New Jersey Assignment of Interest in Joint Venture

Description

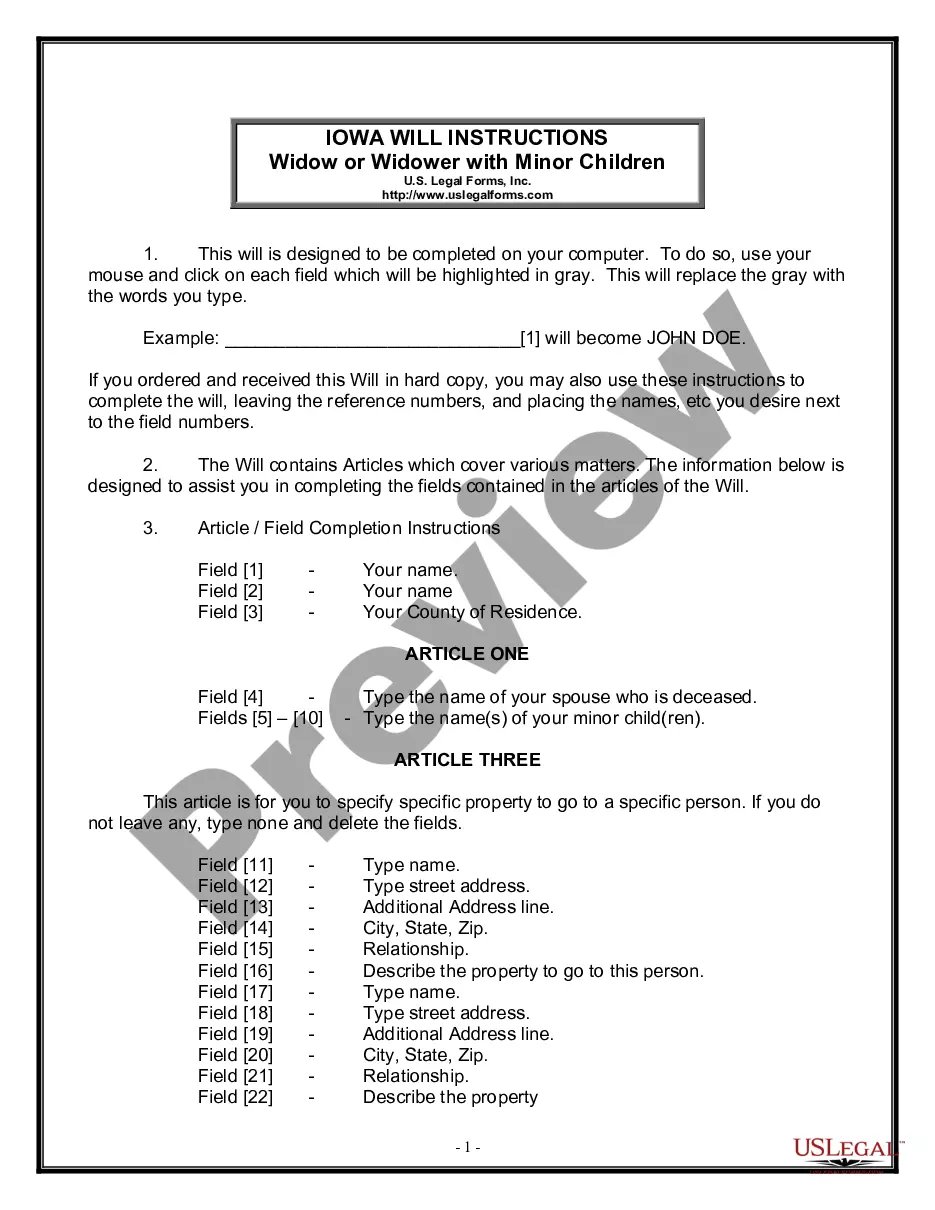

How to fill out Assignment Of Interest In Joint Venture?

Locating the appropriate legal document template can be a challenge.

Of course, numerous designs are available on the web, but how can you obtain the legal form you need.

Utilize the US Legal Forms website.

First, ensure you have selected the correct form for your city/state. You can view the form using the Review option and read the form's description to confirm it is suitable for you.

- The service offers thousands of designs, including the New Jersey Assignment of Interest in Joint Venture, suitable for both business and personal purposes.

- All forms are reviewed by experts and comply with federal and state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the New Jersey Assignment of Interest in Joint Venture.

- Use your account to browse through the legal forms you have previously purchased.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward steps you should follow.

Form popularity

FAQ

Because any profits made from a joint venture flow through to the individual members of the venture, the portion of the profit that each member receives is claimed on that member's individual or corporate tax returns. The venture itself does not make a tax filing on any of the funds that flow through it.

Partnerships file Form 8308 to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange).

