New Jersey Sample Letter for Agreement to Compromise Debt

Description

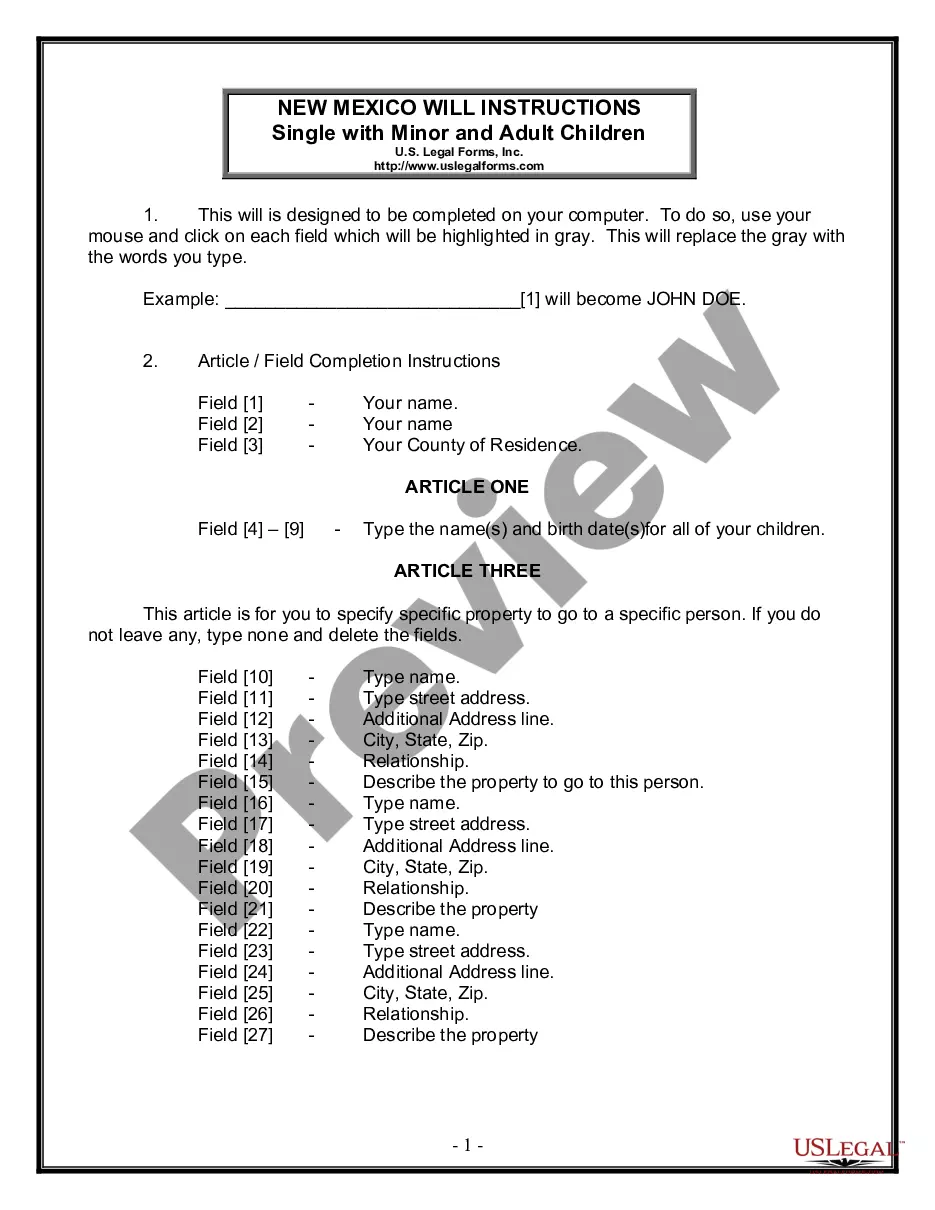

How to fill out Sample Letter For Agreement To Compromise Debt?

Selecting the appropriate legal document template can be a challenge.

Obviously, there are numerous templates available online, but how do you find the legal form you require.

Utilize the US Legal Forms website. This service offers a multitude of templates, including the New Jersey Sample Letter for Agreement to Compromise Debt, that can be used for both business and personal purposes.

You can review the form with the Review button and read the form description to ensure it is suitable for your needs.

- All forms are reviewed by experts and meet federal and state requirements.

- If you are already registered, Log In to your account and click on the Download button to retrieve the New Jersey Sample Letter for Agreement to Compromise Debt.

- Use your account to browse the legal forms you have previously purchased.

- Navigate to the My documents tab in your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure you have selected the correct form for your location.

Form popularity

FAQ

The 777 rule refers to the general guideline that a debt collector should wait at least seven days after default before contacting you. It suggests that before making any settlement offers, they should provide you with seven days to respond to the original debt claim. Understanding this rule can empower you during negotiations. Consider using a New Jersey Sample Letter for Agreement to Compromise Debt to formalize your communications and ensure compliance with these timelines.

