New Jersey Authority to Borrow Money - Resolution Form - Corporate Resolutions

Description

How to fill out Authority To Borrow Money - Resolution Form - Corporate Resolutions?

You can spend significant time online looking for the appropriate legal document template that fulfills the local and national regulations you require.

US Legal Forms offers an extensive collection of legal documents that have been verified by professionals.

You can easily download or print the New Jersey Authority to Borrow Money - Resolution Form - Corporate Resolutions from this service.

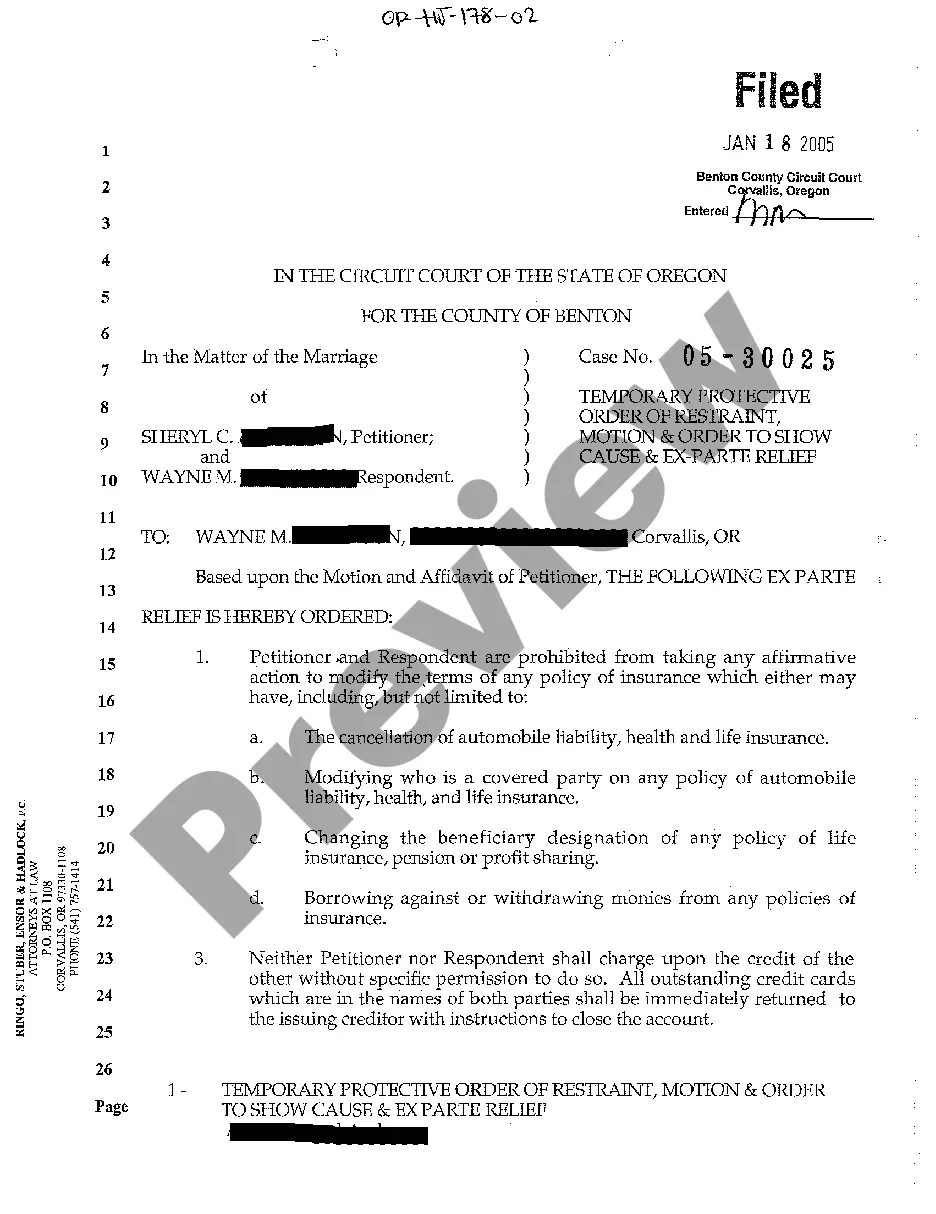

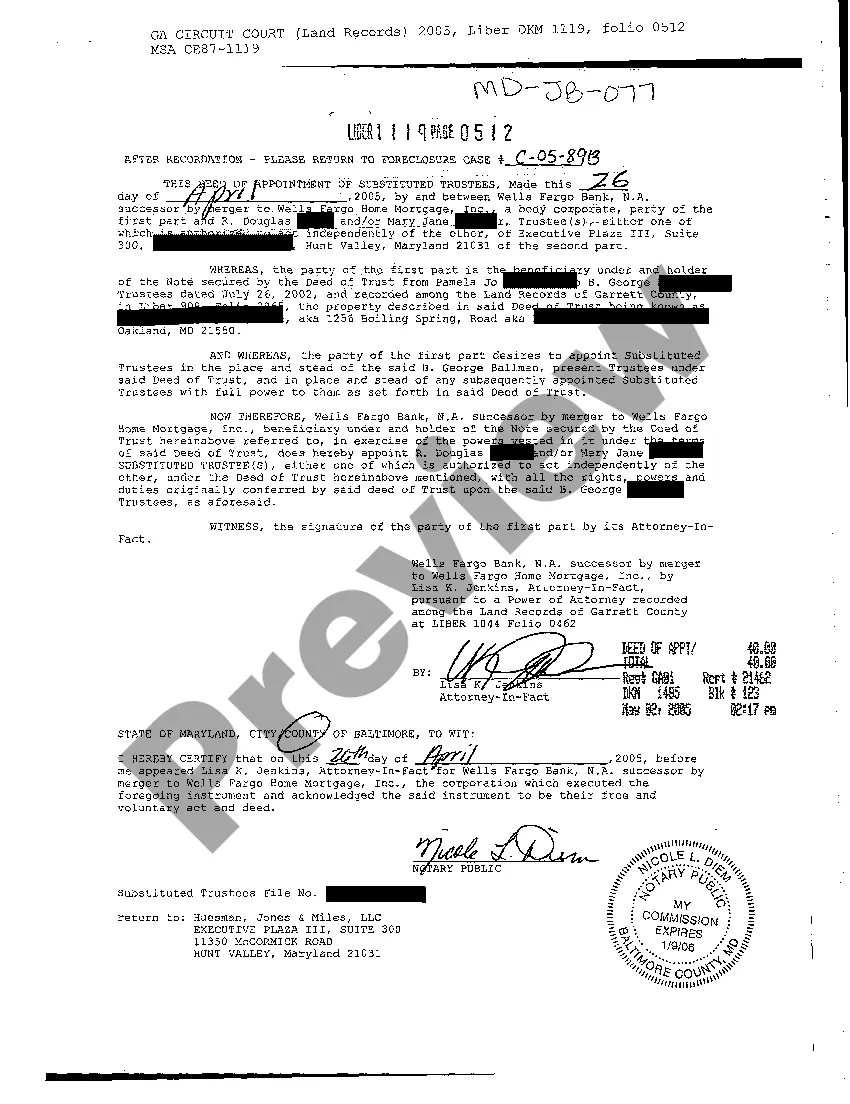

If available, utilize the Review button to examine the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Acquire button.

- Then, you can complete, modify, print, or sign the New Jersey Authority to Borrow Money - Resolution Form - Corporate Resolutions.

- Every legal document template you purchase is yours indefinitely.

- To obtain an additional copy of a purchased document, navigate to the My documents tab and click on the respective button.

- If you are visiting the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure that you have selected the appropriate document template for the county/town of your choice.

- Review the document information to confirm you have chosen the right document.

Form popularity

FAQ

Loan Resolution means that certain Resolution, adopted by the Board of the City on March 8, 2021, authorizing a loan under a loan agreement between the Borrower and the Issuer to finance the Project.

A corporate resolution that authorizes borrowing on a line of credit is often referred to a borrowing resolution. This resolution indicates that the members (LLC) or Board of Directors (Corporation) have held a meeting and conducted a vote allowing the company to borrow a specific loan amount.

A board resolution template is a manner of documenting decisions made by the company's Shareholders or Board of Directors. The decision can cover anything relevant to the affairs of the organization like a decision extending loans to other companies or when voting for a new member to join the board.

Name of the lender from whom they will borrow sums of money. Signature of authorized member/director that will execute and endorse all such documents required by said bank as well as agreement to perform all acts and sign all agreements and obligations required by said bank. The state where the business is formed.

What to Include in a Corporate Resolution FormThe date of the resolution.The state in which the corporation is formed and under whose laws it is acting.Signatures of officers designated to sign corporate resolutionsusually the board chairperson or the corporate secretary.Title the document with its purpose.More items...?

A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances. Corporate resolutions provide a paper trail of the decisions made by the board and the executive management team.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

A corporate resolution to open a business bank account is a document that clearly shows the bank who has the authority to start an account on behalf of your corporation. If this information isn't specifically covered in your Articles of Incorporation or bylaws, your bank may require a resolution.

RESOLVED THAT the company do hereby obtain and avail financial assistance/Credit facility of an amount not exceeding (Loan or Credit/Overdraft amount) from (Name, Branch and Address of the bank) in order to meet the (requirements of the company), and such loan shall be obtained on such terms and conditions as specified