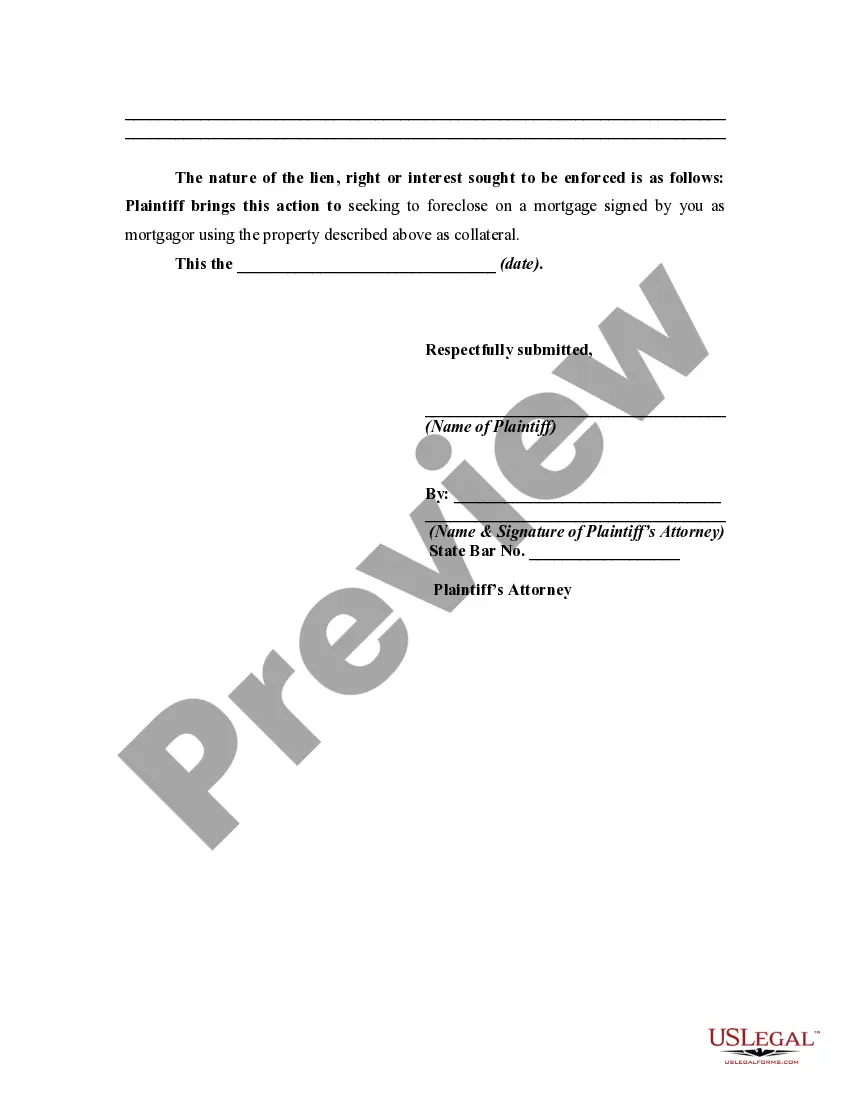

If you wish to total, down load, or produce legitimate document web templates, use US Legal Forms, the largest collection of legitimate types, that can be found online. Use the site`s simple and easy hassle-free lookup to get the files you require. A variety of web templates for business and person functions are sorted by groups and says, or keywords. Use US Legal Forms to get the New Jersey Lis Pendens Notice in Connection with Action to Foreclose within a handful of mouse clicks.

If you are presently a US Legal Forms consumer, log in for your accounts and click on the Download key to have the New Jersey Lis Pendens Notice in Connection with Action to Foreclose. You can even accessibility types you earlier saved inside the My Forms tab of your accounts.

Should you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for your appropriate city/land.

- Step 2. Make use of the Preview choice to look over the form`s articles. Don`t forget about to learn the outline.

- Step 3. If you are not satisfied with the kind, use the Lookup field near the top of the monitor to find other models in the legitimate kind template.

- Step 4. When you have discovered the shape you require, click the Buy now key. Opt for the costs program you prefer and include your accreditations to register for an accounts.

- Step 5. Method the deal. You should use your charge card or PayPal accounts to perform the deal.

- Step 6. Pick the formatting in the legitimate kind and down load it on your device.

- Step 7. Full, modify and produce or sign the New Jersey Lis Pendens Notice in Connection with Action to Foreclose.

Each legitimate document template you acquire is your own property for a long time. You possess acces to every single kind you saved with your acccount. Click on the My Forms portion and select a kind to produce or down load yet again.

Remain competitive and down load, and produce the New Jersey Lis Pendens Notice in Connection with Action to Foreclose with US Legal Forms. There are thousands of specialist and status-particular types you may use for the business or person demands.