New Jersey Assignment to Living Trust

What is this form?

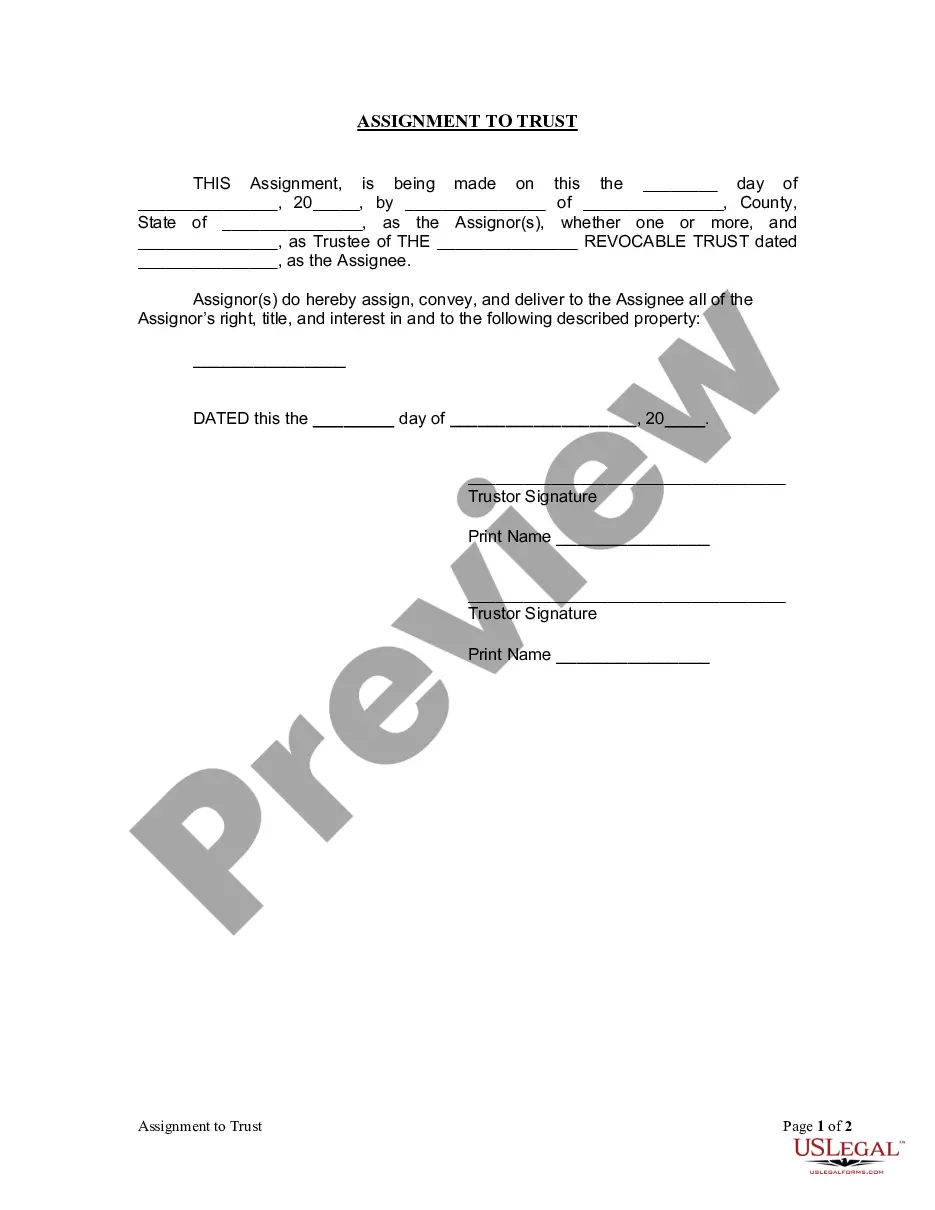

The Assignment to Living Trust form is a legal document used to transfer ownership of specific property into a living trust. A living trust is created during an individual's lifetime and allows for the management of their assets and property for easier estate planning. This form is essential for ensuring that desired assets are part of the trust, which can help in avoiding probate and simplifying the estate distribution process.

Main sections of this form

- Assignor information: Includes details of the person transferring the property.

- Trustee information: Specifies the trustee of the living trust receiving the property.

- Property description: Clearly defines the specific property being assigned to the trust.

- Signatures: Requires signatures from the Assignor(s) and notarization to validate the transfer.

- Date fields for both the assignment and notarization to ensure proper documentation timelines.

Situations where this form applies

This form should be used when an individual wishes to transfer ownership of property into a living trust. It is particularly useful in the following scenarios: when creating an estate plan, when wanting to manage assets during one's lifetime, or when preparing for the distribution of assets after death while avoiding probate.

Intended users of this form

- Individuals who have established a living trust and want to fund it with specific property.

- Persons who are involved in estate planning and wish to ensure a smooth transfer of assets.

- Trustees or individuals acting on behalf of the trust who require clarity in asset ownership.

Instructions for completing this form

- Identify the Assignor: Enter the name and address of the individual transferring the property.

- Fill in the Trustee's details: Specify the name of the trustee of the living trust receiving the property.