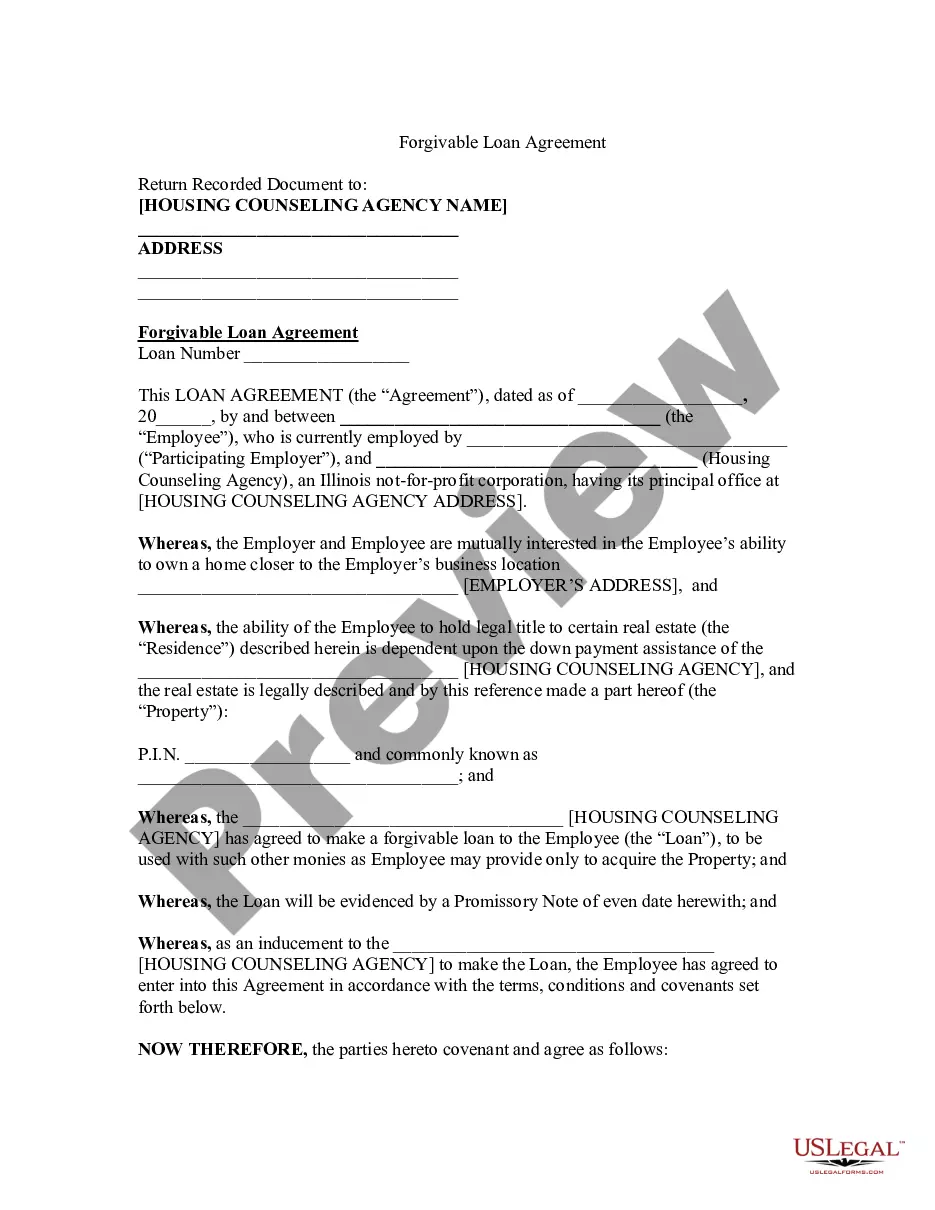

To write a debt settlement agreement, begin with basic information such as your name, contact details, and the creditor's information. Specify the settlement amount, payment terms, and due dates. Utilizing a New Jersey Sample Letter for Agreement to Compromise Debt can guide you in formulating an effective document. This format allows you to present your settlement offer in a clear, organized manner, enhancing the chances of reaching an agreement.

Writing a debt agreement involves clearly outlining the terms you and the creditor have both agreed upon. Start with accurate details about both parties, the original debt amount, and the proposal for settlement. Including a New Jersey Sample Letter for Agreement to Compromise Debt can streamline the writing process. Clarity and professionalism in your agreement can increase the likelihood of acceptance.

A debt agreement can be a beneficial strategy if you're struggling with payments. It allows for potential savings and provides a clear path for resolving your debt. Moreover, utilizing a New Jersey Sample Letter for Agreement to Compromise Debt can serve as an effective means of communicating your intentions to creditors. When done thoughtfully, a debt agreement offers a structured solution to alleviate financial stress.

When looking to settle a debt, a common starting point is to offer around 30% to 50% of the total amount owed. However, the exact percentage can depend on factors like your financial situation and the creditor's willingness to negotiate. You may find that using a New Jersey Sample Letter for Agreement to Compromise Debt helps formalize your offer, making it more persuasive. Remember, each case is different, so be prepared for counteroffers.

The 777 rule for debt collectors is a guideline that helps consumers understand their rights during debt collection. In New Jersey, this rule can aid in establishing fair practices when dealing with creditors. When you utilize a New Jersey Sample Letter for Agreement to Compromise Debt, you can assert your rights more effectively. This letter may provide you protection against unfair collection tactics.

Filling out a debt validation letter involves specifying the debt in question and requesting verification from the creditor. You should include your personal information, account details, and a clear request for the creditor to validate the debt. Utilizing a New Jersey Sample Letter for Agreement to Compromise Debt can help format your letter correctly. Always keep a copy of your letter for your records, as this ensures you have proof of your request.