New Jersey Subcontract Purchase Order for Labor and Materials

Description

How to fill out Subcontract Purchase Order For Labor And Materials?

You can spend multiple hours online attempting to locate the appropriate legal document format that complies with the state and federal regulations you desire.

US Legal Forms provides thousands of legal documents that have been evaluated by professionals.

You can download or print the New Jersey Subcontract Purchase Order for Labor and Materials from my service.

First, ensure that you have selected the correct document format for the county/town of your choice. Review the form description to guarantee you have chosen the right template. If available, utilize the Preview button to view the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire button.

- Subsequently, you can complete, edit, print, or sign the New Jersey Subcontract Purchase Order for Labor and Materials.

- Every legal document template you purchase is yours forever.

- To obtain another copy of the purchased form, visit the My documents tab and click on the relevant button.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

Form popularity

FAQ

To write a subcontract agreement, begin by clearly defining the scope of work, including the materials and labor needed. Include payment terms, timelines, and any legal obligations relevant to the New Jersey Subcontract Purchase Order for Labor and Materials. You may want to use a reliable platform like US Legal Forms to access templates and ensure that your agreement meets all necessary legal standards.

The procurement process of a subcontract involves several key steps, starting with identifying the project requirements and finding the right subcontractor. Next, you gather bids, negotiate terms, and establish the New Jersey Subcontract Purchase Order for Labor and Materials. This ensures that all parties understand their responsibilities and deadlines, leading to a smooth workflow and successful project completion.

A purchase order (PO) is a document that a buyer sends to a seller, indicating the types and quantities of goods or services needed. In contrast, a subcontract is an agreement between a contractor and a subcontractor that outlines the labor and materials required for a specific project. When dealing with the New Jersey Subcontract Purchase Order for Labor and Materials, understanding this difference is crucial, as it impacts how you manage your contracts and budgets.

Creating a subcontractor agreement involves a few essential steps to ensure clarity and legal compliance. Start by defining the scope of work, including specific tasks the subcontractor will perform. Additionally, specify payment details and deadlines to align expectations. For a thorough approach, consider using a New Jersey Subcontract Purchase Order for Labor and Materials template, which simplifies the process and ensures that all necessary elements are included.

Purchasing refers to the act of acquiring goods or services from suppliers for immediate use, while subcontracting involves hiring another party to complete specific tasks under a contract. The difference lies primarily in the nature of the relationship and responsibilities. A New Jersey Subcontract Purchase Order for Labor and Materials clearly delineates these roles, promoting transparency and accountability in project execution.

The five steps of the procurement process include identifying needs, defining specifications, sourcing suppliers, placing orders, and managing contracts. This streamlined approach enhances efficiency and ensures that all project requirements are met. A New Jersey Subcontract Purchase Order for Labor and Materials can facilitate these steps by providing a clear framework for cooperation between contractors and subcontractors.

The procurement process can be broken down into seven steps: identify needs, define specifications, request quotes, evaluate proposals, negotiate terms, create purchase orders, and manage contracts. Each step aims to optimize the acquisition of necessary materials and services. When utilizing a New Jersey Subcontract Purchase Order for Labor and Materials, you can simplify contract management and ensure compliance.

The procurement process typically involves four main steps: identifying needs, market research, soliciting proposals, and selecting vendors. Each step plays a crucial role in ensuring that resources align with project objectives. Using a New Jersey Subcontract Purchase Order for Labor and Materials helps streamline this process by formalizing agreements and expectations.

Procurement in contracting refers to the process of acquiring goods and services needed for a project. This includes identifying needs, soliciting bids, and selecting vendors to fulfill those needs. In relation to a New Jersey Subcontract Purchase Order for Labor and Materials, procurement ensures that the necessary resources are efficiently managed and delivered on time.

