New Jersey Sample Letter for Explanation of Insurance Rate Increase

Description

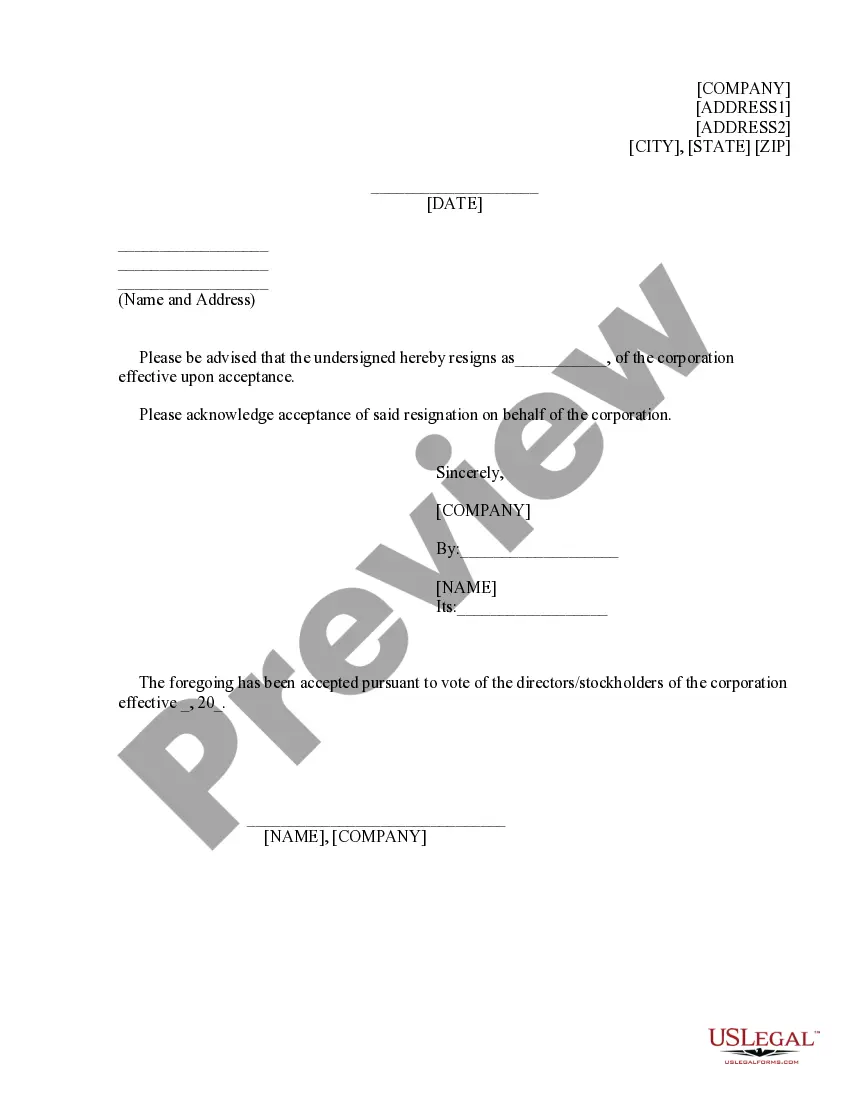

How to fill out Sample Letter For Explanation Of Insurance Rate Increase?

It is feasible to spend time online trying to locate the legal document template that meets the federal and state criteria you require.

US Legal Forms offers a vast array of legal forms that can be reviewed by experts.

You can easily download or print the New Jersey Sample Letter for Explanation of Insurance Rate Increase from the service.

To discover an alternate version of your form, use the Search field to find the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Next, you can complete, modify, print, or sign the New Jersey Sample Letter for Explanation of Insurance Rate Increase.

- Every legal document template you obtain belongs to you permanently.

- To get another copy of any downloaded form, go to the My documents section and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- Firstly, ensure that you have selected the correct template for the area/city you choose.

- Review the form outline to verify you have chosen the appropriate document.

Form popularity

FAQ

To file a complaint against an insurance company in New Jersey, start by gathering all relevant documents related to your policy and the rate increase. Next, you can submit your complaint to the New Jersey Department of Banking and Insurance through their website or by mail. Include the New Jersey Sample Letter for Explanation of Insurance Rate Increase to clearly outline your concerns. This letter provides a structured way to present your issue and can help regulatory bodies understand your situation more clearly.

Yes, title insurance is indeed regulated in New Jersey. The New Jersey Department of Banking and Insurance oversees the rates and practices of title insurance companies in the state. If you notice an increase in your title insurance rate, you may want to consider using a New Jersey Sample Letter for Explanation of Insurance Rate Increase. This letter can help you communicate with your insurance provider and seek clarification on any unexpected increases.

Car insurance rates can increase even without a change in your circumstances due to the insurance company’s overall underwriting criteria. Factors such as broader market trends or increased claims in your area might influence your rates. If you feel the increase is unmerited, utilize the New Jersey Sample Letter for Explanation of Insurance Rate Increase to clearly outline your case to your insurance provider.

Lowering your car insurance in New Jersey may involve shopping around for better rates, increasing your deductible, or bundling different types of insurance. You can also inquire about discounts for safe driving or low mileage. For further guidance, the New Jersey Sample Letter for Explanation of Insurance Rate Increase can help you communicate effectively with your insurer about rate discrepancies.

To file a complaint against an insurance company in New Jersey, you can contact the New Jersey Department of Banking and Insurance. They provide guidance and resources for consumers facing issues with their insurance providers. Additionally, using the New Jersey Sample Letter for Explanation of Insurance Rate Increase can help you detail your concerns clearly.

Insurance costs in New Jersey are rising due to various reasons, like increased claim payouts, higher repair costs, and more frequent natural disasters. Additionally, changes in state laws and regulations can affect premium rates. If you're looking for ways to explain these changes to clients, consider using a New Jersey Sample Letter for Explanation of Insurance Rate Increase to ensure you cover all relevant points clearly.

Explaining an auto insurance rate increase to customers involves being transparent and factual. You should outline the reasons for the increase, such as claims history, changes in regulations, or increased risk factors. A New Jersey Sample Letter for Explanation of Insurance Rate Increase can serve as an excellent tool to structure this explanation and keep communication professional.

In New Jersey, insurance rates typically increase by about 20% after an at-fault accident, although the exact increase varies by insurer and individual circumstances. Factors such as past driving history and the severity of the accident also play a role. You can utilize a New Jersey Sample Letter for Explanation of Insurance Rate Increase to help articulate this potential impact to policyholders.

The 80% rule in insurance relates to the minimum coverage requirement to avoid penalties during claims. It states that if a policyholder does not insure their property for at least 80% of its actual value, they may receive a reduced claim payout. If you need to explain this concept in relation to premium changes, a New Jersey Sample Letter for Explanation of Insurance Rate Increase can illustrate this effectively.

Insurance rates can increase due to various factors, including claims history, changes in credit scores, or market trends. Insurers often adjust their rates based on the data collected from these factors. Using a New Jersey Sample Letter for Explanation of Insurance Rate Increase can help convey these adjustments in a clear and professional manner.