New Jersey Sample Letter for Request for Removal of Derogatory Credit Information

Description

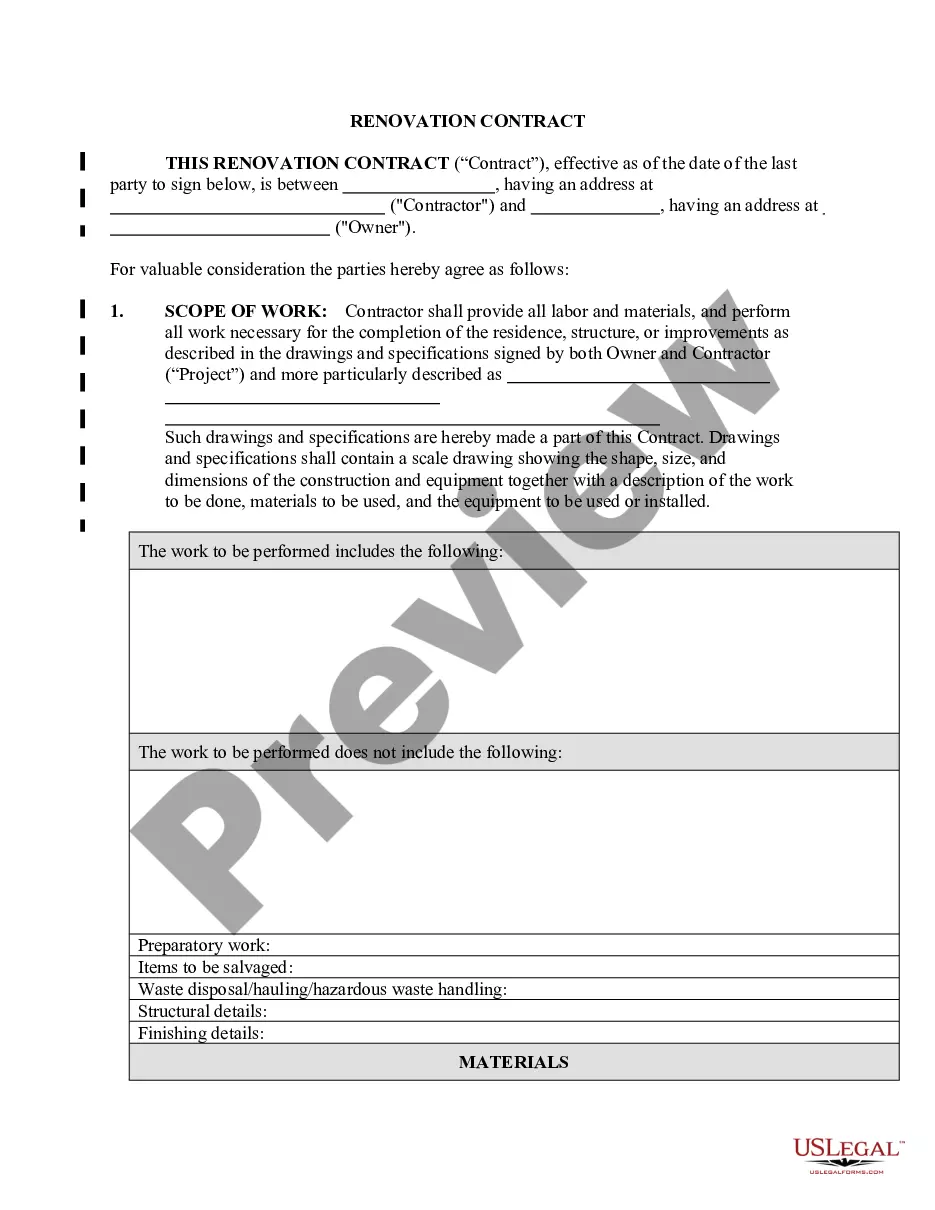

How to fill out Sample Letter For Request For Removal Of Derogatory Credit Information?

Choosing the right lawful file template might be a have a problem. Of course, there are a lot of layouts accessible on the Internet, but how can you get the lawful kind you need? Utilize the US Legal Forms web site. The support provides 1000s of layouts, including the New Jersey Sample Letter for Request for Removal of Derogatory Credit Information, that you can use for company and private needs. Each of the kinds are checked by professionals and satisfy state and federal requirements.

Should you be presently listed, log in to your bank account and click on the Acquire switch to have the New Jersey Sample Letter for Request for Removal of Derogatory Credit Information. Make use of bank account to check with the lawful kinds you may have acquired previously. Proceed to the My Forms tab of your bank account and get another version in the file you need.

Should you be a fresh end user of US Legal Forms, allow me to share simple guidelines so that you can comply with:

- Very first, make certain you have selected the appropriate kind to your area/region. It is possible to look through the shape making use of the Review switch and look at the shape outline to make sure it is the right one for you.

- When the kind is not going to satisfy your requirements, take advantage of the Seach area to find the appropriate kind.

- Once you are positive that the shape is proper, click on the Acquire now switch to have the kind.

- Pick the prices plan you need and type in the required info. Create your bank account and buy the order making use of your PayPal bank account or Visa or Mastercard.

- Opt for the document formatting and obtain the lawful file template to your device.

