New Jersey Sample Letter for Annual Report - Dissolved Corporation

Description

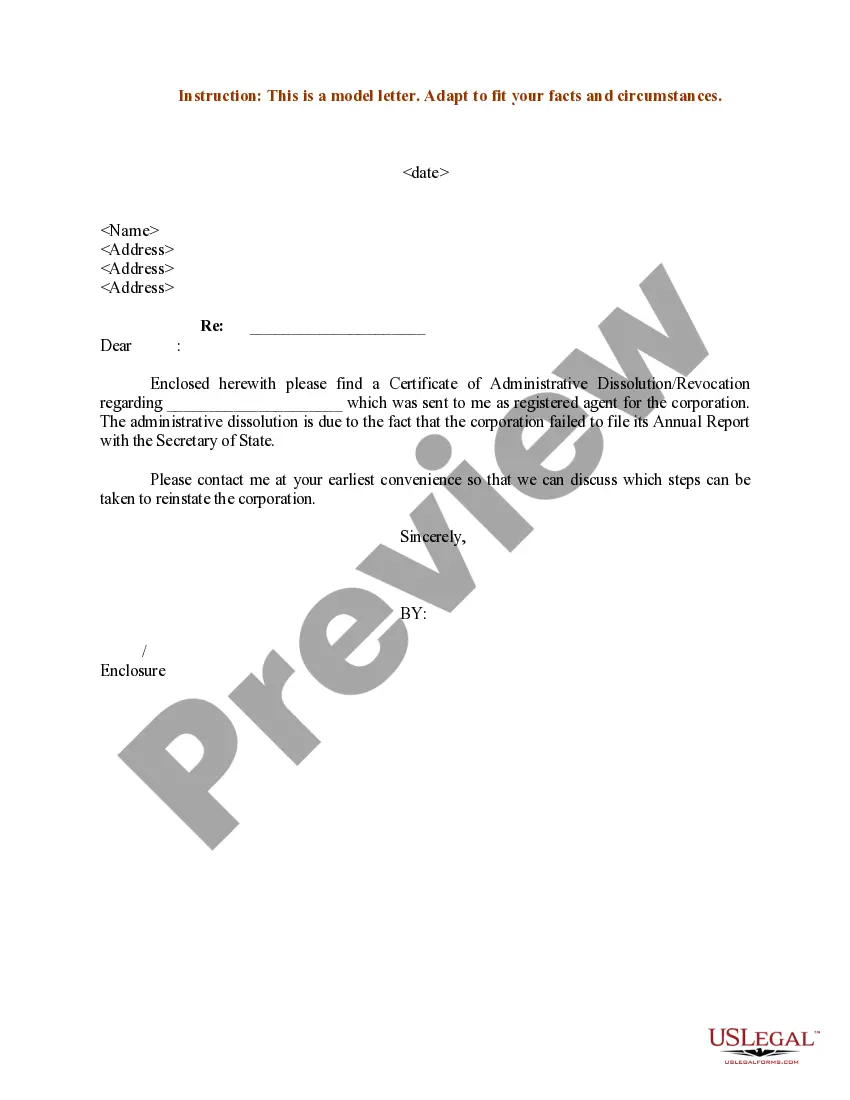

How to fill out Sample Letter For Annual Report - Dissolved Corporation?

Are you presently in a position in which you require paperwork for sometimes business or individual functions almost every day time? There are plenty of authorized document templates available on the Internet, but locating ones you can depend on isn`t easy. US Legal Forms provides a huge number of type templates, like the New Jersey Sample Letter for Annual Report - Dissolved Corporation, which are written to satisfy state and federal needs.

In case you are already informed about US Legal Forms site and get your account, merely log in. Following that, it is possible to download the New Jersey Sample Letter for Annual Report - Dissolved Corporation web template.

Unless you offer an accounts and need to start using US Legal Forms, adopt these measures:

- Obtain the type you will need and make sure it is for the appropriate city/area.

- Utilize the Preview switch to review the form.

- Browse the explanation to actually have chosen the proper type.

- When the type isn`t what you`re trying to find, take advantage of the Look for area to obtain the type that meets your requirements and needs.

- When you obtain the appropriate type, click on Get now.

- Opt for the pricing program you need, fill in the desired details to produce your account, and pay money for the order making use of your PayPal or bank card.

- Pick a convenient paper formatting and download your copy.

Locate each of the document templates you may have purchased in the My Forms menus. You can aquire a more copy of New Jersey Sample Letter for Annual Report - Dissolved Corporation anytime, if needed. Just go through the essential type to download or printing the document web template.

Use US Legal Forms, probably the most considerable selection of authorized types, to save lots of some time and prevent mistakes. The services provides appropriately manufactured authorized document templates which you can use for a range of functions. Generate your account on US Legal Forms and commence generating your daily life easier.

Form popularity

FAQ

The report is due every year on the last day of the month, in the month in which you completed your business formation (LLC, Corporation, etc). The responsibility to file falls on the business, even if you fail to receive any notification from the State. Failure to file can result in the revocation of your business. Taxes and Annual Report - NJ Business - NJ.gov nj.gov ? pages ? filings-and-accounting nj.gov ? pages ? filings-and-accounting

While both words are concerned with the end of a business partnership, dissolution refers to the process itself, and usually to the departure (or death) of one or more individuals from the entity, while termination refers to the cessation of all operations, including the disposal of all assets.

