New Jersey Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren

Description

A lactation consultant is a healthcare provider recognized as having expertise in the fields of human lactation and breastfeeding

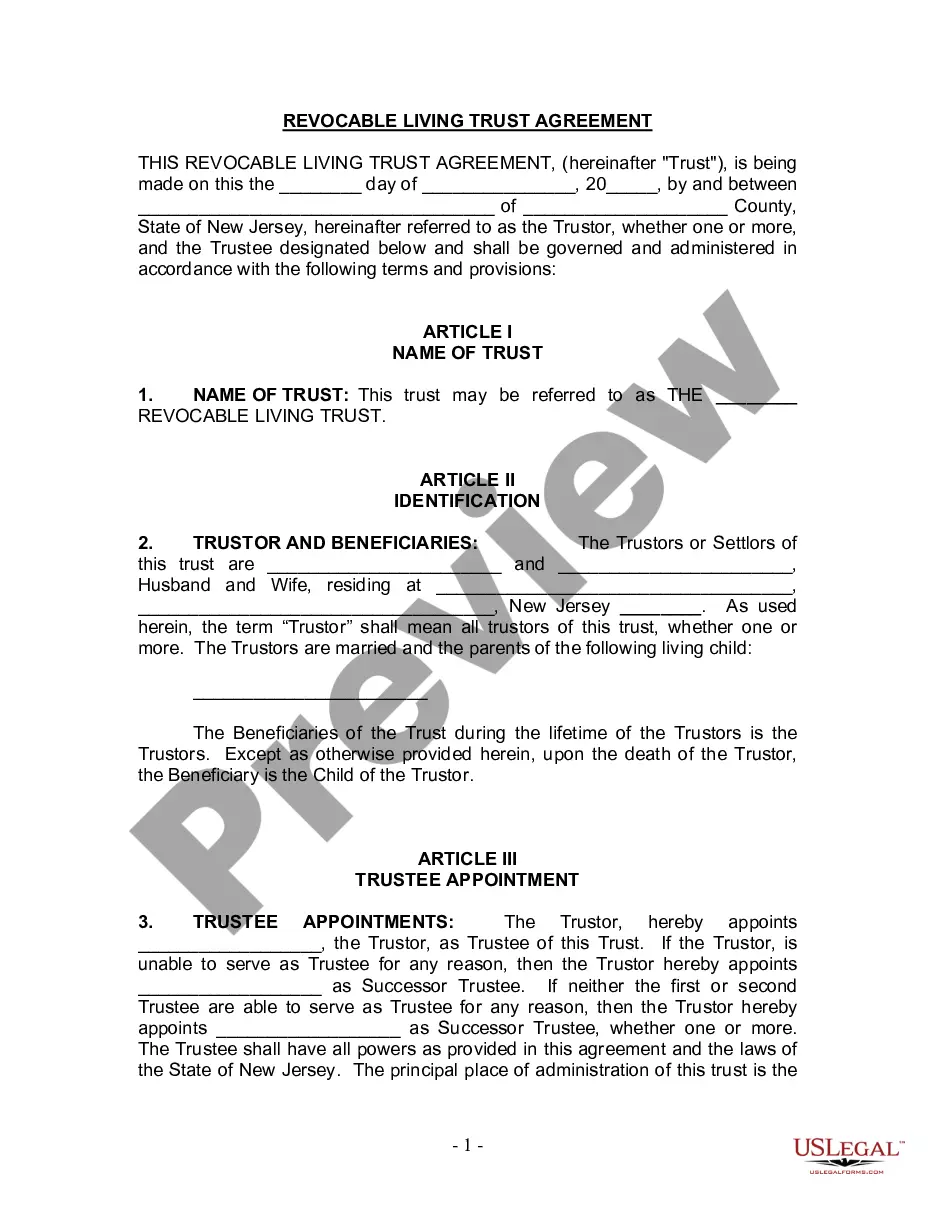

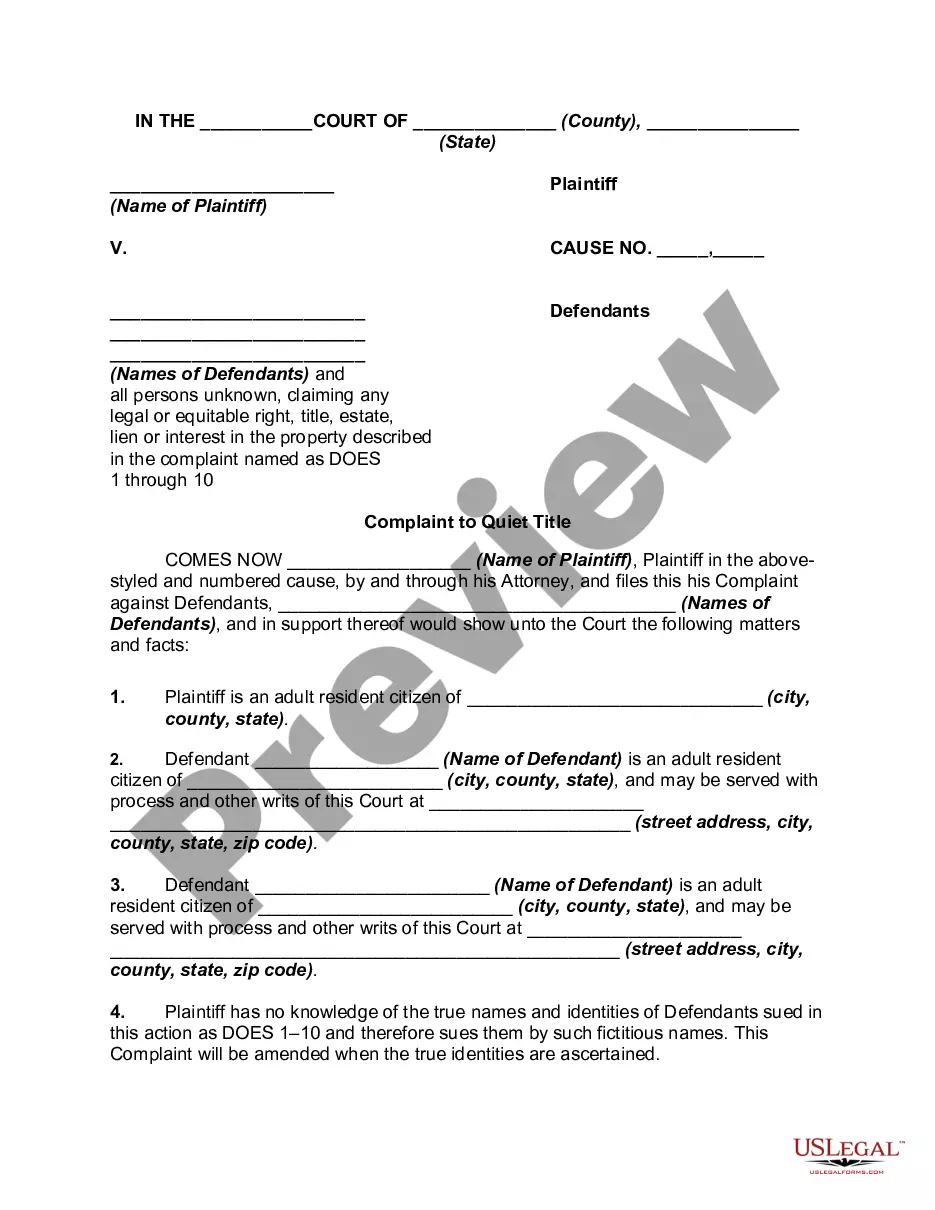

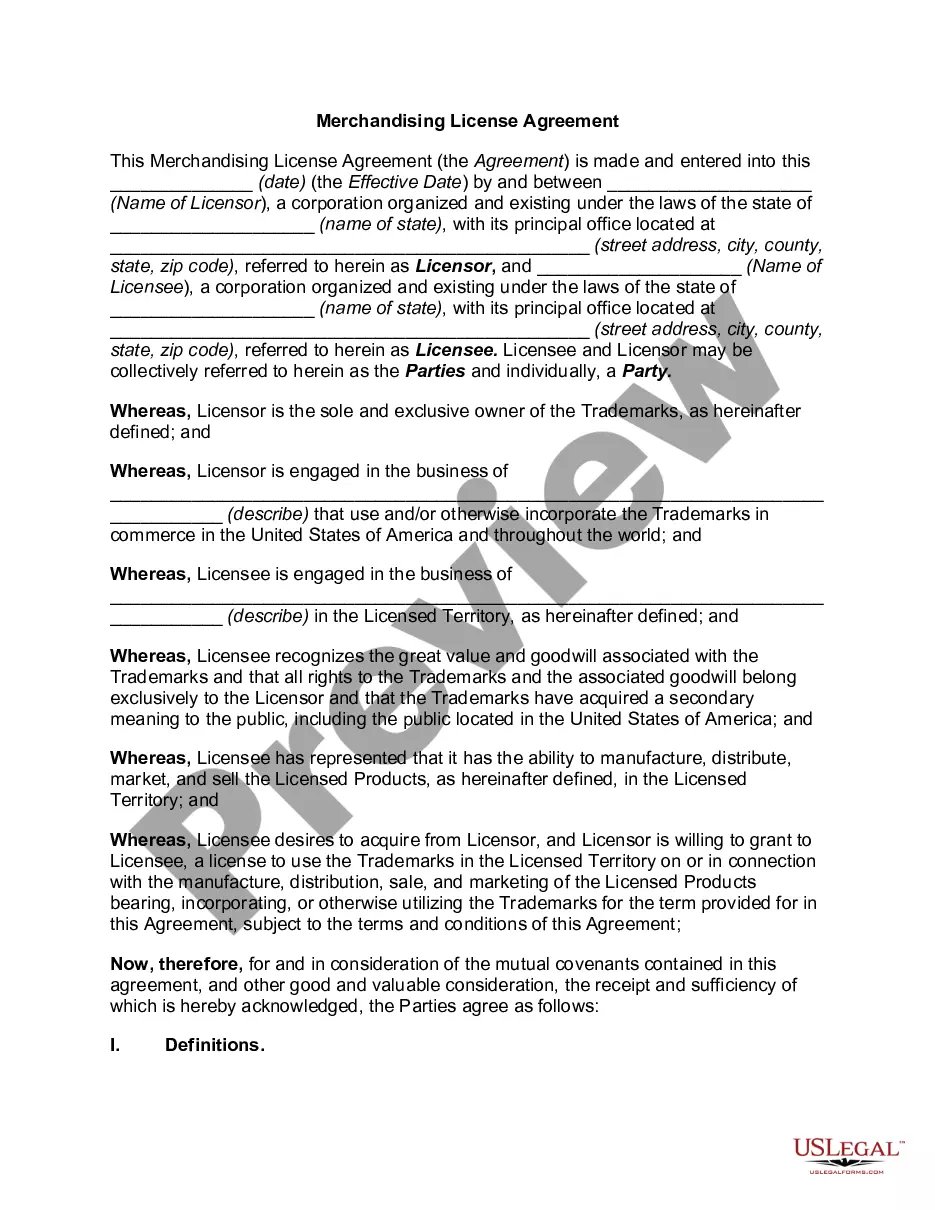

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

How to fill out Irrevocable Trust Agreement For The Benefit Of Spouse, Children And Grandchildren?

US Legal Forms - one of the largest collections of legal templates in the USA - offers a range of legal document templates that you can download or print. By utilizing the website, you can discover thousands of forms for business and personal use, categorized by types, states, or keywords. You can locate the latest templates of documents such as the New Jersey Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren in just a few minutes.

If you already possess an account, Log In and retrieve the New Jersey Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren from the US Legal Forms library. The Download button appears on every form you view. You can access all previously downloaded forms within the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to get started: Ensure you have selected the correct form for your area/state. Click the Review button to examine the content of the form. Check the form summary to confirm you have chosen the correct document. If the form does not meet your needs, utilize the Search bar at the top of the screen to find one that does. When you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select your preferred pricing plan and provide your details to sign up for an account.

- Process the payment. Use a credit card or PayPal account to complete the transaction.