- Comprehensive, edit and print out and signal the acquired New Jersey Sample Letter for Request for Removal of Derogatory Credit Information.

US Legal Forms will be the largest library of lawful kinds for which you can find a variety of file layouts. Utilize the company to obtain skillfully-made files that comply with condition requirements.

Form popularity

FAQ

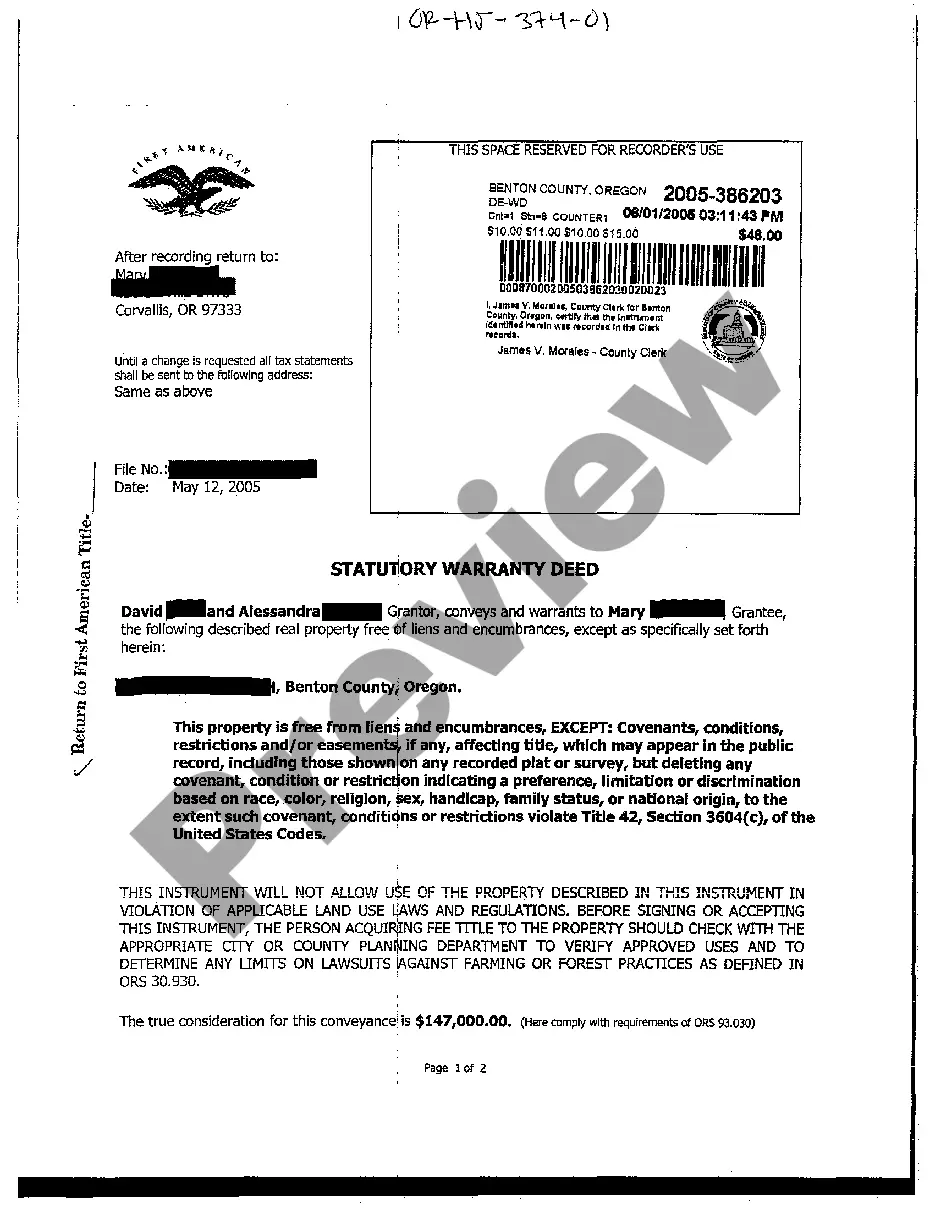

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

Successfully disputing inaccurate information is the only surefire way to get collections removed from your credit report. If you've repaid a debt and the collection account remains on your credit report, you can request a goodwill deletion from your creditor, though there's no guarantee they'll grant your request.

After writing a general dispute letter or a 609 credit disputing letter, followed by a 611 credit disputing letter, consumers can send a 623 credit disputing letter. With a 623 credit disputing letter, consumers request the credit agency to provide evidence to validate that the debt is theirs.

You can ask the creditor ? either the original creditor or a debt collector ? for what's called a ?goodwill deletion.? Write the collector a goodwill letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

If the derogatory mark is in error, you can file a dispute with the credit bureaus to get negative information removed from your credit reports. You can see all three of your credit reports for free on a weekly basis. If the derogatory marks are not errors, you'll need to wait for them to age off your credit reports.

Write a Dispute Letter Also, clearly state that you want this inaccurate information removed from your credit report as quickly as possible. Before submitting your request, be sure to make copies of all the documentation you're sending along. Don't send your original documents.

A 609 letter is a formal document consumers use to request more information about account details listed on their credit reports they believe to be erroneous and to request the removal or correction of this inaccurate information.