New Jersey Warranty Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife

What this document covers

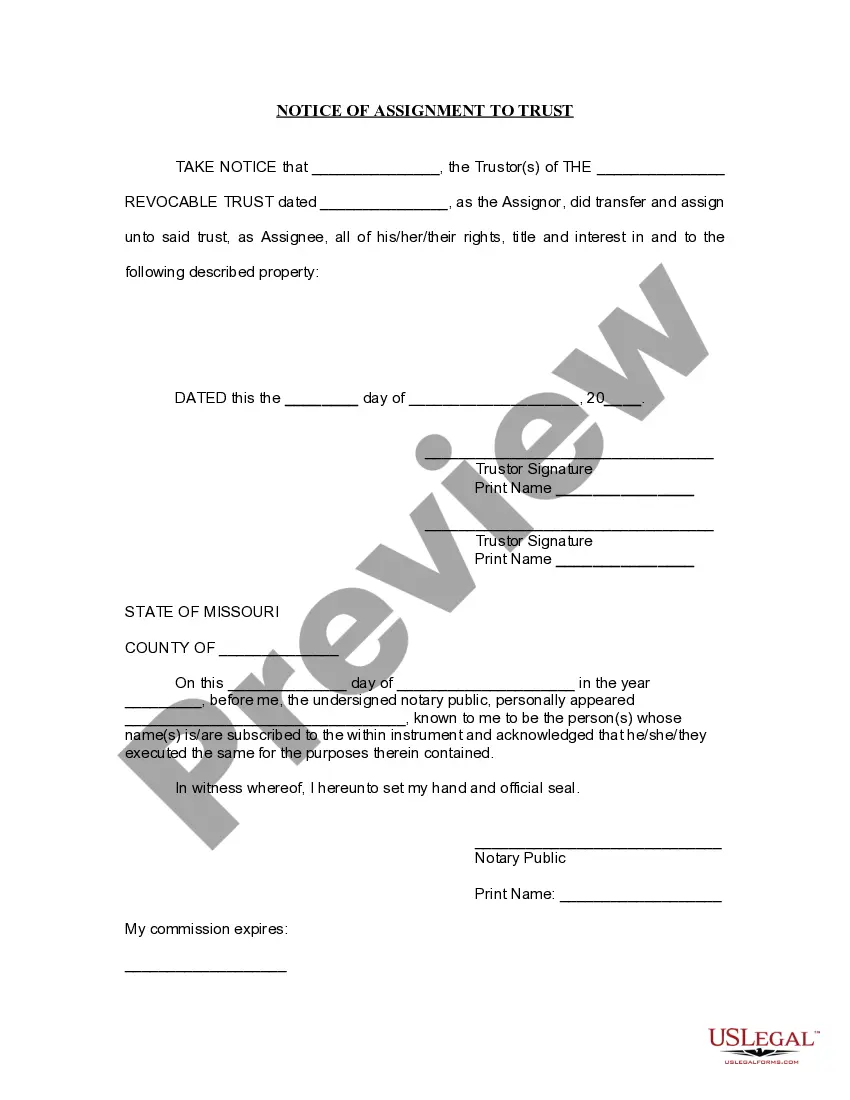

The Warranty Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife is a legal document that enables a husband and wife, or two individuals, who own a property (the Grantors) to convey and warrant that property to another husband and wife, or two individuals (the Grantees). This form ensures that the property is transferred with a guarantee of clear title, distinguishing it from quitclaim deeds, which do not offer such a warranty of title.

