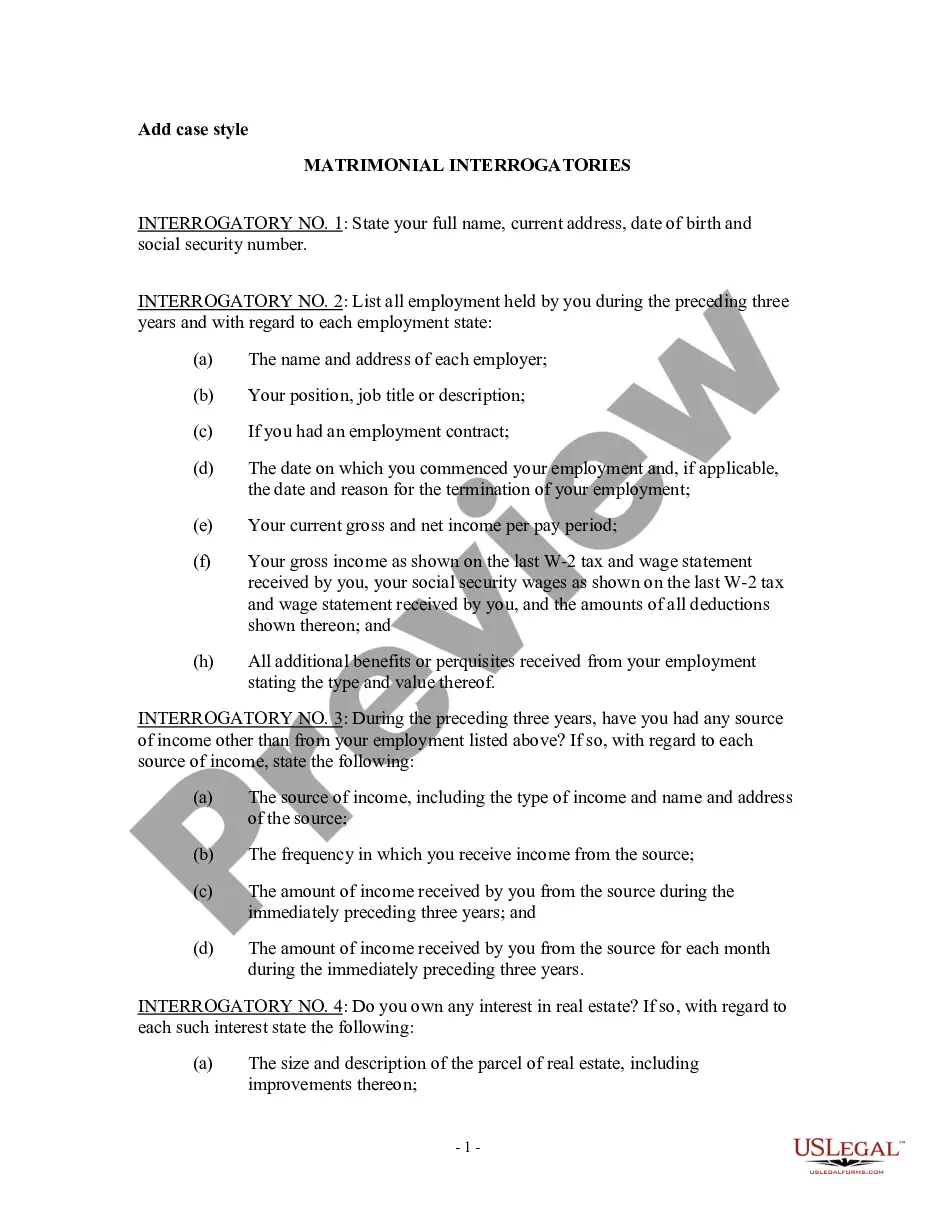

New Jersey Employment Statement

Description

How to fill out Employment Statement?

Are you currently situated in a location that necessitates documentation for potential business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can rely on isn’t easy.

US Legal Forms offers a vast array of template files, including the New Jersey Employment Statement, which are designed to comply with federal and state regulations.

You can obtain an additional copy of the New Jersey Employment Statement whenever necessary. Just navigate to the required form to download or print the document template.

Utilize US Legal Forms, the most extensive selection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are currently acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the New Jersey Employment Statement template.

- If you lack an account and wish to start utilizing US Legal Forms, follow these instructions.

- Obtain the document you need and verify it is for the correct city/area.

- Utilize the Preview button to review the form.

- Examine the details to ensure you have selected the appropriate document.

- If the form isn’t what you are looking for, use the Search section to locate the document that suits your needs and requirements.

- Once you find the correct form, click Buy now.

- Choose the payment plan you desire, fill in the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Select a convenient format and download your copy.

- Find all the document templates you have purchased in the My documents section.

Form popularity

FAQ

New Jersey employers should provide new employees with both the IRS Form W-4 and the Form NJ-W4. See Employee Withholding Forms. New Jersey employers just provide new employees with notice of employee rights under New Jersey wage and hour laws.

Log on to your account at the New Jersey Department of Labor and Workforce Development (NJLWD) Unemployment Insurance Benefits website (see Resources) by clicking on "File a Continued Claim." If you filed your original claim using the website, you created an account when you filed and should use the same username and

What documents can be used to verify proof of income before the pandemic?Paycheck stubs.Earnings and leave statements that include the employer's name and address.W-2 form.

Certificate of Voluntary Withholding of Gross Income Tax from Pension and Annuity Payments. NJ-927-H.

Employers must contact Client Registration at the New Jersey Division of Revenue and Enterprise Services at (609) 292-9292 to register to withhold income tax for their domestic employees.

Earned income also includes net earnings from self-employment. Earned income does not include amounts such as pensions and annuities, welfare benefits, unemployment compensation, worker's compensation benefits, or social security benefits.

For tax year 2020:If we have your email address on file, you will receive your 1099-G for 2020 by email by January 30.1099-G information will also be available from the Check Claim Status tool no later than January 30.

Form 1099-G, Certain Government Payments, is a report of income paid to you by a government agency. A 1099-G from the New Jersey Division of Taxation reflects (in Box 2) the State taxes you overpaid through withholdings, State tax payments, or credits during the tax year, which was then refunded to you.

The WR-30 form is a report of all of the people who were employed or paid wages by an employer in the state of New Jersey. Employers are required to file a WR-30 form on a quarterly basis.

Acceptable 2019 or 2020 income documents, depending on the year you filed your claim, may include one or more of the following:Federal tax return (IRS Form 1040, Schedule C or F).State tax return (CA Form 540).W-2.Paycheck stubs.Payroll history.Bank receipts.Business records.Contracts.More items...?