New Jersey Self-Employed Independent Contractor Questionnaire

Description

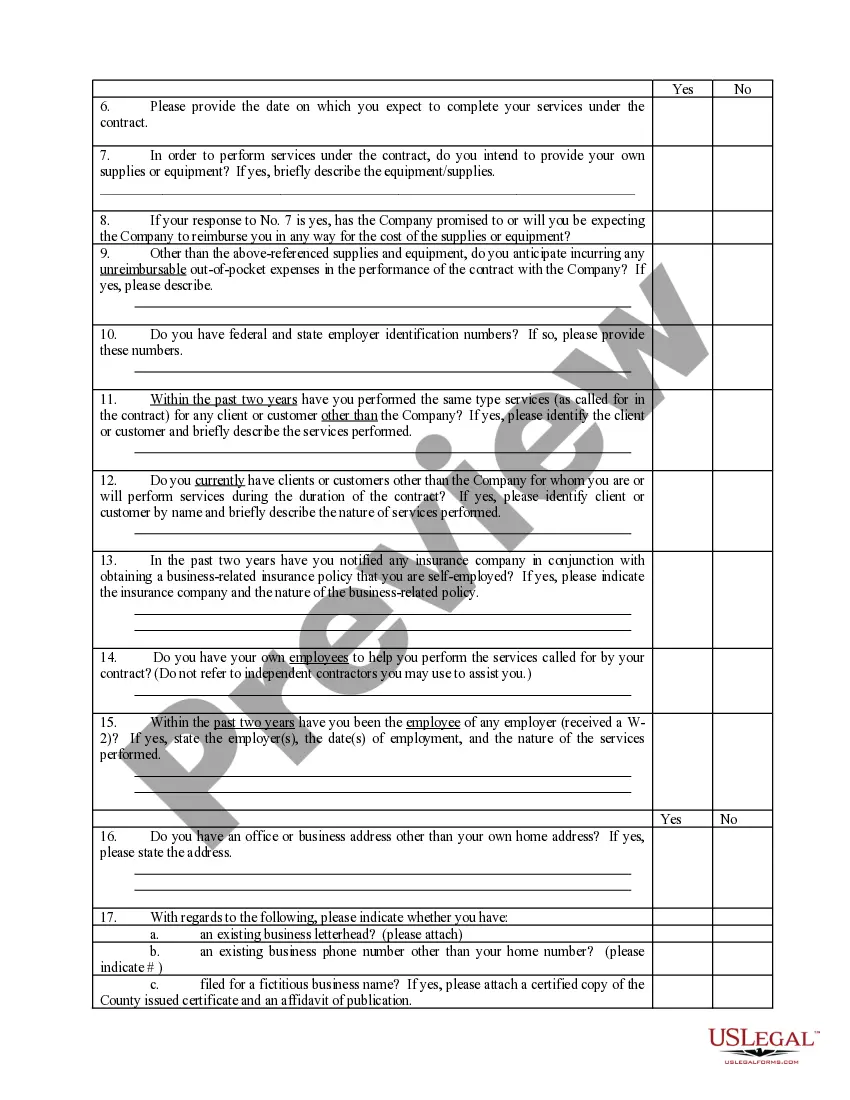

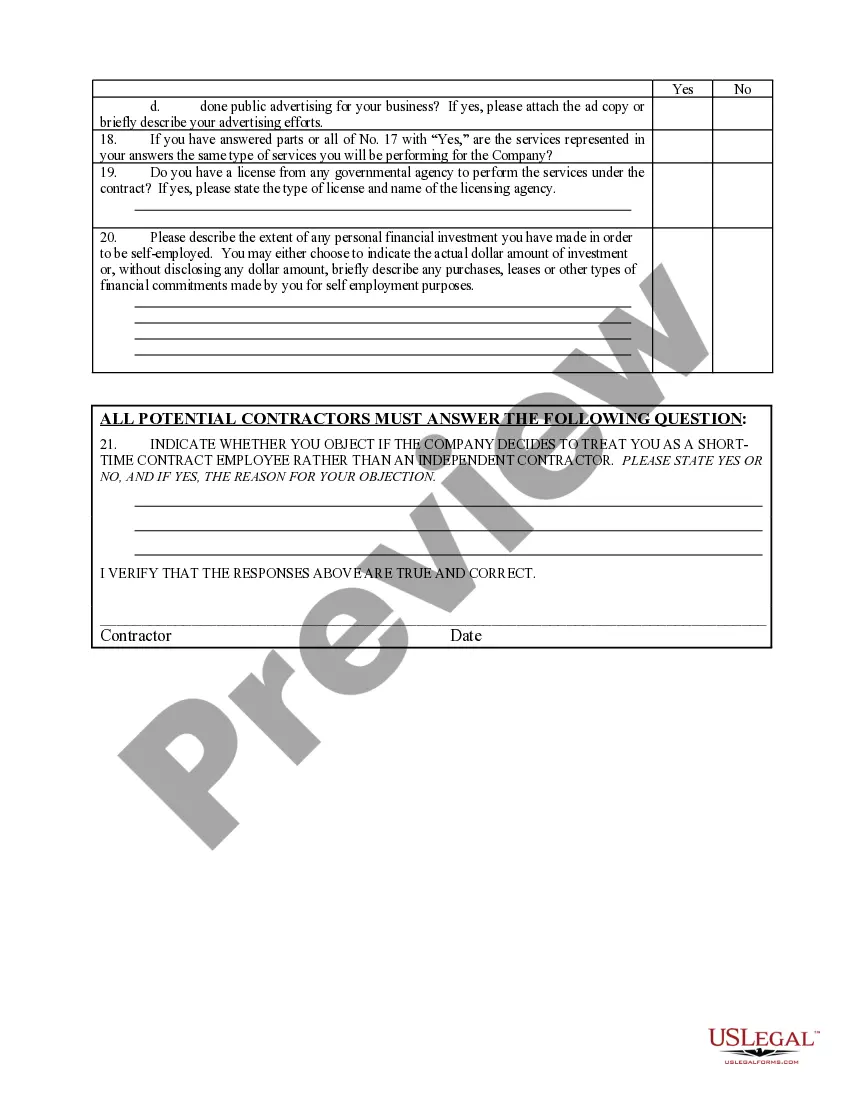

How to fill out Self-Employed Independent Contractor Questionnaire?

It is feasible to invest hours on the Internet looking for the official document format that fulfills the state and federal requirements you need.

US Legal Forms offers thousands of legal templates that are verified by experts.

You can easily download or print the New Jersey Self-Employed Independent Contractor Questionnaire from our services.

If available, utilize the Preview button to view the document format as well.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can fill out, modify, print, or sign the New Jersey Self-Employed Independent Contractor Questionnaire.

- Every legal document template you obtain is yours permanently.

- To get an additional copy of any purchased form, go to the My documents tab and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the simple instructions listed below.

- First, ensure that you have selected the correct document format for the county/city of your choice.

- Check the form description to ensure you have chosen the correct form.

Form popularity

FAQ

Self-employed, independent contractors, and gig workers:Workers who have been properly classified as independent contractors are not eligible for traditional unemployment insurance benefits.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The individual is customarily engaged in an independently established trade, occupation, profession or business.

Independent Contractor Interview Questions:Why did you choose to become an independent contractor?Can you tell me about the project that you are proudest of?Have you ever had difficulty meeting deadlines?How do you track your performance?What would you do if you encountered unexpected difficulties on a project?

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

Cons of Independent Contracting Employers like contractors because they can avoid paying for taxes and benefits, and that means those costs fall entirely on independent contractors. Contractors must withhold their own federal, state, and local taxes. They may also have to submit quarterly estimated taxes to the IRS.

In this article, we discuss five questions that you should ask yourself before deciding to become an independent contractor.What are the Advantages of Being an IC?What Do I Lose by Becoming an IC?Do I Have the Requisite Expertise?Can I Self-Motivate to Find Business and Complete Projects?More items...

If you are classified as an "independent contractor," you may be paid with a 1099 with no deductions made for taxes, unemployment, or other contributions that an employee pays.