Key components of this form

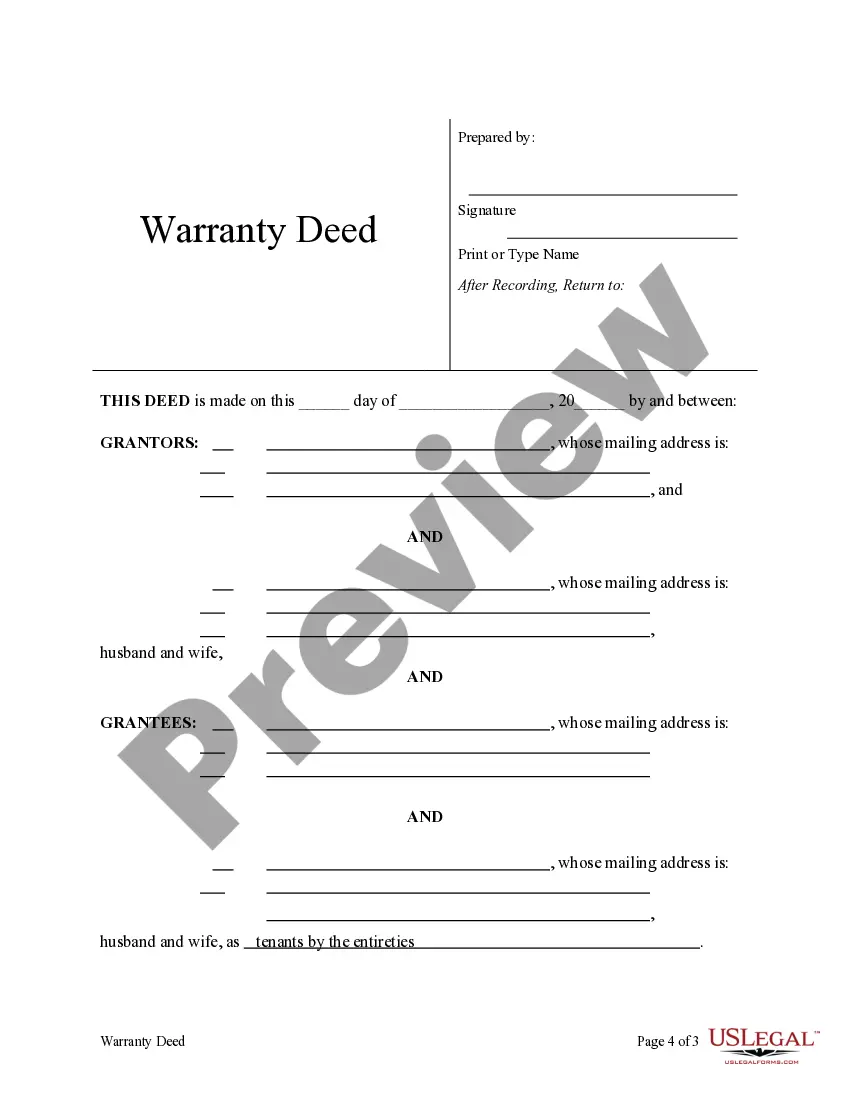

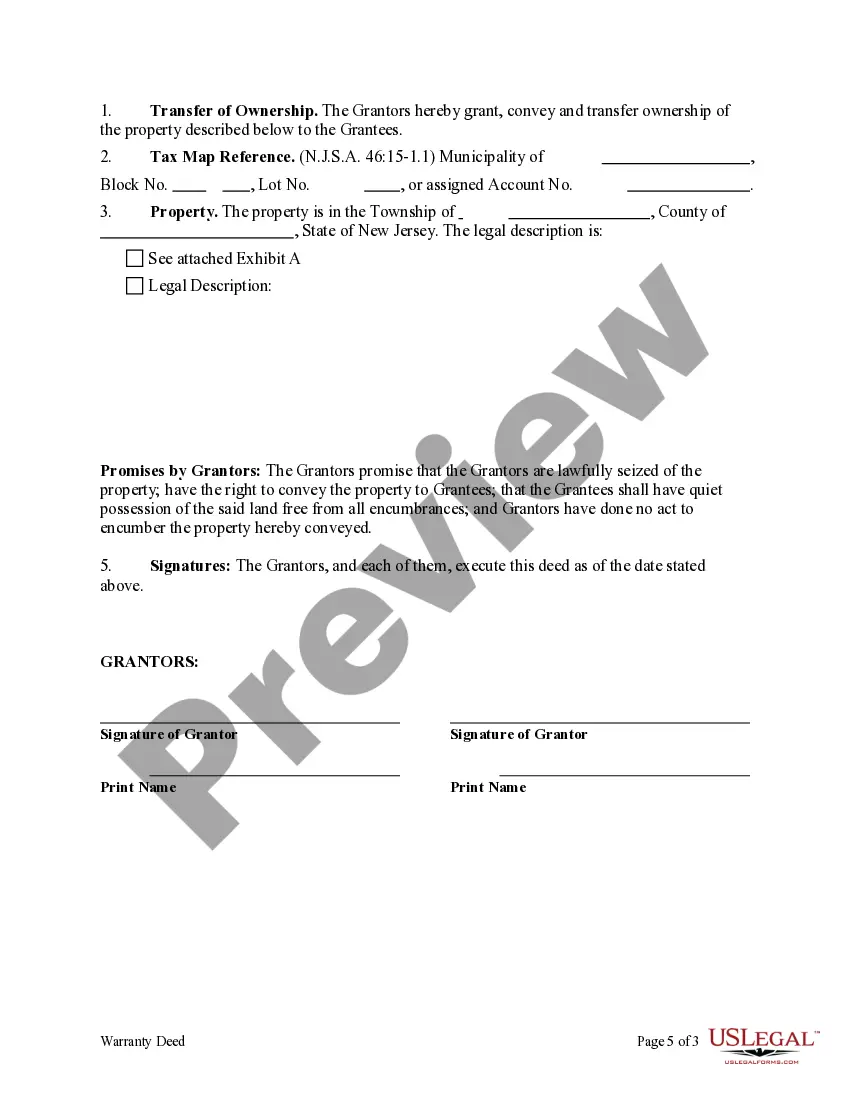

- Identifying the Grantors and Grantees involved in the transaction.

- Descriptive details of the property being transferred.

- Statement of warranty, providing assurances regarding title status.

- Section to indicate how Grantees will hold the property (e.g., tenants in common, joint tenants with rights of survivorship).

- Signatures of the Grantors for execution of the deed.

When to use this form

This Warranty Deed form should be used when a husband and wife or two individuals wish to transfer ownership of real estate to another husband and wife or two individuals, while ensuring that the grantors provide warrants against title defects. This form is particularly applicable during transactions such as family property transfers or when couples wish to consolidate ownership as part of estate planning.

Who can use this document

This form is intended for:

- Husbands and wives looking to transfer property to another couple.

- Two individual co-owners who want to transfer property to another set of individuals.

- Individuals seeking clear title transfer with warranty assurances.

How to prepare this document

- Identify the Grantors as the current property owners (husband and wife or two individuals).

- Enter the names of the Grantees to whom the property is being transferred.

- Provide a detailed description of the property being conveyed.

- Select how Grantees will hold the property (e.g., tenants in common, joint tenants with right of survivorship, or tenants by the entirety).

- Ensure that both Grantors sign the deed, indicating their agreement to the transfer.

