New Jersey Business Start-up Checklist

Description

How to fill out Business Start-up Checklist?

You might spend hours online searching for the valid document format that meets the federal and state requirements you need.

US Legal Forms offers a vast number of legal templates that are vetted by experts.

You can conveniently download or print the New Jersey Business Start-up Checklist from the service.

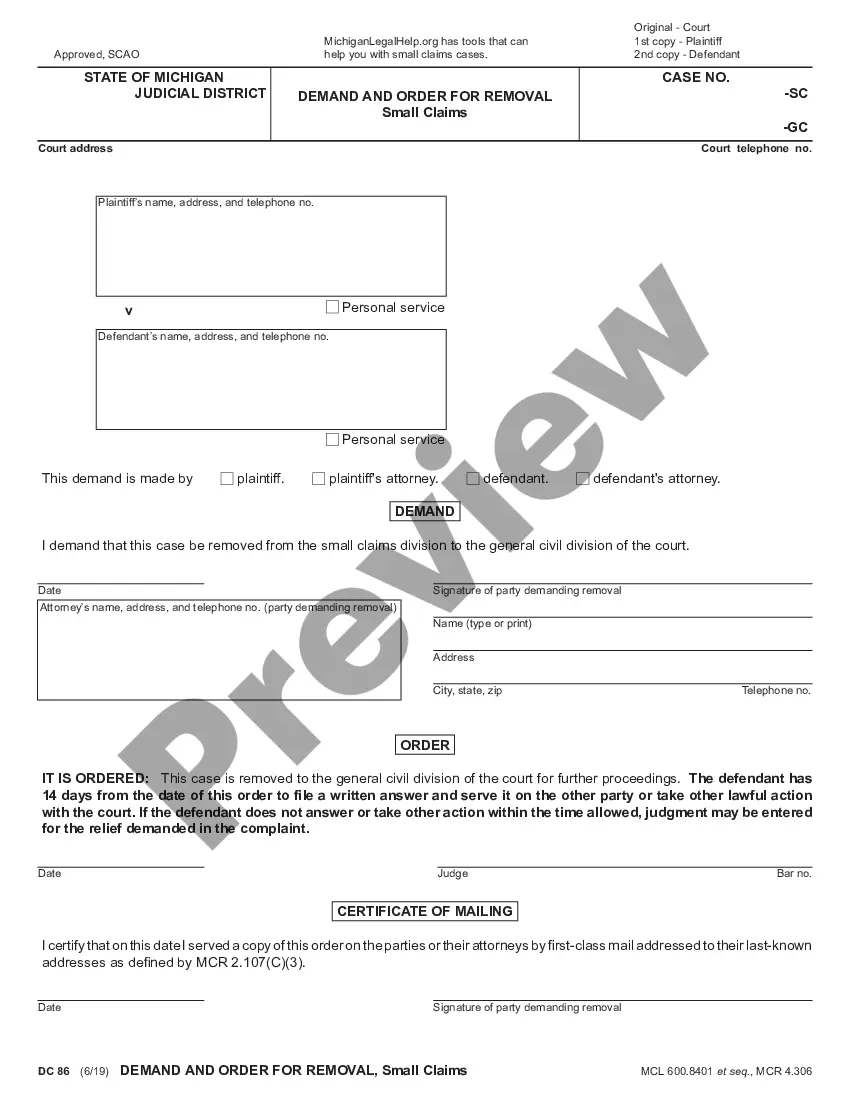

If available, use the Preview button to check the document format at the same time. To find another version of the form, use the Search section to locate the format that satisfies your needs and requirements. Once you have identified the desired format, click on Get now to proceed. Choose the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms. Complete the purchase using your Visa or Mastercard or PayPal account to pay for the legal form. Select the format of the document and download it to your device. Make adjustments to your document as needed. You can fill out, edit, and sign and print the New Jersey Business Start-up Checklist. Download and print a large number of document templates using the US Legal Forms site, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Thereafter, you can fill out, modify, print, or sign the New Jersey Business Start-up Checklist.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of the acquired form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions outlined below.

- First, ensure that you select the correct document format for the state/city of your choice.

- Review the form description to confirm that you have chosen the right one.

Form popularity

FAQ

The fee is $125 for all for-profit entities and Foreign Non-Profit corporations. The fee is $75 for Domestic Non-Profit corporations. File your certificate online. Second, after filing the certificate of formation/authorization, file the tax/employer registration form (Form NJ-REG).

The New Jersey Complete Business Registration Package contains: Application for Business Registration, Form NJ-REG; 2022 Applications for Motor Fuel and Cigarette Licenses; and 2022 The State of New Jersey New Hire Reporting Form. Employers must complete the New Hire Reporting Form for all employees at the time of hiring.

Business Plan. Almost every business needs a little funding to get started.Partnership Agreement.LLC Operating Agreement.Buy/Sell Agreement.Employment Agreement.Employee Handbook.Non-Disclosure Agreement.Non-Compete Agreement.More items...

New Jersey does not have a statewide business license however businesses may need to register with the New Jersey Department of State. All businesses must register with the New Jersey Department of Treasury. Businesses may be liable for business tax, sales tax, payroll tax and others.

Starting a business in New Jersey takes 7 steps:Choose a name for your business.Choose the right type of business entity.Register your business with the New Jersey Division of Revenue.Get your EIN Number (Federal Tax ID Number)Open a bank account and get a debit/credit card.Get a state business license.More items...

The fee is $125 for all for-profit entities and Foreign Non-Profit corporations. The fee is $75 for Domestic Non-Profit corporations. File your certificate online. Second, after filing the certificate of formation/authorization, file the tax/employer registration form (Form NJ-REG).

Forming an LLC in NJStep 1: Choose a name for your NJ LLC.Step 2: Choose a registered agent in NJ.Step 3: Obtain an NJ business license.Step 4: File your certificate of formation.Step 5: Draft an LLC operating agreement.Step 6: Comply with state and federal obligations.Pros.Cons.

Who needs a New Jersey business license? Every business needs a New Jersey business registration certificate, and any business that sells taxable goods or services needs a certificate of authority. Businesses in certain professions or locations may need other licenses.