Minnesota Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock

Description

How to fill out Notice And Proxy Statement To Effect A 2-for-1 Split Of Outstanding Common Stock?

Finding the right legal papers web template could be a have difficulties. Obviously, there are a variety of web templates available on the Internet, but how would you discover the legal kind you want? Utilize the US Legal Forms internet site. The assistance offers thousands of web templates, including the Minnesota Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock, which you can use for company and personal demands. Each of the varieties are inspected by experts and meet up with federal and state demands.

When you are presently authorized, log in in your account and click on the Down load switch to find the Minnesota Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock. Use your account to appear through the legal varieties you possess acquired in the past. Check out the My Forms tab of your respective account and have yet another backup from the papers you want.

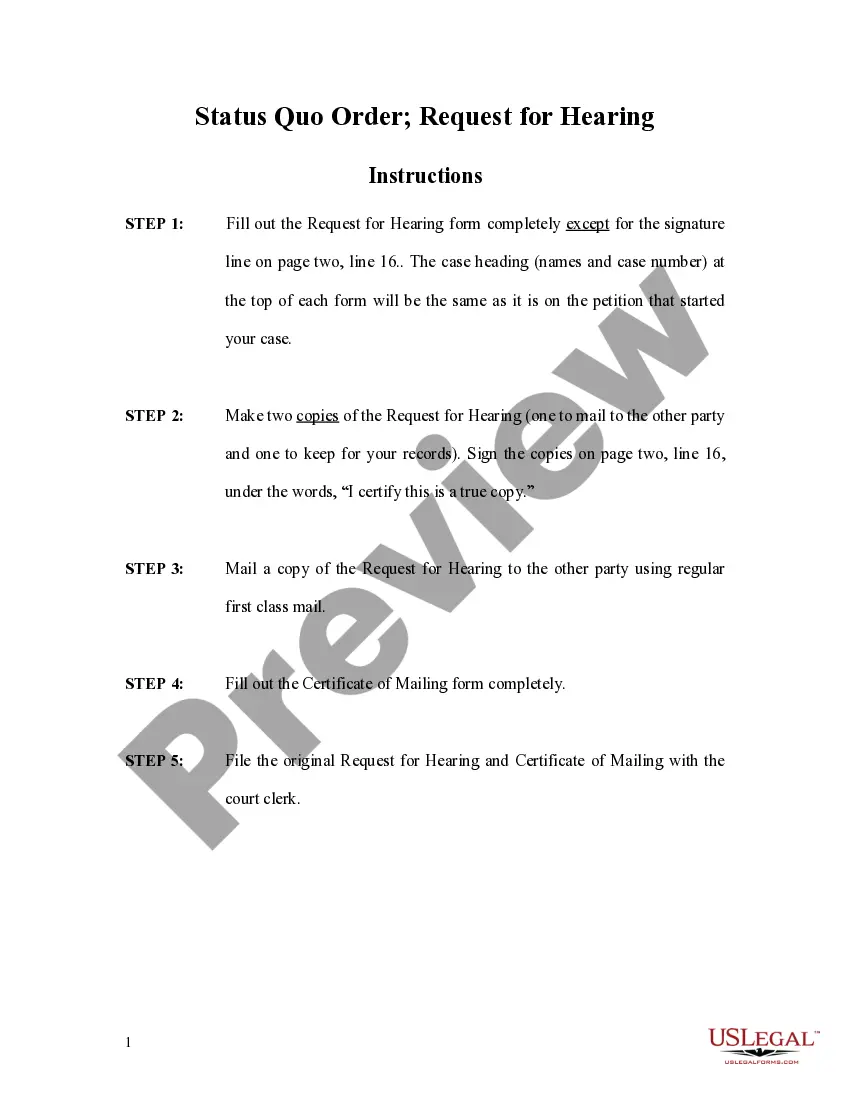

When you are a new customer of US Legal Forms, listed below are basic instructions for you to stick to:

- Initially, ensure you have selected the appropriate kind for the city/county. You are able to look through the form making use of the Review switch and read the form description to ensure it will be the best for you.

- In case the kind is not going to meet up with your expectations, use the Seach field to discover the correct kind.

- Once you are positive that the form is suitable, go through the Acquire now switch to find the kind.

- Choose the rates prepare you desire and enter in the needed information and facts. Design your account and purchase the order utilizing your PayPal account or credit card.

- Choose the document structure and obtain the legal papers web template in your gadget.

- Comprehensive, revise and produce and indicator the acquired Minnesota Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock.

US Legal Forms may be the most significant local library of legal varieties in which you can find numerous papers web templates. Utilize the company to obtain appropriately-produced papers that stick to status demands.

Form popularity

FAQ

Reverse stock splits do not impact a corporation's value, although they usually are a result of its stock having shed substantial value. The negative connotation associated with such an act is often self-defeating as the stock is subject to renewed selling pressure.

Proxy statements must offer insights into board and company performance, including: The salaries of the company's five highest-paid executives (including bonuses and equity) and the appropriate benchmark in chart form. Executive performance and the performance of executives of similar companies.

Proxy statements are filed with the SEC as Form DEF 14A, or definitive proxy statement, and can be found using the SEC's database, known as the electronic data gathering, analysis and retrieval system (EDGAR).

Reverse stock splits work the same way as regular stock splits but in reverse. A reverse split takes multiple shares from investors and replaces them with fewer shares. The new share price is proportionally higher, leaving the total market value of the company unchanged.