New Jersey Buy Sell Agreement Between Partners of a Partnership

Description

How to fill out Buy Sell Agreement Between Partners Of A Partnership?

Are you in a position where you need documentation for a company or particular operations nearly every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of form templates, such as the New Jersey Buy Sell Agreement Between Partners of a Partnership, specifically created to comply with federal and state regulations.

Access all the document templates you’ve purchased in the My documents section. You can obtain another copy of the New Jersey Buy Sell Agreement Between Partners of a Partnership anytime if necessary. Just click the required form to download or print the document template.

Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid errors. The service offers expertly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New Jersey Buy Sell Agreement Between Partners of a Partnership template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/state.

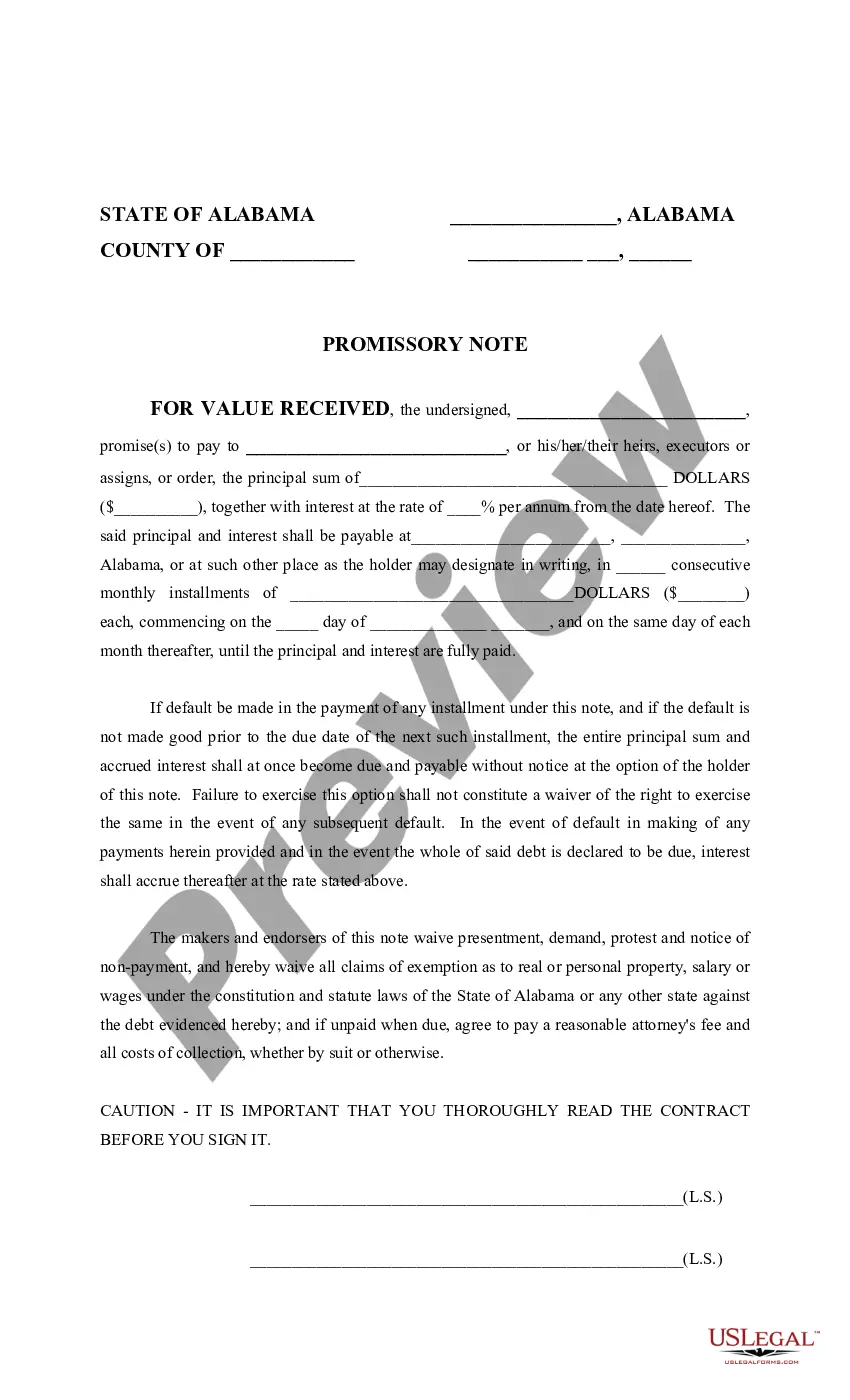

- Use the Preview option to review the form.

