New Jersey Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

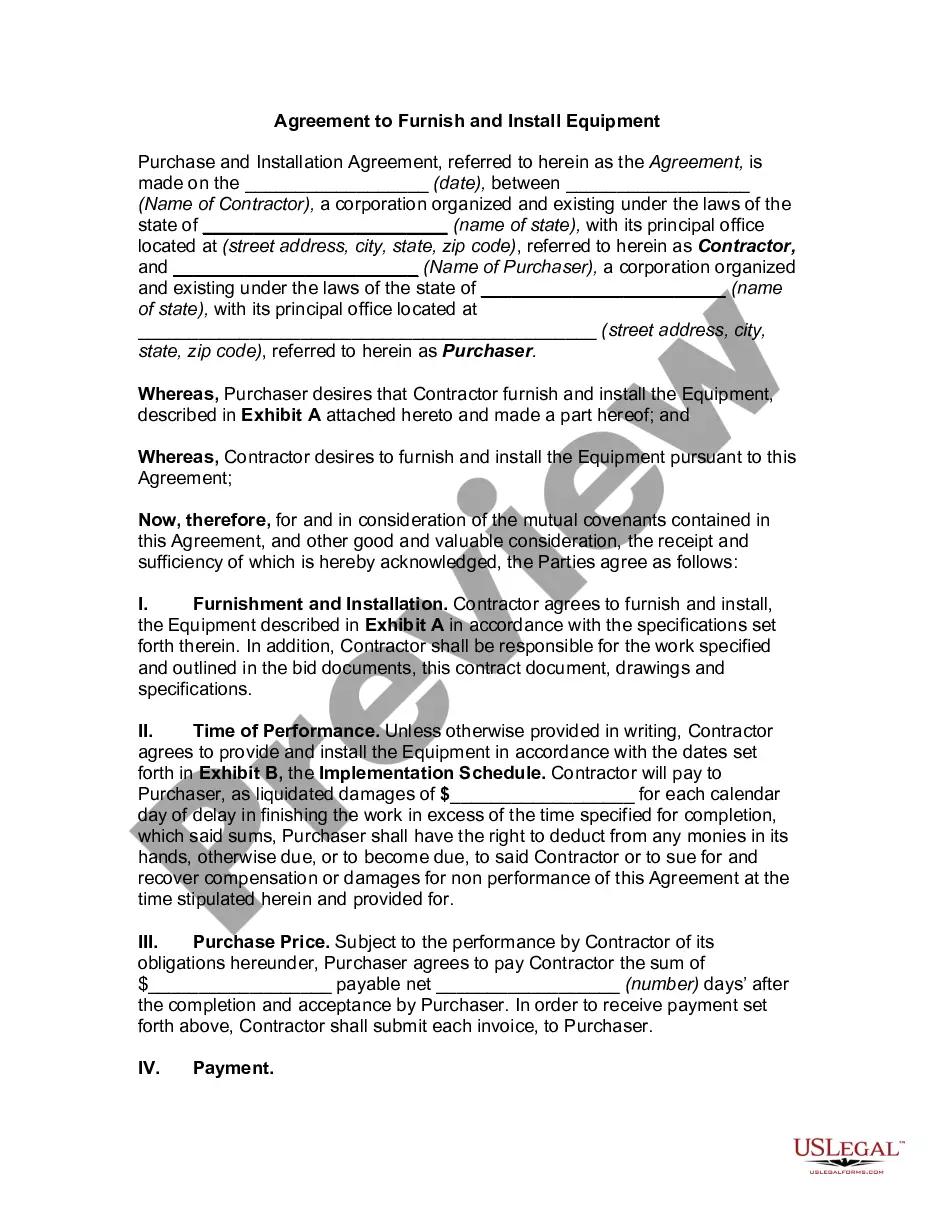

How to fill out Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

You can spend hours on the web attempting to locate the legal document template that meets the federal and state criteria you require.

US Legal Forms provides a vast array of legal documents that are assessed by experts.

