This form is a Class Action Complaint. Plaintiffs seek damages and injunctive relief from defendants for liability under the Racketeer Influenced and Corrupt Organizations Act(RICO). Plaintiffs contend that the defendants' actions justify an award of substantial punitive damages against each.

New Jersey Complaint for Class Action For Wrongful Conduct - RICO - by Insurers

Description

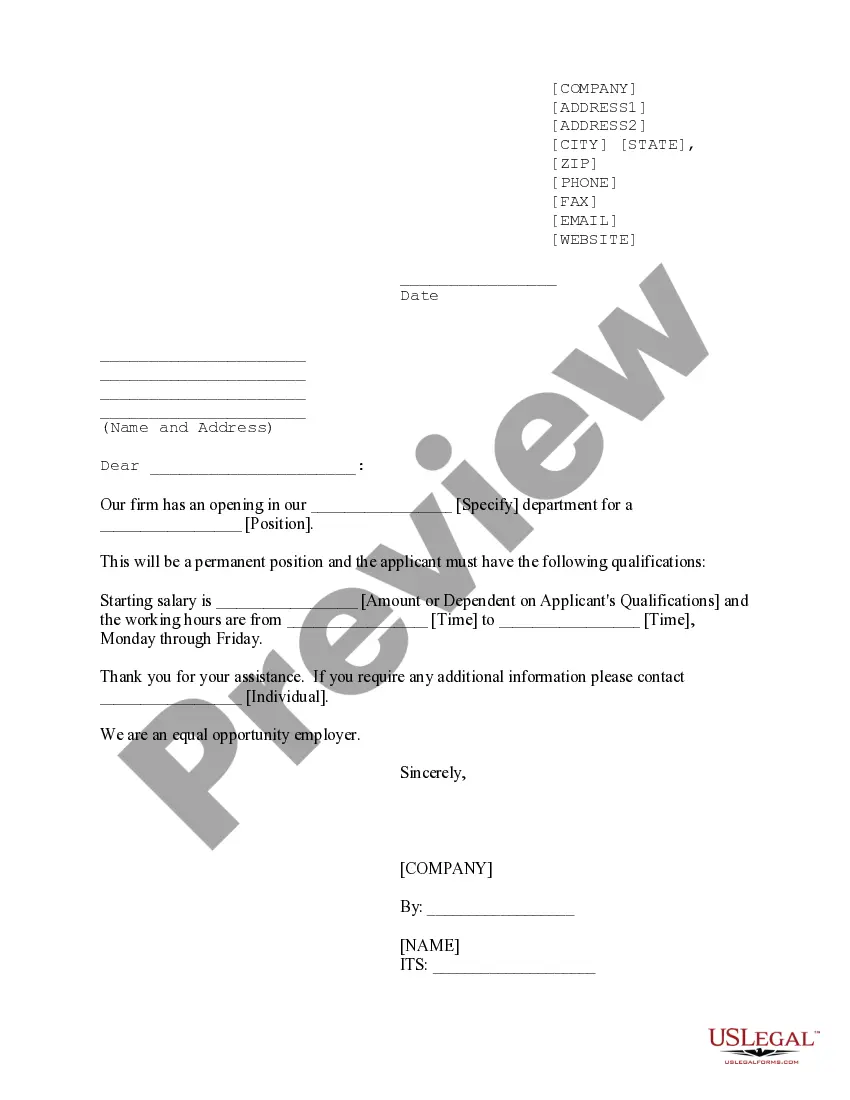

How to fill out Complaint For Class Action For Wrongful Conduct - RICO - By Insurers?

Have you ever found yourself in a situation where you need documents for both professional or personal purposes almost every day.

There are many legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, such as the New Jersey Complaint for Class Action For Wrongful Conduct - RICO - by Insurers, which are designed to comply with federal and state regulations.

Once you locate the appropriate form, simply click Buy now.

Choose the pricing plan you prefer, fill in the necessary details to create your account, and pay for the order using your PayPal or Visa or Mastercard. Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can download an additional copy of the New Jersey Complaint for Class Action For Wrongful Conduct - RICO - by Insurers at any time, if needed. Click the desired form to download or print the document template. Use US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the New Jersey Complaint for Class Action For Wrongful Conduct - RICO - by Insurers template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct area/county.

- Utilize the Preview button to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs and specifications.

Form popularity

FAQ

Damages available for bad faith may include consequential damages, emotional distress damages, and punitive damages, depending on the circumstances of the case. These damages aim to compensate the affected party for losses experienced due to the insurer's wrongful conduct. By filing a New Jersey Complaint for Class Action For Wrongful Conduct - RICO - by Insurers, you can pursue these potential damages and hold the insurer accountable.

To prove that an insurance company acted in bad faith, you must gather evidence showing the insurer's unreasonable actions or decisions regarding your claim. Documentation of communication, delays, and denials will strengthen your case. A New Jersey Complaint for Class Action For Wrongful Conduct - RICO - by Insurers can provide a structured approach to present your evidence and seek justice.

The two types of bad faith include first-party bad faith, where an insurer mistreats its own policyholder, and third-party bad faith, which involves mishandling a claim made by an injured third party. Each type represents a breach of the insurer's duty to act fairly and in good faith. Pursuing a New Jersey Complaint for Class Action For Wrongful Conduct - RICO - by Insurers can address these grievances effectively.

Insurers can be liable for bad faith through unreasonable denial of a claim, failing to investigate a claim properly, or delaying payment without justification. These actions indicate a disregard for the policyholder's rights and can lead to significant consequences for insurers. If you suspect bad faith, consider a New Jersey Complaint for Class Action For Wrongful Conduct - RICO - by Insurers as a potential remedy.

To file a complaint against an insurance company in New Jersey, consumers should first document all interactions and gather relevant evidence. Next, they can submit their complaint to the New Jersey Department of Banking and Insurance or explore legal action. Utilizing a New Jersey Complaint for Class Action For Wrongful Conduct - RICO - by Insurers can streamline this process and enhance the chances of a successful outcome.

Bad faith in insurance typically includes an insurer's failure to investigate claims, unreasonable delays in payment, or outright denial of valid claims. These actions demonstrate a lack of good faith in the insurer's dealings with policyholders. Filing a New Jersey Complaint for Class Action For Wrongful Conduct - RICO - by Insurers can help those who have experienced bad faith recover damages.

The Unfair Claim Settlement Practices Act in New Jersey aims to protect consumers from unfair practices by insurance companies. It outlines specific standards that insurers must follow when handling claims. If an insurer violates these standards, affected parties may pursue a New Jersey Complaint for Class Action For Wrongful Conduct - RICO - by Insurers to seek justice.