New Jersey Notice of Default under Security Agreement in Purchase of Mobile Home

Description

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

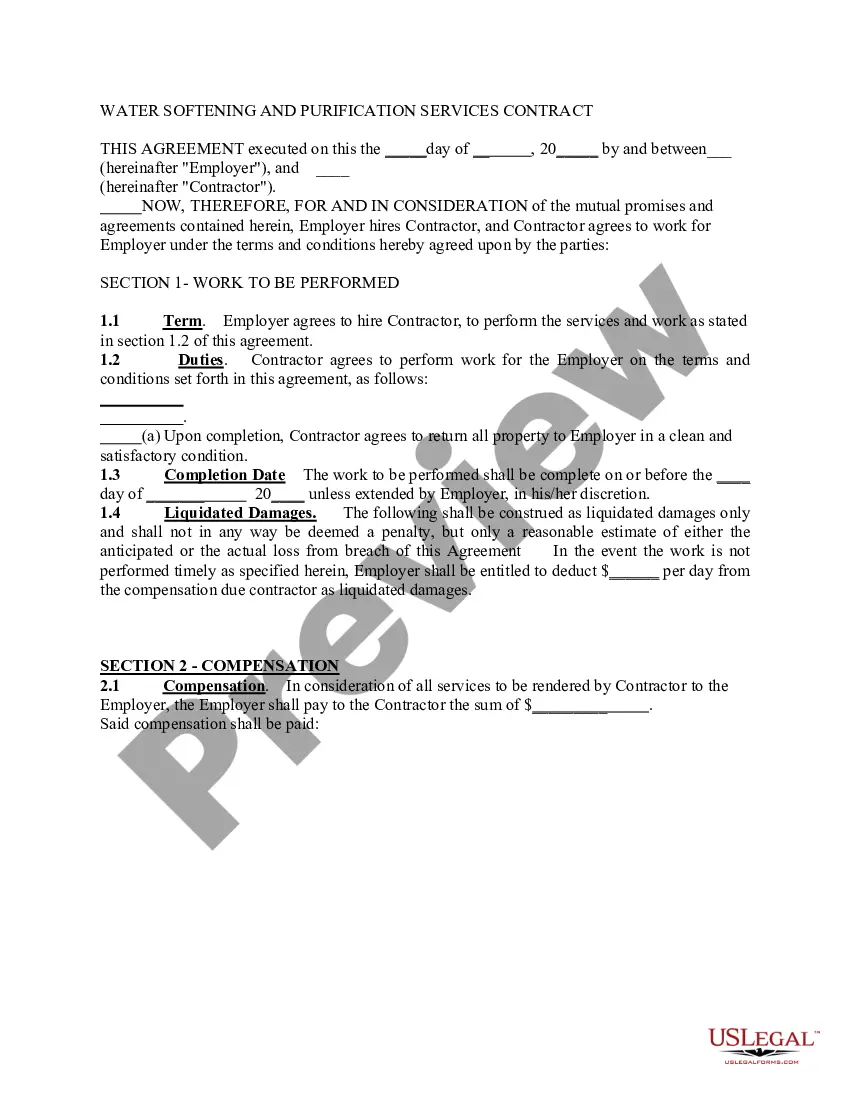

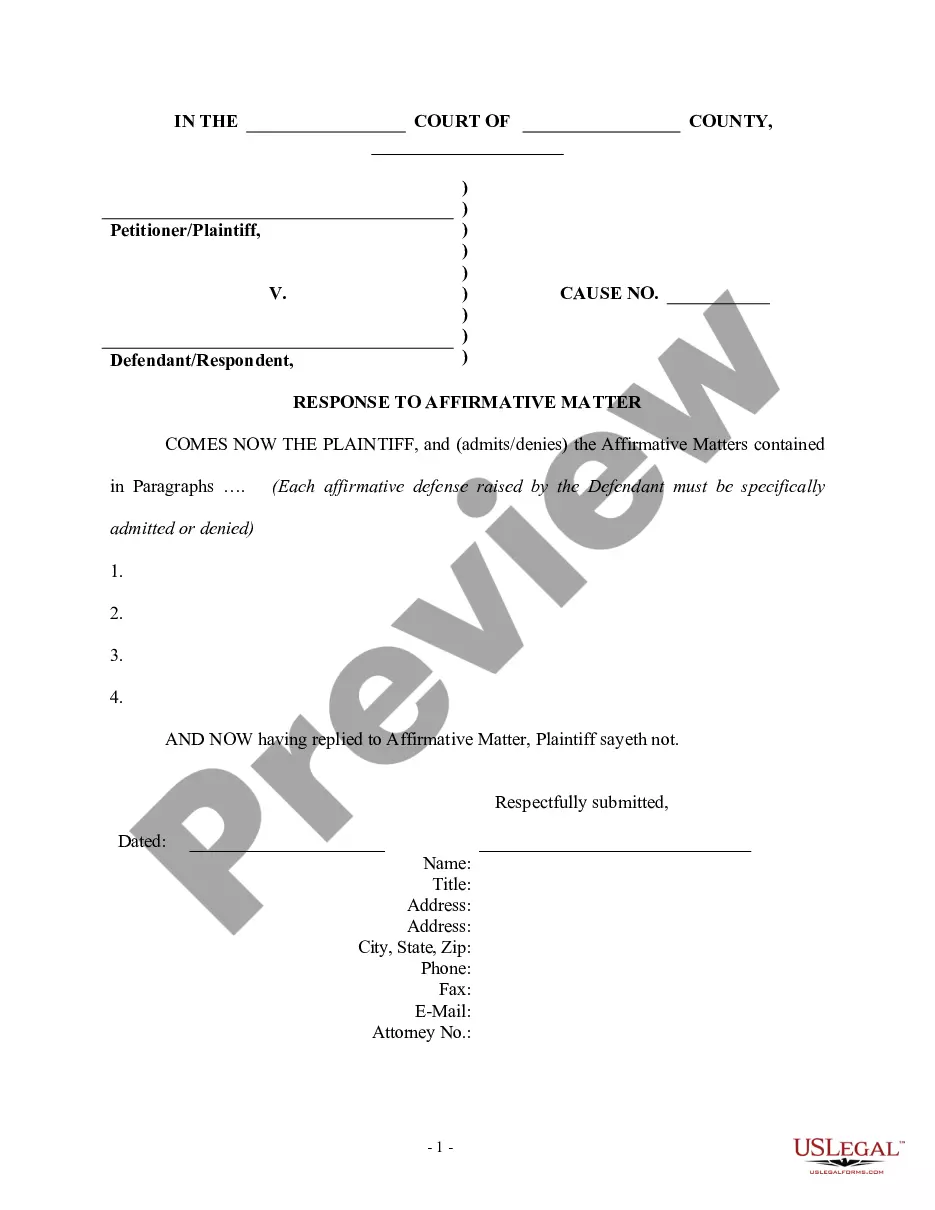

How to fill out Notice Of Default Under Security Agreement In Purchase Of Mobile Home?

If you wish to finalize, obtain, or print legitimate document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Make use of the site`s straightforward and user-friendly search to find the documents you require.

Numerous templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to obtain the New Jersey Notice of Default under Security Agreement in Purchase of Mobile Home in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to get the New Jersey Notice of Default under Security Agreement in Purchase of Mobile Home.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to check the form’s details. Don’t forget to read the information.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other models in the legal form template.

Form popularity

FAQ

After a repossession in New Jersey, you retain certain rights under state law. You should receive a notice detailing any outstanding balances and the sale of the mobile home. You can challenge the repossession if you believe it was conducted improperly. Engaging with platforms like US Legal Forms can help clarify your options and assist in protecting your rights.

A security interest in many types of collateral, including "negotiable documents, goods, instruments, money, or tangible chattel paper," may be perfected by the secured party possessing the collateral. However, so-called "intangible" collateral, such as accounts receivable, cannot be perfected by possession.

At common law, chattel included all property that was not real estate and not attached to real estate. Examples included everything from leases, to cows, to clothes. In modern usage, chattel often merely refers to tangible movable personal property.

