New Jersey Agreement to Execute Mutual or Joint and Mutual Will by Husband and Wife with Estate to Survivor

Description

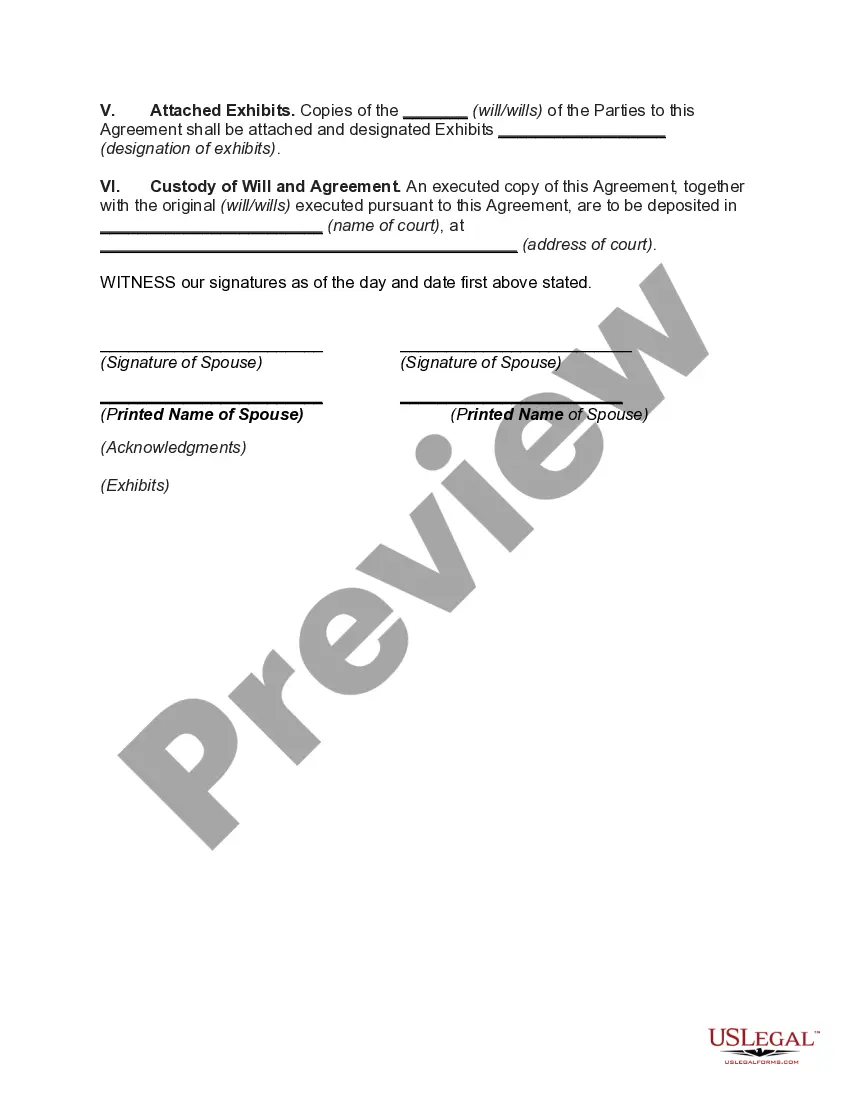

How to fill out Agreement To Execute Mutual Or Joint And Mutual Will By Husband And Wife With Estate To Survivor?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers an extensive selection of legal form templates that you can download or print.

Utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, claims, or keywords. You will locate the latest editions of forms such as the New Jersey Agreement to Execute Mutual or Joint and Mutual Will by Husband and Wife with Estate to Survivor in moments.

If you already hold a subscription, Log In and download the New Jersey Agreement to Execute Mutual or Joint and Mutual Will by Husband and Wife with Estate to Survivor from the US Legal Forms library. The Download button will appear on every form you view. You gain access to all previously downloaded forms from the My documents section of your account.

Complete the purchase. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make edits. Fill in, adjust, print, and sign the downloaded New Jersey Agreement to Execute Mutual or Joint and Mutual Will by Husband and Wife with Estate to Survivor. Each document you added to your account does not expire and is yours indefinitely. Therefore, if you want to download or print another version, simply navigate to the My documents section and click on the form you need. Access the New Jersey Agreement to Execute Mutual or Joint and Mutual Will by Husband and Wife with Estate to Survivor with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Ensure you have selected the correct form for the area/county.

- Click the Preview button to review the form’s content.

- Examine the form summary to confirm that you have chosen the right form.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your details to sign up for an account.

Form popularity

FAQ

If one owner of a jointly owned property dies in New Jersey, the remaining owner typically retains full ownership. The deceased owner's interest does not pass to their heirs unless specified otherwise in a will. A well-structured New Jersey Agreement to Execute Mutual or Joint and Mutual Will by Husband and Wife with Estate to Survivor can clarify these matters and protect both partners’ assets.

Outright distribution. You and your spouse may have one of the most common types of estate plans between married couples, which is a simple will leaving everything to each other. With this type of plan, you leave all of your assets outright to your surviving spouse.

A mirror will is a pair of wills for couples who want to mirror each other's wishes. They are, in effect, identical wills, one for each person. Most commonly, couples will choose to leave everything they own to their partner, then their children.

A mirror will is a pair of wills for couples who want to mirror each other's wishes. They are, in effect, identical wills, one for each person. Most commonly, couples will choose to leave everything they own to their partner, then their children.

As per the law, the joint assets are owned by both individuals hence both individuals i.e. husband & wife should make a Will either two separate Wills or one single Joint Will.

Generally speaking, there are three kinds of Wills: (1) holographicwritten entirely in the handwriting of the person writing the Will; (2) standard, formal typewrittenprinted or typed; and (3) partially handwritten and partially typed. The requirements for a valid Will are different for each type of Will.

If I have a will, does my spouse need one? The answer is yes everyone should have a will! If you're married, you and your spouse can have separate (or joint) wills that you sign yourselves. This way, if something were to happen to one of you, there's no room for ambiguity or confusion.

A joint will is one document signed by two people. A mutual will represents two individual wills that are signed separately, but are largely the same in content.

A mirror will can include instructions for both parties' estates to be left to any surviving children should the couple die at the same time. If you have any children under the age of 18, you can appoint a guardian for them should both parents pass away.

A joint will can be a good idea if both you and your partner are in total agreement about how you want to distribute your property, your estates aren't complicated, and you only have a few beneficiaries.