New Jersey Sample Letter for Announcement of Sale

Description

How to fill out Sample Letter For Announcement Of Sale?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a range of legal form categories you can download or create.

By utilizing the website, you will access thousands of documents for commercial and personal purposes, organized by categories, states, or keywords. You will find the latest versions of documents such as the New Jersey Sample Letter for Announcement of Sale within moments.

If you already maintain a monthly subscription, Log In and retrieve the New Jersey Sample Letter for Announcement of Sale from the US Legal Forms library. The Download button will appear on every template you view. You have access to all previously obtained documents from the My documents tab in your profile.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the document to your device. Edit. Fill out, modify, and print and sign the obtained New Jersey Sample Letter for Announcement of Sale.Every document you added to your account does not have an expiration date and is yours forever. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the document you need. Access the New Jersey Sample Letter for Announcement of Sale with US Legal Forms, likely the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Ensure you have chosen the appropriate template for the city/region.

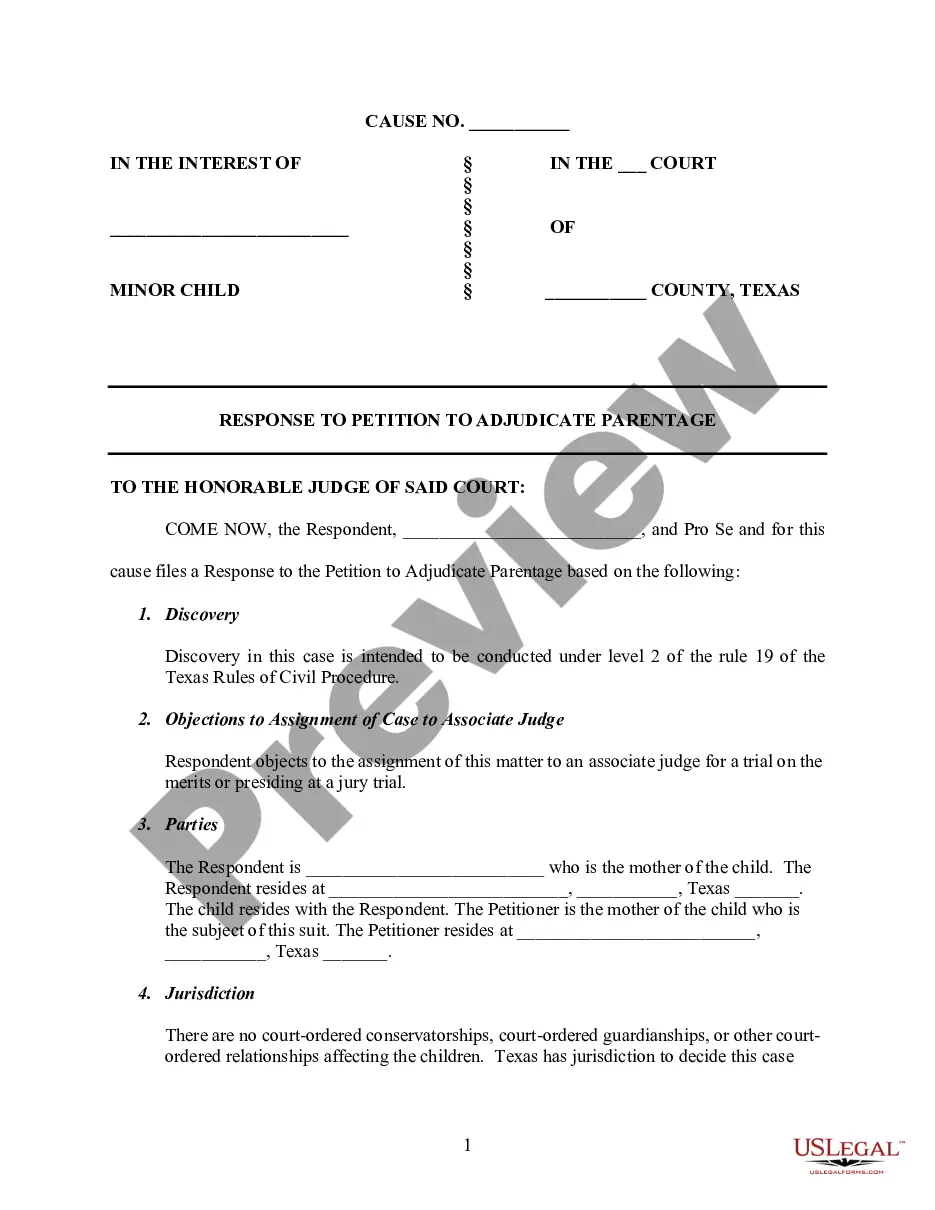

- Click on the Preview button to review the document's content.

