New Jersey Warranty Deed to Child Reserving a Life Estate in the Parents

What this document covers

The Warranty Deed to Child Reserving a Life Estate in the Parents is a legal document that allows parents to transfer property to their child while retaining the right to use and benefit from the property during their lifetime. This form establishes a clear distinction from other types of deeds, as it includes a reservation of life estate, ensuring that the parents maintain an interest in the property even after the transfer is made.

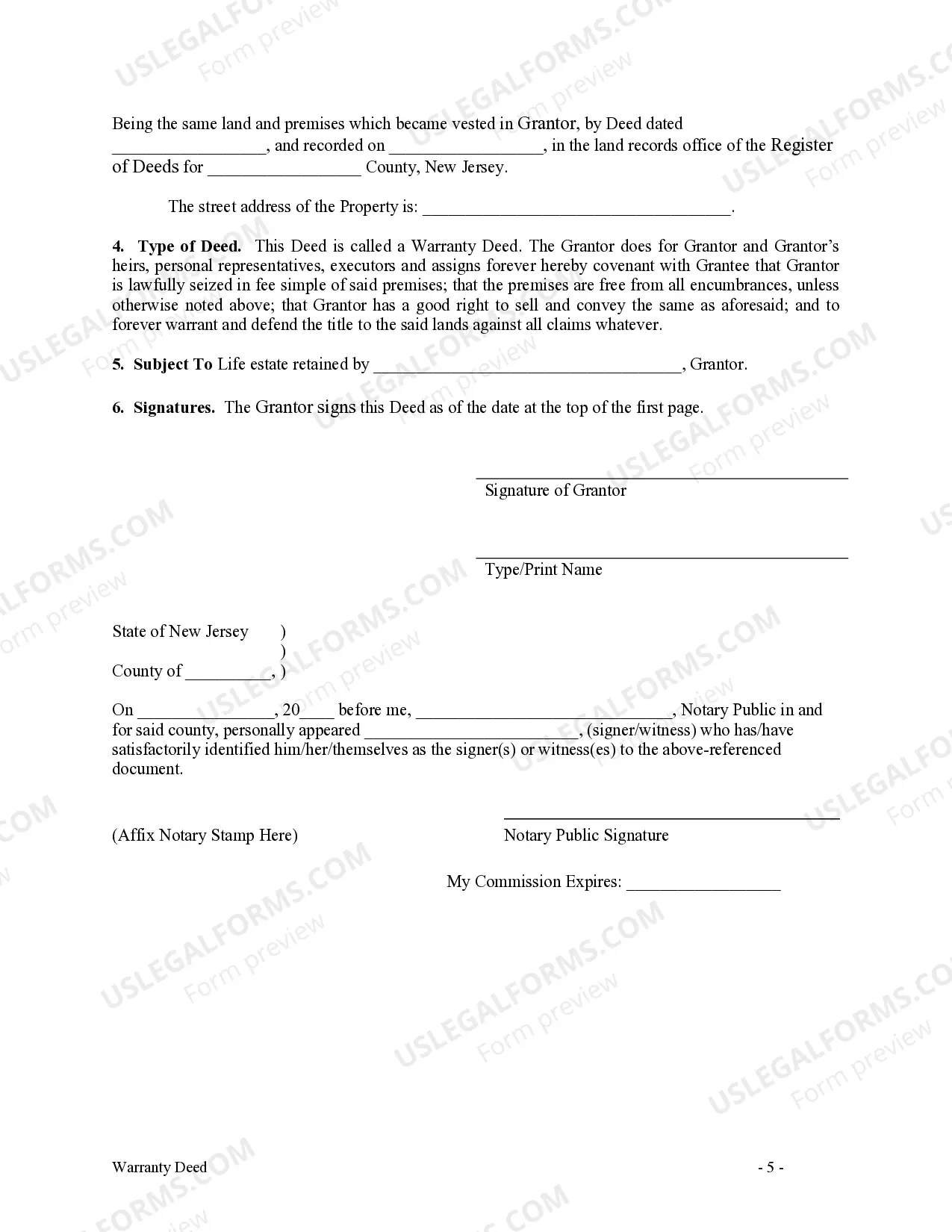

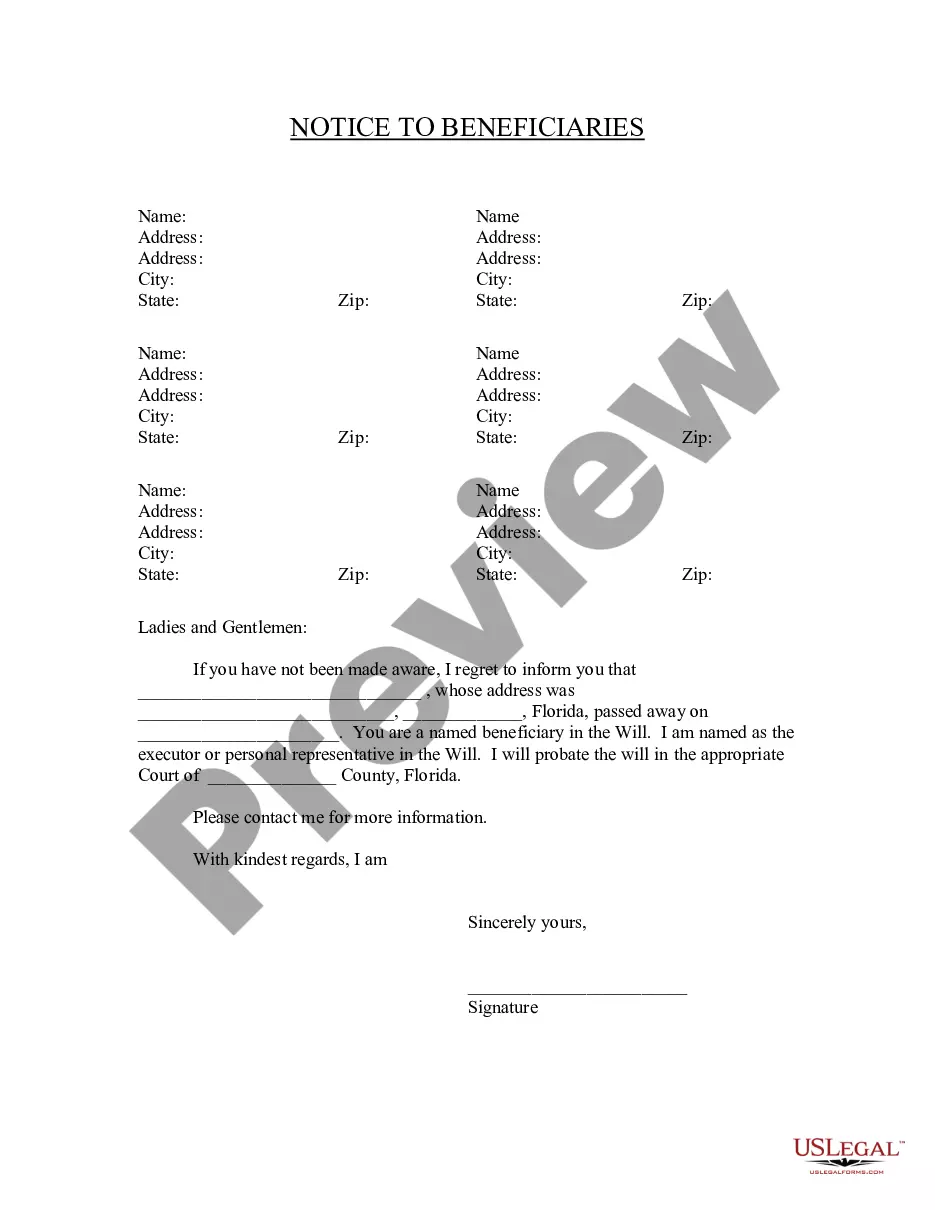

What’s included in this form

- Transfer of ownership details, including the parties involved and the consideration amount.

- Tax map reference to ensure proper identification of the property.

- Legal description of the property, outlining its location and boundaries.

- Covenant of title ensuring the grantor has the right to convey the property free from encumbrances.

- Specification of the life estate being retained by the grantors.

- Notary section for verification of the deed signing.

When to use this form

This form is particularly useful when parents wish to gift property to their child while still retaining the right to live on or use that property during their lifetime. It may be important in estate planning scenarios to protect the property from creditors and simplify the transfer of assets after the parents pass away.

Intended users of this form

- Parents looking to transfer property to their child while maintaining a life estate.

- Individuals planning their estate and wanting to reduce potential estate taxes.

- Homeowners needing to clarify ownership while keeping the use of the property.

How to prepare this document

- Identify the parties involved by filling in the names and addresses of both the grantor(s) and the grantee.

- Specify the amount of consideration for the property transfer in the designated field.

- Provide the tax map reference, including municipal and block/lot numbers.

- Detail the legal description of the property to ensure clarity regarding its location and boundaries.

- Sign and date the deed in the presence of a notary public for proper validation.

