New Jersey General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion

Description

How to fill out General Form Of Trust Agreement For Minor Qualifying For Annual Gift Tax Exclusion?

If you're looking to finalize, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly and convenient search feature to locate the documents you need.

A range of templates for business and personal purposes are organized by categories and states or keywords.

Step 4. After finding the form you need, select the Purchase now button. Choose the payment plan you want and enter your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to acquire the New Jersey General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion in just a few clicks.

- If you are already a customer of US Legal Forms, Log In to your account and click on the Acquire button to obtain the New Jersey General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion.

- You can also access forms you have previously purchased from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct region/state.

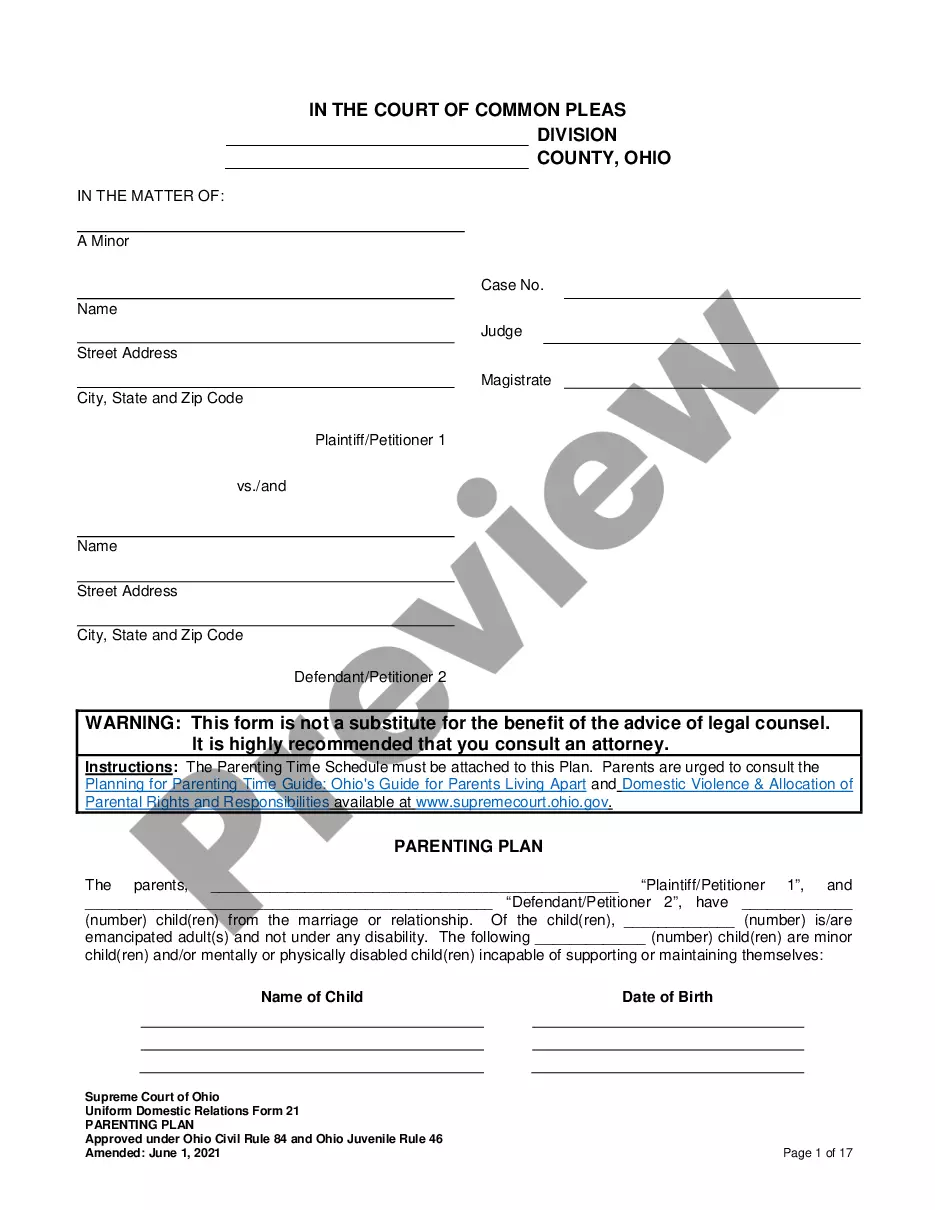

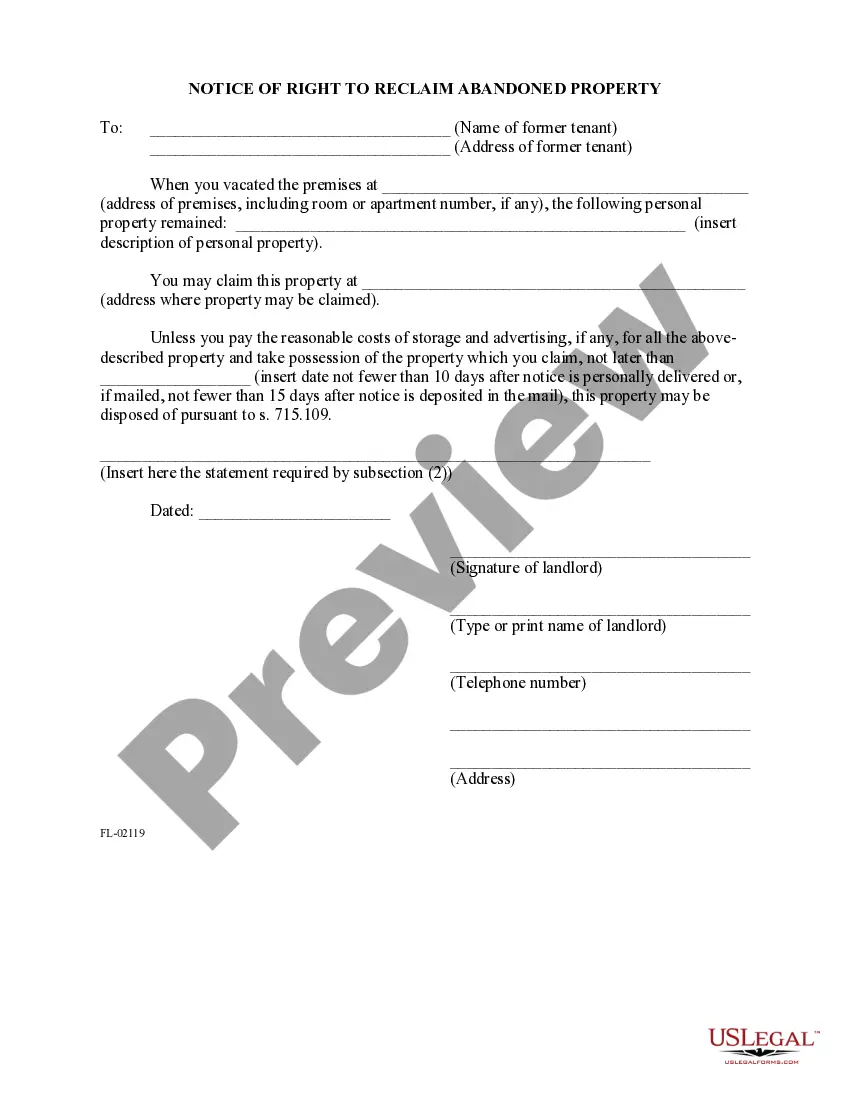

- Step 2. Use the Preview option to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the page to find alternate versions of the legal form template.

Form popularity

FAQ

The federal gift tax law provides that every person can give a present interest gift of up to $14,000 each year to any individual they want.

The trust allows the trustee to gift from the trust to the current beneficiary's issue up to the annual gift exclusion (currently $15K).

