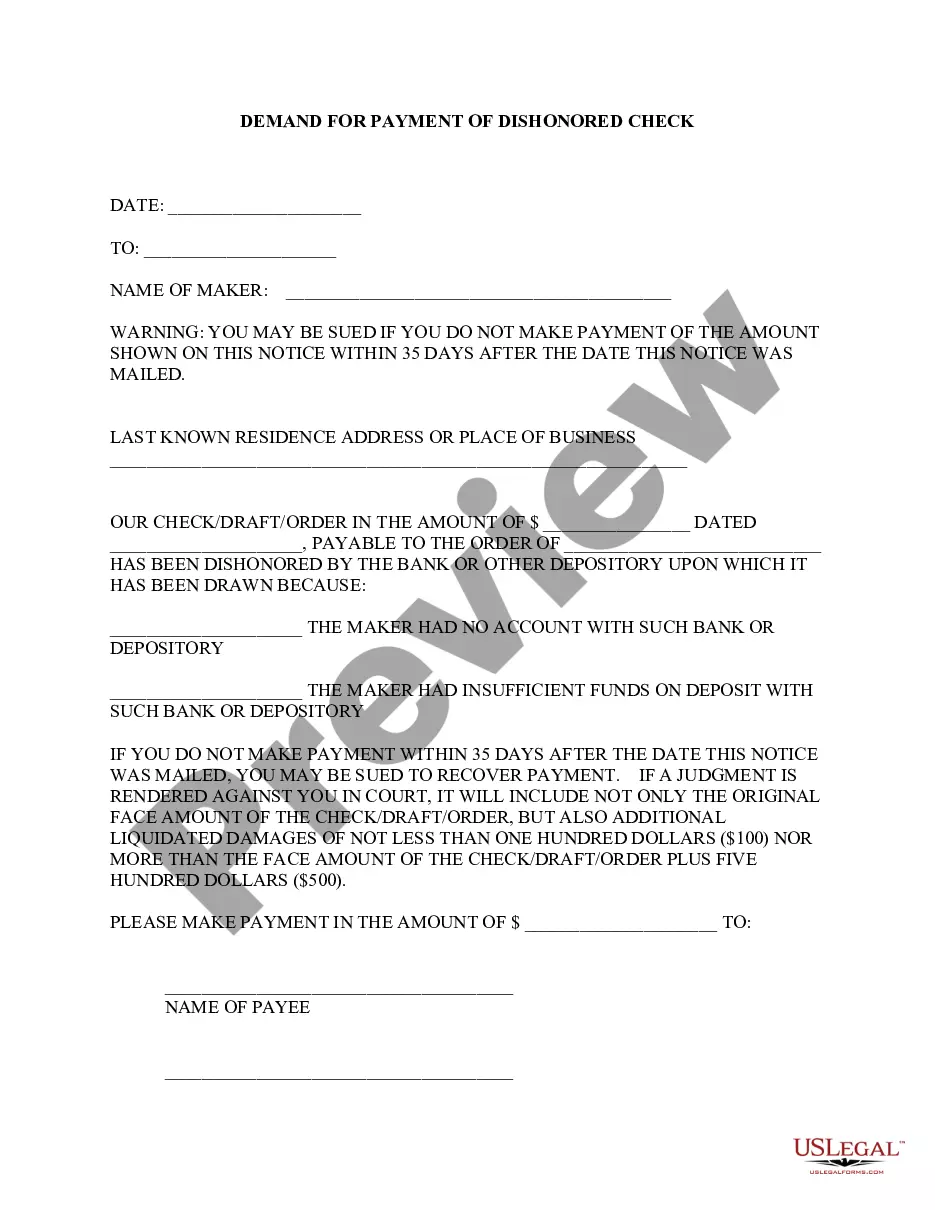

New Jersey Demand For Payment of Dishonored Check

Description

How to fill out New Jersey Demand For Payment Of Dishonored Check?

US Legal Forms is actually a unique system where you can find any legal or tax template for completing, such as New Jersey Demand For Payment of Dishonored Check. If you’re tired of wasting time seeking appropriate samples and spending money on papers preparation/attorney fees, then US Legal Forms is precisely what you’re looking for.

To enjoy all the service’s benefits, you don't have to install any software but just choose a subscription plan and register your account. If you already have one, just log in and look for an appropriate sample, download it, and fill it out. Saved files are kept in the My Forms folder.

If you don't have a subscription but need to have New Jersey Demand For Payment of Dishonored Check, check out the instructions below:

- make sure that the form you’re checking out applies in the state you need it in.

- Preview the form and read its description.

- Simply click Buy Now to get to the sign up webpage.

- Choose a pricing plan and proceed registering by providing some info.

- Decide on a payment method to complete the sign up.

- Download the document by selecting the preferred file format (.docx or .pdf)

Now, complete the document online or print out it. If you are unsure concerning your New Jersey Demand For Payment of Dishonored Check sample, speak to a lawyer to examine it before you send out or file it. Get started hassle-free!

Form popularity

FAQ

Writing a bad check is considered a wobbler crime in California, meaning it can be charged as either a misdemeanor or felony depending on circumstances of the crime. If the value of the check was under $450, the offense is generally charged as a misdemeanor. If the amount is over $450, you can be charged with a felony.

As defined under California Penal Code Section 476a, writing a check while knowing that funds are insufficient can be charged as a misdemeanor offense that can result in sentence of up to one year in county jail.

Writing bad checks can lead to several theft charges, but with the help of a skilled defense attorney, you can work to reduce or even dismiss charges.

A bad check valued at $200 or more is an indictable offense (felony) in NJ.

Whether you write or receive a bounced check also called a nonsufficient funds, or NSF, check it will cost you.If you receive and deposit a check that bounces, you'll owe a fee to your bank for returning the check, in addition to having the headache of recovering the money you're due.

Under criminal penalties, you can be prosecuted and even arrested for writing a bad check.This can be seen as a felony in many states, especially when the checks are for more than $500. It's important to note that provision is made for accidents, because bookkeeping mistakes do happen.

As defined under California Penal Code Section 476a, writing a check while knowing that funds are insufficient can be charged as a misdemeanor offense that can result in sentence of up to one year in county jail.

Write a letter to the person who passed you the bad check. Inform him that they need to pay the check in full plus any resulting fees. Give them 7 to 10 days to pay the debt in full. Send the letter certified so you have proof it was received.

Legal TroubleIf you don't clear things up quickly, you may face civil (you have to pay fines) or criminal (you face potential jail time) penalties. Criminal charges can go on your criminal record, might eventually result in jail time, and are likely to come with higher fines.