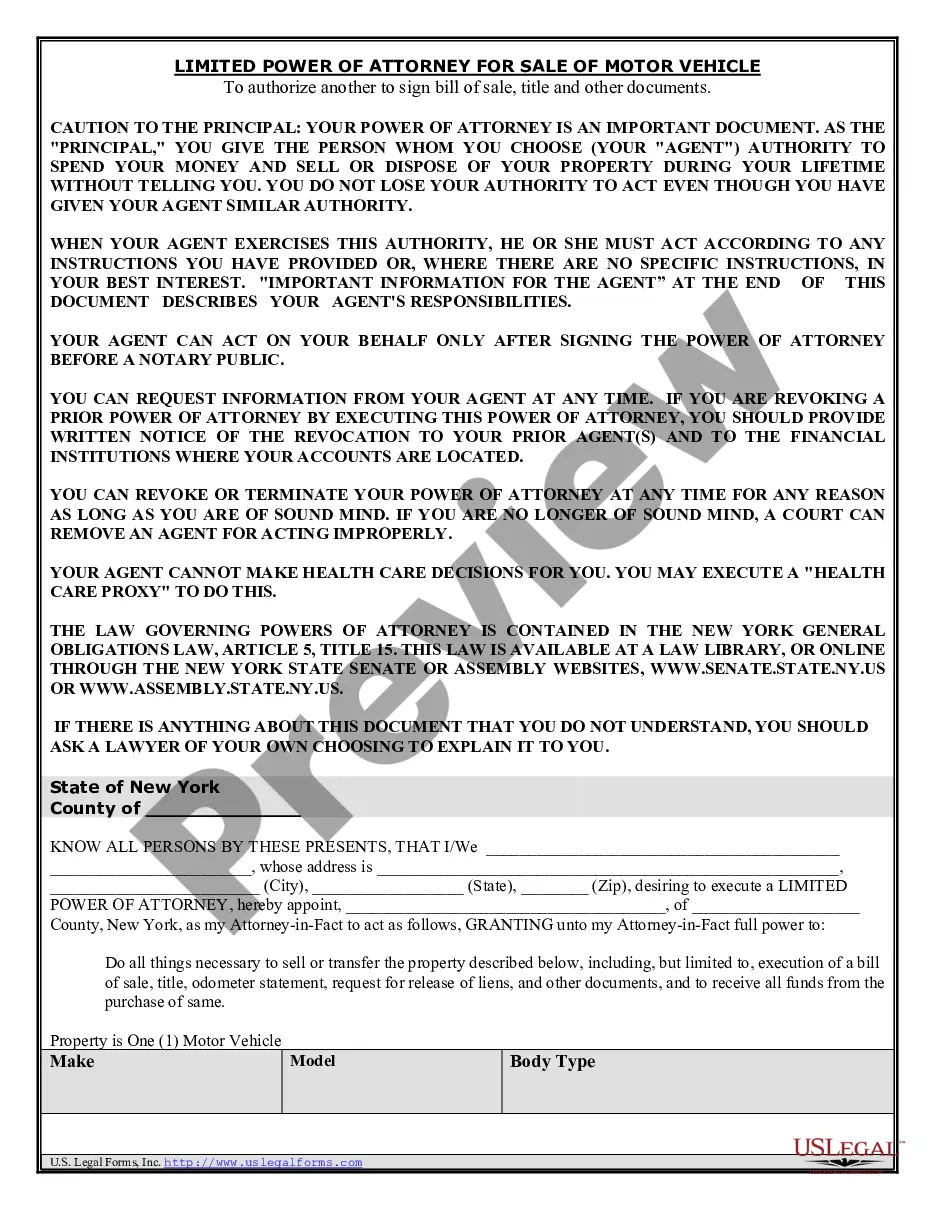

Notarization requirements for this form

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Avoid these common issues

- Failing to include the legal description of the property, which can lead to confusion about what is being transferred.

- Not having the deed notarized, which is essential for its validity in many cases.

- Leaving out the correct tax map reference, which may affect the property transfer process.

- Inaccurate or incomplete information about the grantor(s) and grantee, which can complicate the transaction.

Why use this form online

- Convenient downloading options allow for immediate access to the form.

- Editable fields enable users to complete the form accurately and quickly.

- Access to legal forms drafted by licensed attorneys, ensuring reliability and compliance with state laws.

Form popularity

FAQ

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.

In New Jersey, the deed must be in English, identify the seller/buyer (grantor/grantee), name the person that prepared the deed, state the consideration (amount paid) for the transfer, contain a legal description of the property (a survey), include the signature of the grantor and be signed before a notary.

There does not have to be a deed recorded to convey a life estate, and transferring the property fee simple during life could cause tax issues.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

In New Jersey, the preparation of legal documents such as a deed is considered the practice of law which may only be undertaken by an Attorney at Law of the State of New Jersey. The only exception to that rule is that an individual representing him/herself may prepare his/her own documents.

Reservation of the present interest allows the owner to retain ownership for a period of time measured by the life of one or more individuals, by a term of years, or by a combination of the two.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.