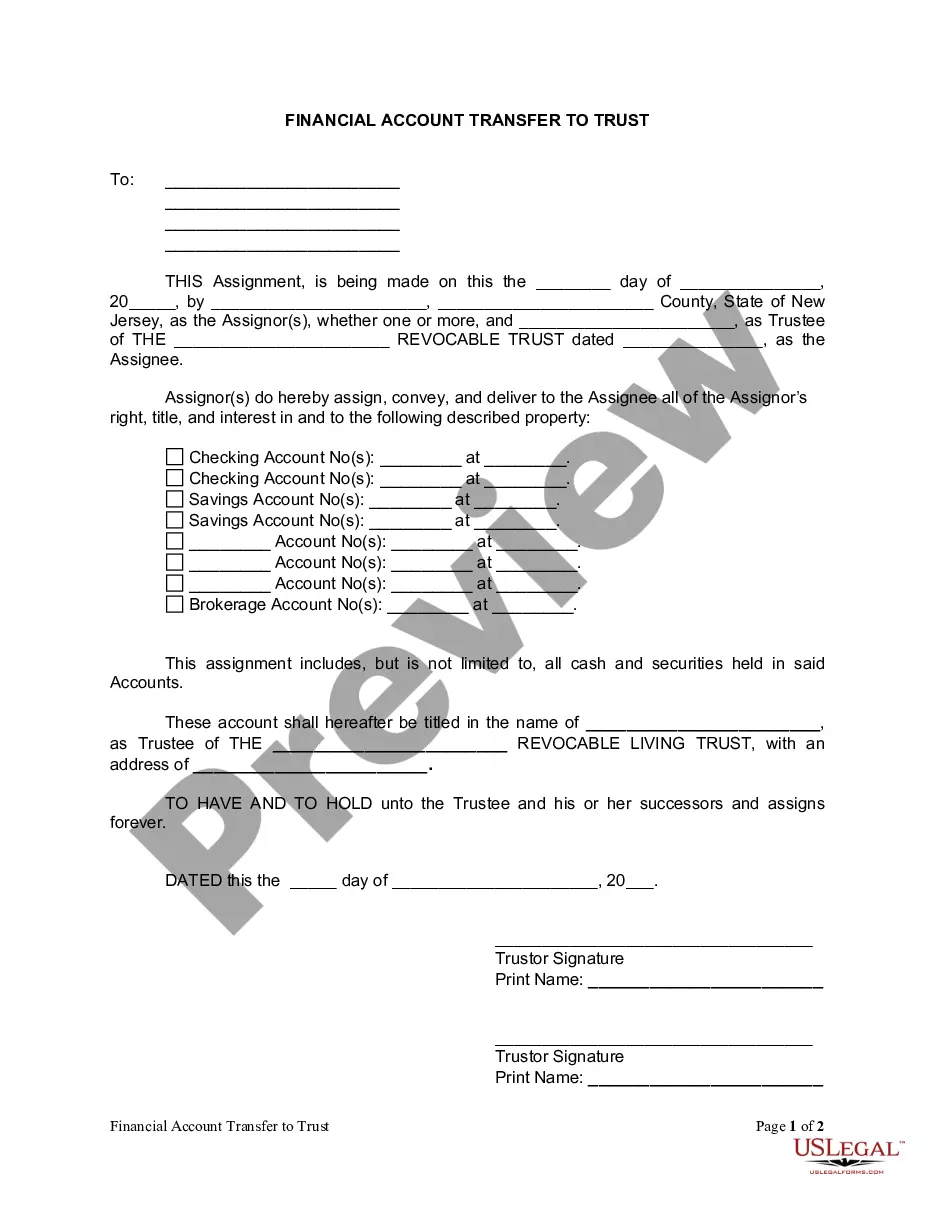

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

New Jersey Financial Account Transfer to Living Trust

Description

Definition and meaning

The New Jersey Financial Account Transfer to Living Trust is a legal document used to assign ownership of financial accounts, such as bank and brokerage accounts, to a living trust. This process helps individuals manage their assets during their lifetime and ensures a smoother transition of those assets to beneficiaries after they pass away.

Key components of the form

This form includes essential elements that establish the transfer of ownership:

- Assignor(s): The individual(s) transferring the accounts.

- Assignee: The trustee of the living trust.

- Account details: Specific information about the financial accounts being transferred, including account numbers and institutions.

- Signatures: Signatures of the assignor(s) and notarization to validate the document.

How to complete a form

To complete the New Jersey Financial Account Transfer to Living Trust, follow these steps:

- Fill in the date of the assignment.

- Enter the names of the assignor(s) and the address.

- Provide the name of the trustee and the trust's title.

- List all financial accounts being transferred, including checking and savings accounts.

- Ensure the assignor(s) sign the document in front of a notary public.

Who should use this form

This form is intended for individuals in New Jersey who have established a living trust and wish to transfer the ownership of their financial accounts into that trust. This is particularly useful for those who want to simplify the management and distribution of their assets upon their death.

State-specific requirements

In New Jersey, a Financial Account Transfer to Living Trust must comply with state laws regarding trusts and property transfer. It requires notarization to ensure the validity of the assignment, as recommended by the New Jersey Statutes.

Common mistakes to avoid when using this form

When completing the form, be cautious of the following errors:

- Omitting account details or incorrect account numbers.

- Failing to obtain notarization.

- Not updating the form after changes in trust ownership or account details.

