New Jersey Annual Expense Report

Description

How to fill out Annual Expense Report?

Are you in a location where you often need documents for business or specific objectives almost every day.

There are many legitimate document templates available online, but finding reliable ones is not easy.

US Legal Forms offers thousands of form templates, including the New Jersey Annual Expense Report, designed to comply with state and federal regulations.

Select the pricing plan you want, fill in the required information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

Choose a convenient file format and download your copy. You can find all the document templates you have purchased in the My documents section. You can download another copy of the New Jersey Annual Expense Report at any time if needed. Just click on the desired form to download or print the document template. Use US Legal Forms, the largest collection of legitimate forms, to save time and avoid errors. The service provides properly drafted legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Jersey Annual Expense Report template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

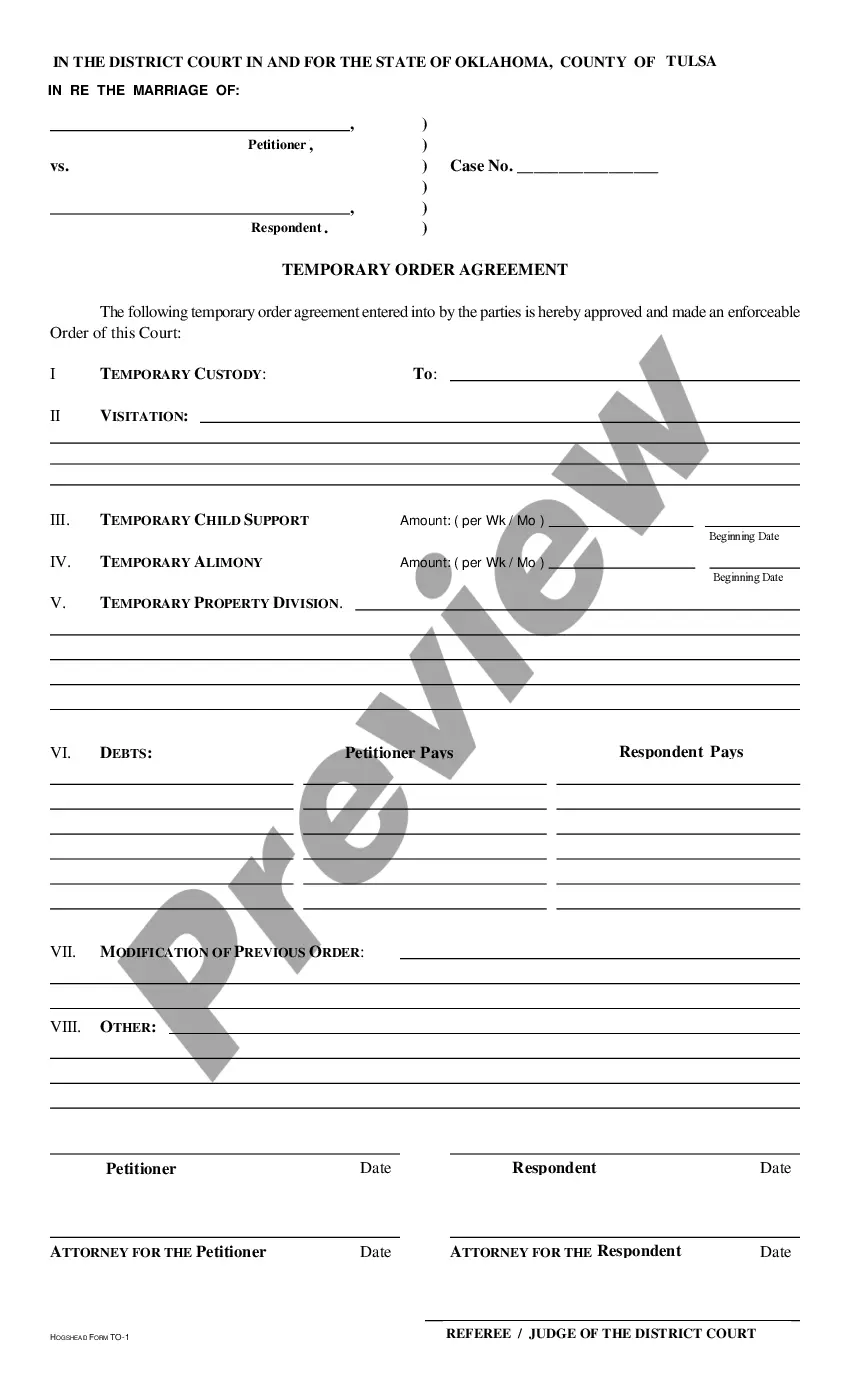

- Use the Preview button to view the form.

- Check the description to confirm that you have the right form.

- If the form is not what you are looking for, use the Search box to find the form that meets your requirements.

- If you have found the right form, click Buy now.

Form popularity

FAQ

Failing to file a New Jersey Annual Expense Report can lead to significant consequences for your LLC. The state may impose late fees, or worse, administratively dissolve your business. This means you could lose your legal protections and benefits associated with your LLC status. To avoid these pitfalls, consider using uslegalforms as a helpful resource to stay compliant and file your report promptly.

In New Jersey, all Limited Liability Companies (LLCs) must submit a New Jersey Annual Expense Report. This requirement ensures that your business remains in good standing with the state. Both new and established LLCs need to file this report annually, as it provides essential information about your company's financial activities. By submitting your report on time, you protect your business from potential penalties.

To obtain a copy of a New Jersey Annual Expense Report, visit the New Jersey Division of Revenue and Enterprise Services online portal. You can request copies of reports directly through their system by searching for the specific business. If you prefer a more personalized service, consider using USLegalForms, which can help you acquire official documents with ease and efficiency.

You can easily download the annual report of a company by visiting the New Jersey Division of Revenue's website. Simply navigate to the business records section and enter the company name or identification number. Once you locate the appropriate file, you can download the New Jersey Annual Expense Report directly to your computer for your records.

If you need to contact the New Jersey Division of Revenue and Enterprise Services for inquiries about the New Jersey Annual Expense Report, call their office at (609) 292-9292. This number will connect you with helpful representatives who can guide you through the filing process and answer any specific questions you may have. It's always a good idea to have your company information handy for quicker assistance.

If an LLC does not file its annual report in New Jersey, it risks incurring penalties and may face administrative dissolution. This can jeopardize its legal standing and ability to operate. Maintaining compliance through the New Jersey Annual Expense Report is vital for the longevity and legitimacy of your LLC.

New Jersey offers various types of business structures, including Corporations, Limited Liability Companies (LLCs), Partnerships, and Sole Proprietorships. Each type has unique legal implications and filing requirements. It is essential to understand these differences, especially regarding the filing of the New Jersey Annual Expense Report and other compliance tasks.

To find your New Jersey entity ID, you can perform a search on the New Jersey Division of Revenue's website. By entering your business name, you will locate essential identifiers such as the entity ID. This ID is necessary for various filings, including the New Jersey Annual Expense Report, ensuring you keep your business records accurate.

If you fail to file your annual report with New Jersey, your business may face penalties and could be marked as 'not in good standing'. This status can affect your ability to conduct business or open bank accounts. Timely submission of the New Jersey Annual Expense Report is crucial to maintaining your company's compliance and reputation.

In a New Jersey business search, 'DP' refers to a business entity that is registered as a Domestic Partnership. This differentiates such entities from other types of business organizations. Understanding these classifications can help you navigate the requirements for the New Jersey Annual Expense Report and other compliance matters.