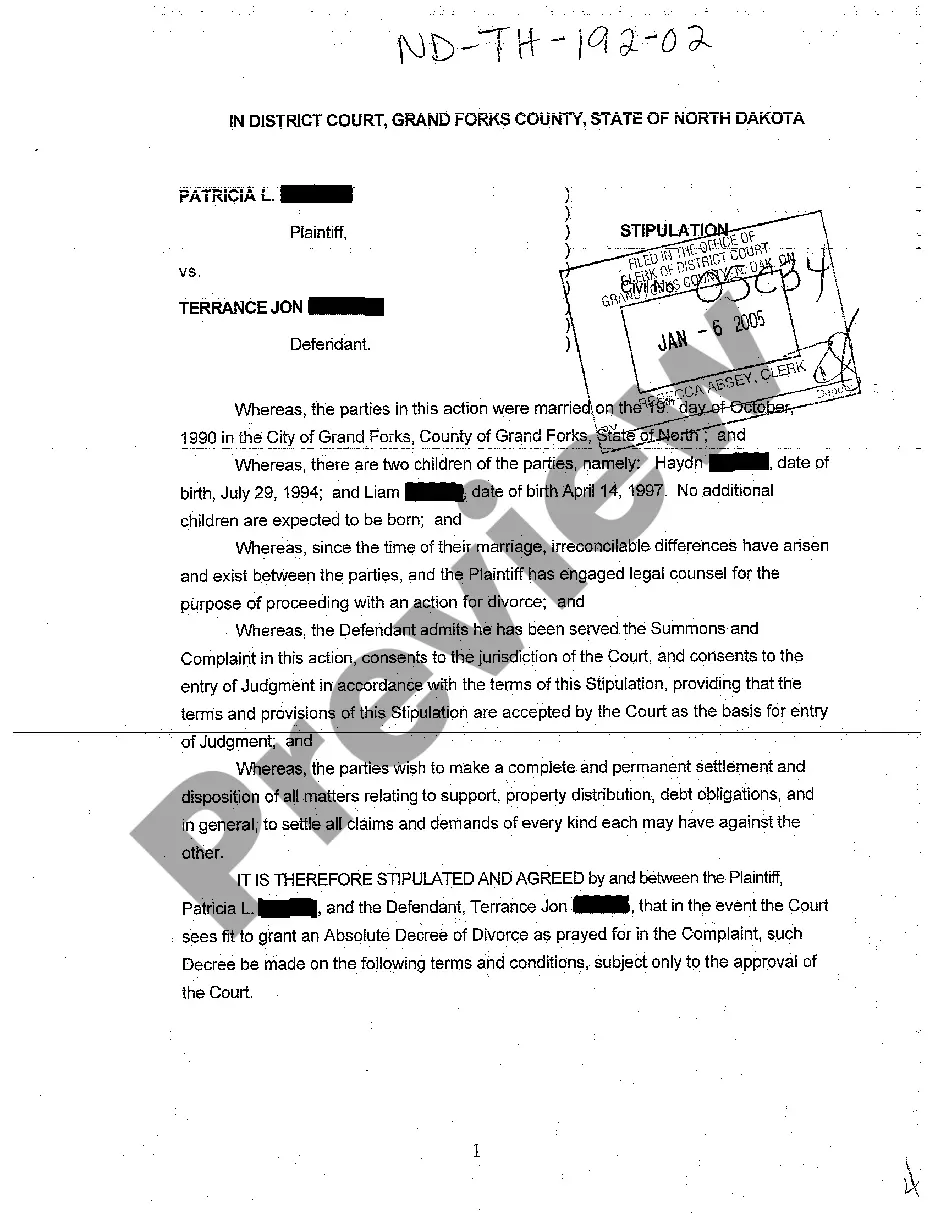

An Assignment of Partnership Interest occurs when a partner sells their stake in a partnership to a third party. The assignment document records the details of the transfer to the new partner.

How to Report a Sale of a Share of a Partnership on a 1065Complete Part I and Part II, Items E through I, on each partner's K-1. This is used to provide personal information.Complete Part III of each partner's K-1.Complete the selling partner's K-1.Complete the remaining partners' K-1s.

Report investment interest expense on line 12b of Schedule K and in box 12 of Schedule K-1 using code H. partnership interests. The long-term holding period for gains and losses with respect to applicable partnership interests is more than 3 years.

New Jersey does not allow federal deductions, such as mortgage interest, employee business expenses, and IRA and Keogh Plan contributions. Full-year residents can only deduct amounts paid during the tax year. Part-year residents can only deduct those amounts paid while they were New Jersey residents.

Most investment income is taxable in New Jersey as interest, dividends, or capital gains. Earnings on tuition savings programs formed under Section 529A of the Internal Revenue Code. This includes the State's Achieving a Better Life Experience (ABLE) program.

2012 Review Schedule D, Form 8949 and Form 4797 to determine the amount of gain or loss the partner reported on the sale of the partnership interest. After determining a partner sold its interest in the partnership, establish other relevant facts that can impact the tax treatment of this transaction.

You can deduct investment interest expense you incurred to acquire a partnership interest from your distributive share of partnership income. If you are a New Jersey resident, you can deduct the full amount of qualified, unreimbursed business expenses from your distributive share of partnership income.

The sale of a partnership interest is generally treated as a sale of a capital asset, resulting in capital gain or loss for the selling partner.