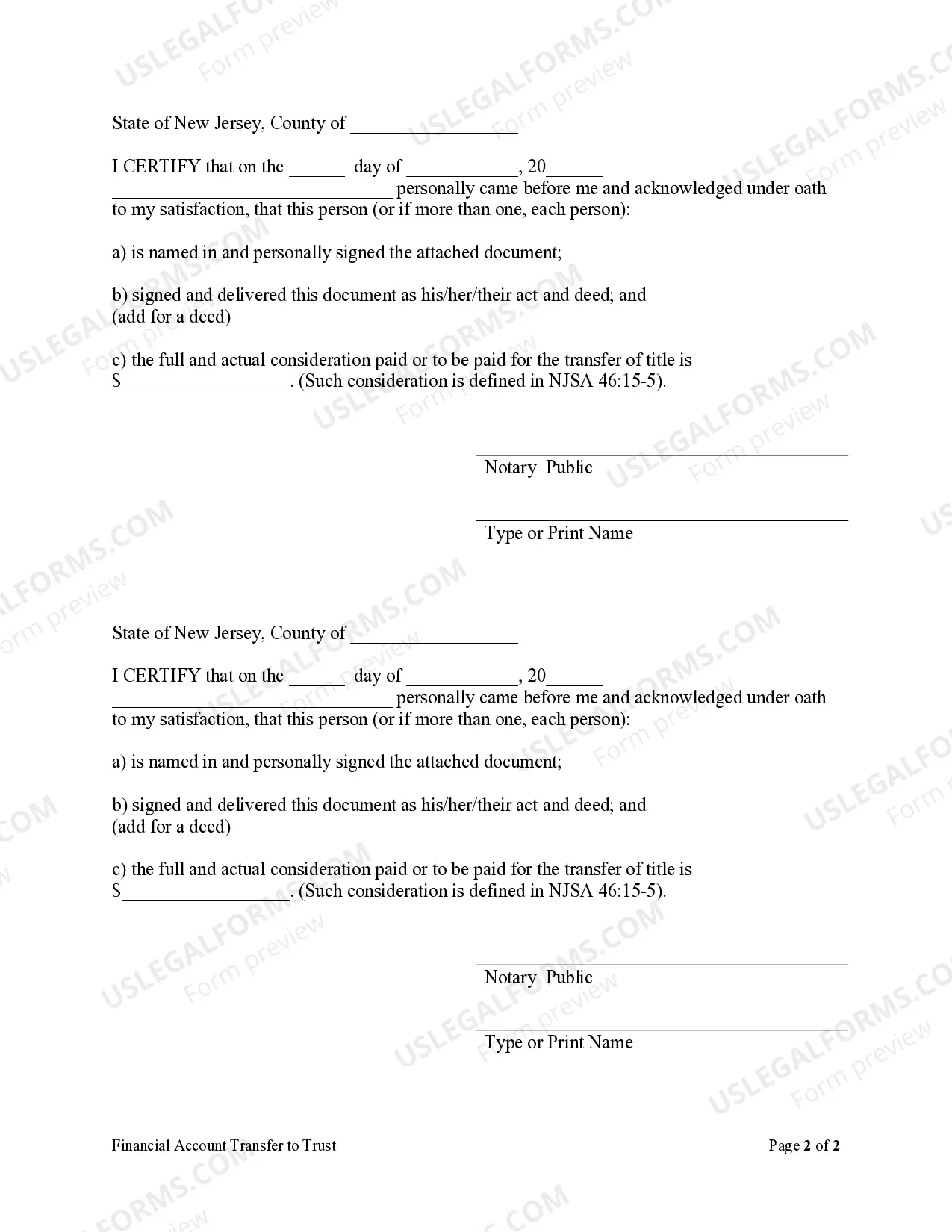

What to expect during notarization or witnessing

During the notarization process, the assignor(s) will need to present valid identification to the notary public. The notary will confirm the identity of the signer(s) and witness the signing of the document, ensuring all required signatures are in place. The notary will then affix their seal to complete the process.

How to fill out New Jersey Financial Account Transfer To Living Trust?

US Legal Forms is actually a special platform where you can find any legal or tax form for filling out, including New Jersey Financial Account Transfer to Living Trust. If you’re tired with wasting time looking for suitable examples and spending money on file preparation/lawyer fees, then US Legal Forms is exactly what you’re searching for.

To experience all of the service’s benefits, you don't need to download any software but just select a subscription plan and create an account. If you have one, just log in and find the right sample, save it, and fill it out. Saved documents are all saved in the My Forms folder.

If you don't have a subscription but need New Jersey Financial Account Transfer to Living Trust, take a look at the instructions listed below:

- make sure that the form you’re checking out is valid in the state you want it in.

- Preview the example and read its description.

- Click on Buy Now button to access the sign up webpage.

- Choose a pricing plan and keep on signing up by providing some information.

- Pick a payment method to finish the registration.

- Save the file by selecting the preferred format (.docx or .pdf)

Now, submit the file online or print it. If you feel unsure regarding your New Jersey Financial Account Transfer to Living Trust form, speak to a attorney to examine it before you decide to send or file it. Begin hassle-free!

Form popularity

FAQ

To put checking or savings accounts into the trust, go down to your bank and fill out the institutional paperwork. You don't have to change the name on the checks. When you die, your successor trustee will assume control of the account and distribute the money to your heirs.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

To transfer assets into a trust, the grantor must transfer titles from their name to the legal name of the trust. A grantor can create a living trust using an online legal document provider or by hiring an attorney. They can transfer almost any asset, including bank accounts, into a trust.

Lifetime Gift Tax Exemption The IRS allows you, as of 2014, to give up to $5.34 million in gifts or, after you die, bequests free of estate tax. This means you can put additional money into your irrevocable trust and, as long as you stay below your lifetime limit, it'll be a tax-free transfer.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.