Full text and statutory guidelines for the Insurers Rehabilitation and Liquidation Model Act.

New Jersey Insurers Rehabilitation and Liquidation Model Act

Description

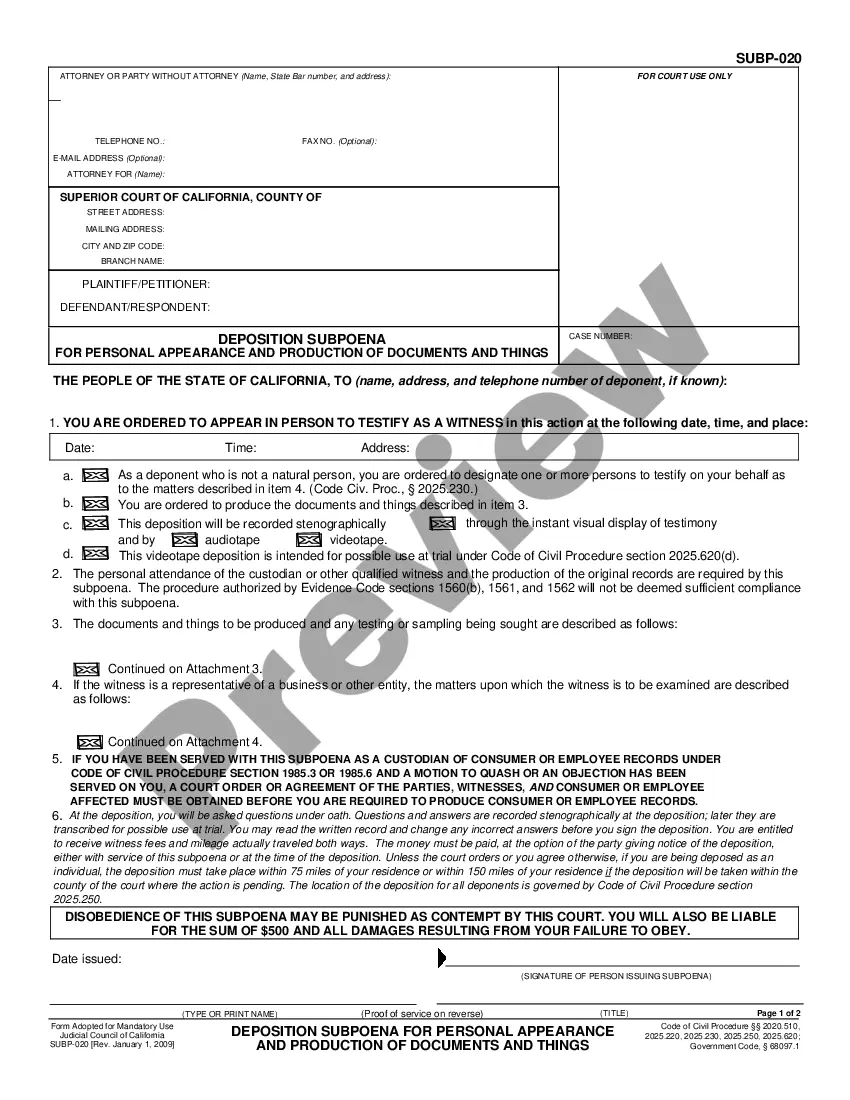

How to fill out Insurers Rehabilitation And Liquidation Model Act?

You may invest hrs on the web attempting to find the legal file template that fits the federal and state demands you will need. US Legal Forms gives a huge number of legal forms which can be examined by pros. You can easily download or print the New Jersey Insurers Rehabilitation and Liquidation Model Act from your support.

If you already have a US Legal Forms bank account, it is possible to log in and then click the Acquire key. Next, it is possible to full, revise, print, or signal the New Jersey Insurers Rehabilitation and Liquidation Model Act. Each legal file template you purchase is your own eternally. To get one more duplicate associated with a obtained form, visit the My Forms tab and then click the related key.

If you work with the US Legal Forms internet site initially, adhere to the easy instructions listed below:

- First, be sure that you have chosen the best file template for that region/metropolis of your liking. See the form information to ensure you have chosen the correct form. If offered, make use of the Review key to check from the file template as well.

- In order to discover one more version in the form, make use of the Search industry to discover the template that meets your requirements and demands.

- Once you have discovered the template you need, click Purchase now to carry on.

- Pick the costs prepare you need, type in your accreditations, and sign up for a free account on US Legal Forms.

- Full the transaction. You can use your credit card or PayPal bank account to cover the legal form.

- Pick the structure in the file and download it in your product.

- Make modifications in your file if necessary. You may full, revise and signal and print New Jersey Insurers Rehabilitation and Liquidation Model Act.

Acquire and print a huge number of file themes making use of the US Legal Forms Internet site, that offers the greatest selection of legal forms. Use professional and status-distinct themes to take on your small business or personal demands.

Form popularity

FAQ

Understanding Risk-Based Capital Requirement Under the Dodd-Frank rules, each bank is required to have a total risk-based capital ratio of 8% and a tier 1 risk-based capital ratio of 4.5%.

Justin Zimmerman - Acting Commissioner - New Jersey State Department of Banking and Insurance | LinkedIn.

The New Jersey Department of Banking & Insurance oversees how insurance companies operate in the state.

Contact the New Jersey Department of Banking and Insurance (NJDOBI) for complaints against insurance carriers and discount health plan providers, complaints involving mortgage, banking and real estate issues, and for questions about insurance coverage.

The regulatory action level occurs if surplus falls below 150 percent of the RBC amount. The authorized control level occurs if surplus falls below 100 percent of the RBC amount.

CDI enforces the insurance laws of California and has authority over how insurers and licensees conduct business in California.

Under the new law, N.J.S.A. B-1.1, insurers are now required to disclose their policy limits in response to a written request for such information from a New Jersey-licensed attorney, even if the matter is not yet in suit. The statute is currently in effect.

The New Jersey Commissioner of Banking and Insurance is a state executive position in the New Jersey state government. The commissioner serves as head of the Department of Banking and Insurance, which is responsible for regulating the banking, insurance, and real estate industries in the state.