- Describe the property: Clearly outline the property being assigned to the trust.

- Enter dates: Complete the date fields for both the assignment and notarization.

- Sign the document: The Assignor(s) must sign in front of a notary public to validate the document.

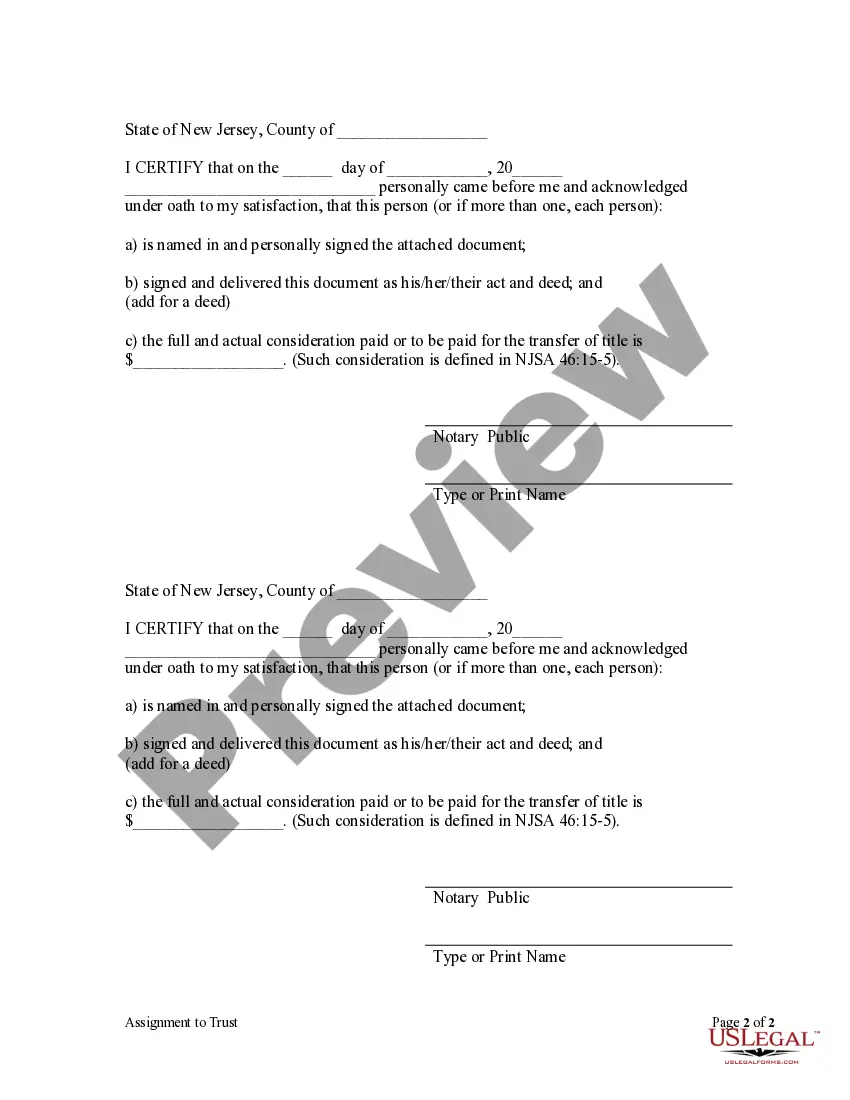

Notarization requirements for this form

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to accurately describe the property being transferred.

- Not obtaining notarization, which is crucial for legal validity.

- Leaving date fields blank or incorrect, which can lead to disputes later.

- Not confirming that the transfer aligns with state laws regarding trust and asset management.

Advantages of online completion

- Convenience of downloading and completing the form at your own pace.

- Editability allows for personal customization as needed.

- Access to reliable legal templates drafted by licensed attorneys ensures compliance with applicable laws.

Summary of main points

- The Assignment to Living Trust form is essential for transferring property into a living trust.

- Proper completion and notarization of the form can simplify estate management and avoid probate issues.

- Ensure all details are accurate to prevent complications regarding asset ownership.

Looking for another form?

Form popularity

FAQ

List Your Assets and Decide Which You'll Include in the Trust. Gather the Paperwork. Decide Whether You Will Be the Sole Grantor. Choose Beneficiaries. Choose a Successor Trustee. Choose Someone to Manage Property for Minor Children. Prepare the Trust Document. Sign and Notarize.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

Sure you can write your own revocable living trust.The discussion of your need for a revocable living trust is in another of my articles, but it is safe to say that if you own real property and have a significant estate (over about $50,000), then you could use a trust and it would help your loved ones.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Make a List of All Your Assets. Be sure to include make a list of your assets that includes everything you own. Find the Paperwork for Your Assets. Choose Beneficiaries. Choose a Successor Trustee. Choose a Guardian for Your Minor Children.

Obtain a California grant deed from a local office supply store or your county recorder's office. Complete the top line of the deed. Indicate the grantee on the second line. Enter the trustees' names and addresses.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Decide on the type of trust you want to form. Take stock of your property. Pick a trustee. Create the trust document, either using an online program or with the help of a lawyer. Go to a notary public and sign the document. Fund the trust.