New Jersey Letter to Lender for Produce the Note Request

Description

How to fill out Letter To Lender For Produce The Note Request?

Are you presently in a situation where you regularly require documents for potential business or personal purposes.

There are numerous legal document templates available online, but it isn't easy to find trustworthy versions.

US Legal Forms provides thousands of template forms, including the New Jersey Letter to Lender for Produce the Note Request, designed to meet federal and state regulations.

Once you find the appropriate form, click Get now.

Choose the pricing plan you want, fill in the necessary information to create your account, and purchase your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Jersey Letter to Lender for Produce the Note Request template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

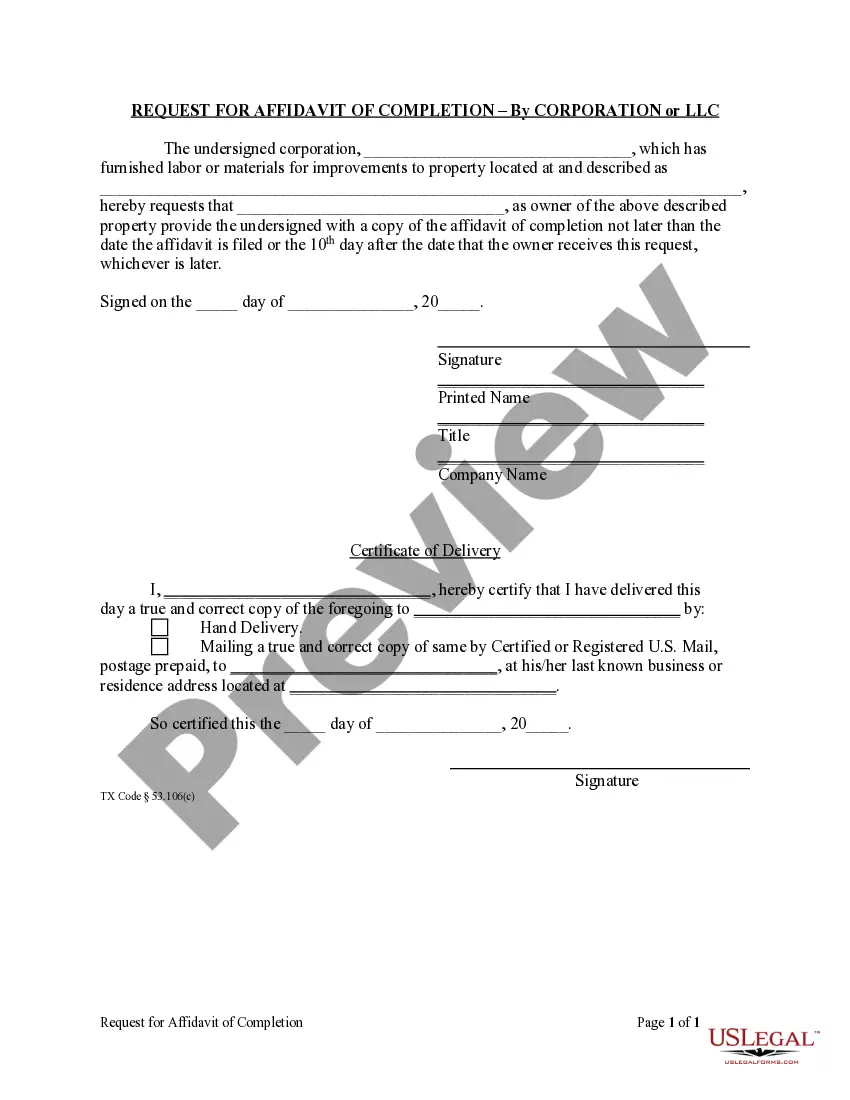

- Utilize the Review option to evaluate the form.

- Check the description to confirm that you have selected the correct form.

- If the form isn’t what you’re looking for, use the Lookup section to find the form that meets your needs.

Form popularity

FAQ

When a lender makes a mistake, it can lead to significant delays and complications in the mortgage process. Errors may include incorrect records, misapplied payments, or improper foreclosure notices. Filing a New Jersey Letter to Lender for Produce the Note Request may prompt the lender to address their mistakes and ensure all documents are properly aligned. Taking proactive steps helps protect your interests and keeps the situation under control.

Being on the mortgage but not the note means you have financial responsibility for the property but not for making the debt payments. This can create confusion if you face repayment issues or foreclosure. Utilizing a New Jersey Letter to Lender for Produce the Note Request may help clarify your obligations and ensure that all parties understand the situation. Consulting legal help can provide further guidance on your rights in this scenario.

If the lender loses the promissory note, they may have difficulty enforcing the mortgage. This situation can lead to complications regarding foreclosure and payment claims. In many cases, the lender can file a New Jersey Letter to Lender for Produce the Note Request to establish their right to the mortgage without the physical note. This letter may help clarify the lender's position and assert their rights in the matter.

To write a letter of explanation to a lender, structure your letter clearly and make sure to address the specific issue at hand. Start with a brief introduction, then detail your explanation, ensuring that it is straightforward and factual. Add any relevant supporting documents, and finish with a polite closing expressing your willingness to provide further information if needed. Referencing a New Jersey Letter to Lender for Produce the Note Request within your letter can direct your lender's focus to important aspects of your financial profile.

A notice of intent to foreclose in New Jersey is a formal notification from your lender about their intent to initiate foreclosure proceedings on your property. This document typically outlines the reasons for foreclosing and the next steps that the borrower must follow. Understanding this notice is critical to take timely action and potentially salvage your mortgage situation. If you're facing this situation, a New Jersey Letter to Lender for Produce the Note Request can clarify your options moving forward.

To write a letter to a lender, begin with your personal information and the lender's details. Clearly state the purpose of your letter, whether it's a request or response. Use a respectful tone, keep your messages concise, and include any relevant documents. A New Jersey Letter to Lender for Produce the Note Request typically follows this structure to ensure clarity and effectiveness.

Recently, New Jersey enacted laws aimed at protecting homeowners in the foreclosure process. These laws introduce additional requirements for lenders, giving homeowners more time and information regarding their rights. With changes in the legal landscape, utilizing tools like a New Jersey Letter to Lender for Produce the Note Request is vital for those navigating these new regulations. Staying informed is key to safeguarding your home.

A notice of intent to foreclose is a legal document informing a homeowner that the lender plans to start the foreclosure process. This notice acts as a warning, giving the homeowner time to respond or remedy the situation. Engaging with a New Jersey Letter to Lender for Produce the Note Request can be a proactive step to mitigate the impact of foreclosure. Understanding this notice is essential for those looking to protect their property in New Jersey.

After a property is foreclosed in New Jersey, tenants usually have a specific period to vacate. Depending on the circumstances, a tenant might stay until the eviction process is finalized, which can sometimes take weeks or even months. It's crucial for tenants to communicate with the new owner and understand their rights. Resources like a New Jersey Letter to Lender for Produce the Note Request can provide additional support and clarity during this transitional period.