- Check the description to confirm you have selected the right form.

- If the form is not what you are searching for, utilize the Lookup field to find the form that meets your requirements.

- Once you find the right form, click Buy now.

- Select the pricing plan you prefer, fill in the required details to create your account, and pay for your order using PayPal or credit card.

- Choose a suitable file format and download your copy.

Form popularity

FAQ

Yes, a partner can sell property to a partnership, provided the terms are agreeable to all partners involved. It is important to outline the details of such transactions within the buy-sell agreement to ensure transparency and fairness. The New Jersey Buy Sell Agreement Between Partners of a Partnership should include specific provisions that address how these property sales are handled, to prevent any potential conflicts or miscommunications among partners.

Typically, the partners in a partnership collaborate to create a buy-sell agreement, but it is wise to involve legal professionals for guidance. An attorney with experience in partnership law can provide valuable insights into the legal requirements and implications of the agreement. By collaborating closely with a legal expert, you can customize the New Jersey Buy Sell Agreement Between Partners of a Partnership to suit your partnership’s unique needs. Remember, a well-drafted agreement can save time and prevent disputes in the future.

sell agreement serves as a crucial tool for partners in a business partnership. It outlines the procedures for transferring ownership interests when a partner decides to sell or is forced to sell their share. This agreement helps ensure a smooth transition and protects the interests of both the partnership and the partners. When dealing with a New Jersey Buy Sell Agreement Between Partners of a Partnership, it is essential to have clear provisions to avoid conflicts and misunderstandings.

When a partner contributes property to a partnership, that property typically becomes part of the partnership's assets, subject to the terms of the New Jersey Buy Sell Agreement Between Partners of a Partnership. This agreement can define how ownership interests are adjusted and how profits from the property will be shared. Partners must discuss the implications of such contributions to maintain clarity and harmony within the partnership. To formalize this process, consider using uslegalforms to provide a clear and binding agreement.

Partners generally have the right to sell property owned by the partnership, but this right is usually subject to the stipulations within the New Jersey Buy Sell Agreement Between Partners of a Partnership. This agreement often outlines the procedures and approvals required for such transactions. Clear communication and legal guidelines can help prevent conflicts between partners. Using a service like uslegalforms can ensure your agreement is thorough and effective.

The 7 year rule for partnerships refers to the time frame in which partners must report capital gains on the sale of partnership interest. This rule impacts tax obligations and financial planning for partners in a partnership. Understanding this rule is crucial when considering a New Jersey Buy Sell Agreement Between Partners of a Partnership, as it may influence how agreements are structured. Consulting with a tax advisor or legal expert can provide necessary insights for partners.

Yes, a partner can sell assets of the partnership, but this often depends on the terms outlined in the New Jersey Buy Sell Agreement Between Partners of a Partnership. This agreement typically governs the rights and obligations of each partner regarding asset management and sales. It's important for partners to review these terms carefully, as improper asset sales can lead to disputes. For clarity and guidance, consider utilizing a legal platform like uslegalforms to draft a comprehensive agreement.

Yes, a New Jersey Buy Sell Agreement Between Partners of a Partnership is typically legally binding when properly executed. This means that all parties involved are obligated to adhere to its terms. To ensure enforceability, consult with a legal expert during the drafting process to include all necessary elements. Legal platforms like USLegalForms can also assist you in creating an agreement that meets your specific needs.

A partnership buyout agreement is a vital component of a New Jersey Buy Sell Agreement Between Partners of a Partnership. This document outlines the terms under which a partner can sell their interest in the business, ensuring a smooth transition. It helps protect the interests of remaining partners, establishes a fair valuation method, and specifies payment terms. Having this agreement in place can prevent misunderstandings and conflicts down the road.

Backing out of a New Jersey Buy Sell Agreement Between Partners of a Partnership can be complex. Generally, once the agreement is signed, it is binding unless it contains specific exit clauses. If you find yourself needing to withdraw, consult with a legal professional to review your options. It's essential to ensure any resulting actions comply with the existing agreement to avoid legal complications.