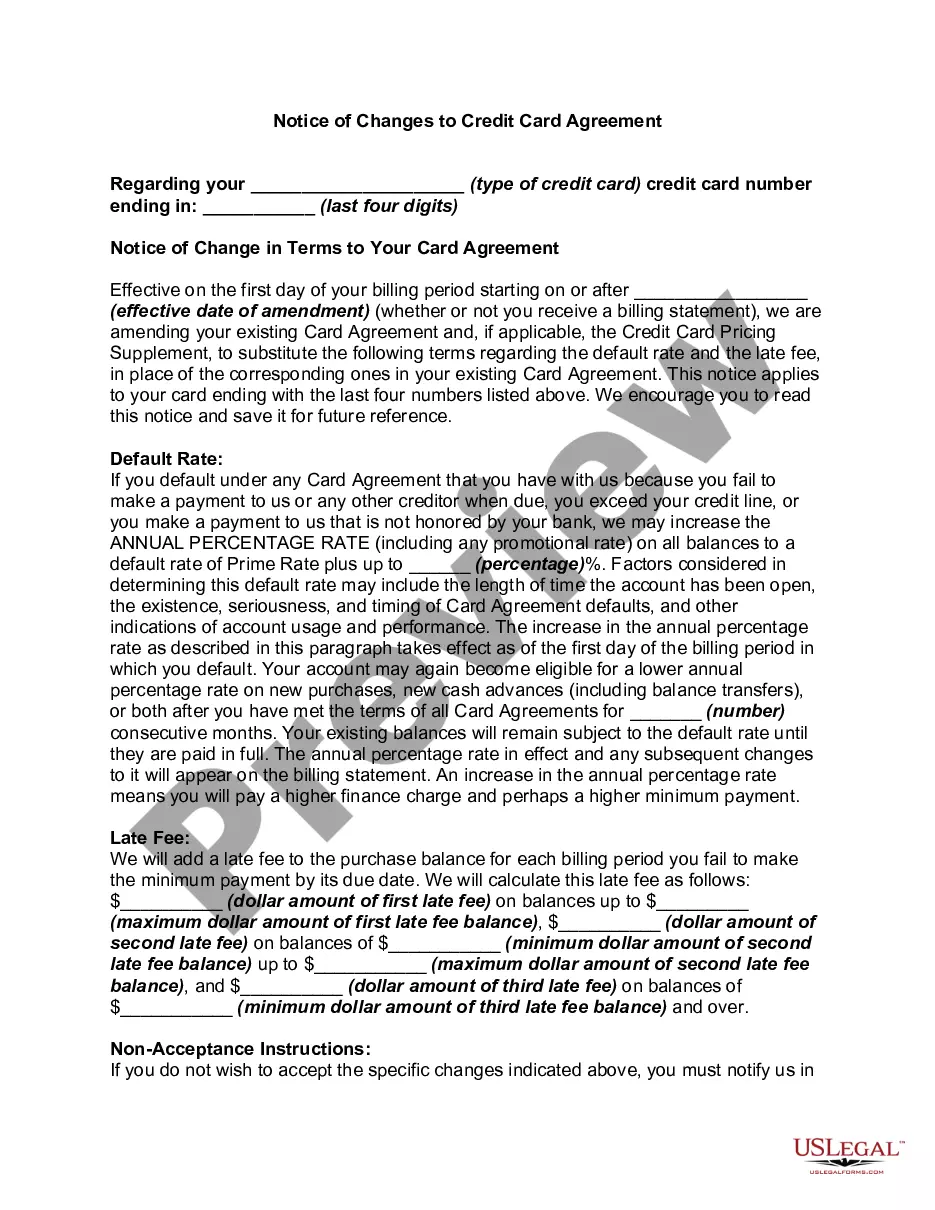

How to fill out Specific Consent Form For Qualified Joint And Survivor Annuities - QJSA?

Selecting the appropriate legal document template can be quite challenging. It goes without saying that there are numerous templates available online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the New Jersey Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA, which you can use for both business and personal needs. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, sign in to your account and then click the Download button to obtain the New Jersey Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA. Use your account to browse the legal forms you have purchased previously. Go to the My documents tab in your account to retrieve another copy of the document you need.

US Legal Forms is the largest repository of legal forms where you can find various document templates. Take advantage of the service to obtain professionally crafted papers that adhere to state requirements.

- If you are a new user of US Legal Forms, here are clear steps for you to follow.

- First, ensure you have selected the correct form for your city/region.

- You may browse the form using the Review button and read the form description to confirm this is the right one for you.

- If the form does not meet your needs, use the Search field to find the correct form.

- Once you are certain that the form is accurate, click on the Acquire now button to obtain the form.

- Choose the pricing plan you need and enter the required information. Create your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, edit, print, and sign the received New Jersey Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA.

Form popularity

FAQ

Spousal Waiver Form means that form established by the Plan Administrator, in its sole discretion, for use by a spouse to consent to the designation of another person as the Beneficiary or Beneficiaries under a Participant's Account.

The QJSA payment form gives your spouse, the annuitant, a retirement payment for the rest of his or her life. Under the QJSA payment form, after your spouse dies, the contract will pay you, the surviving spouse, at least 50% percent of the retirement benefit that was paid to your spouse, the annuitant.

A qualified pre-retirement survivor annuity (QPSA) is a death benefit that is paid to the surviving spouse of a deceased employee.

If you do not waive the QPSA, after your death the Plan will pay your spouse the QPSA unless your spouse elects another benefit form. The QPSA will not pay benefits to other beneficiaries after your spouse dies. If you waive the QPSA, the Plan will pay your account to your designated beneficiary.

A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant's surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO) following the

A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant's surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO) following the

A joint and survivor annuity is an annuity that pays out for the remainder of two people's lives. Depending on the contract, the annuity may pay 100 percent of the payments upon the death of the first annuitant or a lower percentage typically 50 or 75 percent.

ANSWER: Spousal consent is required if a married participant designates a nonspouse primary beneficiary and may be necessary if a 401(k) plan offers one or more annuity forms of distribution. Here is a summary of these rules and the way many 401(k) plans avoid spousal consents.

A qualified joint and survivor annuity (QJSA) provides a lifetime payment to an annuitant and spouse, child, or dependent from a qualified plan. QJSA rules apply to money-purchase pension plans, defined benefit plans, and target benefits.

Qualified Joint and Survivor Annuity (QJSA) includes a level monthly payment for your lifetime and a survivor benefit for your spouse after your death equal to the percentage designated of that monthly payment.