Mortgage is different from a security agreement. A mortgage is used to secure the lender's rights by placing a lien against the title of the property. Once all loan repayments have been made, the lien is removed. However, the buyer doesn't own the property till all loan payments have been made.

Certain types of collateral may or must be perfected by possession. Money, for example, must be perfected by possession of the secured party. A security interest in instruments, certificated securities, chattel paper, goods and negotiable documents may be perfected by possession.

A security interest in a manufactured home that is or becomes a fixture (defined in UCC § 9-102 as goods that have become so related to particular real property that an interest in them arises under real property law) is perfected by one of three methods: making a fixture filing, noting the secured party's lien on

A chattel mortgage is a loan used to purchase an item of movable personal property, such as a manufactured home or a piece of construction equipment. The property, or chattel, secures the loan, and the lender holds an ownership interest in it.

Perfected Collateral means all Collateral, including without limitation Eligible Collateral in which the Bank has attempted in good faith to perfect its security interest by giving constructive notice to third parties through taking possession of the Collateral, filing a financing statement describing the Collateral,

A Chattel Mortgage is primarily used to purchase an asset for business use. Structured similarly to a regular mortgage, the lenders provide funds to purchase the asset (known as a Chattel) and register their security interest on the Personal Property Securities Register (PPSR) for the life of the loan.

Unperfected Security Interests: When one secured party has a perfected security interest in collateral and another secured party has an unperfected security interest in the same collateral, the perfected interest prevails. 2022 Secured Party vs.