New Jersey General Form of Inter Vivos Irrevocable Trust Agreement

Description

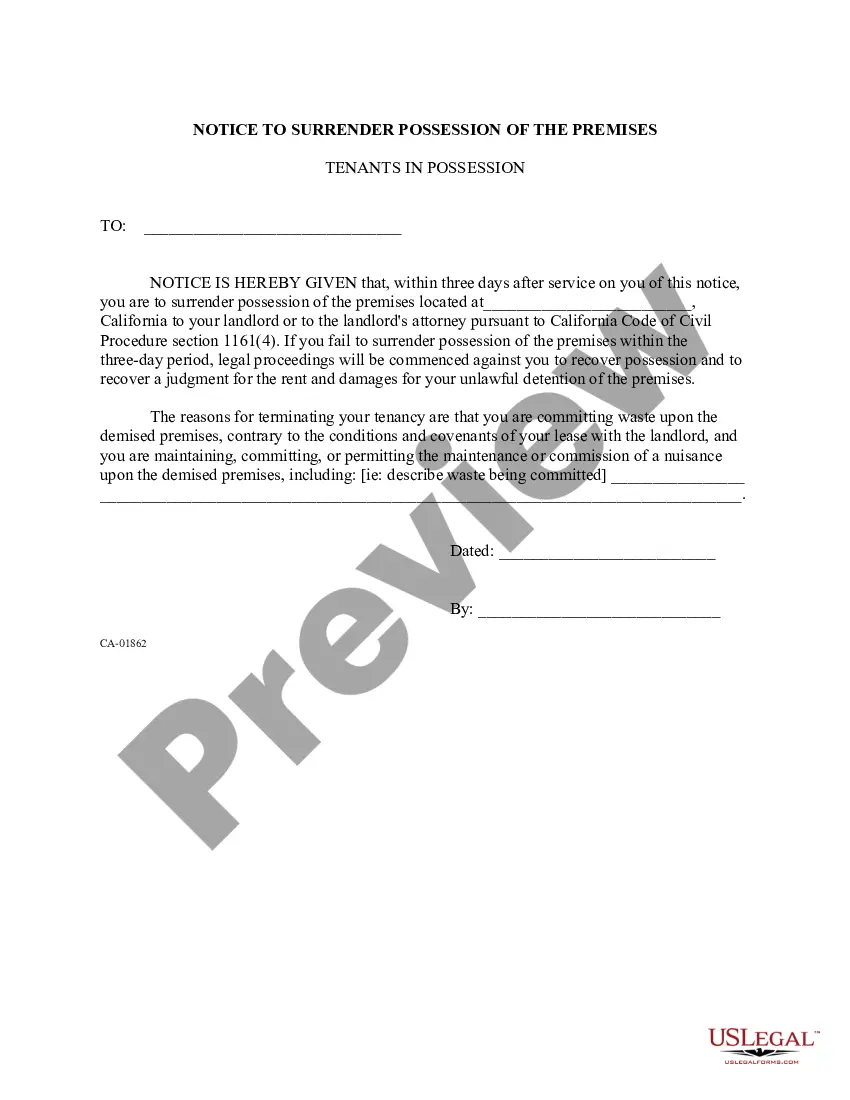

How to fill out General Form Of Inter Vivos Irrevocable Trust Agreement?

It is feasible to allocate time online searching for the authentic document template that meets the state and federal requirements you desire.

US Legal Forms provides thousands of authentic forms that are evaluated by professionals.

It is straightforward to download or print the New Jersey General Form of Inter Vivos Irrevocable Trust Agreement from the platform.

If available, use the Review button to browse through the document template as well. To find an additional version of the form, use the Search field to locate the template that meets your specifications.

- If you already possess a US Legal Forms account, you may Log In and click the Acquire button.

- Afterward, you may complete, modify, print, or sign the New Jersey General Form of Inter Vivos Irrevocable Trust Agreement.

- Every legitimate document template you purchase is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the state/region of your preference.

- Examine the form description to confirm you have selected the right form.

Form popularity

FAQ

To create an inter vivos trust, start by identifying your assets and the individuals you wish to benefit. Next, you need to draft a New Jersey General Form of Inter Vivos Irrevocable Trust Agreement, which outlines the trust's terms, trustees, and beneficiaries. Once the document is prepared, sign it in the presence of a notary to give it legal standing. Finally, fund the trust by transferring your assets into it, ensuring that your wishes are honored throughout your lifetime and beyond.

Form 1041 and Form 706 serve different purposes. Form 1041 reports the income generated by an irrevocable trust, while Form 706 is used to report estate taxes at the death of an individual. It’s crucial to align these forms with your New Jersey General Form of Inter Vivos Irrevocable Trust Agreement to ensure accurate compliance. If you have questions about these forms, you can find resources on US Legal Forms to help clarify your obligations.

The primary IRS form to file with an irrevocable trust is Form 1041. This form must be submitted if the trust earns any taxable income. Make sure to understand the specifics laid out in your New Jersey General Form of Inter Vivos Irrevocable Trust Agreement to comply fully with IRS requirements. Utilizing tools from US Legal Forms can help streamline your filing process.

You file Form 1041 for your irrevocable trust with the IRS. The location varies based on the trust's address and whether you are enclosing a payment. It’s advisable to review your New Jersey General Form of Inter Vivos Irrevocable Trust Agreement to determine the exact filing requirements. For best practices, consider using the US Legal Forms platform to ensure proper filing procedures.

You will generally need to file Form 1041 for an irrevocable trust. This form is specifically designed for reporting the trust's financial activities to the IRS. In addition to Form 1041, you may need to provide supplemental documents, depending on the details outlined in your New Jersey General Form of Inter Vivos Irrevocable Trust Agreement.

Yes, you typically need to file Form 1041 for an irrevocable trust. This form reports the income, deductions, gains, and losses of the trust. If the trust generates income, it is essential to file to comply with tax regulations. The New Jersey General Form of Inter Vivos Irrevocable Trust Agreement might create obligations that require Form 1041 to be filed annually.

Inter vivos trusts primarily include both revocable and irrevocable trusts created during the grantor's lifetime. The New Jersey General Form of Inter Vivos Irrevocable Trust Agreement falls under the irrevocable category, allowing for permanent asset distribution after your passing. Understanding the types of inter vivos trusts expands your options for estate planning and helps you decide the best approach for managing your assets.

The three primary types of irrevocable trusts include irrevocable life insurance trusts, charitable remainder trusts, and special needs trusts. Each serves different purposes, making them suitable for various financial and family situations. By utilizing the New Jersey General Form of Inter Vivos Irrevocable Trust Agreement, you can effectively establish an irrevocable trust that meets your unique needs, ensuring both protection and efficient management of your assets.

There are two main types of inter vivos trusts: revocable trusts and irrevocable trusts. A revocable trust allows the grantor to retain control and make changes during their lifetime, while an irrevocable trust, as exemplified by the New Jersey General Form of Inter Vivos Irrevocable Trust Agreement, locks in the trust's terms. Understanding these distinctions can help you choose the right type based on your estate planning goals.

An irrevocable trust can function as an inter vivos trust. In fact, the New Jersey General Form of Inter Vivos Irrevocable Trust Agreement provides a solid structure for individuals looking to leave a lasting estate plan. By setting up the trust while you are alive, you take proactive steps to manage your assets, ensuring they are distributed according to your wishes. This long-term commitment can be beneficial for both your heirs and tax planning.