- Select the file format and download the form to your device.

- Make edits. Fill out, modify, print, and sign the downloaded New Jersey Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren.

- Each template saved in your account has no expiration date and belongs to you indefinitely. So, to download or print another copy, simply navigate to the My documents section and click on the form you desire.

- Gain access to the New Jersey Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren with US Legal Forms, the most comprehensive collection of legal document templates.

- Utilize a vast array of professional and state-specific templates that fulfill your business or personal needs and preferences.

Form popularity

FAQ

To report income for an irrevocable trust, you will primarily use IRS Form 1041, as mentioned earlier. This form helps you disclose the trust’s income, deductions, and distributions to beneficiaries. Additionally, depending on the trust's specific activities, certain supplemental forms may be needed. Utilizing resources like USLegalForms can guide you through filling out these forms correctly, ensuring compliance with tax regulations.

Income earned by the trust from amounts that you've deposited will not be taxed to you; the trust pays the taxes. Amounts deposited in trust, and the income earned from those funds, will be used for the benefit of your grandchildren. You can provide that the trust terminate at any age you specify.

Beneficiaries of an irrevocable trust have rights to information about the trust and to make sure the trustee is acting properly. The scope of those rights depends on the type of beneficiary. Current beneficiaries are beneficiaries who are currently entitled to income from the trust.

