New Jersey Sample Letter regarding Application for Employer Identification Number

Description

How to fill out Sample Letter Regarding Application For Employer Identification Number?

Are you in the situation where you will require documentation for both commercial or particular purposes almost every time.

There is a multitude of legal document templates accessible online, but finding ones you can trust isn't simple.

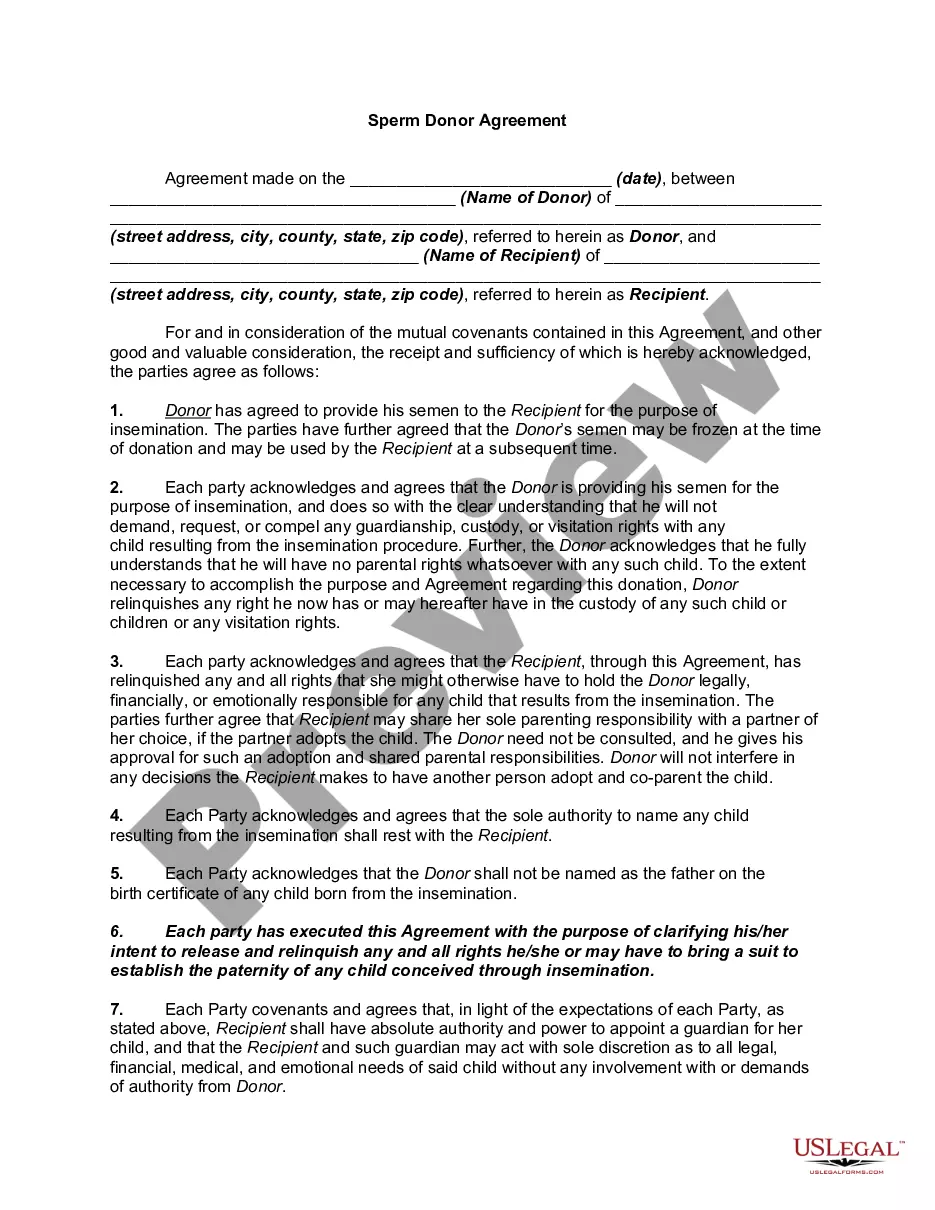

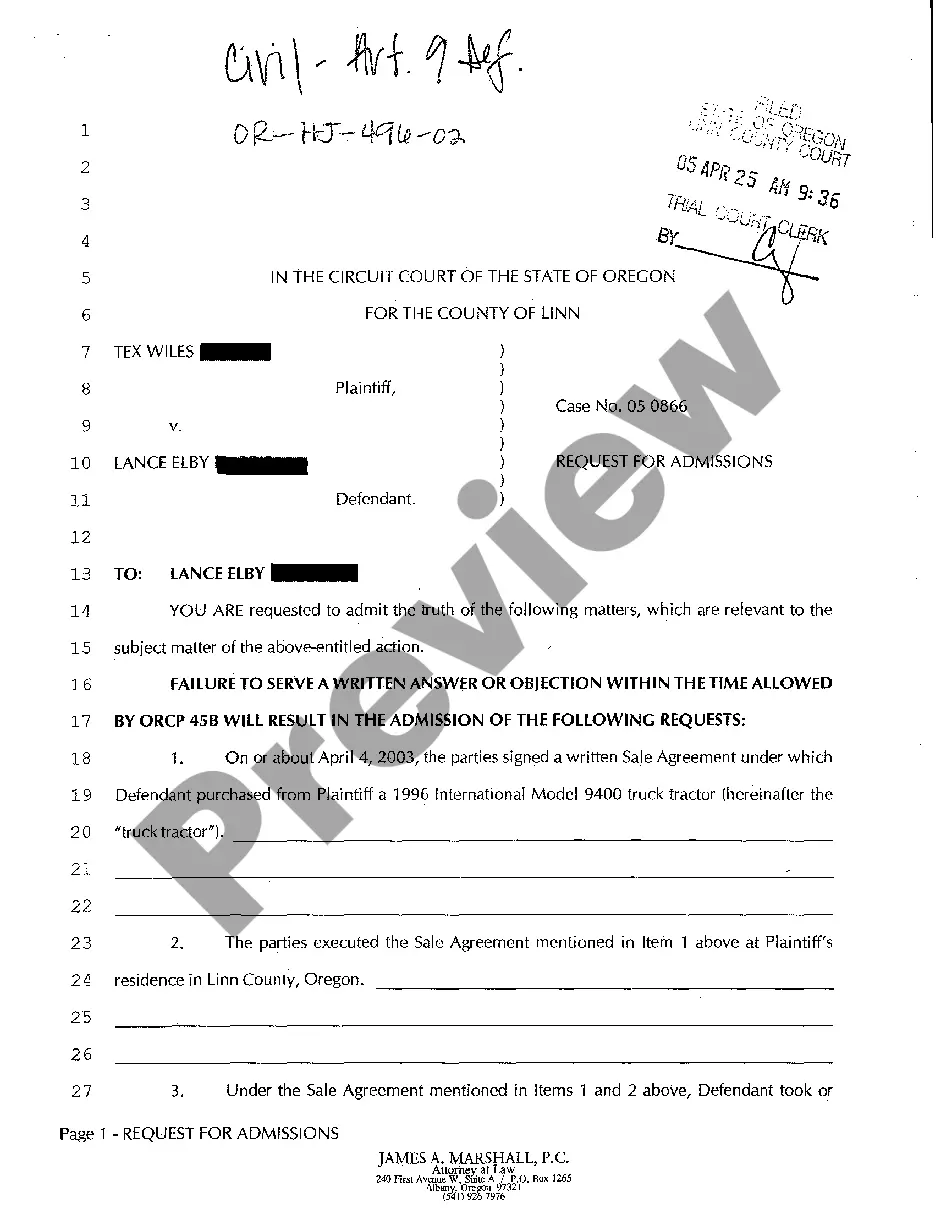

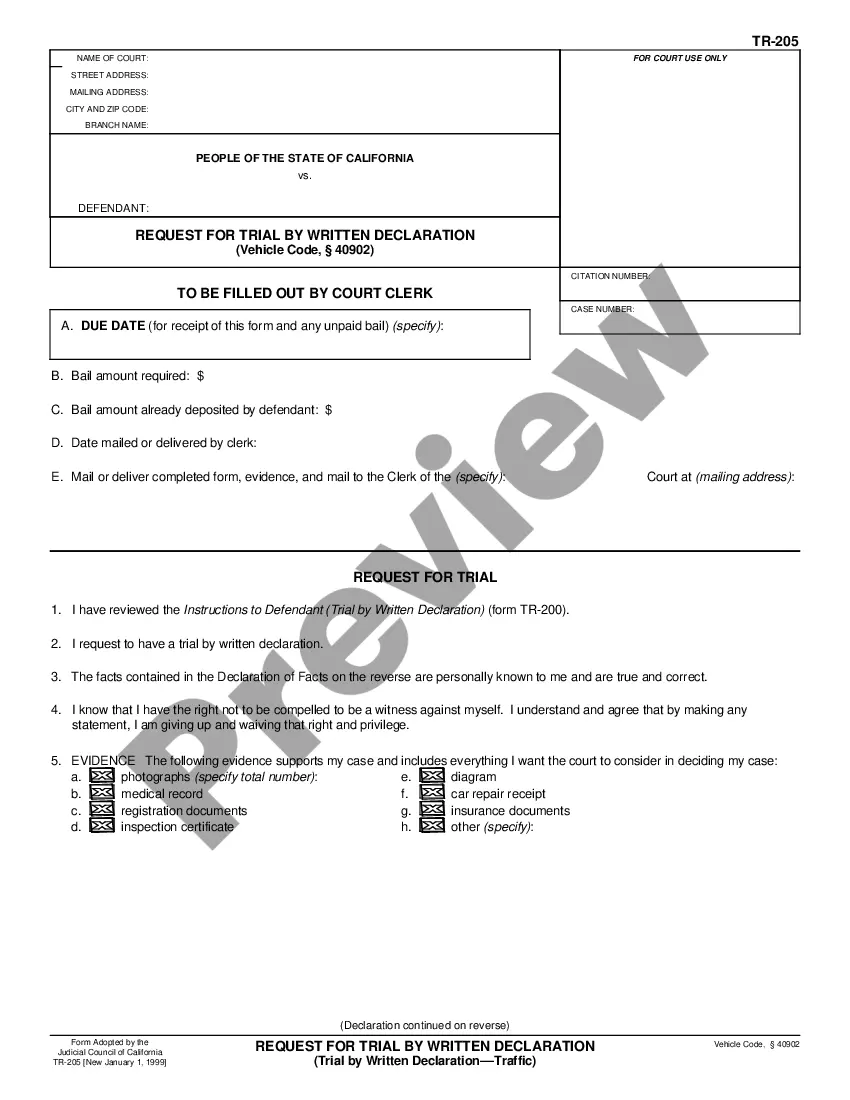

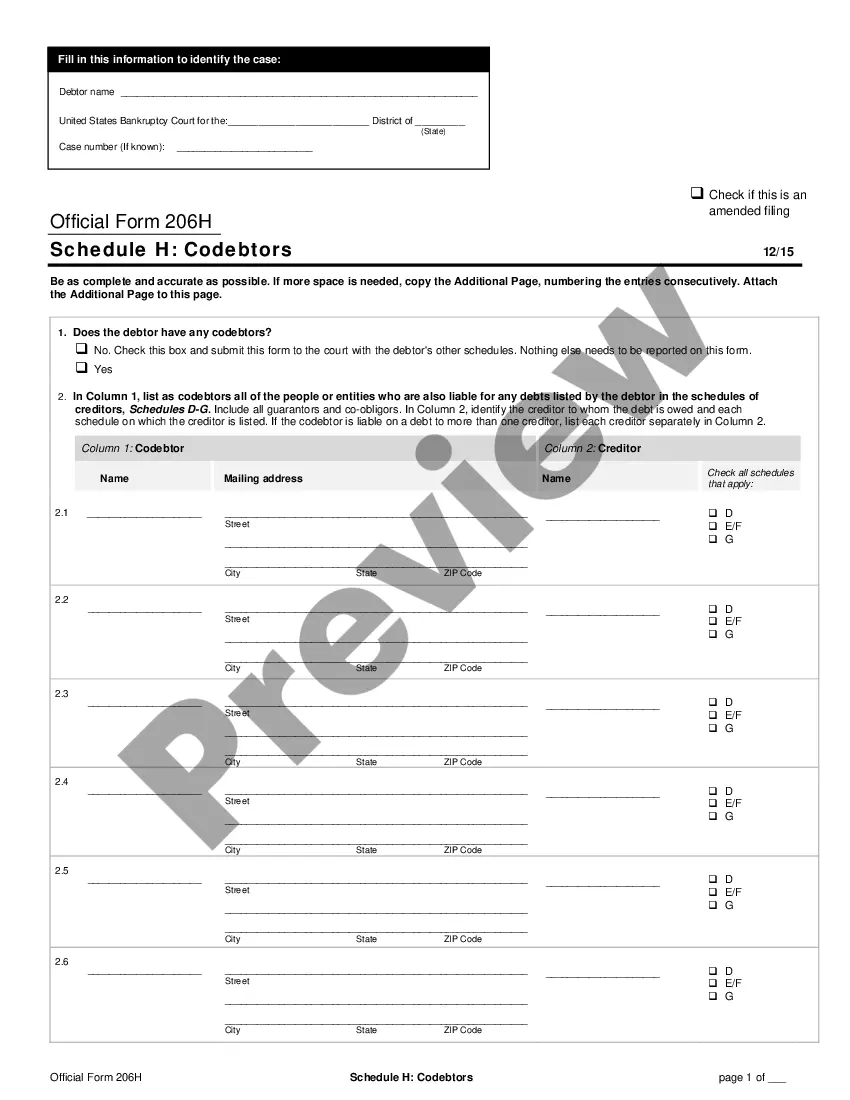

US Legal Forms offers a vast array of form templates, such as the New Jersey Sample Letter concerning Application for Employer Identification Number, which are designed to fulfill state and federal requirements.