You can effortlessly obtain or print the New Jersey Liquidation of Partnership with Sale of Assets and Assumption of Liabilities through my services.

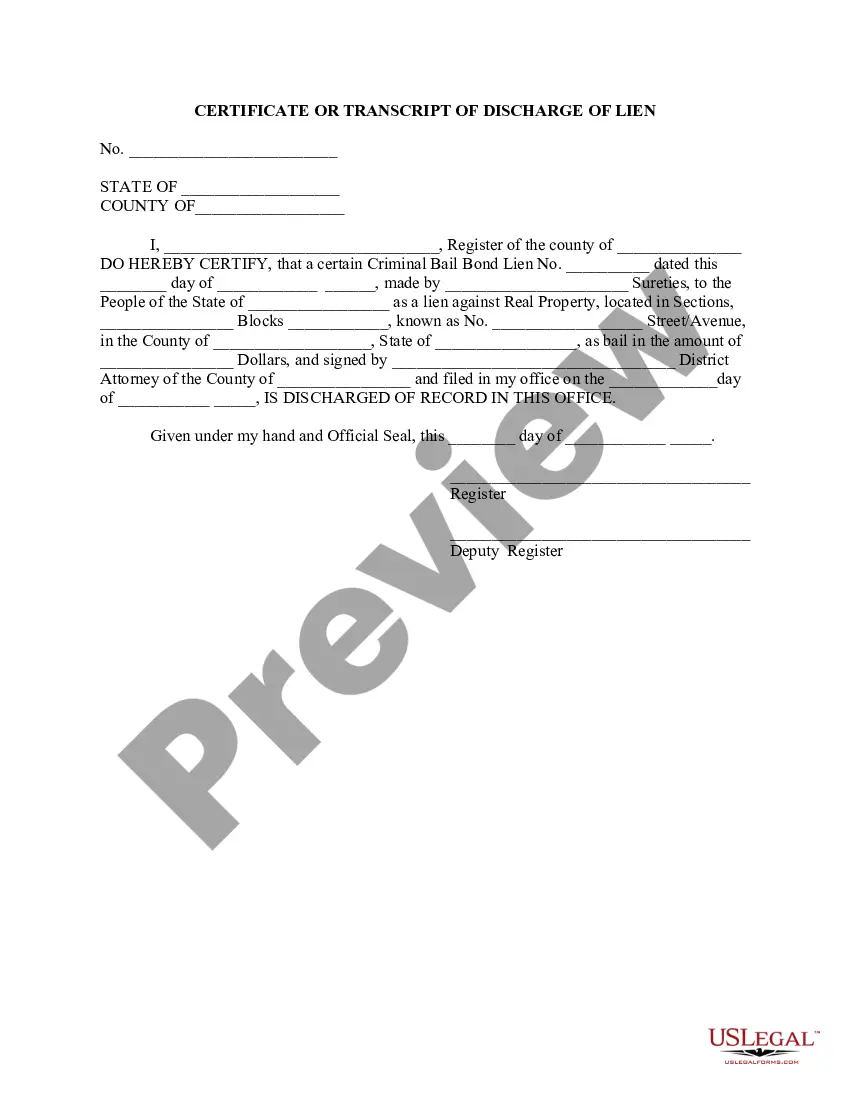

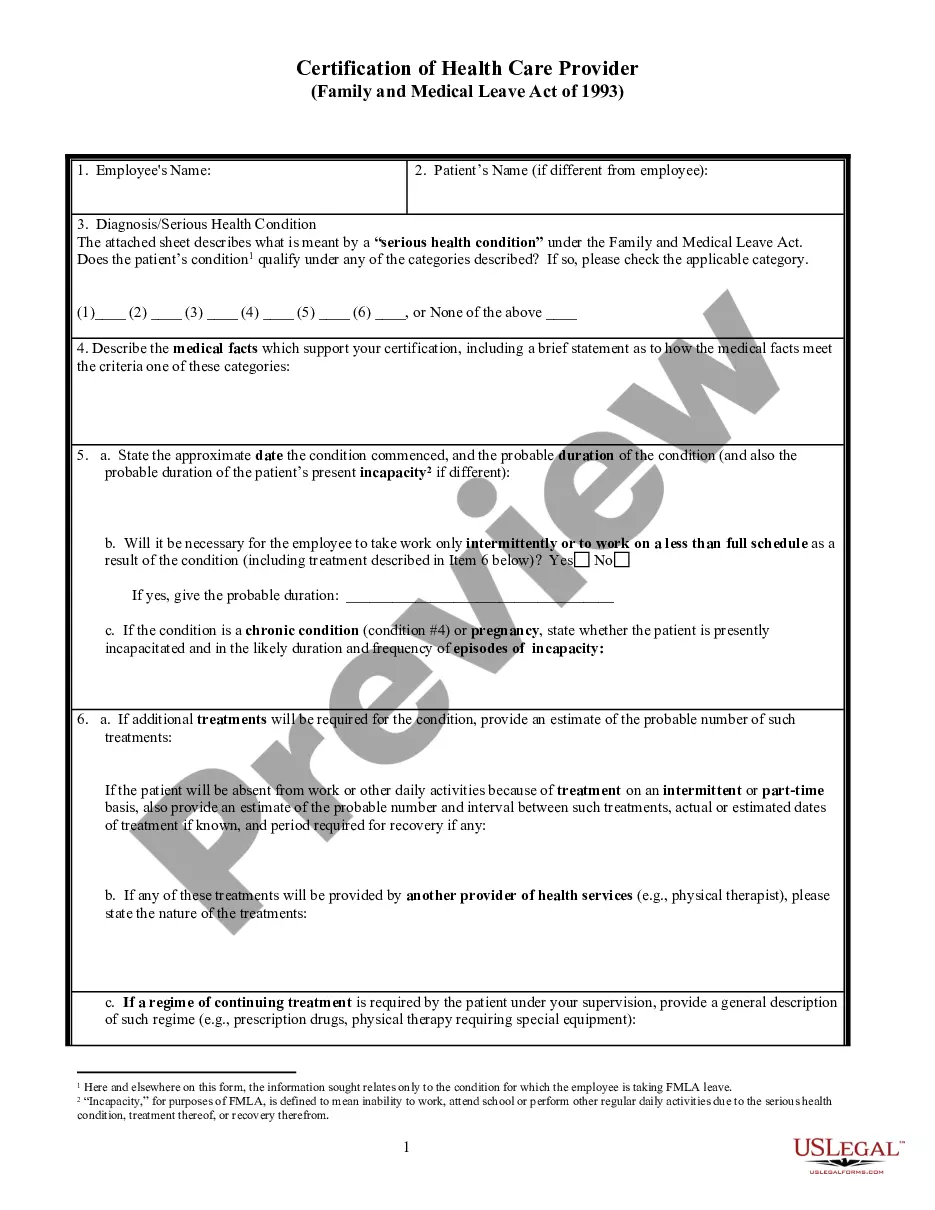

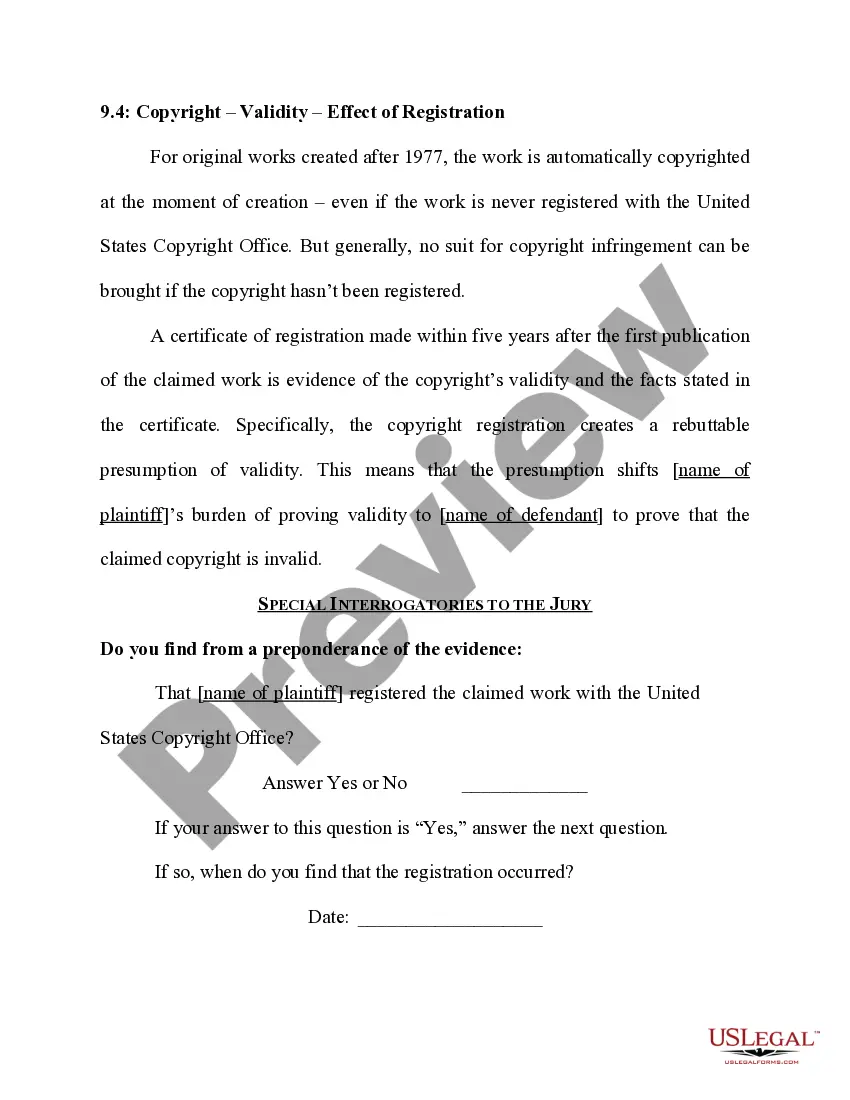

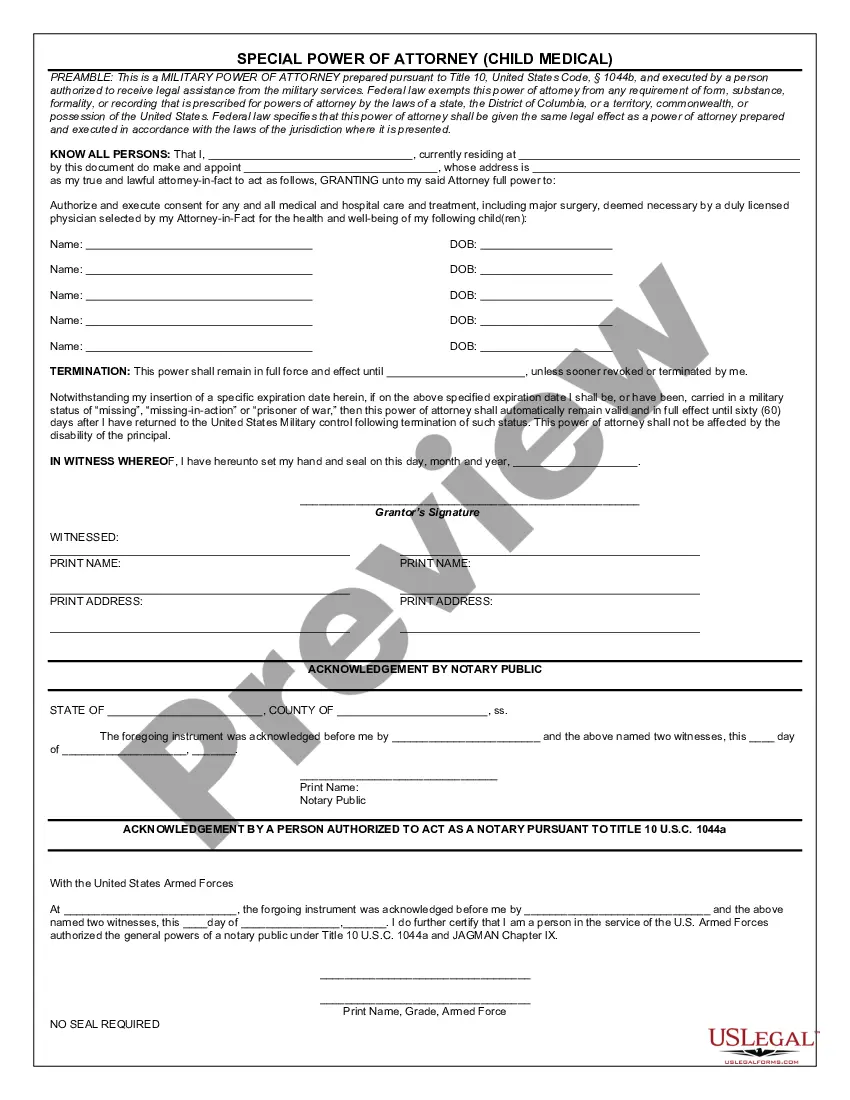

If available, use the Review button to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the New Jersey Liquidation of Partnership with Sale of Assets and Assumption of Liabilities.

- Every legal document template you purchase is yours indefinitely.

- To retrieve another copy of any purchased document, visit the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the area/city of your choice.

- Review the document description to confirm you have selected the appropriate document.

Form popularity

FAQ

