New Jersey Quitclaim Deed from Individual to Corporation

Description

Key Concepts & Definitions

Quitclaim Deed: A legal instrument by which the owner of a property ('grantor') transfers their interest to a recipient ('grantee'), without warranties of clear title. In the case of quitclaim deed from individual to corporation, it means an individual transfers their interest in a property directly to a corporate entity.

Corporation: A legal entity that is separate and distinct from its owners, capable of owning property, being sued, and suing.

Step-by-Step Guide to Transferring Property via Quitclaim Deed

- Determine the Need: Assess why a quitclaim deed is the preferred method of transferring property to a corporation. Common reasons include transferring property into a property LLC for asset protection and business operations.

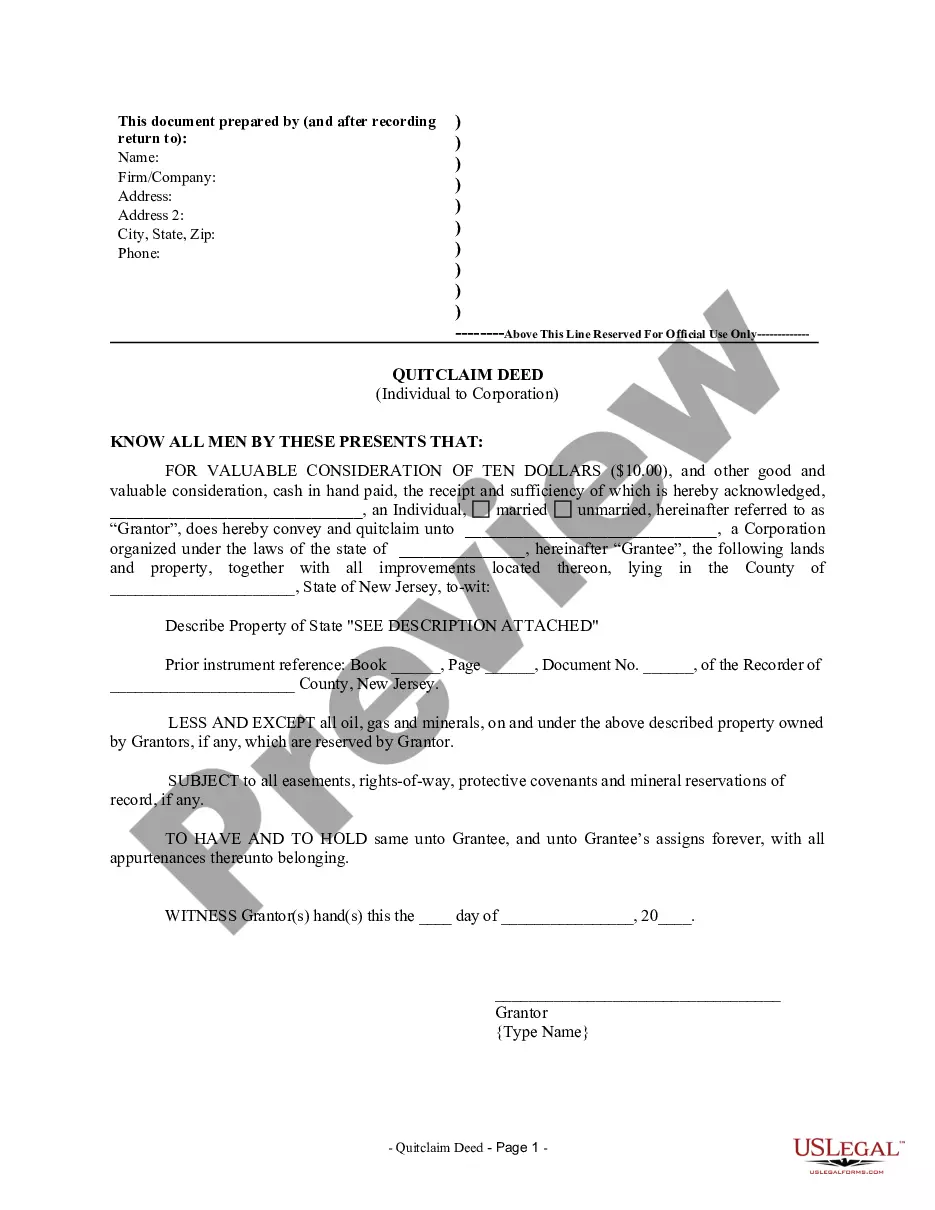

- Prepare the Deed: Obtain the necessary legal forms for a quitclaim deed. The deed must specify details such as the grantor(s), grantee (corporation), and the legal description of the property.

- Execution of Deed: The individual, as grantor, needs to sign the deed in the presence of a notary public to legalize the transfer.

- Record the Deed: File the signed deed with the local county recorders office to make the deed effective and public.

Risk Analysis

Using a quitclaim deed to transfer property to a corporation involves risks such as potential tax implications and the lack of warranty. Tax Implications: Transferring property to a corporation may trigger real estate taxes or capital gains tax if the propertys value has increased. Lack of Warranty: Quitclaim deeds do not guarantee clear title against other claims or liens, potentially complicating future sales or refinancing.

Pros & Cons

- Pros:

- Simple and fast transfer process.

- Efficient for transferring property to a property LLC or corporation already controlled by the grantor.

- Cons:

- No protection against liens or hidden title issues.

- Potential tax consequences if not handled properly.

Best Practices

When transferring property using a quitclaim deed from an individual to a corporation, ensure to:

- Consult with real estate and tax professionals to understand implications.

- Verify corporate authority to receive and hold property.

- Ensure accurate and complete documentation are used and filed.

Common Mistakes & How to Avoid Them

Common pitfalls include inadequate preparation and failure to record the deed. Avoid these by always using up-to-date legal forms and promptly filing the quitclaim deed with the appropriate county office. Consult a legal professional for personalized advice.