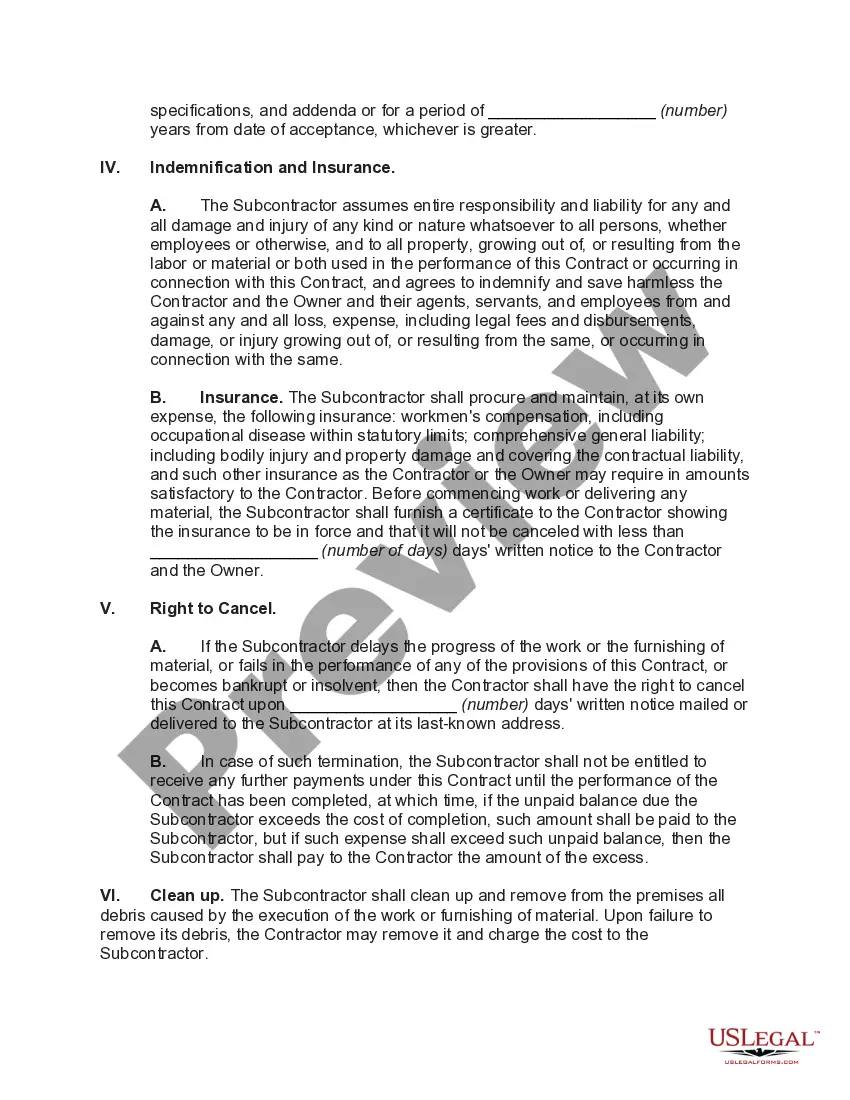

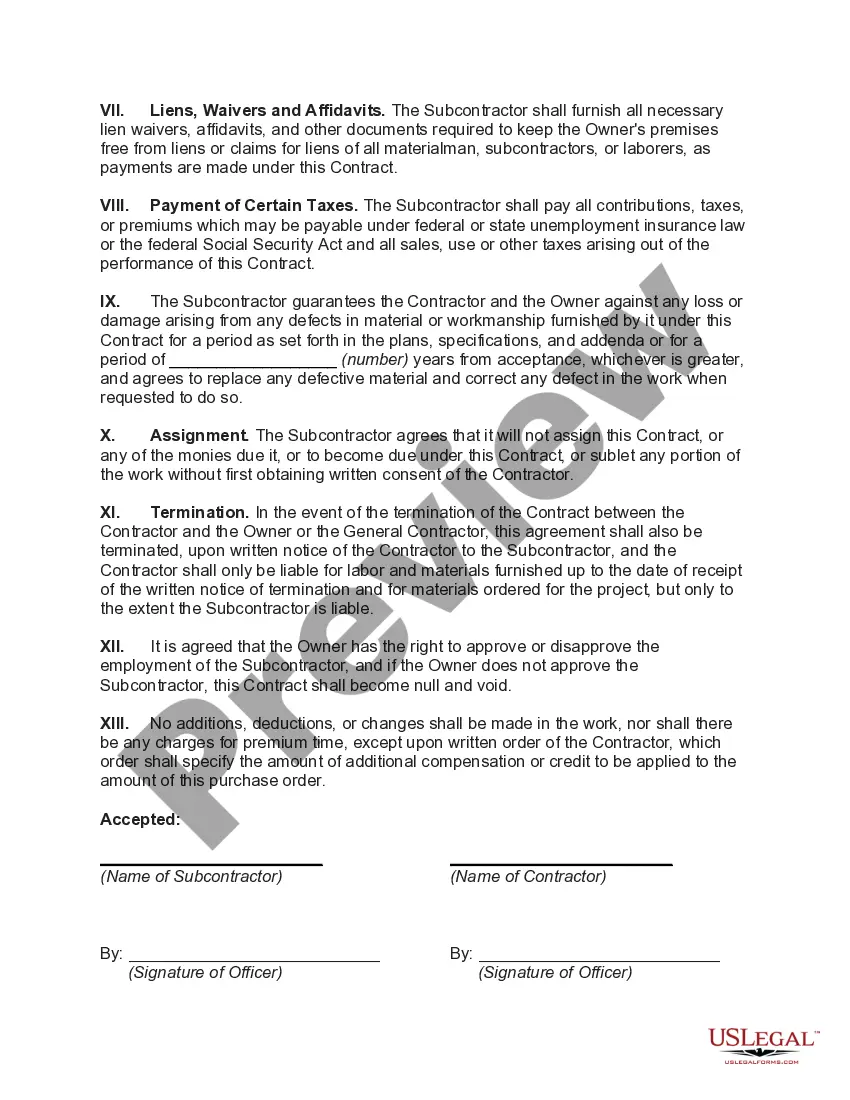

A subcontract order is a document that outlines the agreement between a contractor and a subcontractor for specific tasks. It details the scope of work, payment terms, and timelines for the completion of labor and materials. In the context of a New Jersey Subcontract Purchase Order for Labor and Materials, this order ensures compliance with local regulations and contractual obligations.