Close your withholding account: Option 1: Submit an Online Registration Change (REG-C) indicating the date on which payment of wages ceased. When in the online portal, please select "End Tax Eligibility" option. Then under "Select a tax" select "Giter/UI/DI" and indicate the date on which payment of wages ceased.

You must have your LLC be in good standing, so make sure you file any missed annual reports. The filing fee for dissolving an LLC in New Jersey is $149 + state fees. Alternatively, you can hire a professional service provider to file your articles of dissolution for you.

Corporations ending business in New Jersey can dissolve, cancel, or withdraw online. Go to njportal.com/dor/annualreports and select Close a Business. Businesses that choose to complete a paper application must submit all of the following: Appropriate dissolution/withdrawal/cancellation form.

Filing by mail generally takes 1-2 weeks, while online filings are processed immediately. However, in either case, the dissolution is not complete until you receive tax clearance from the Division of Taxation, which can take several months.

Step 1: Follow Your New Jersey LLC Operating AgreementHolding a vote with LLC members to dissolve the LLC.Recording the dissolution vote in the LLC's meeting minutes.Determining the formal date of dissolution.Distribution of LLC assets.Notifying creditors and settling any business debts.

Corporations ending business in New Jersey can dissolve, cancel, or withdraw online. Go to njportal.com/dor/annualreports and select Close a Business. Businesses that choose to complete a paper application must submit all of the following: Appropriate dissolution/withdrawal/cancellation form.

A certificate of dissolution NJ may be sought by a company looking to dissolve itself. When you dissolve your company in the state of New Jersey, you are ending your existence as a business entity registered in the state. This can put a company past the reach of claimants or creditors.

How to Dissolve a LLC in New JerseyFile a certificate of cancellation or dissolution with the state Division of Revenue.Pay the required fees.Wind up the company's remaining business.

Close your withholding account:When in the online portal, please select "End Tax Eligibility" option.Then under "Select a tax" select "Giter/UI/DI" and indicate the date on which payment of wages ceased.

It will cost $120 to dissolve a New Jersey Corporation. This includes the $95 dissolution filing fee and the $25 tax clearance fee. If you pay with a credit card, there's an additional $3 processing fee. There is an additional $15 fee for 8.5 business hour over the counter expedited processing of dissolution documents.