FAQ

- What is a quitclaim deed? A document transferring a grantor's rights in property to a grantee without warranties.

- Can you transfer a property with a mortgage via a quitclaim deed? Yes, but the original grantor remains liable unless the mortgage is refinanced under the new owner.

- Is a quitclaim deed suitable for all types of property transfers? No, it's primarily used between parties who trust each other as there are no warranties against liens or other claims.

How to fill out New Jersey Quitclaim Deed From Individual To Corporation?

US Legal Forms is actually a unique system where you can find any legal or tax form for completing, such as New Jersey Quitclaim Deed from Individual to Corporation. If you’re fed up with wasting time searching for suitable samples and paying money on papers preparation/attorney charges, then US Legal Forms is exactly what you’re looking for.

To experience all of the service’s benefits, you don't have to install any application but simply select a subscription plan and register an account. If you have one, just log in and look for a suitable template, save it, and fill it out. Downloaded files are all stored in the My Forms folder.

If you don't have a subscription but need New Jersey Quitclaim Deed from Individual to Corporation, have a look at the instructions below:

- make sure that the form you’re looking at is valid in the state you need it in.

- Preview the sample its description.

- Click Buy Now to get to the sign up page.

- Select a pricing plan and continue signing up by providing some information.

- Pick a payment method to finish the sign up.

- Download the document by choosing your preferred format (.docx or .pdf)

Now, complete the file online or print it. If you feel uncertain about your New Jersey Quitclaim Deed from Individual to Corporation form, contact a attorney to examine it before you decide to send or file it. Start hassle-free!

Form popularity

FAQ

Signing - According to New Jersey law, the quit claim deed must be signed by the seller of the property in the presence of a Notary Public. Recording - All quit claim deeds that have been notarized should be filed with the County Clerk's Office within the jurisdiction that the property falls under.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

Quitclaim deeds are most often used to transfer property between family members.Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners divorce and one spouse's name is removed from the title or deed.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.