Hawaii While You Were Out

Description

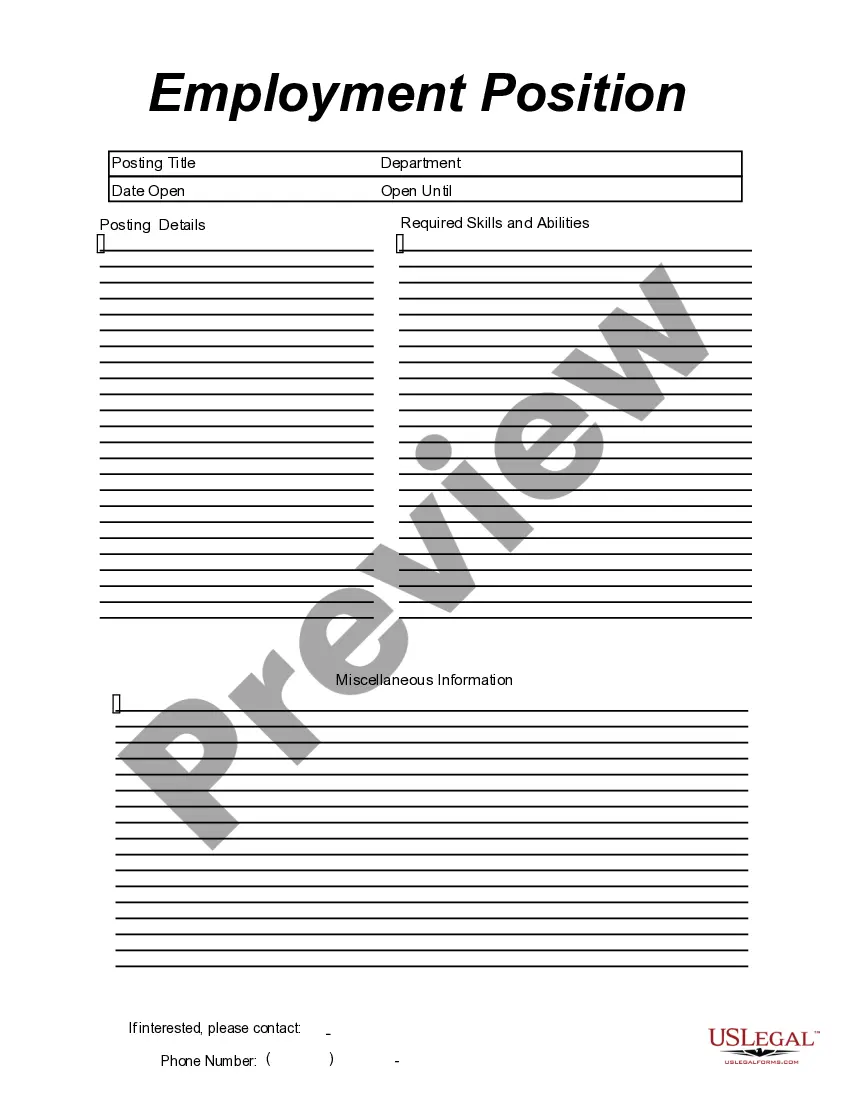

How to fill out While You Were Out?

If you need to finalize, obtain, or produce legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's simple and user-friendly search feature to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or by keywords.

Step 4. Once you have located the form you need, click on the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to find the Hawaii While You Were Out with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download option to access the Hawaii While You Were Out.

- You can also find forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Confirm you have chosen the form for the appropriate city/state.