- Check the document overview to confirm you have selected the right template.

- If the document does not meet your requirements, use the Search field at the top of the page to find one that does.

- Once you are satisfied with the document, confirm your choice by clicking on the Get now button.

- Then, select the pricing plan you want and provide your details to register for the account.

Form popularity

FAQ

In New Jersey, a bulk sale occurs when a business sells a substantial portion of its inventory or assets rather than selling it under regular circumstances. Specifically, this applies when the sale involves more than 50% of the seller's total inventory or assets, excluding real estate. To ensure compliance with local laws, businesses often utilize a New Jersey Sample Letter for Announcement of Sale. This letter can help communicate the details of the bulk sale to all relevant parties and maintain transparency throughout the process.

The ST3 form in New Jersey is a Sales Tax Exempt Certificate, which allows certain buyers to make tax-exempt purchases. Businesses, organizations, or individuals qualifying for tax exemptions use this form during transactions. When drafting your New Jersey Sample Letter for Announcement of Sale, you should mention the ST3 to ensure that all parties understand their tax responsibilities. Proper use of the ST3 form can help you avoid sales tax complications.

To email a bulk sale in New Jersey, you must comply with local regulations and submit the necessary paperwork electronically. Typically, you will need to gather all relevant sales information and compile it into a formatted document before sending it to the appropriate state department. Including your New Jersey Sample Letter for Announcement of Sale in your email can provide context and clarity. Consider using a reputable platform like US Legal Forms to streamline the process and ensure you have all required documentation.

In New Jersey, the exempt form for sales is the ST-3 Sales Tax Exempt Certificate. This form allows eligible purchasers to buy goods without paying sales tax under certain conditions. When you prepare your New Jersey Sample Letter for Announcement of Sale, make sure to clarify the tax-exempt status if applicable. Utilizing this form can simplify your sales process and ensure compliance with state tax laws.

NJ Form C 9600 is the New Jersey Tax Clearance Certificate application. This form is needed when a corporation or business entity seeks to dissolve or withdraw from New Jersey. When using the form, a New Jersey Sample Letter for Announcement of Sale can accompany it to notify relevant parties and clarify your business's status.

Certain transactions in New Jersey may be exempt from transfer tax, including transfers to a government entity, certain family transfers, and transfers involving nonprofit organizations. However, it's essential to claim such exemptions properly to avoid penalties. When documenting a transaction, a New Jersey Sample Letter for Announcement of Sale can clearly outline exemptions and ensure transparency.

A DLN, or Document Locator Number, is a unique identifier issued by the New Jersey Division of Taxation for documents filed within their systems. This number helps track tax-related documents and can be vital when ensuring compliance with tax regulations. When preparing your New Jersey Sample Letter for Announcement of Sale, including your DLN can assist in keeping records organized.

To avoid the exit tax in New Jersey, you can establish residency in another state or sell your property and settle tax obligations before moving. Proper planning and compliance with state laws can prevent complications and tax liabilities. When finalizing your plans, a New Jersey Sample Letter for Announcement of Sale can effectively communicate your intentions and provide essential updates.

An estate tax return must be filed in New Jersey if the deceased person's estate exceeds a certain threshold, which currently stands at $2 million. Executors or administrators of estates must prepare and submit this return to fulfill tax obligations. Ensure informed communication by utilizing a New Jersey Sample Letter for Announcement of Sale to notify potential heirs and relevant parties.

The New Jersey Bulk Sales Law 54-50-38 governs the sale of a business's assets outside of regular inventory, primarily to prevent tax evasion. Under this law, buyers may need to provide notice to the New Jersey Division of Taxation to ensure all tax liabilities are settled. If you're preparing a New Jersey Sample Letter for Announcement of Sale, referencing this law can inform buyers about their obligations.