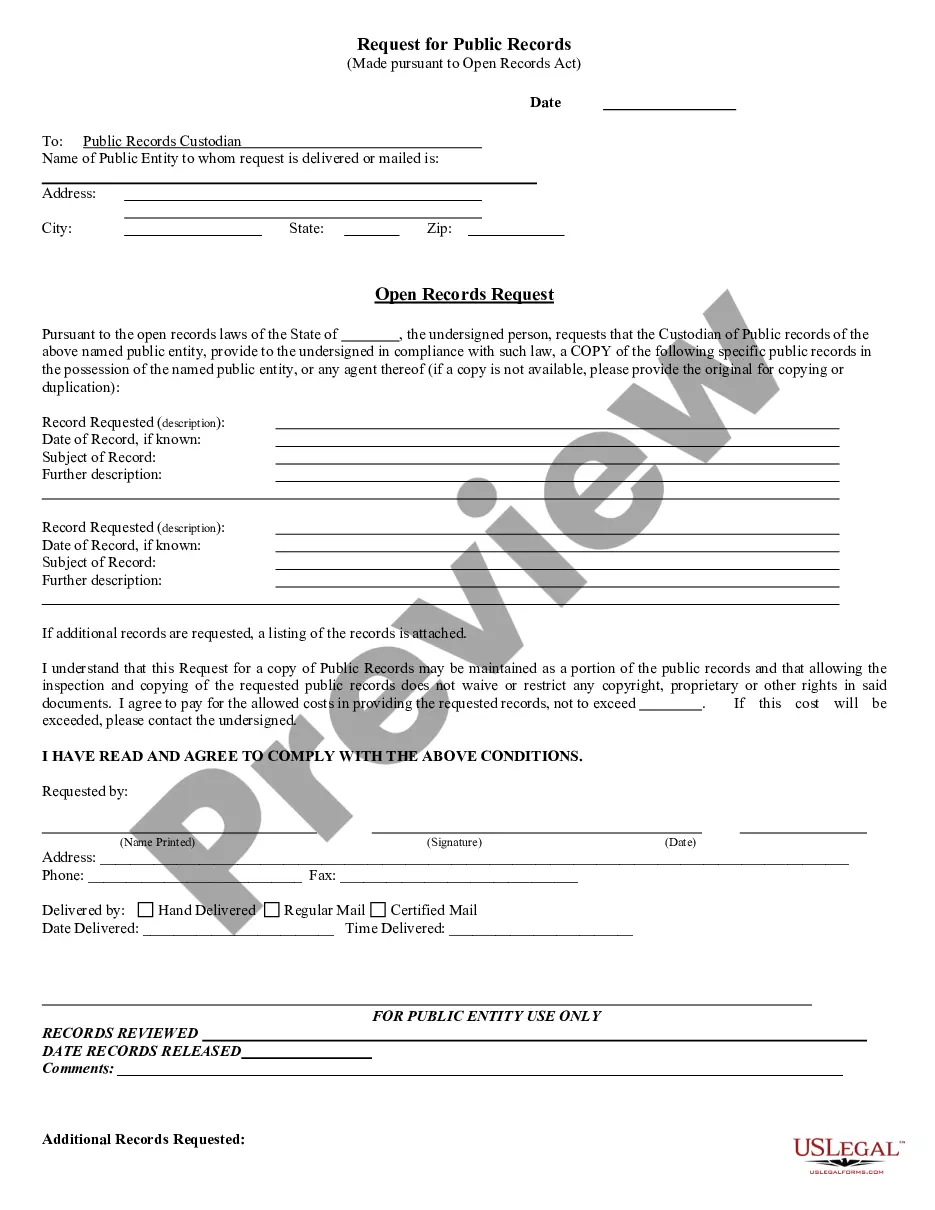

Corporations ending business in New Jersey can dissolve, cancel, or withdraw online. Go to njportal.com/dor/annualreports and select ?Close a Business.? Businesses that choose to complete a paper application must submit all of the following: Appropriate dissolution/withdrawal/cancellation form. A-5033-TC - NJ.gov nj.gov ? taxation ? pdf ? current ? cbt nj.gov ? taxation ? pdf ? current ? cbt

You can also dissolve a New Jersey corporation by submitting the appropriate Certificate of Dissolution form (in duplicate) to the New Jersey Division of Revenue. If you submit a paper Certificate of Dissolution form, you need to include an Estimated Summary Tax Return and an Application for Tax Clearance Certificate.

Assets are liquidated and distributed, or if the company is to continue, procedures that reflect the changes in the makeup of members are specified. Dissolution concludes with the termination of the company's legal existence and filing of a certificate of dissolution with the NJ Secretary of State. Dissolution of a NJ LLC - New Jersey Lawyers | Hanlon Niemann & Wright hnwlaw.com ? new-jersey-llc-attorney ? diss... hnwlaw.com ? new-jersey-llc-attorney ? diss...

State law or your corporation's organizational documents likely requires a certain number of shareholders to vote in favor of the dissolution for it to pass. Some states might even allow for dissolution by written consent of the shareholders without the need for a meeting. Minimum required vote.

Within the report, the Division of Revenue requires an assessment of Insurance Policy Information and Workman's Compensation. If your business has insurance, you need to provide policy numbers, the date the policy went into effect and the name of the insurer. NJ Annual Report: Everything You Need to Know - UpCounsel upcounsel.com ? nj-annual-report upcounsel.com ? nj-annual-report

Steps to dissolving a corporation or obtaining a corporate dissolution Call a board meeting. ... File a certificate of dissolution with the Secretary of State. ... Notify the Internal Revenue Service (IRS) ... Close accounts and credit lines, cancel licenses, etc.