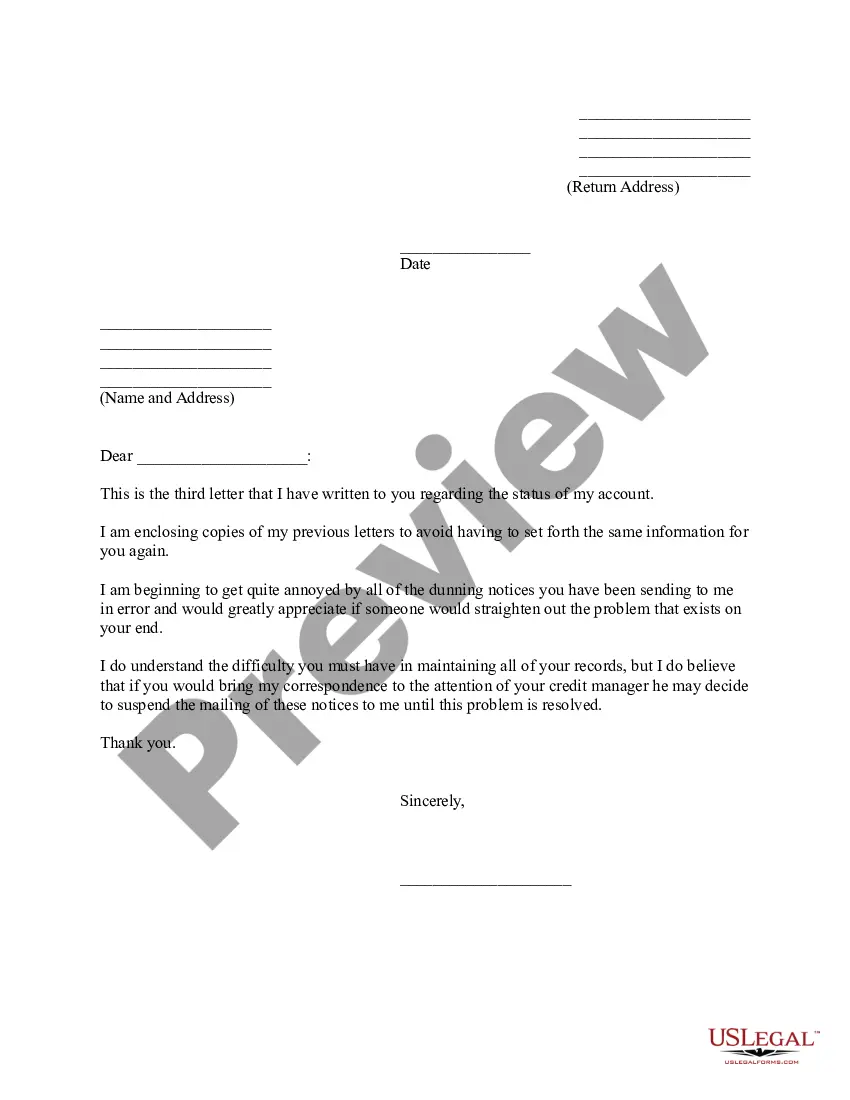

- Step 2. Use the Preview option to review the content of the form. Remember to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Non-residents in Hawaii must file a return if they earn income in the state. Specifically, they need to complete the appropriate tax forms and provide details about the income received while in Hawaii. By utilizing the Hawaii While You Were Out platform, non-residents can access essential tools to navigate the filing requirements effectively.

11. Individual Income Tax Return (Resident Form)

Download. 2019: 44,027 Dollars Annual Updated: . 2019: 44,027 (+ more)

According to Hawaii Instructions for Form N-11, every individual doing business in Hawaii during the taxable year must file a return, whether or not the individual derives any taxable income from that business.

A phase out refers to the gradual reduction of a tax credit that a taxpayer is eligible for as their income approaches the upper limit to qualify for that credit.

If you had your legal domicile in Hawaii for the whole tax year, or if you lived in Hawaii for at least 200 days (no matter where you had your domicile in this period), you are a resident of Hawaii.

To help us with this commitment, we welcome your feedback to assist our effort to improve our services and make voluntary compliance as easy as possible. Please address your written suggestions to the Department of Taxation, P.O. Box 259, Honolulu, HI, 96809-0259, or email them to Tax.

Hawaii does not have a sales tax; instead, we have the GET, which is assessed on all business activities. The tax rate is 0.15% for Insurance Commission, 0.5% for Wholesaling, Manufacturing, Producing, Wholesale Services, and Use Tax on Imports For Resale, and 4% for all others.

A Hawai02bbi driver's license, voter or automobile registration, the appearance of a person's name on a city or town street list, and rent, utility, mortgage or telephone bills normally provide tangible proof of residence.

According to Hawaii Instructions for Form N-11, every individual doing business in Hawaii during the taxable year must file a return, whether or not the individual derives any taxable income from that business.