In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust. In this form, the trustee had been given the authority to terminate the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Jersey Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary

Description

How to fill out Termination Of Trust By Trustee And Acknowledgment Of Receipt Of Trust Funds By Beneficiary?

Have you found yourself in a scenario where you require documents for either professional or personal purposes almost every day.

There are numerous legal document templates available online, but locating ones you can trust isn't easy.

US Legal Forms provides a wide array of template options, including the New Jersey Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary, which are designed to comply with federal and state regulations.

You can find all the document templates you have purchased in the My documents section. You can obtain another copy of the New Jersey Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary anytime you wish. Simply select the desired form to download or print the template.

Utilize US Legal Forms, one of the largest collections of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the New Jersey Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- 1. Locate the form you need and ensure it is for the correct city/state.

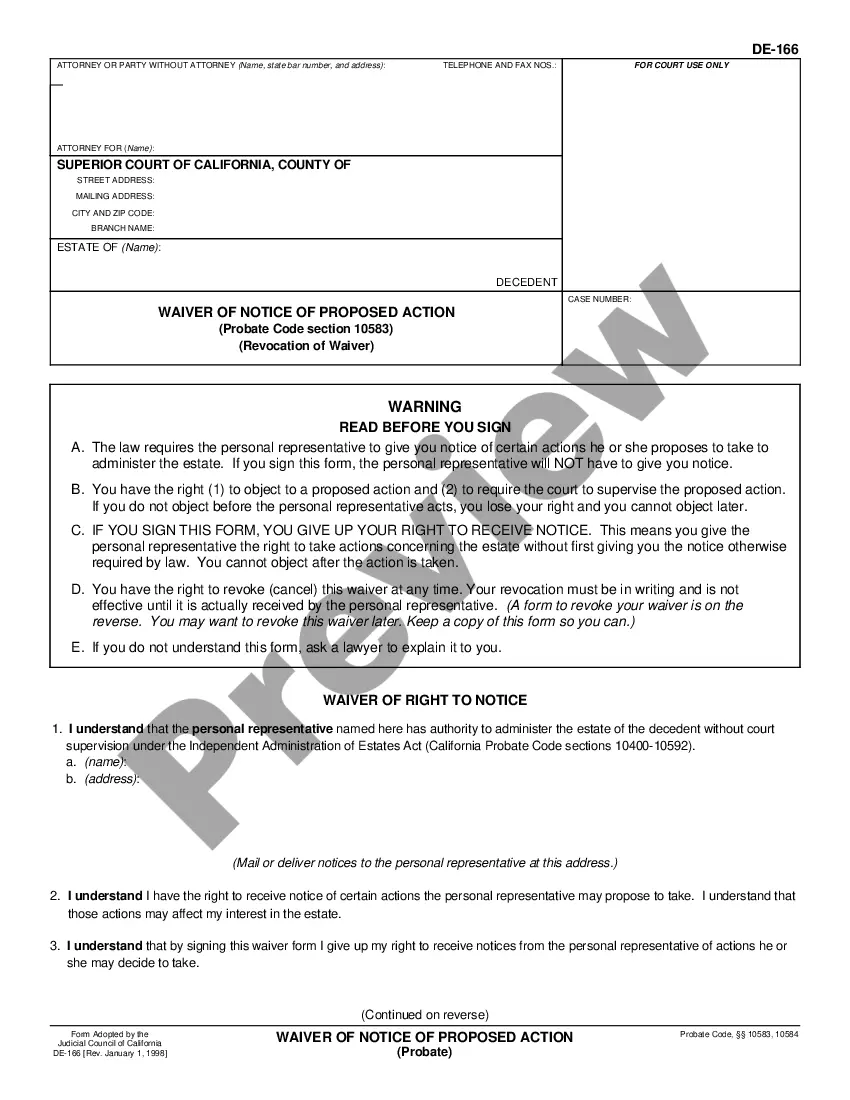

- 2. Use the Preview button to review the form.

- 3. Check the description to make sure you've selected the right document.

- 4. If the form isn’t what you are looking for, use the Search field to find a document that meets your requirements.

- 5. Once you find the correct form, click Buy now.

- 6. Select the pricing plan you want, provide the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- 7. Choose a convenient file format and download your copy.

Form popularity

FAQ

The legal definition of acknowledgment refers to a formal declaration that a person has received an item or document, typically in the presence of a witness or notary. In the situation of New Jersey Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary, this term is crucial for ensuring that all legal obligations are met during asset distribution. Acknowledgment provides protection for trustees and beneficiaries alike by formally documenting the transfer of responsibility and ownership. Using reliable resources, such as uslegalforms, can guide you through properly completing this legal requirement.

Verification typically involves confirming facts or details, while acknowledgment refers to recognizing receipt or acceptance of something. In the context of the New Jersey Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary, acknowledgment means the beneficiary confirms they have received their distribution from the trust. Both processes play essential roles, but they serve distinct functions in legal documentation and financial transactions.

A receipt of a beneficiary of a trust is a document that confirms a beneficiary has received their share of assets from a trust. This document serves as proof of distribution and can be crucial during the New Jersey Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary process. By providing a structured receipt, all parties can ensure clarity and avoid potential disputes in the future. Utilizing platforms like uslegalforms can simplify this documentation process, ensuring beneficiaries understand what they are receiving.

A trust can be terminated in several ways, including by the terms laid out in the trust document, by mutual agreement of the beneficiaries and trustee, or by court order. Each method has legal implications and requirements that must be carefully followed. Understanding these processes ensures that you correctly execute a New Jersey Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary. Consulting with legal experts or platforms like uslegalforms can simplify this process.

One major mistake parents often make when establishing a trust fund is failing to communicate openly with their beneficiaries. Transparency about the trust's purpose, its terms, and distribution plans can prevent misunderstandings later. It’s equally important to ensure that the trust is properly funded and that the trustee understands their responsibilities. A comprehensive understanding helps in executing a New Jersey Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary when the time comes.

To terminate a trust in New Jersey, the trustee must follow specific steps outlined in the trust agreement or state law. You begin by reviewing the trust document for any termination clauses. Typically, a trustee must notify beneficiaries, settle any outstanding debts, and distribute the remaining trust assets. Ultimately, completing a New Jersey Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary is essential to ensure a smooth conclusion.

In New Jersey, a beneficiary cannot simply remove a trustee without cause. However, if the trustee fails to adhere to the terms of the trust or acts against the best interests of the beneficiaries, a legal process can be initiated. This may lead to the New Jersey Termination of Trust By Trustee, allowing for a new trustee to be appointed. It is advisable for beneficiaries to consult with a legal professional to navigate these complex situations and to ensure that all trust-related documentation, including the Acknowledgment of Receipt of Trust Funds By Beneficiary, is properly managed.

When a trust is terminated, the trustee distributes the trust assets to the beneficiaries according to the trust terms. The trust ceases to exist legally, and the trustee's duties end. Being informed about the New Jersey termination of trust by trustee process helps beneficiaries understand their rights during this final stage.

A trustee can step down by formally resigning as outlined in the trust document. This process typically involves notifying the beneficiaries and possibly appointing a successor trustee. Understanding the legal steps within New Jersey termination of trust by trustee ensures a smooth transition.

A trust acknowledgment is a formal recognition by a beneficiary that they have received their allotted share of trust assets. This document helps protect the trustee from future claims by beneficiaries. Proper handling of acknowledgment of receipt of trust funds by beneficiary is crucial for maintaining clear records.