The trust remains revocable while both spouses are alive. The couple may withdraw assets or cancel the trust completely before one spouse dies. When the first spouse dies, the trust becomes irrevocable and splits into two parts: the A trust and the B trust.

One of the most preferred ways to leave assets to grandchildren is by naming them as a beneficiary in your will or trust. As the grantor or trustor, you are able to specify a set amount of money or a percentage of your total accounts and property to each grandchild as you see fit.

Irrevocable trusts can also protect assets from being used in determining Medicare eligibility. Once an irrevocable trust is funded, the trust property cannot be taken back by the grantor without the consent of the beneficiary. It is legal to name a beneficiary as trustee, such as a spouse.

A Trust (or Marital Trust)The surviving spouse must be the only beneficiary of the trust during his/her lifetime, however, at the time of the second spouse's death, the trust can pass to any other named beneficiaries like children, grandchildren, etc.

The Trust may provide that upon the death of the first spouse, the Trust becomes irrevocablecannot be changed or amended. But the surviving spouse is given the power to appoint the assets to any of the children he or she chooses and can even exclude some of the children.

Often there is someone the grantor knows who the grantor suggests to be the trustee. Typical choices are the grantor's spouse, sibling, child, or friend. Any of these may be an acceptable choice from a legal perspective, but may be a poor choice for other reasons.

Individual trusts for each grandchild. Most grandparents choose to put equal amounts of money into each grandchild's individual trust. The trustee can then decide when and how much money to distribute to each grandchild from their individual trust based on the standards written into the trust.