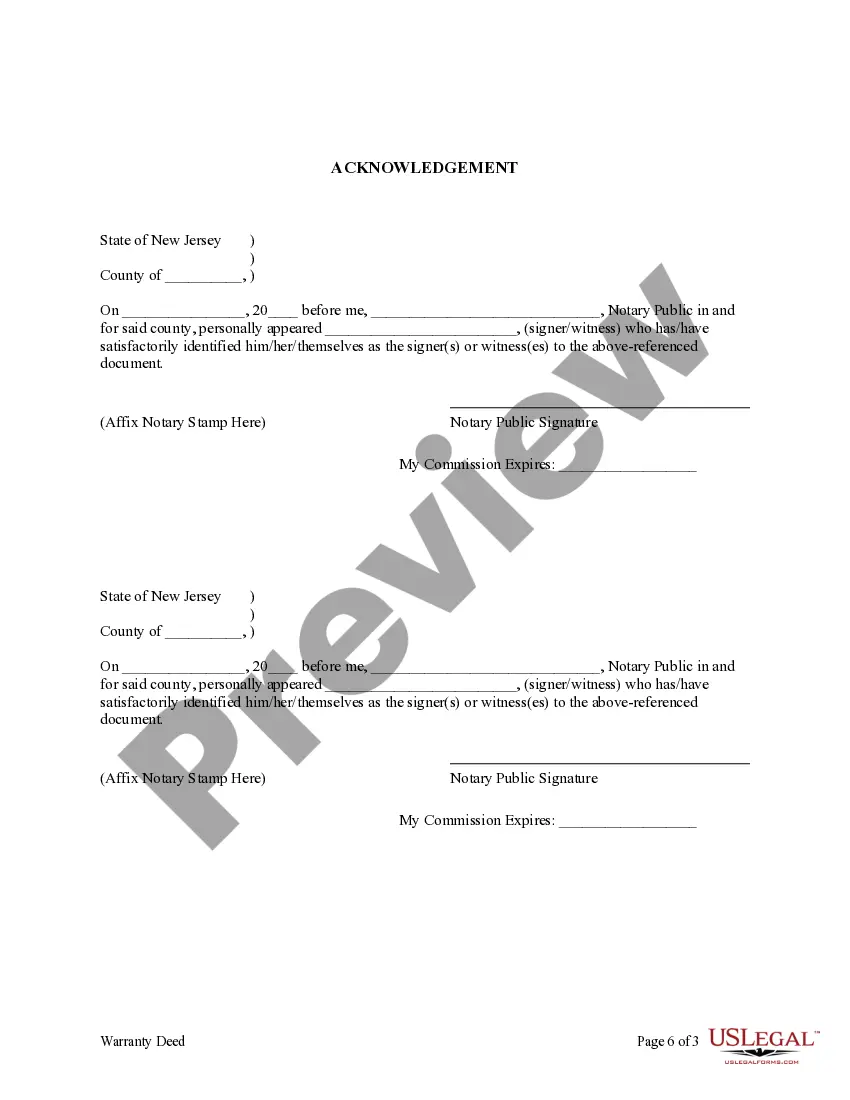

Notarization requirements for this form

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Avoid these common issues

- Failing to clearly identify the property being transferred.

- Skipping the selection of how Grantees will hold the property.

- Not both Grantors signing the deed.

- Using outdated or incorrect forms not compliant with state regulations.

Advantages of online completion

- The form is easily downloadable and can be completed digitally.

- Field visibility in digital formats makes it convenient to fill out.

- Immediate access to legal documentation without delays.

- No need for physical trips to obtain forms or legal advice.

Legal requirements by state

This form adheres to the statutory laws of New Jersey, ensuring compliance with local requirements concerning property transfer and ownership designations.

Form popularity

FAQ

This is called recording your deed. When done properly, a deed is recorded anywhere from two weeks to three months after closing.

Once a quit claim deed has been completed and filed with the County Clerk's Office, the title will officially pass from the grantor to the grantee. The only way to reverse a quit claim deed is to go to court and prove that the grantor was forced to sign the document under duress.

First, so long as you own the property you purchased, you are obligated to pay its property taxes. One way to get a warranty deed to the property you acquired via a foreclosure where you got a quit claim deed for it is to simply deed the property to yourself or a trust that you created as a grant (warranty) deed.

A quitclaim deed only transfers the grantor's interests in a piece of real estate.A warranty deed contains a guarantee that the grantor has legal title and rights to the real estate. A quitclaim deed offers little to no protection to the grantee. It offers the least amount of protection out of any other type of deed.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Once you sign a quitclaim deed and it has been filed and recorded with the County Clerks Office, the title has been officially transferred and cannot be easily reversed. In order to reverse this type of transfer, it would require your spouse to cooperate and assist in adding your name back to the title.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.