For all practical purposes, the trust is invisible to the Internal Revenue Service (IRS). As long as the assets are sold at fair market value, there will be no reportable gain, loss or gift tax assessed on the sale. There will also be no income tax on any payments paid to the grantor from a sale.

A gift in trust is a way to avoid taxes on gifts that exceed the annual gift tax exclusion amount. One type of gift in trust is a Crummey trust, which allows gifts to be given for a specific period, establishing the gifts as a present interest and eligible for the gift tax exclusion.

The trust allows the trustee to gift from the trust to the current beneficiary's issue up to the annual gift exclusion (currently $15K).

As mentioned previously, up to $2,600 of taxable income of a trust can be accumulated in the trust and taxed at the 10% tax rate (based on 2019 tax brackets), thus avoiding the kiddie tax, if applicable, on income distributions to a child.

The IRS requires that any gifts be made out of a trust be under the beneficiary's full control immediately. This present interest rule means that if a gift is made with conditions and the beneficiary does not have control over it at the time its made then it doesn't qualify for the annual exclusion amount.

Qualifying gifts to an irrevocable trust for the annual gift tax exclusion will involve giving the beneficiary either the right, for a limited time, to withdraw assets given to the trust (a "Crummey withdrawal right") or the use of a trust that lasts only until the beneficiary reaches age 21.

Gifts in trust do not qualify for the annual exclusion unless the trust either qualifies as a Minor's Trust under Internal Revenue Code Section 2503(c) or has certain temporary withdrawal powers called Crummey powers.

Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.