Once you find the correct template, click on Purchase now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for the transaction with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New Jersey Sample Letter concerning Application for Employer Identification Number template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the template you need and ensure it is for your specific city/state.

- Utilize the Preview function to review the form.

- Check the outline to confirm you have selected the correct template.

- If the template isn’t what you’re looking for, use the Search field to locate the form that meets your needs and requirements.

Form popularity

FAQ

Applying for an Employer Identification Number (EIN) is a free service offered by the Internal Revenue Service. Beware of websites on the Internet that charge for this free service.

You'll need to file for an EIN online with the IRS. There is no filing fee. You receive your EIN immediately after filing. The IRS uses EINs, also known as federal tax identification numbers, to identify businesses.

We recommend applying for an EIN online if you have a SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number). This is the easiest filing method and it has the fastest approval time. Your EIN Number will be issued at the end of the online application, which takes about 15 minutes to complete.

Use Form SS-4 to apply for an employer identification number (EIN). An EIN is a 9-digit number (for example, 12-3456789) assigned to employers, sole proprietors, corporations, partnerships, estates, trusts, certain individuals, and other entities for tax filing and reporting purposes.

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). You are limited to one EIN per responsible party per day.

The only way to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933. For security reasons, the IRS will never send anything by email. Instead, the IRS will send you an EIN Verification Letter (147C) two ways: by mail.

Apply online You can complete your application for an EIN online: This is the fastest way to get your EIN. The site will validate your information and issue the EIN immediately.

Your New Jersey Tax ID number will be the same as your EIN plus a 3-digit suffix and is used for state tax purposes. Your BRC will include a control number used only to verify that your certificate is current.